A Visible Information to Chart Patterns: Decoding the Language of Market Traits

Associated Articles: A Visible Information to Chart Patterns: Decoding the Language of Market Traits

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to A Visible Information to Chart Patterns: Decoding the Language of Market Traits. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

A Visible Information to Chart Patterns: Decoding the Language of Market Traits

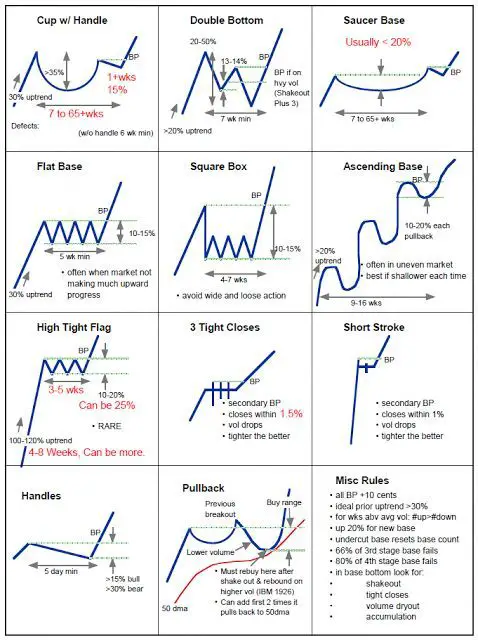

Chart patterns are recurring formations on worth charts that may provide beneficial insights into potential future worth actions. They don’t seem to be crystal balls, however they signify statistically important occurrences of previous worth motion that may enhance your buying and selling choices when mixed with different types of evaluation. Understanding and figuring out these patterns requires apply and a eager eye, however the rewards by way of improved buying and selling efficiency may be substantial. This text offers a visible information to a few of the commonest and dependable chart patterns, explaining their formation, interpretation, and potential implications.

I. Continuation Patterns: These patterns counsel a short lived pause in an current development, adopted by a resumption of the development in the identical course.

A. Triangles: Triangles are characterised by converging trendlines. There are three most important sorts:

-

Symmetrical Triangle: This sample exhibits converging trendlines, with neither displaying a stronger slope. The worth motion oscillates throughout the triangle, creating a way of indecision. Breakouts can happen in both course, however the breakout course usually signifies the continuation of the pre-existing development. A breakout above the higher trendline suggests a continuation of an uptrend, whereas a breakout beneath the decrease trendline suggests a continuation of a downtrend.

(Insert picture of a symmetrical triangle with labeled trendlines and breakout factors)

-

Ascending Triangle: This sample incorporates a flat decrease trendline and an upward-sloping higher trendline. The worth motion constantly exams the decrease trendline, indicating robust shopping for help. Breakouts above the higher trendline are thought-about bullish alerts, confirming the continuation of the uptrend.

(Insert picture of an ascending triangle with labeled trendlines and breakout factors)

-

Descending Triangle: This sample is the alternative of the ascending triangle, that includes a flat higher trendline and a downward-sloping decrease trendline. The worth motion constantly exams the higher trendline, indicating weakening shopping for strain. Breakouts beneath the decrease trendline are thought-about bearish alerts, confirming the continuation of the downtrend.

(Insert picture of a descending triangle with labeled trendlines and breakout factors)

B. Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the prior development).

-

Flag: This sample consists of a pointy worth transfer (the flagpole) adopted by a interval of consolidation inside parallel trendlines, forming an oblong or barely sloped form. The breakout from the flag sometimes happens within the course of the previous development.

(Insert picture of a bullish and bearish flag sample)

-

Pennant: Much like a flag, however the consolidation section types a triangular form, converging trendlines. Breakouts from pennants additionally often observe the course of the previous development.

(Insert picture of a bullish and bearish pennant sample)

C. Rectangles: Rectangles are characterised by horizontal help and resistance ranges. The worth oscillates between these ranges, creating an oblong form. Breakouts above the resistance degree are bullish, whereas breakouts beneath the help degree are bearish, usually persevering with the previous development.

**(Insert picture of a rectangle sample with labeled help and resistance ranges and breakout factors)**II. Reversal Patterns: These patterns counsel a possible change within the course of the present development.

A. Head and Shoulders: This can be a basic reversal sample. It consists of three peaks: a left shoulder, a head (the best peak), and a proper shoulder. The neckline is a line connecting the troughs between the peaks. A break beneath the neckline is taken into account a bearish sign, indicating a possible reversal of an uptrend.

**(Insert picture of a head and shoulders sample with labeled neckline, head, shoulders, and breakout level)**B. Inverse Head and Shoulders: That is the mirror picture of the pinnacle and shoulders sample. It is a bullish reversal sample, with three troughs: a left shoulder, a head (the bottom trough), and a proper shoulder. A break above the neckline is taken into account a bullish sign, indicating a possible reversal of a downtrend.

**(Insert picture of an inverse head and shoulders sample with labeled neckline, head, shoulders, and breakout level)**C. Double Tops and Double Bottoms: These patterns contain two comparable peaks (double prime) or troughs (double backside) at roughly the identical worth degree. A double prime is a bearish reversal sample; a break beneath the neckline (connecting the 2 peaks) signifies a possible downtrend. A double backside is a bullish reversal sample; a break above the neckline (connecting the 2 troughs) signifies a possible uptrend.

**(Insert picture of a double prime and double backside sample with labeled necklines and breakout factors)**D. Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs. These patterns are usually thought-about stronger reversal alerts as a result of elevated affirmation.

**(Insert picture of a triple prime and triple backside sample with labeled necklines and breakout factors)**III. Necessary Concerns:

-

Quantity Affirmation: Whereas chart patterns present visible clues, it is essential to think about quantity. A robust breakout ought to ideally be accompanied by elevated quantity, confirming the power of the transfer. Weak breakouts with low quantity usually result in false alerts.

-

Timeframe Issues: Chart patterns can seem on numerous timeframes (e.g., every day, weekly, month-to-month). The timeframe influences the potential period and magnitude of the expected worth motion.

-

Context is Key: Chart patterns must be analyzed throughout the broader market context. Take into account total market traits, financial indicators, and information occasions that might affect worth motion.

-

Not foolproof: Chart patterns are probabilistic, not deterministic. They provide potential situations, not ensures. All the time use stop-loss orders to handle threat.

-

Observe Makes Excellent: Figuring out chart patterns successfully requires important apply and expertise. Begin by analyzing historic charts and step by step refine your sample recognition expertise.

Conclusion:

Chart patterns are a beneficial device for technical analysts, offering insights into potential market actions. By understanding their formations and interpretations, merchants can enhance their decision-making course of and probably improve their buying and selling efficiency. Nonetheless, keep in mind that chart patterns are only one piece of the puzzle. Combining them with elementary evaluation and threat administration methods is essential for profitable buying and selling. Steady studying and apply are key to mastering the artwork of chart sample recognition. This visible information serves as a place to begin; additional analysis and sensible utility are important for creating experience on this space.

Closure

Thus, we hope this text has offered beneficial insights into A Visible Information to Chart Patterns: Decoding the Language of Market Traits. We thanks for taking the time to learn this text. See you in our subsequent article!