A Decade of Fluctuations: Analyzing the Gasoline Value Chart (2014-2024)

Associated Articles: A Decade of Fluctuations: Analyzing the Gasoline Value Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to A Decade of Fluctuations: Analyzing the Gasoline Value Chart (2014-2024). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

A Decade of Fluctuations: Analyzing the Gasoline Value Chart (2014-2024)

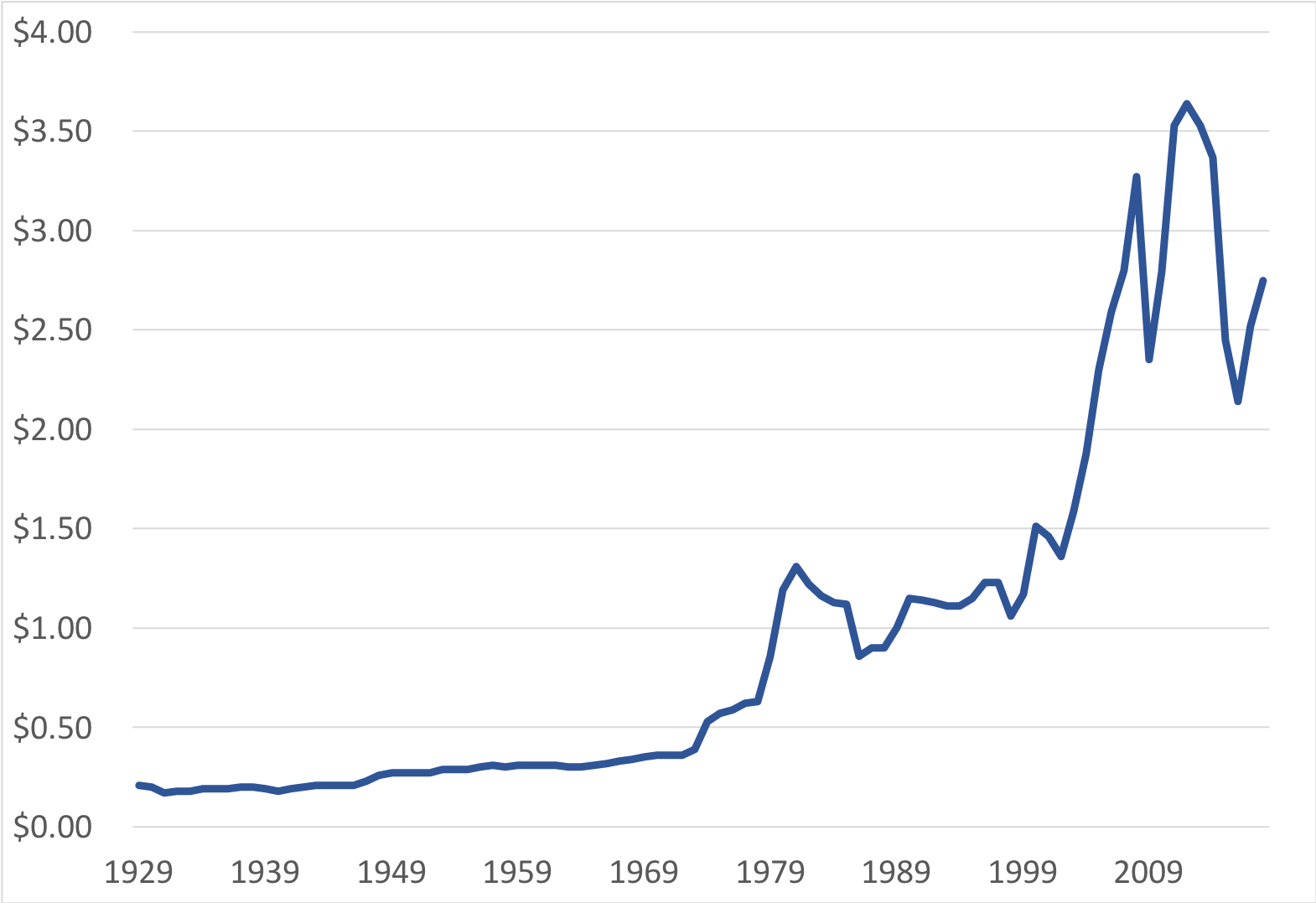

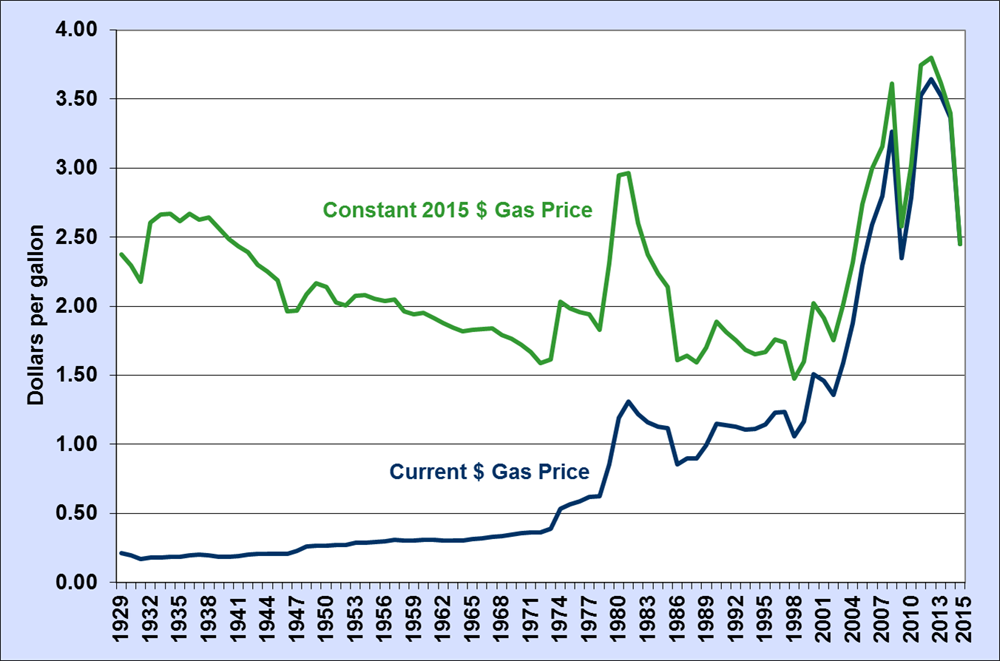

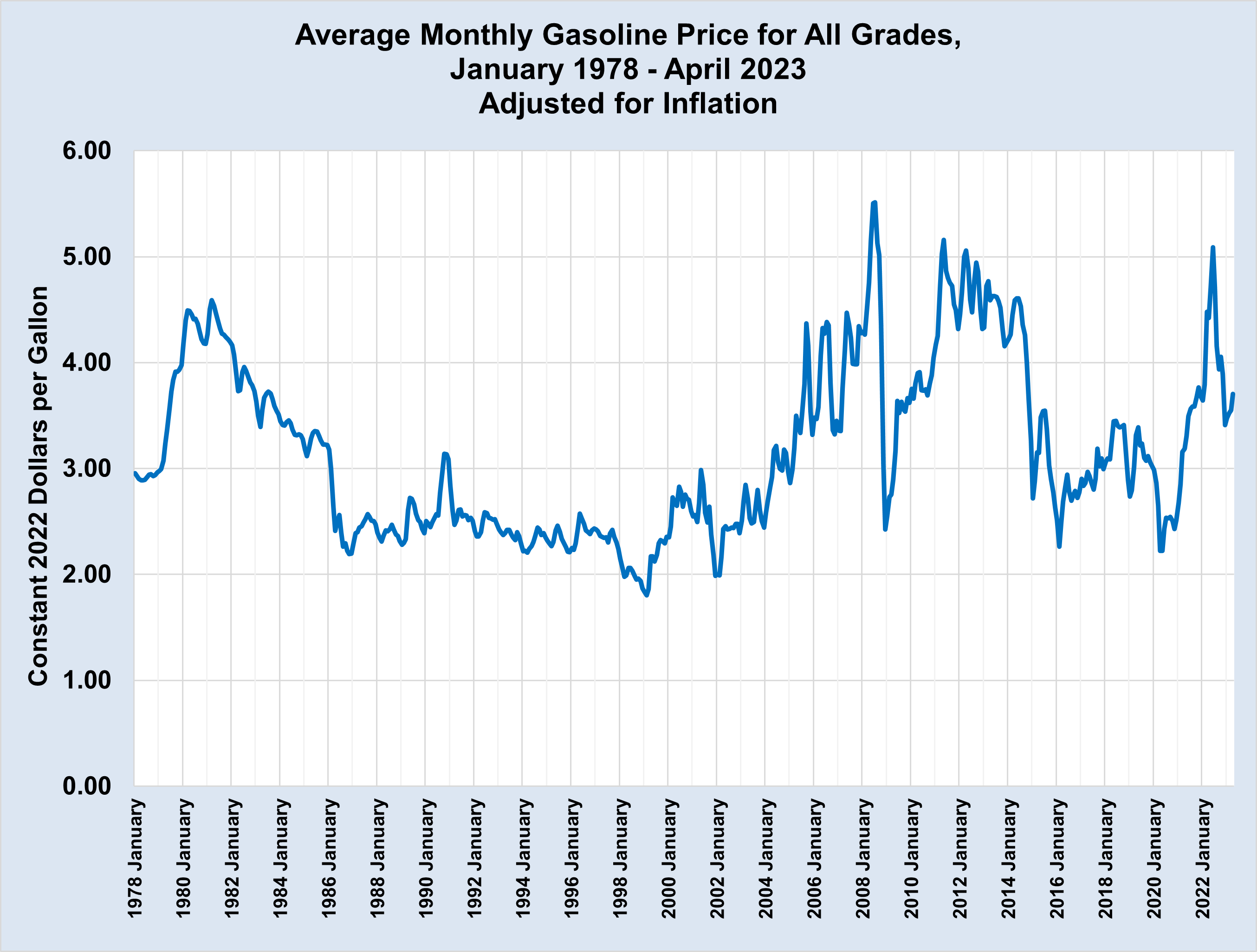

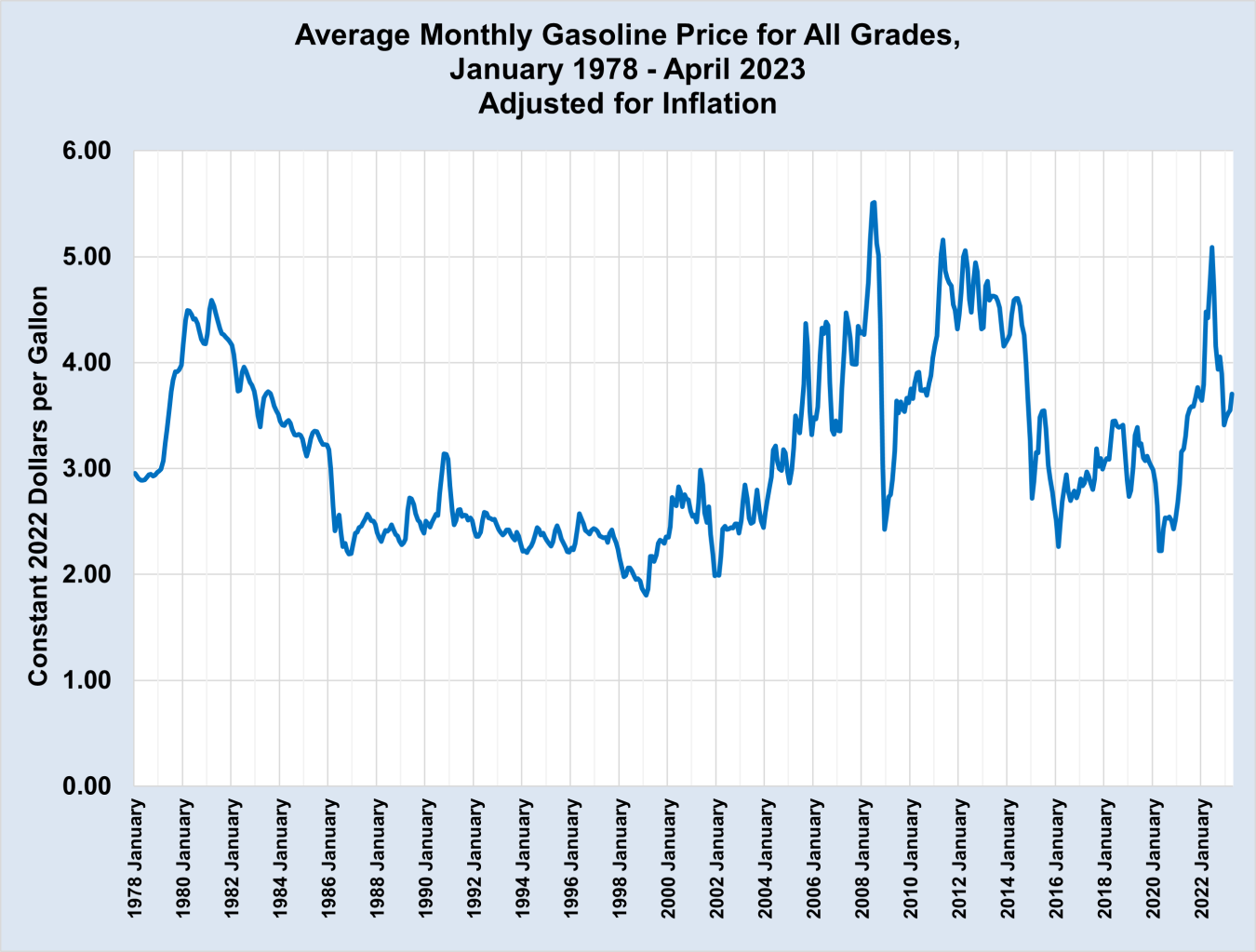

The value of gasoline, a ubiquitous commodity affecting almost each facet of recent life, has skilled vital volatility over the previous decade. Analyzing the gasoline worth chart from 2014 to 2024 (projected) reveals a fancy interaction of world occasions, financial situations, and geopolitical components which have formed client prices on the pump. This text delves into the important thing drivers behind these fluctuations, highlighting vital durations of worth spikes and declines, and providing insights into potential future developments. Whereas exact information for your entire 2024 projection is unavailable on the time of writing, we are going to extrapolate based mostly on present developments and knowledgeable predictions.

2014-2015: A Interval of Relative Stability and Decline:

The interval starting in 2014 noticed a gradual decline in gasoline costs, largely pushed by a surge in US shale oil manufacturing. The fracking revolution had unlocked huge reserves of home crude oil, decreasing reliance on overseas imports and growing provide. This abundance of crude translated into decrease costs on the pump, providing shoppers a short lived reprieve. The worldwide financial restoration following the 2008 monetary disaster additionally performed a job, though progress was nonetheless comparatively modest. Geopolitical components had been comparatively calm throughout this era, with no main disruptions to international oil provide chains. The chart for this era would present a comparatively easy downward development, punctuated by minor seasonal fluctuations.

2016-2017: OPEC’s Affect and Market Uncertainty:

The Group of the Petroleum Exporting International locations (OPEC) considerably influenced the market on this interval. After a interval of trying to keep up larger costs by manufacturing cuts, OPEC ultimately elevated manufacturing, resulting in an extra decline in crude oil costs. This contributed to comparatively low gasoline costs for shoppers. Nevertheless, market uncertainty remained, influenced by components reminiscent of the continued international financial slowdown in some areas and the continued rise of renewable vitality sources. The value chart would mirror this era as a continuation of the downward development from the earlier years, with occasional durations of minor worth will increase as a consequence of seasonal demand or sudden geopolitical occasions.

2018-2019: A Resurgence of Costs and Geopolitical Tensions:

This era marked a noticeable resurgence in gasoline costs. A number of components contributed to this upward development. OPEC applied manufacturing cuts once more, aiming to stabilize and lift oil costs. Geopolitical instability in a number of oil-producing areas, together with ongoing conflicts within the Center East and sanctions on Iran, created uncertainty and tightened provide. Rising international demand, significantly from rising economies like China and India, additionally performed a major position in pushing costs larger. The chart would present a transparent upward trajectory, with sharp spikes doubtlessly correlated with particular geopolitical occasions or sudden provide disruptions.

2020: The COVID-19 Pandemic and the Oil Value Crash:

The COVID-19 pandemic dramatically altered the worldwide vitality panorama. Lockdowns and journey restrictions led to an unprecedented drop in international oil demand. This resulted in a historic crash in crude oil costs, with gasoline costs plummeting to ranges not seen in years. The chart would dramatically illustrate this sharp and sudden decline, a transparent outlier within the decade’s developments. The oversupply of crude and the collapse in demand created a singular scenario the place even damaging oil costs had been briefly noticed in some futures markets.

2021-2022: Restoration and Inflationary Pressures:

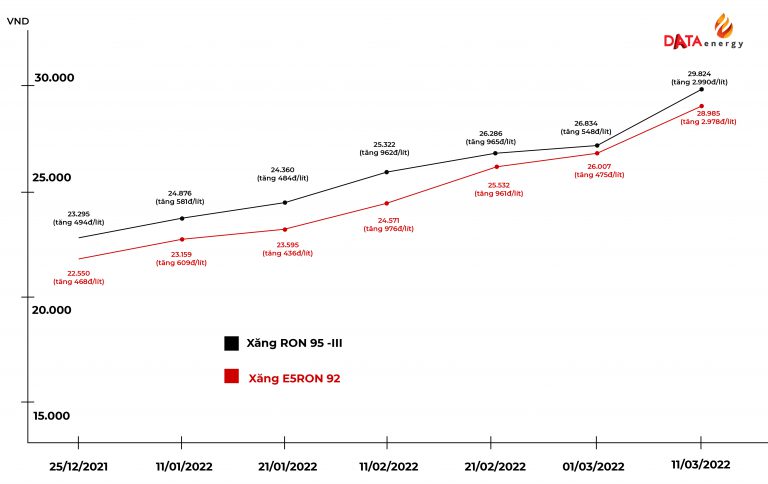

As economies started to get well from the pandemic, international oil demand surged. This, coupled with ongoing OPEC manufacturing controls and provide chain disruptions, led to a major improve in gasoline costs. Inflationary pressures throughout the worldwide economic system additional exacerbated the scenario, making gasoline much more costly for shoppers. The chart would present a steep restoration from the 2020 lows, reflecting the robust rebound in demand and the varied supply-side constraints. The influence of the struggle in Ukraine, starting in late February 2022, dramatically intensified these worth will increase.

2023-2024 (Projected): Navigating Uncertainty:

Predicting gasoline costs precisely for 2023-2024 is difficult, given the multitude of interacting components. Nevertheless, a number of developments counsel potential eventualities. The continued vitality transition in direction of renewable sources may progressively cut back demand for gasoline in the long run. Nevertheless, this transition is gradual, and oil will doubtless stay a major vitality supply for years to come back. Geopolitical stability (or instability) in main oil-producing areas will proceed to be a key determinant of costs. Financial progress charges in main consuming nations can even play a vital position. Moreover, authorities insurance policies geared toward regulating emissions or supporting renewable vitality may affect costs. The chart for this era would doubtless present continued volatility, with potential durations of worth stabilization or additional will increase relying on the interaction of those components. Consultants predict a gradual decline in costs over the long term as renewable vitality adoption will increase and provide chains stabilize, however short-term fluctuations are nearly sure.

Conclusion:

The gasoline worth chart over the previous decade and projected future reveals a dynamic and sophisticated market influenced by a large number of interconnected components. From the shale oil increase to the COVID-19 pandemic and geopolitical tensions, the worth on the pump has mirrored these occasions with exceptional sensitivity. Understanding these drivers is essential for shoppers, companies, and policymakers alike. Whereas predicting future costs with certainty is unattainable, analyzing previous developments and contemplating the doubtless affect of ongoing developments offers precious insights into the potential trajectory of this very important commodity. The continued transition to renewable vitality sources guarantees long-term modifications, however the short-term stays risky and depending on a fancy interaction of world forces. Cautious monitoring of geopolitical occasions, financial indicators, and technological developments can be important for navigating the way forward for gasoline pricing.

Closure

Thus, we hope this text has offered precious insights into A Decade of Fluctuations: Analyzing the Gasoline Value Chart (2014-2024). We thanks for taking the time to learn this text. See you in our subsequent article!