A Golden Historical past: Charting the Rise and Fall of Gold Costs

Associated Articles: A Golden Historical past: Charting the Rise and Fall of Gold Costs

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to A Golden Historical past: Charting the Rise and Fall of Gold Costs. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

A Golden Historical past: Charting the Rise and Fall of Gold Costs

Gold. The lustrous steel has captivated humanity for millennia, serving as forex, decoration, and a retailer of worth. Its value, nonetheless, has been something however static, fluctuating wildly all through historical past, reflecting financial shifts, geopolitical occasions, and altering investor sentiment. Tracing the historical past of gold’s value by charts reveals a compelling narrative, a narrative etched within the peaks and valleys of its market efficiency. Whereas exact historic value information for earlier intervals is scarce and infrequently unreliable, piecing collectively accessible data supplies an interesting glimpse into this treasured steel’s journey.

Early Historical past and the Gold Normal (Pre-1971):

Earlier than the fashionable period of freely floating change charges, gold performed a central function in international financial methods. For hundreds of years, numerous types of the gold normal prevailed, the place currencies had been straight or not directly pegged to gold. This meant that the value of gold was basically mounted, or at the least tightly managed, by governments. Charting gold’s value throughout this era is difficult as a result of the "value" was largely outlined by the forex’s convertibility to gold. Nonetheless, we will glean insights from historic data of gold manufacturing, commerce flows, and forex devaluations.

Intervals of great gold discoveries, just like the Californian Gold Rush of 1849, usually led to a relative lower within the worth of gold (expressed when it comes to different items and companies), though this impact was usually mitigated by the elevated cash provide wanted to deal with the inflow of gold. Conversely, intervals of warfare or financial instability may see an implicit improve in gold’s worth as folks sought protected haven on this tangible asset. Whereas a steady, exact chart is not possible, we will visualize this period as a interval of comparatively secure, although not solely unchanging, gold worth, punctuated by occasional shifts pushed by geopolitical occasions and discoveries.

The Bretton Woods System and its Demise (1944-1971):

The Bretton Woods Settlement of 1944 established a brand new worldwide financial system the place the US greenback was pegged to gold at $35 per ounce, and different currencies had been pegged to the greenback. This created a comparatively secure, albeit synthetic, gold value. This era, depicted on a chart, would present a flat line at $35/oz for nearly three a long time. Nonetheless, the system confronted rising stress all through the Sixties. The rising US commerce deficit and the rising demand for gold to transform {dollars} led to a gradual erosion of confidence within the system.

President Nixon’s determination in 1971 to finish the greenback’s convertibility to gold marked a watershed second. The chart would dramatically shift at this level, exhibiting the value of gold breaking free from its synthetic peg and coming into a interval of unprecedented volatility.

The Submit-Bretton Woods Period (1971-Current):

The dismantling of the Bretton Woods system unleashed gold’s value, permitting it to fluctuate freely based mostly on market forces. The following a long time have witnessed dramatic swings in gold’s value, reflecting a posh interaction of things:

-

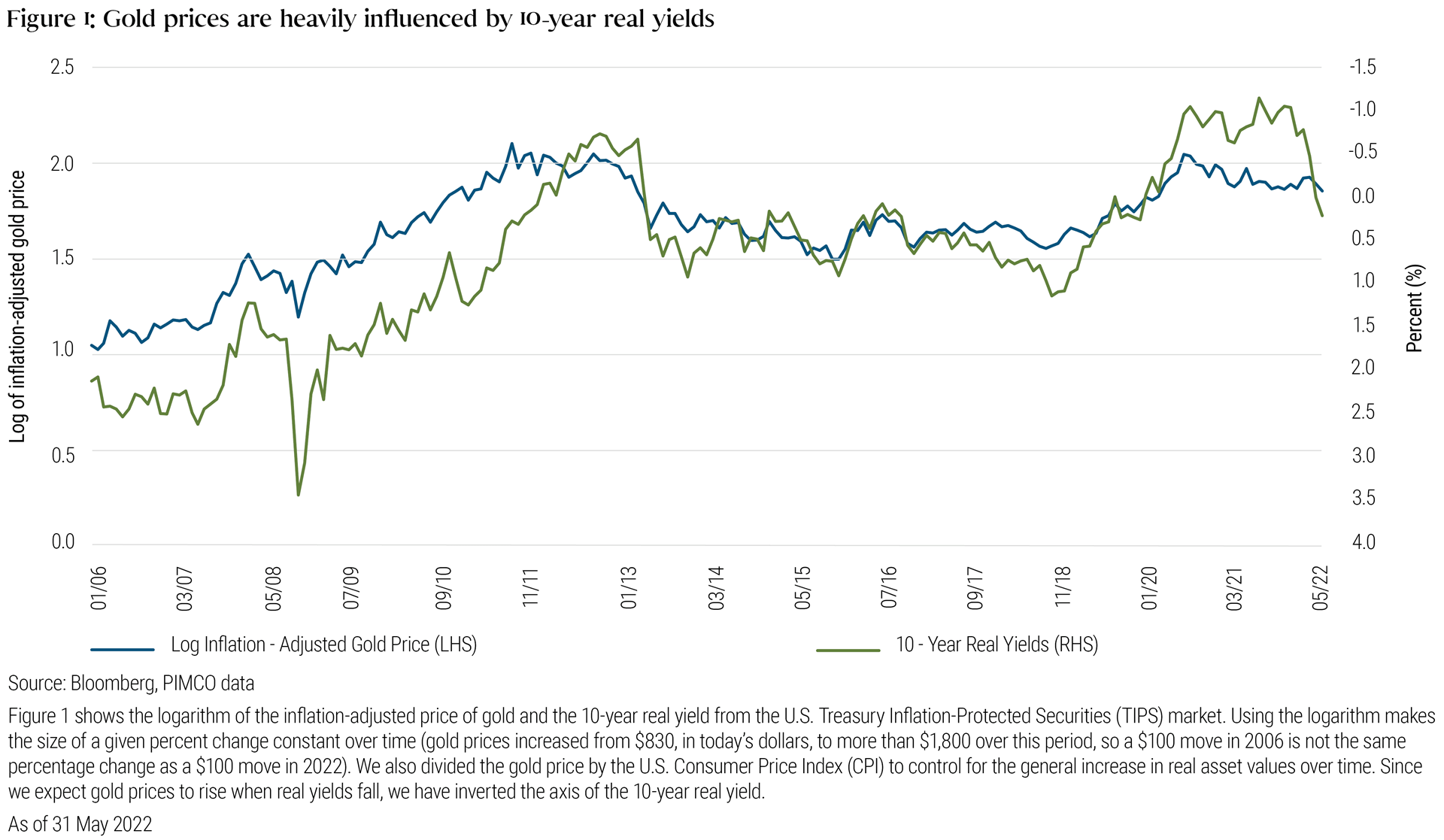

Inflation: Gold has traditionally served as a hedge in opposition to inflation. Intervals of excessive inflation, as seen within the Seventies and early 2000s, usually led to vital will increase in gold costs. A chart of this era would present a robust constructive correlation between inflation charges and gold costs.

-

Curiosity Charges: Inversely associated to gold costs to a point, rates of interest affect the chance value of holding gold. Larger rates of interest make holding non-interest-bearing property like gold much less enticing, doubtlessly resulting in decrease gold costs. A chart would illustrate this inverse relationship, though different elements usually overshadow this correlation.

-

US Greenback Power: The US greenback and gold usually exhibit an inverse relationship. A weaker greenback usually boosts gold costs, because it turns into cheaper for buyers holding different currencies to purchase gold. Charts would present a adverse correlation between the US greenback index and gold costs.

-

Geopolitical Occasions: International instability, wars, and political uncertainty steadily drive buyers in direction of safe-haven property like gold, pushing costs greater. The chart would replicate spikes in gold costs throughout occasions of disaster, such because the 1991 Gulf Warfare, the 2008 monetary disaster, and the continued geopolitical tensions.

-

Provide and Demand: The interaction of gold provide (mining manufacturing, recycling) and demand (jewellery, funding, industrial use) considerably influences value. A chart would replicate intervals of elevated demand main to cost will increase and vice versa.

-

Investor Sentiment: Hypothesis and investor sentiment play an important function in gold’s value actions. Intervals of robust bullish sentiment can result in value rallies, whereas bearish sentiment can set off value declines. That is evident within the chart’s volatility, with sharp upswings and downswings usually pushed by shifts in market psychology.

Analyzing the Chart:

A complete chart of gold costs from 1971 onwards would reveal a number of key options:

-

Lengthy-term Upward Pattern: Regardless of vital short-term fluctuations, gold’s value has proven a basic upward pattern over the long run, reflecting its enduring worth as a retailer of wealth and hedge in opposition to uncertainty.

-

Periodic Worth Corrections: The chart would present quite a few intervals of value corrections, the place costs quickly decline earlier than resuming their upward trajectory. These corrections are sometimes pushed by profit-taking, modifications in investor sentiment, or shifts in macroeconomic circumstances.

-

Sharp Worth Spikes: The chart would spotlight a number of cases of sharp value will increase, usually coinciding with main geopolitical occasions or financial crises.

-

Intervals of Consolidation: There are intervals the place the value of gold consolidates inside a selected vary, indicating a interval of relative market stability earlier than one other vital transfer happens.

Conclusion:

The historical past of gold costs, as depicted on a chart, is an interesting reflection of worldwide financial and political occasions. Whereas the value has been topic to vital fluctuations, its long-term upward pattern underscores its enduring attraction as a retailer of worth and a protected haven asset. Understanding the elements influencing gold’s value is essential for buyers looking for to navigate this dynamic market. Analyzing historic charts, coupled with a radical understanding of macroeconomic elements and geopolitical developments, can present useful insights for making knowledgeable funding selections on this timeless treasured steel. The story of gold’s value is way from over; its future trajectory will proceed to be formed by the interaction of those complicated forces, making a compelling narrative for future generations to chart and interpret.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has offered useful insights into A Golden Historical past: Charting the Rise and Fall of Gold Costs. We hope you discover this text informative and helpful. See you in our subsequent article!