Chart of Accounts: A Complete Information to Creation and Administration

Associated Articles: Chart of Accounts: A Complete Information to Creation and Administration

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Chart of Accounts: A Complete Information to Creation and Administration. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts: A Complete Information to Creation and Administration

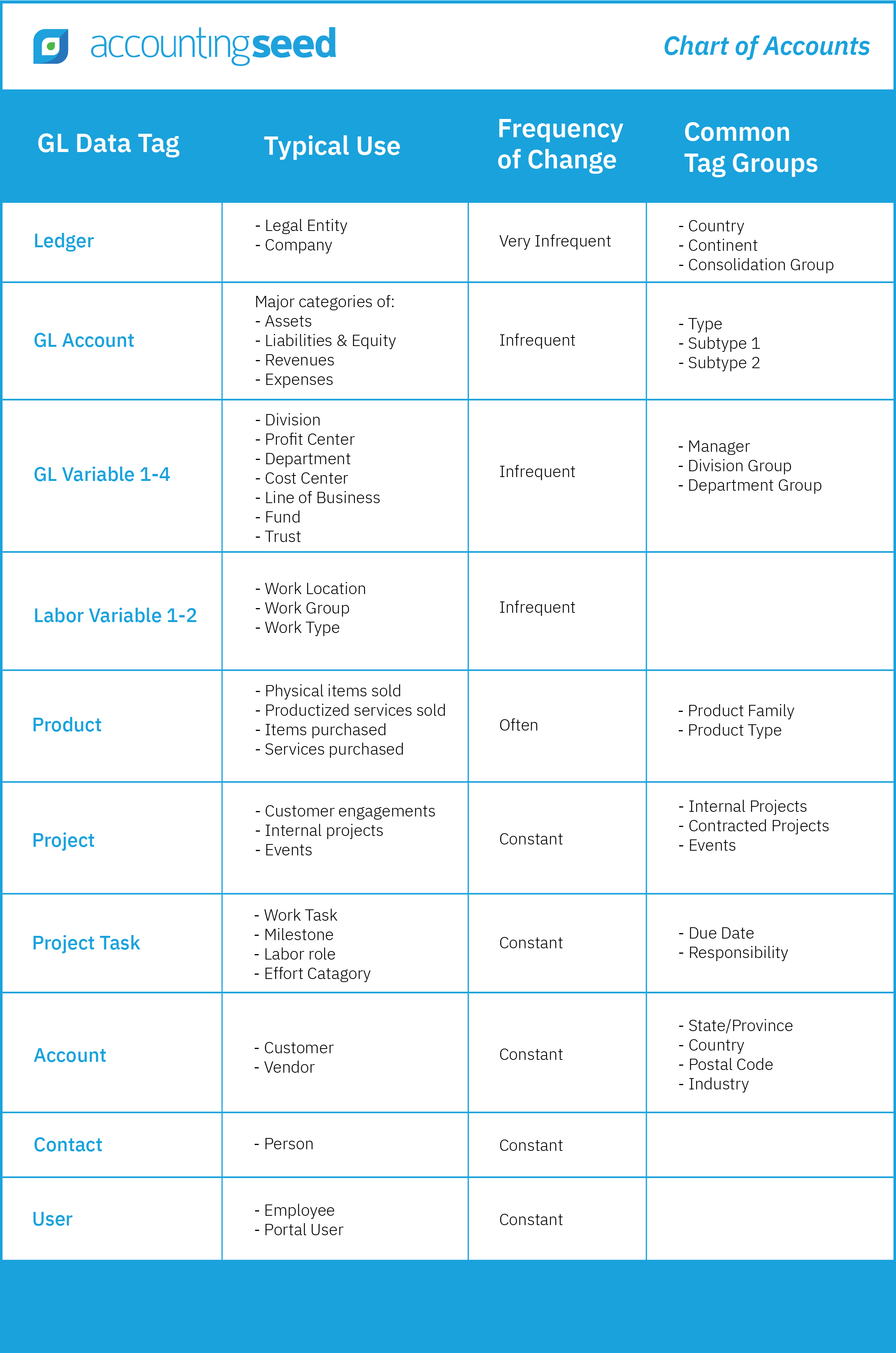

A Chart of Accounts (COA) is the spine of any profitable accounting system. It is a structured listing of all of the accounts utilized by a enterprise to document its monetary transactions. Consider it as an in depth organizational map of an organization’s funds, categorizing each penny earned and spent. A well-designed COA is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. This complete information will stroll you thru the method of making and managing a Chart of Accounts, overlaying all the pieces from basic ideas to superior issues.

I. Understanding the Fundamentals:

Earlier than diving into the creation course of, let’s make clear some key ideas:

- Account: A particular class used to document monetary transactions. Examples embody Money, Accounts Receivable, Stock, Gross sales Income, and Salaries Expense.

- Account Quantity: A singular identifier assigned to every account, sometimes utilizing a hierarchical numbering system for simpler categorization and reporting.

-

Account Sort: Accounts are categorized into differing types, primarily property, liabilities, fairness, income, and bills. Understanding these account varieties is key to double-entry bookkeeping.

- Property: What an organization owns (e.g., money, accounts receivable, stock, tools).

- Liabilities: What an organization owes to others (e.g., accounts payable, loans payable).

- Fairness: The proprietor’s stake within the firm (e.g., capital inventory, retained earnings).

- Income: Revenue generated from enterprise operations (e.g., gross sales income, service income).

- Bills: Prices incurred in working the enterprise (e.g., salaries expense, hire expense, utilities expense).

- Normal Ledger: The central repository of all monetary transactions, organized by account. The COA acts because the index for the final ledger.

- Trial Steadiness: A report summarizing the debit and credit score balances of all accounts within the normal ledger. A balanced trial stability is a vital step in making certain the accuracy of the accounting information.

II. Designing Your Chart of Accounts:

Making a COA requires cautious planning and consideration of your corporation’s particular wants. This is a step-by-step information:

-

Outline Your Enterprise Construction: The construction of your COA will rely upon whether or not you are a sole proprietorship, partnership, LLC, or company. Completely different authorized constructions have totally different accounting necessities.

-

Determine Your Trade: Sure industries have particular accounting wants. For instance, a producing firm would require accounts for uncooked supplies, work-in-progress, and completed items stock, whereas a service-based enterprise may not.

-

Select a Chart of Accounts System: You possibly can create a COA from scratch, use a pre-designed template (out there from accounting software program or on-line sources), or adapt an present template to your particular wants. The selection is dependent upon your accounting experience and the complexity of your corporation.

-

Develop a Numbering System: A well-structured numbering system is essential for organizing and retrieving account info effectively. Frequent methods embody:

-

Hierarchical System: Makes use of a collection of numbers to signify totally different ranges of element. For instance:

- 1000 – Property

- 1100 – Present Property

- 1110 – Money

- 1120 – Accounts Receivable

-

Decimal System: Makes use of decimal factors to separate account classes. For instance:

- 1.00 – Property

- 1.10 – Present Property

- 1.10.1 – Money

- 1.10.2 – Accounts Receivable

-

Hierarchical System: Makes use of a collection of numbers to signify totally different ranges of element. For instance:

-

Record Your Accounts: Based mostly on your corporation construction and business, meticulously listing all of the accounts you may want. Think about using a spreadsheet to prepare this info. Embrace:

- Account Title

- Account Quantity

- Account Sort (Asset, Legal responsibility, Fairness, Income, Expense)

- Description (a quick clarification of the account’s objective)

-

Think about Sub-accounts: For detailed monitoring, use sub-accounts inside main accounts. For instance, you might need sub-accounts beneath "Gross sales Income" for various product traces or providers.

-

Evaluate and Refine: As soon as you have created your preliminary COA, overview it totally to make sure it is complete, correct, and aligns with your corporation wants. Search recommendation from an accountant if wanted.

III. Account Sorts in Element:

Let’s look at the 5 major account varieties in additional element:

-

Property: These signify what your corporation owns. They’re listed so as of liquidity (how rapidly they are often transformed to money). Examples embody:

- Present Property: Property anticipated to be transformed to money inside one 12 months (e.g., money, accounts receivable, stock, pay as you go bills).

- Non-Present Property: Property with a lifespan exceeding one 12 months (e.g., property, plant, and tools (PP&E), long-term investments).

-

Liabilities: These signify what your corporation owes to others. They’re listed so as of maturity (when they’re due). Examples embody:

- Present Liabilities: Liabilities due inside one 12 months (e.g., accounts payable, salaries payable, short-term loans).

- Non-Present Liabilities: Liabilities due in multiple 12 months (e.g., long-term loans, bonds payable).

-

Fairness: This represents the proprietor’s stake within the enterprise. For companies, this consists of:

- Frequent Inventory: Represents the possession shares issued to buyers.

- Retained Earnings: Gathered earnings that haven’t been distributed as dividends.

-

Income: This represents revenue generated from enterprise operations. Examples embody:

- Gross sales Income: Revenue from promoting items.

- Service Income: Revenue from offering providers.

- Curiosity Income: Revenue from interest-bearing accounts.

-

Bills: These signify prices incurred in working the enterprise. Examples embody:

- Value of Items Bought (COGS): Direct prices related to producing items offered.

- Promoting, Normal, and Administrative Bills (SG&A): Bills associated to advertising and marketing, gross sales, administration, and different operational prices.

IV. Sustaining and Updating Your Chart of Accounts:

Your COA will not be a static doc. As your corporation grows and evolves, you may have to replace it to mirror adjustments in your operations and monetary reporting wants. Common overview and updates are essential for sustaining the accuracy and relevance of your accounting system. Listed below are some key issues:

- Including New Accounts: As your corporation expands, you could want so as to add new accounts to trace new merchandise, providers, or bills.

- Deleting Out of date Accounts: If sure services or products are discontinued, it is best to delete the corresponding accounts out of your COA.

- Renaming Accounts: Account names may should be up to date to mirror adjustments in your corporation operations or accounting practices.

- Reconciling Accounts: Commonly reconcile your accounts to make sure they precisely mirror your monetary place. This entails evaluating your accounting information to financial institution statements and different exterior sources.

V. Using Accounting Software program:

Most fashionable accounting software program packages embody built-in COA options. These options typically simplify the method of making, managing, and updating your COA. They sometimes provide:

- Pre-designed Templates: Many software program packages present pre-designed COA templates that may be personalized to suit your enterprise wants.

- Automated Numbering Techniques: The software program mechanically assigns account numbers primarily based in your chosen numbering system.

- Account Sort Classification: The software program mechanically categorizes accounts into the suitable account varieties (Asset, Legal responsibility, and many others.).

- Reporting Capabilities: The software program generates varied monetary reviews primarily based in your COA, comparable to revenue statements, stability sheets, and money movement statements.

VI. Conclusion:

A well-designed and maintained Chart of Accounts is an indispensable device for any enterprise. It gives a structured framework for recording monetary transactions, making certain correct monetary reporting, and facilitating knowledgeable decision-making. By following the steps outlined on this information, you possibly can create a COA that successfully helps your corporation’s monetary administration wants. Keep in mind to usually overview and replace your COA to mirror the evolving nature of your corporation operations. Consulting with an accountant can present invaluable steerage all through the method, making certain your COA is compliant with related accounting requirements and finest practices.

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

Closure

Thus, we hope this text has supplied invaluable insights into Chart of Accounts: A Complete Information to Creation and Administration. We admire your consideration to our article. See you in our subsequent article!