Chart Industries’ Debt: A Deep Dive into Monetary Leverage and Future Prospects

Associated Articles: Chart Industries’ Debt: A Deep Dive into Monetary Leverage and Future Prospects

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Industries’ Debt: A Deep Dive into Monetary Leverage and Future Prospects. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart Industries’ Debt: A Deep Dive into Monetary Leverage and Future Prospects

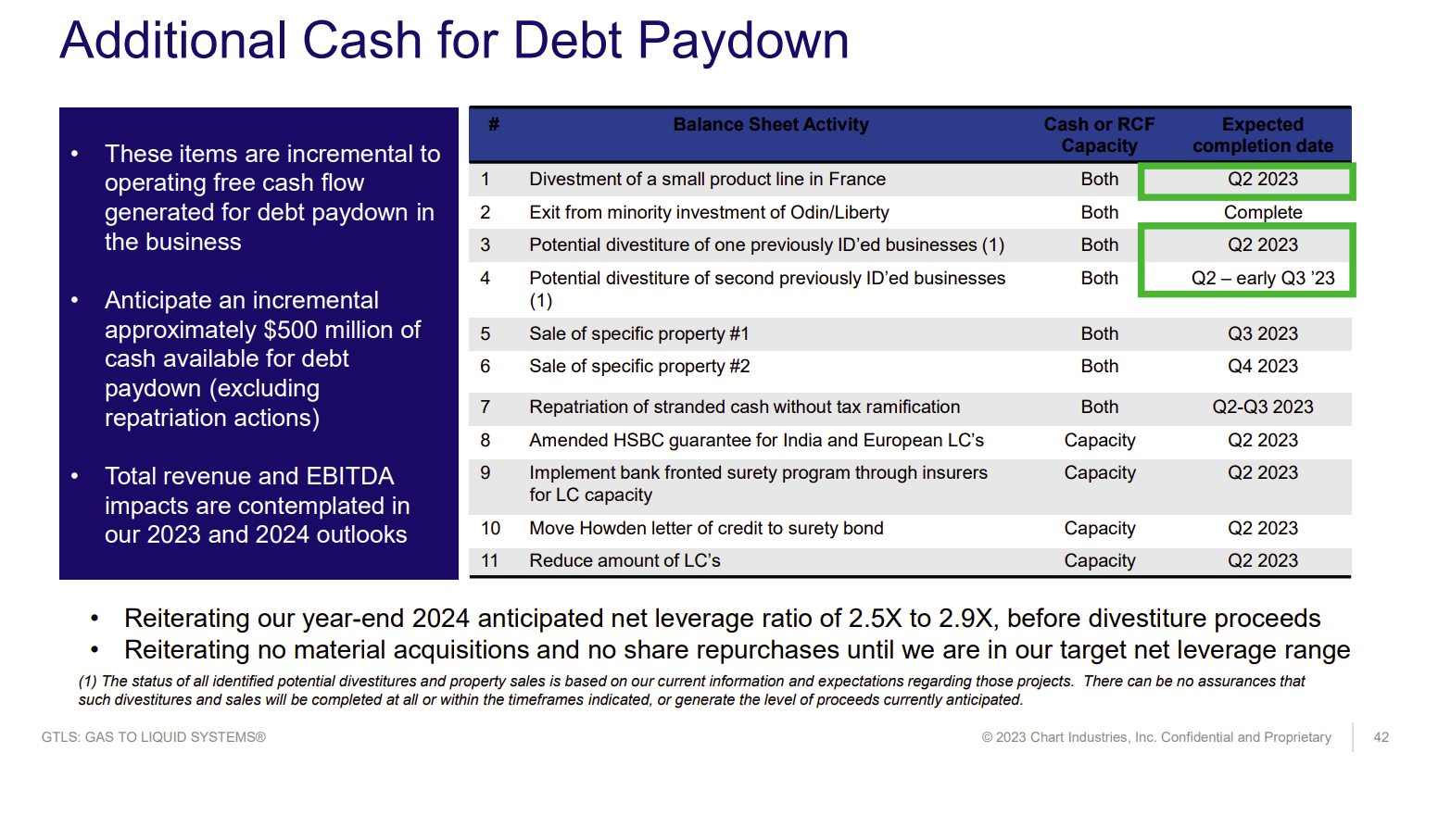

Chart Industries, a number one supplier of cryogenic tools and providers, occupies a novel place within the industrial gasoline and power sectors. Its subtle know-how and important function in varied rising markets, reminiscent of LNG and hydrogen, have fueled important progress. Nonetheless, this enlargement has additionally been accompanied by a considerable enhance in debt, elevating questions concerning the firm’s monetary well being and long-term sustainability. This text will delve into Chart Industries’ debt profile, analyzing its composition, sources, makes use of, and the potential implications for traders and stakeholders.

Chart Industries’ Debt Construction: A Multifaceted Panorama

Chart Industries’ debt construction is advanced, encompassing quite a lot of devices with differing maturities and rates of interest. Understanding this complexity is essential for evaluating its total monetary danger. The corporate’s debt usually consists of:

-

Lengthy-term debt: This represents the majority of Chart Industries’ debt obligations, together with financial institution loans, bonds, and notes payable. Lengthy-term debt presents the corporate flexibility in managing its money stream, however it additionally carries the chance of rate of interest fluctuations and potential refinancing challenges. The maturity dates of those devices are unfold throughout a number of years, decreasing the instant strain of compensation however rising the general publicity to rate of interest danger over the long run.

-

Brief-term debt: This class consists of industrial paper, strains of credit score, and different obligations due inside one yr. Brief-term debt supplies instant liquidity however requires common refinancing, exposing the corporate to potential credit score market volatility. A major reliance on short-term debt can enhance monetary danger, notably throughout financial downturns.

-

Lease obligations: Chart Industries, like many capital-intensive companies, makes use of leasing preparations for a few of its tools and amenities. These lease obligations signify a type of off-balance-sheet financing, however they nonetheless contribute to the corporate’s total monetary burden. Analyzing these obligations is vital for a complete understanding of the corporate’s debt profile.

Sources and Makes use of of Debt: Fueling Progress and Acquisitions

Chart Industries’ debt has been primarily used to finance its progress technique, which incorporates:

-

Capital expenditures (CAPEX): The corporate’s manufacturing and repair operations require important investments in tools, amenities, and know-how. Debt financing permits Chart Industries to undertake these capital expenditures with out considerably diluting fairness possession.

-

Acquisitions: Chart Industries has pursued a technique of strategic acquisitions to increase its product portfolio, market attain, and technological capabilities. These acquisitions have been largely financed by debt, accelerating progress however rising the corporate’s leverage.

-

Working capital administration: Debt can be utilized to handle working capital wants, reminiscent of stock financing and accounts receivable administration. Whereas important for operational effectivity, extreme reliance on debt for working capital can sign underlying monetary weaknesses.

-

Share repurchases: Whereas much less distinguished than the opposite makes use of, debt could sometimes be used to fund share repurchases, returning capital to shareholders. Nonetheless, this technique must be rigorously evaluated in gentle of the corporate’s total debt burden and funding alternatives.

Analyzing Debt Metrics: Evaluating Monetary Well being

A number of key monetary ratios present insights into Chart Industries’ debt administration and monetary well being:

-

Debt-to-equity ratio: This ratio compares the corporate’s whole debt to its shareholder fairness, indicating the proportion of financing derived from debt versus fairness. A excessive debt-to-equity ratio suggests greater monetary danger.

-

Curiosity protection ratio: This ratio measures the corporate’s skill to pay its curiosity bills from its earnings earlier than curiosity and taxes (EBIT). A low curiosity protection ratio signifies the next danger of default.

-

Instances curiosity earned ratio: Just like the curiosity protection ratio, this metric assesses the corporate’s capability to fulfill its curiosity obligations.

-

Debt-to-assets ratio: This ratio signifies the proportion of the corporate’s property financed by debt. A excessive ratio suggests higher monetary leverage and danger.

-

Money stream to debt ratio: This ratio assesses the corporate’s skill to repay its debt utilizing its working money stream. The next ratio signifies stronger debt servicing capability.

Analyzing these ratios over time and evaluating them to business benchmarks is essential for evaluating Chart Industries’ monetary danger and its skill to handle its debt obligations successfully. A deteriorating development in these metrics might sign rising monetary misery.

The Impression of Financial Circumstances and Business Developments

Chart Industries’ debt profile is considerably influenced by macroeconomic elements and business traits:

-

Rate of interest fluctuations: Modifications in rates of interest instantly affect the corporate’s curiosity expense and its skill to refinance its debt. Rising rates of interest can enhance borrowing prices and pressure the corporate’s monetary sources.

-

Commodity costs: Fluctuations within the costs of uncooked supplies and power can have an effect on Chart Industries’ profitability and its skill to service its debt.

-

Demand for cryogenic tools: The demand for Chart Industries’ merchandise is intently tied to the expansion of the LNG and hydrogen industries. A slowdown in these sectors might negatively affect the corporate’s income and its skill to handle its debt.

-

Geopolitical dangers: World political instability and commerce tensions can disrupt provide chains and have an effect on demand for cryogenic tools, impacting the corporate’s monetary efficiency.

Future Outlook and Potential Challenges

Chart Industries’ future success hinges on its skill to handle its debt successfully whereas capitalizing on the expansion alternatives within the LNG and hydrogen markets. Key challenges embrace:

-

Sustaining profitability: Sustained profitability is important for servicing debt and investing in future progress. The corporate must successfully handle prices and pricing to make sure wholesome margins.

-

Managing refinancing danger: As debt matures, Chart Industries might want to refinance its obligations. The supply and price of refinancing will rely on market circumstances and the corporate’s credit standing.

-

Navigating financial uncertainty: The corporate’s monetary well being is susceptible to financial downturns and commodity value volatility. Efficient danger administration methods are essential to mitigate these dangers.

-

Competitors: Chart Industries faces competitors from each established gamers and new entrants within the cryogenic tools market. Sustaining a aggressive edge requires steady innovation and environment friendly operations.

Conclusion:

Chart Industries’ debt is a major consider its monetary profile. Whereas debt has performed a vital function in its progress, managing this leverage successfully is vital for long-term success. Traders and stakeholders ought to rigorously analyze the corporate’s debt metrics, business traits, and administration’s methods for debt administration to evaluate the related dangers and alternatives. A radical understanding of the corporate’s debt construction and its skill to service its obligations is important for making knowledgeable funding choices. Steady monitoring of key monetary ratios and business developments might be essential in evaluating Chart Industries’ monetary well being and its future prospects. The corporate’s skill to navigate the complexities of its debt profile whereas capitalizing on the expansion potential of the power transition will in the end decide its long-term success.

Closure

Thus, we hope this text has supplied useful insights into Chart Industries’ Debt: A Deep Dive into Monetary Leverage and Future Prospects. We thanks for taking the time to learn this text. See you in our subsequent article!