Financial institution Nifty Stay Chart Right now: A Deep Dive into the Day’s Buying and selling Motion

Associated Articles: Financial institution Nifty Stay Chart Right now: A Deep Dive into the Day’s Buying and selling Motion

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Financial institution Nifty Stay Chart Right now: A Deep Dive into the Day’s Buying and selling Motion. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Financial institution Nifty Stay Chart Right now: A Deep Dive into the Day’s Buying and selling Motion

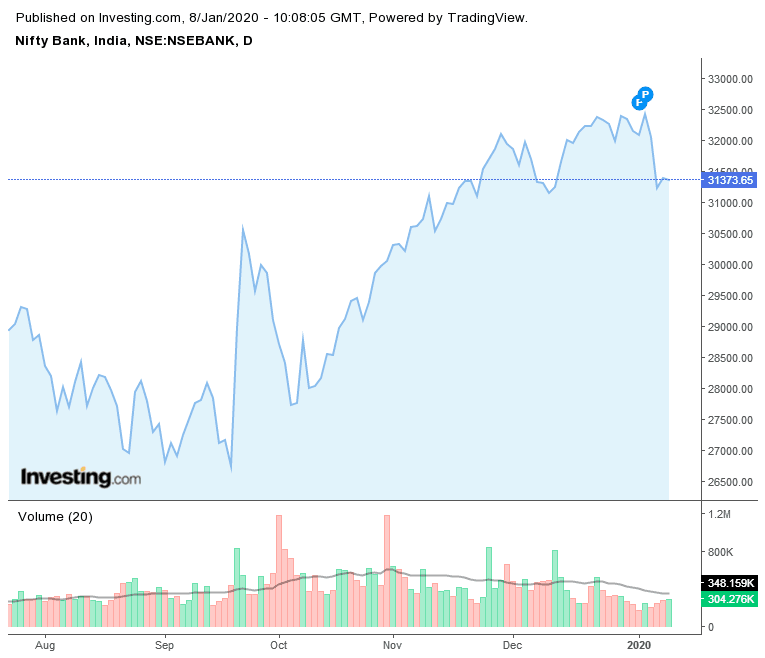

The Financial institution Nifty, a vital barometer of India’s banking sector and a major factor of the broader Nifty 50 index, skilled [Insert today’s date] with [Describe the overall market sentiment – e.g., significant volatility, a steady upward trend, a period of consolidation, a sharp decline]. This text will dissect the Financial institution Nifty’s stay chart efficiency all through the day, analyzing key worth actions, quantity developments, and potential contributing components, providing insights for each seasoned merchants and people new to the market. Be aware that this evaluation relies on the info obtainable as much as the time of writing and future efficiency is just not assured.

Opening Bell and Early Tendencies:

The Financial institution Nifty opened at [Insert opening price] at [Insert opening time], reflecting [Describe the opening sentiment – e.g., a positive carryover from the previous day’s close, a cautious start after recent volatility, a gap-up/gap-down opening]. Preliminary buying and selling noticed [Describe the early trends – e.g., a surge in buying pressure, a period of consolidation around the opening price, selling pressure pushing the index lower]. Quantity within the early hours was [Describe volume – e.g., relatively low, significantly higher than average, in line with recent trends]. This may very well be attributed to [Offer potential reasons – e.g., profit-booking after recent gains, anticipation of key economic data releases, general market sentiment].

Intraday Worth Motion and Key Assist/Resistance Ranges:

All through the day, the Financial institution Nifty encountered key help and resistance ranges at [List key support and resistance levels with explanations]. As an illustration, a break under [Support level] might have triggered additional promoting stress, doubtlessly resulting in a transfer in the direction of [Lower target level]. Conversely, a decisive break above [Resistance level] may need signaled a bullish pattern, doubtlessly concentrating on [Higher target level]. The chart displayed [Describe the chart pattern – e.g., a clear upward trend, a consolidation pattern, a bearish reversal pattern] which recommended [Explain the implication of the pattern].

Influence of Information and World Occasions:

World market actions, notably within the US and European markets, performed a [Describe the impact – e.g., significant, minor, negligible] function in shaping the Financial institution Nifty’s trajectory. [Mention specific global events or news that influenced the market – e.g., interest rate hikes by the US Federal Reserve, geopolitical tensions, performance of global banking indices]. Home information additionally had a major affect. [Mention specific domestic news – e.g., announcements by the Reserve Bank of India (RBI), changes in government policies, performance of other key sectors]. For instance, [Explain the impact of a specific news item on the Bank Nifty].

Quantity Evaluation and Technical Indicators:

Quantity evaluation offered essential insights into the energy of the worth actions. [Describe the volume trends throughout the day – e.g., increasing volume during upward movements confirmed buying strength, declining volume during a price decline suggested weakening momentum]. The usage of technical indicators similar to [List specific technical indicators used – e.g., Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands] helped to gauge the momentum and potential pattern reversals. [Explain how these indicators were used and their implications – e.g., an RSI above 70 indicated overbought conditions, a MACD crossover signaled a potential bullish trend].

Particular person Financial institution Inventory Efficiency:

The efficiency of particular person financial institution shares throughout the Financial institution Nifty index additionally performed a vital function in shaping the general index’s motion. [Mention the performance of some key banking stocks – e.g., HDFC Bank, ICICI Bank, SBI]. For instance, [Explain the impact of a specific bank’s performance on the Bank Nifty]. Analyzing the relative energy of those particular person shares can present a extra granular understanding of the sector’s dynamics.

Elements Affecting Financial institution Nifty’s Motion:

A number of components contributed to the Financial institution Nifty’s efficiency all through the day. These embody:

-

Curiosity Fee Eventualities: The prevailing rate of interest setting and expectations concerning future fee adjustments considerably affect financial institution profitability and lending actions. [Explain how interest rate changes affected the Bank Nifty].

-

Credit score Progress and Asset High quality: The expansion in credit score and the standard of financial institution belongings are essential indicators of the banking sector’s well being. [Explain how credit growth and asset quality impacted the Bank Nifty].

-

Authorities Insurance policies and Laws: Authorities insurance policies and rules associated to the banking sector can have a profound affect available on the market. [Explain the impact of any relevant government policies or regulations].

-

World Financial Outlook: The worldwide financial outlook, together with progress projections and geopolitical dangers, performs a major function in influencing investor sentiment in the direction of the banking sector. [Explain how global economic factors affected the Bank Nifty].

-

Inflation and Financial Coverage: Inflationary pressures and the central financial institution’s response via financial coverage considerably affect the banking sector. [Explain the impact of inflation and monetary policy].

Closing Bell and Outlook:

The Financial institution Nifty closed at [Insert closing price] at [Insert closing time], exhibiting a [Describe the overall change – e.g., net gain, net loss, marginal change] in comparison with the opening worth. The day’s buying and selling exercise mirrored [Summarize the key characteristics of the day’s trading – e.g., significant volatility, a strong buying/selling pressure, a period of consolidation]. The outlook for the approaching days will depend on a number of components, together with [Mention key factors to watch out for – e.g., global economic data, domestic policy announcements, corporate earnings]. Merchants ought to fastidiously monitor these components and alter their methods accordingly.

Disclaimer: This evaluation is for informational functions solely and shouldn’t be thought of as monetary recommendation. Investing within the inventory market includes inherent dangers, and previous efficiency is just not indicative of future outcomes. It is important to conduct thorough analysis and seek the advice of with a certified monetary advisor earlier than making any funding selections. The data offered right here relies on publicly obtainable knowledge and should not embody all related components.

Closure

Thus, we hope this text has offered priceless insights into Financial institution Nifty Stay Chart Right now: A Deep Dive into the Day’s Buying and selling Motion. We recognize your consideration to our article. See you in our subsequent article!