Chart Evaluation Shares: The Rise of AI-Powered Insights

Associated Articles: Chart Evaluation Shares: The Rise of AI-Powered Insights

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Chart Evaluation Shares: The Rise of AI-Powered Insights. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart Evaluation Shares: The Rise of AI-Powered Insights

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-437d981a36724a8c9892a7806d2315ec.jpg)

The inventory market, a fancy ecosystem pushed by human emotion and financial forces, has all the time been a fertile floor for analytical instruments. For many years, technical evaluation, the examine of worth charts and buying and selling quantity to foretell future worth actions, has been a cornerstone of funding methods. Nevertheless, the appearance of synthetic intelligence (AI) is revolutionizing chart evaluation, providing unprecedented capabilities to course of huge datasets, determine refined patterns, and generate actionable insights that have been beforehand past human capability. This text delves into the burgeoning area of AI-powered chart evaluation for shares, exploring its methodologies, advantages, limitations, and the way forward for this thrilling intersection of finance and expertise.

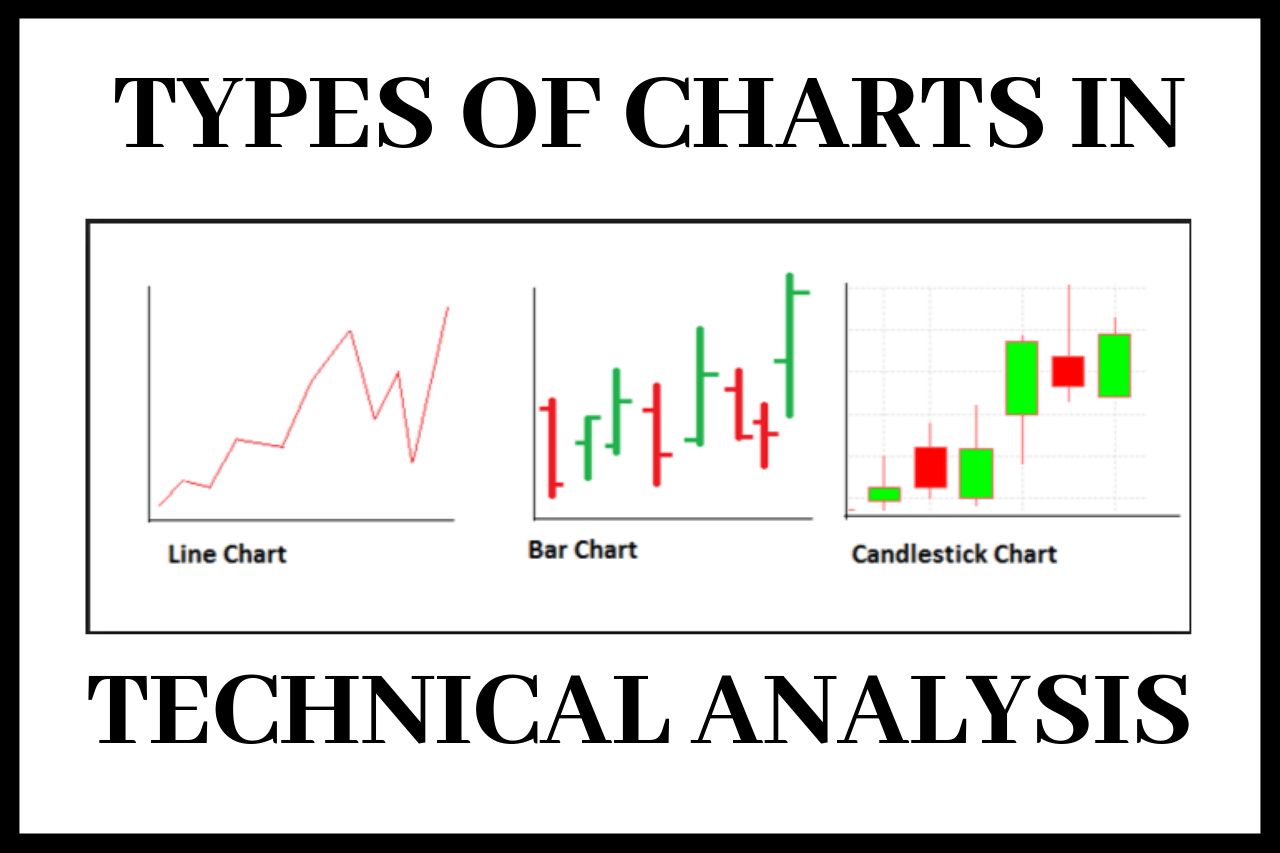

Conventional Chart Evaluation vs. AI-Pushed Approaches:

Conventional chart evaluation depends closely on human experience. Analysts spend numerous hours finding out charts, figuring out patterns like head and shoulders, double tops/bottoms, flags, and pennants, and decoding indicators like shifting averages, RSI, and MACD. Whereas skilled analysts can develop a eager eye for figuring out potential buying and selling alternatives, this strategy is inherently subjective, susceptible to biases, and restricted by the analyst’s cognitive capability to course of data.

AI-powered chart evaluation leverages machine studying (ML) algorithms to automate and improve this course of. These algorithms can analyze considerably bigger datasets than any human analyst may handle, encompassing not simply worth and quantity knowledge but additionally information sentiment, social media exercise, financial indicators, and even different knowledge sources like satellite tv for pc imagery or internet scraping outcomes. By figuring out correlations and patterns which might be invisible to the human eye, AI can uncover hidden market dynamics and predict future worth actions with probably higher accuracy.

Key AI Strategies in Chart Evaluation:

A number of AI strategies are employed in inventory chart evaluation:

-

Deep Studying: Neural networks, significantly recurrent neural networks (RNNs) and convolutional neural networks (CNNs), are well-suited for analyzing time-series knowledge like inventory costs. RNNs are efficient at capturing temporal dependencies, whereas CNNs can determine spatial patterns inside the chart. These fashions may be educated on huge historic datasets to be taught complicated relationships between worth actions and varied influencing elements.

-

Pure Language Processing (NLP): NLP strategies are essential for incorporating different knowledge sources like information articles, monetary studies, and social media posts. By analyzing the sentiment expressed in these texts, AI can gauge market sentiment and incorporate this data into its predictions.

-

Reinforcement Studying: This strategy trains AI brokers to make buying and selling selections by interacting with a simulated market atmosphere. The agent learns to optimize its buying and selling technique over time based mostly on rewards and penalties, resulting in probably extra worthwhile buying and selling algorithms.

-

Time Sequence Forecasting: Numerous time sequence forecasting fashions, together with ARIMA, Prophet, and exponential smoothing, are used to foretell future worth actions based mostly on historic knowledge. AI enhances these fashions by incorporating further options and utilizing extra refined strategies to enhance forecast accuracy.

Advantages of AI-Pushed Chart Evaluation:

The mixing of AI into chart evaluation provides a number of compelling advantages:

-

Enhanced Accuracy: AI algorithms can determine refined patterns and correlations that people would possibly miss, probably resulting in extra correct predictions of worth actions.

-

Elevated Velocity and Effectivity: AI can course of huge datasets and generate insights a lot quicker than human analysts, permitting for faster decision-making.

-

Lowered Bias: AI algorithms aren’t prone to emotional biases that may cloud human judgment, resulting in extra goal evaluation.

-

Scalability: AI-powered methods can simply scale to deal with giant numbers of shares and markets, offering complete market protection.

-

Backtesting and Optimization: AI facilitates rigorous backtesting of buying and selling methods, permitting for steady optimization and enchancment of algorithms.

Limitations and Challenges:

Regardless of its potential, AI-powered chart evaluation just isn’t with out limitations:

-

Information Dependency: The accuracy of AI fashions closely depends on the standard and amount of coaching knowledge. Inadequate or biased knowledge can result in inaccurate predictions.

-

Overfitting: AI fashions can typically overfit the coaching knowledge, that means they carry out properly on the coaching set however poorly on unseen knowledge. This requires cautious mannequin choice and regularization strategies.

-

Black Field Downside: The complexity of some AI fashions could make it obscure their decision-making course of, elevating issues about transparency and explainability.

-

Market Volatility and Unpredictability: The inventory market is inherently unpredictable, and even essentially the most refined AI fashions can not completely predict future worth actions.

-

Moral Issues: Using AI in finance raises moral issues about algorithmic bias, market manipulation, and the potential displacement of human analysts.

The Way forward for AI in Chart Evaluation:

The sphere of AI-powered chart evaluation is quickly evolving. Future developments are more likely to embody:

-

Hybrid Fashions: Combining AI with human experience to leverage the strengths of each approaches.

-

Extra Subtle Algorithms: Growing extra superior AI fashions that may deal with noisy knowledge, adapt to altering market circumstances, and incorporate a wider vary of knowledge sources.

-

Explainable AI (XAI): Growing strategies to make AI fashions extra clear and comprehensible, growing belief and accountability.

-

Personalised Investing: AI-powered platforms that tailor funding methods to particular person investor profiles and threat tolerances.

-

Integration with different Monetary Applied sciences: Combining AI-driven chart evaluation with different fintech improvements like robo-advisors and algorithmic buying and selling platforms.

Conclusion:

AI is remodeling the panorama of inventory chart evaluation, providing highly effective instruments to boost funding decision-making. Whereas challenges stay, the potential advantages are important. By addressing the restrictions and fostering accountable growth, AI can unlock new alternatives for traders and reshape the way forward for monetary markets. Nevertheless, it is essential to keep in mind that AI is a software, not a magic bullet. Profitable utility requires a deep understanding of each AI strategies and the intricacies of the inventory market. A balanced strategy, combining the ability of AI with human experience and important judgment, shall be key to navigating the complexities of the monetary world within the age of synthetic intelligence. The way forward for chart evaluation just isn’t about changing human analysts however somewhat augmenting their capabilities, empowering them with highly effective instruments to make extra knowledgeable and efficient funding selections.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

Closure

Thus, we hope this text has offered beneficial insights into Chart Evaluation Shares: The Rise of AI-Powered Insights. We admire your consideration to our article. See you in our subsequent article!