Bullish Buying and selling Chart Patterns: Recognizing the Upswing Earlier than It Occurs

Associated Articles: Bullish Buying and selling Chart Patterns: Recognizing the Upswing Earlier than It Occurs

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Bullish Buying and selling Chart Patterns: Recognizing the Upswing Earlier than It Occurs. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Bullish Buying and selling Chart Patterns: Recognizing the Upswing Earlier than It Occurs

The inventory market, a posh tapestry woven with threads of hypothesis and actuality, affords quite a few alternatives for revenue. One essential side of profitable buying and selling lies in figuring out potential value actions earlier than they happen. That is the place chart patterns, visible representations of value motion, grow to be invaluable instruments. Whereas no sample ensures future success, understanding bullish chart patterns can considerably enhance your buying and selling technique, serving to you see potential upswings and capitalize on rising markets. This text delves into among the most dependable and incessantly encountered bullish chart patterns, explaining their traits, identification, and buying and selling implications.

Understanding the Fundamentals: Bullish vs. Bearish

Earlier than diving into particular patterns, it is essential to grasp the basic distinction between bullish and bearish tendencies. A bullish development is characterised by a sustained upward value motion, signifying rising purchaser demand. Conversely, a bearish development shows a sustained downward motion, indicating stronger vendor strain. Bullish chart patterns are formations that sometimes precede or accompany bullish tendencies, signaling a possible value enhance.

Key Issues Earlier than Utilizing Chart Patterns:

- Context is King: Chart patterns ought to by no means be analyzed in isolation. Think about the general market development, sector efficiency, firm fundamentals, and information occasions. A bullish sample in a bear market is perhaps a brief bounce, not a major reversal.

- Quantity Affirmation: Adjustments in value ought to be accompanied by corresponding quantity adjustments. A breakout from a bullish sample ought to ideally be confirmed by elevated buying and selling quantity, indicating robust purchaser participation.

- Threat Administration: No sample is foolproof. At all times use applicable danger administration strategies, together with stop-loss orders, to restrict potential losses.

- Timeframes: Chart patterns can seem on varied timeframes (e.g., each day, weekly, month-to-month). The timeframe chosen will affect the buying and selling technique and potential holding interval.

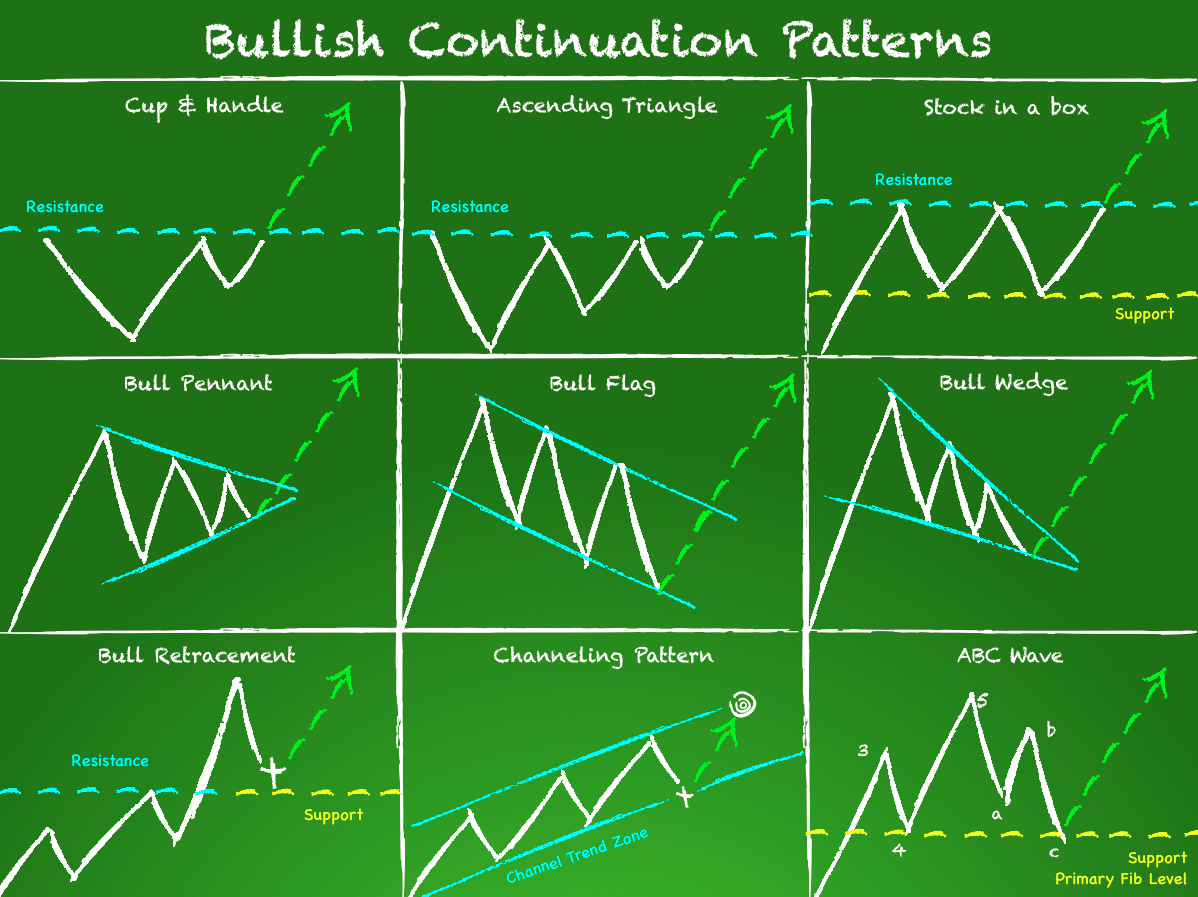

Prime Bullish Chart Patterns:

Listed here are among the most outstanding and dependable bullish chart patterns:

1. Head and Shoulders Backside:

This basic reversal sample signifies a possible shift from a bearish to a bullish development. It is characterised by three troughs (lows):

- Left Shoulder: The primary trough, forming the start of the sample.

- Head: A decrease trough following the left shoulder, representing a major value drop.

- Proper Shoulder: A trough comparable in top to the left shoulder, indicating a possible reversal.

- Neckline: A horizontal trendline connecting the highs between the left shoulder and head, and the pinnacle and proper shoulder.

A breakout above the neckline, confirmed by elevated quantity, alerts a possible bullish transfer. The goal value is usually estimated by measuring the space between the pinnacle and the neckline and projecting it upwards from the breakout level.

2. Double Backside:

This sample is less complicated than the pinnacle and shoulders backside. It includes two consecutive troughs at roughly the identical value stage, adopted by a major value enhance. The neckline is shaped by connecting the highs between the 2 troughs. A breakout above the neckline, with elevated quantity, suggests a possible bullish development. The worth goal is calculated equally to the pinnacle and shoulders backside, measuring the space from the trough to the neckline and including it to the breakout value.

3. Triple Backside:

Just like the double backside, however with three consecutive troughs at roughly the identical value stage. This sample reinforces the potential for a bullish reversal, because it signifies robust purchaser assist on the low value. The neckline is shaped by connecting the highs between the troughs, and a breakout above the neckline, with elevated quantity, alerts a possible bullish transfer. The worth goal calculation is similar because the earlier two patterns.

4. Inverse Head and Shoulders:

That is the bullish counterpart to the pinnacle and shoulders high (a bearish sample). It includes three peaks, with the center peak (the "head") being decrease than the opposite two ("shoulders"). The neckline is drawn by connecting the lows between the peaks. A breakout above the neckline, with elevated quantity, suggests a possible bullish development. The worth goal is calculated by measuring the space between the pinnacle and the neckline and including it to the breakout value.

5. Cup and Deal with:

This sample resembles a cup with a deal with. The "cup" is a U-shaped value trough, indicating a interval of consolidation. The "deal with" is a brief, downward sloping trendline, representing a minor value pullback. A breakout above the deal with’s excessive, with elevated quantity, alerts a possible bullish transfer. The worth goal is usually estimated by measuring the depth of the cup and including it to the breakout value.

6. Ascending Triangle:

This sample exhibits a sequence of upper highs and persistently flat lows, forming a triangle form. The ascending trendline connects the lows, and the horizontal resistance line represents a value ceiling. A breakout above the resistance line, with elevated quantity, suggests a bullish development. The worth goal may be estimated by measuring the peak of the triangle and including it to the breakout value.

7. Bullish Flag:

This sample consists of a pointy upward transfer (the "flagpole") adopted by a interval of consolidation inside a parallel channel (the "flag"). The flag is often characterised by decrease highs and better lows. A breakout above the higher trendline of the flag, with elevated quantity, suggests a continuation of the upward development. The worth goal is usually projected primarily based on the size of the flagpole.

8. Bullish Pennant:

Just like a bullish flag, however the consolidation section types a symmetrical triangle somewhat than a parallel channel. A breakout above the higher trendline, with elevated quantity, alerts a continuation of the upward development. The worth goal is normally calculated equally to the bullish flag, utilizing the flagpole size.

Buying and selling Methods Utilizing Bullish Chart Patterns:

As soon as you’ve got recognized a bullish chart sample, a number of buying and selling methods may be employed:

- Breakout Buying and selling: Enter a protracted place after a confirmed breakout above the sample’s resistance stage, with elevated quantity.

- Pullback Buying and selling: Watch for a minor pullback after the breakout to enter a protracted place at a barely cheaper price, lowering danger.

- Trailing Cease-Loss Orders: Use trailing stop-loss orders to guard earnings as the value strikes upwards.

Conclusion:

Bullish chart patterns are beneficial instruments for figuring out potential value will increase out there. Nonetheless, they need to be used at the side of different technical and elementary evaluation strategies. Keep in mind to all the time handle danger successfully and take into account the broader market context earlier than making any buying and selling selections. Constant follow, cautious commentary, and disciplined danger administration are key to efficiently using these patterns and benefiting from bullish market tendencies. Constantly studying and adapting your methods primarily based on market situations is essential for long-term success in buying and selling.

Closure

Thus, we hope this text has offered beneficial insights into Bullish Buying and selling Chart Patterns: Recognizing the Upswing Earlier than It Occurs. We hope you discover this text informative and helpful. See you in our subsequent article!