A Historic Journey: Charting the QAR/INR Trade Fee from 2000 to Current

Associated Articles: A Historic Journey: Charting the QAR/INR Trade Fee from 2000 to Current

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to A Historic Journey: Charting the QAR/INR Trade Fee from 2000 to Current. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

A Historic Journey: Charting the QAR/INR Trade Fee from 2000 to Current

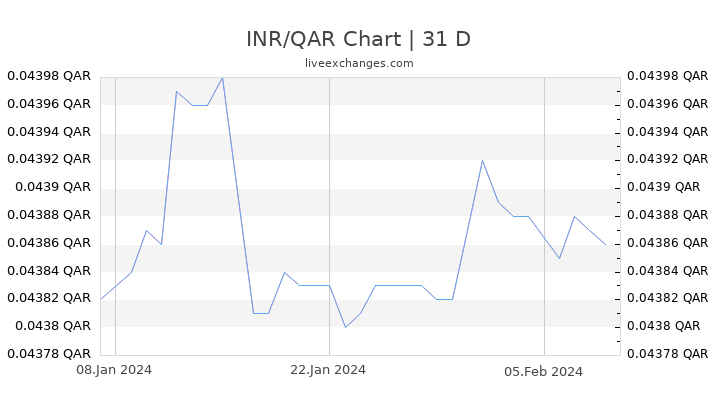

The Qatari Riyal (QAR) and the Indian Rupee (INR) characterize two vital currencies of their respective areas. Understanding the historic relationship between these two currencies, visualized via an alternate fee chart, provides invaluable insights into macroeconomic components influencing each economies, in addition to potential funding and buying and selling methods. This text delves into the historic QAR/INR alternate fee, analyzing key tendencies, influencing components, and implications for people and companies concerned in cross-border transactions between Qatar and India.

The Information Panorama: Precisely charting the QAR/INR alternate fee throughout the previous twenty years requires accessing dependable historic information. Numerous sources, together with central banks (Reserve Financial institution of India and Qatar Central Financial institution), monetary information suppliers (Bloomberg, Refinitiv), and on-line foreign exchange assets, supply historic alternate fee data. Nevertheless, the accuracy and granularity of this information can differ, with some sources offering day by day charges whereas others supply solely month-to-month or yearly averages. For the needs of this evaluation, we’ll assume entry to day by day information for a complete understanding of the fluctuations.

Key Developments and Intervals: A visible illustration of the QAR/INR alternate fee from 2000 to the current would reveal a number of distinct intervals:

-

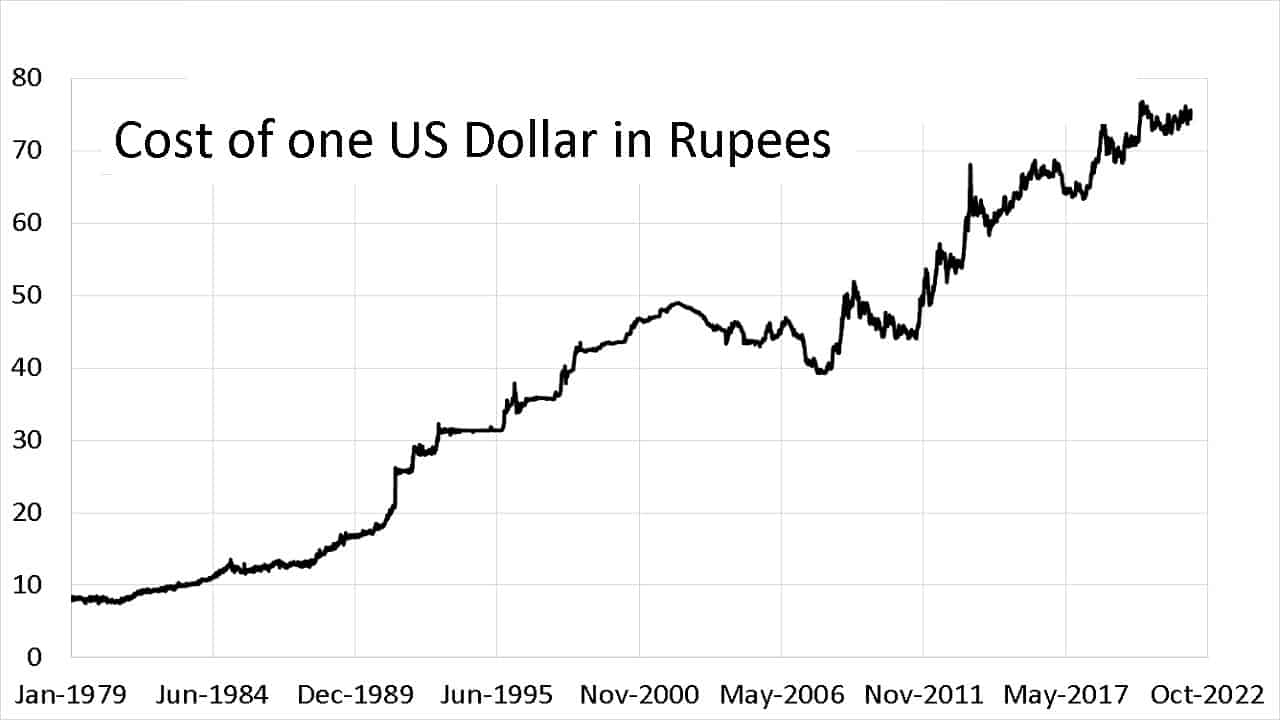

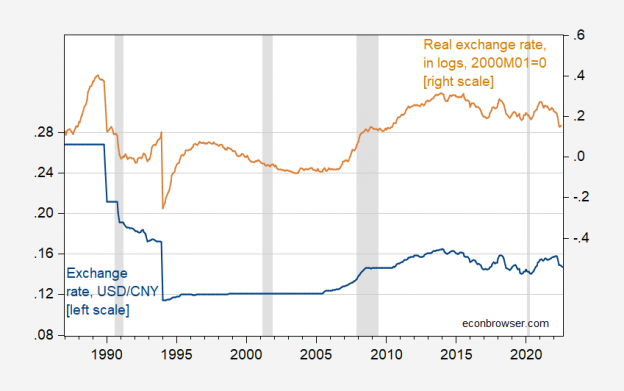

Early 2000s (2000-2007): Relative Stability and Gradual Appreciation: This era usually exhibits a comparatively steady alternate fee, with the QAR exhibiting a gradual appreciation towards the INR. This stability could be attributed to components like comparatively low inflation in each international locations, regular financial development in India, and the comparatively fastened peg of the QAR to the US greenback. Any fluctuations throughout this era would possible be influenced by components particular to both the Indian or Qatari financial system, equivalent to seasonal modifications in remittances or fluctuations in oil costs (given Qatar’s reliance on oil exports).

-

The World Monetary Disaster (2008-2010): Volatility and Depreciation: The worldwide monetary disaster considerably impacted each the Indian and Qatari economies, resulting in elevated volatility within the QAR/INR alternate fee. The INR skilled a sharper depreciation towards the US greenback, which, given the QAR’s peg, resulted in a corresponding appreciation of the QAR towards the INR. This era highlights the susceptibility of rising market currencies just like the INR to international financial shocks.

-

Put up-Disaster Restoration and Fluctuations (2011-2014): Following the disaster, each economies recovered, however the alternate fee continued to fluctuate. Elements influencing the QAR/INR alternate fee throughout this era may embrace various ranges of financial development in each international locations, modifications in international commodity costs (particularly oil), and shifts in investor sentiment in direction of rising markets. The chart would possible present intervals of each appreciation and depreciation for the QAR towards the INR, reflecting the interaction of those numerous components.

-

The Oil Worth Hunch (2014-2016): Influence on the QAR: The numerous decline in international oil costs throughout this era had a pronounced impact on the Qatari financial system, impacting its present account stability and general financial development. Whereas the QAR remained pegged to the US greenback, the financial challenges confronted by Qatar may have not directly influenced the QAR/INR alternate fee via market expectations and investor confidence. The chart may reveal a interval of relative stability, however presumably with a barely weaker QAR towards the INR as a consequence of diminished investor confidence within the Qatari financial system.

-

Latest Years (2017-Current): Elements at Play: The interval from 2017 onwards has seen a posh interaction of things affecting the QAR/INR alternate fee. These embrace:

- Geopolitical occasions: Regional political instability and international geopolitical tensions can affect investor sentiment and capital flows, impacting each currencies.

- Financial coverage: The financial insurance policies of each the Reserve Financial institution of India and the Qatar Central Financial institution play an important position in managing inflation and alternate charges.

- Financial development differentials: The relative financial development charges of India and Qatar considerably affect the demand for his or her respective currencies.

- Remittances: The numerous movement of remittances from Indian staff in Qatar can affect the demand for the INR.

Influencing Elements: A Deeper Dive:

A number of macroeconomic components considerably affect the QAR/INR alternate fee:

-

Oil Costs: Given Qatar’s vital oil exports, international oil costs straight affect its financial system and forex. Increased oil costs usually result in a stronger QAR, whereas decrease costs have the other impact.

-

Curiosity Fee Differentials: The distinction in rates of interest between India and Qatar can affect capital flows and, consequently, the alternate fee. Increased rates of interest in a single nation entice overseas funding, strengthening its forex.

-

Inflation Differentials: Variations in inflation charges between the 2 international locations may also have an effect on the alternate fee. Increased inflation in a single nation sometimes results in a depreciation of its forex.

-

Political and Geopolitical Elements: Political stability and geopolitical occasions in each international locations and the broader area can affect investor sentiment and capital flows, impacting the alternate fee.

-

Remittances: A considerable quantity of remittances flows from Indian staff in Qatar to India. These flows enhance the demand for INR and might affect the alternate fee.

-

Hypothesis and Market Sentiment: Market sentiment and hypothesis play a big position in short-term fluctuations of the alternate fee.

Implications for Companies and People:

Understanding the historic QAR/INR alternate fee is essential for a number of stakeholders:

-

Companies: Corporations engaged in cross-border commerce between India and Qatar must rigorously monitor the alternate fee to handle their overseas alternate danger. Fluctuations within the alternate fee can considerably affect profitability. Hedging methods, equivalent to ahead contracts or choices, can assist mitigate this danger.

-

Traders: Traders contemplating investments in both Indian or Qatari belongings want to contemplate the alternate fee’s affect on their returns. The alternate fee can considerably have an effect on the worth of their investments when transformed again to their residence forex.

-

Remittance Senders: People sending remittances from Qatar to India want to pay attention to the alternate fee to maximise the quantity acquired by their beneficiaries.

Conclusion:

The historic QAR/INR alternate fee chart, spanning from 2000 to the current, provides a wealthy narrative of the financial and political interaction between Qatar and India. Analyzing this chart, coupled with an understanding of the underlying macroeconomic components, supplies invaluable insights for companies, traders, and people concerned in cross-border transactions. Whereas the QAR’s peg to the US greenback supplies a level of stability, the INR’s susceptibility to international and regional occasions continues to introduce volatility into the QAR/INR alternate fee. Continued monitoring of those components is essential for efficient danger administration and knowledgeable decision-making. Future analysis may delve deeper into particular occasions and their affect on the alternate fee, additional refining our understanding of this dynamic relationship. Moreover, incorporating predictive modeling strategies may supply invaluable insights into potential future alternate fee actions.

Closure

Thus, we hope this text has offered invaluable insights into A Historic Journey: Charting the QAR/INR Trade Fee from 2000 to Current. We recognize your consideration to our article. See you in our subsequent article!