Chart of Accounts Expense Classes: A Complete Information

Associated Articles: Chart of Accounts Expense Classes: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart of Accounts Expense Classes: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts Expense Classes: A Complete Information

A well-organized chart of accounts is the spine of any profitable accounting system. It supplies a structured framework for recording monetary transactions, enabling correct monetary reporting, budgeting, and evaluation. Inside this framework, expense classes play an important position, providing granular element on the place a enterprise’s cash is being spent. Understanding and successfully categorizing bills is important for making knowledgeable enterprise selections, figuring out cost-saving alternatives, and guaranteeing compliance with accounting requirements. This text delves into the varied expense classes generally present in a chart of accounts, providing insights into their classification and significance.

The Significance of Detailed Expense Categorization:

Earlier than exploring particular classes, it is essential to grasp why detailed expense categorization is so important. A poorly designed system can result in:

- Inaccurate Monetary Reporting: Imprecise expense classes make it tough to precisely assess profitability, establish tendencies, and evaluate efficiency over time.

- Inefficient Budgeting: With out granular information, budgeting turns into a guessing sport, resulting in potential overspending or underspending in essential areas.

- Missed Value-Saving Alternatives: An absence of detailed data prevents the identification of areas the place prices might be decreased or optimized.

- Compliance Points: Correct expense categorization is important for adhering to tax rules and different authorized necessities.

- Problem in Monetary Evaluation: Detailed categorization permits for insightful evaluation, figuring out value drivers, and informing strategic selections.

Main Expense Class Classifications:

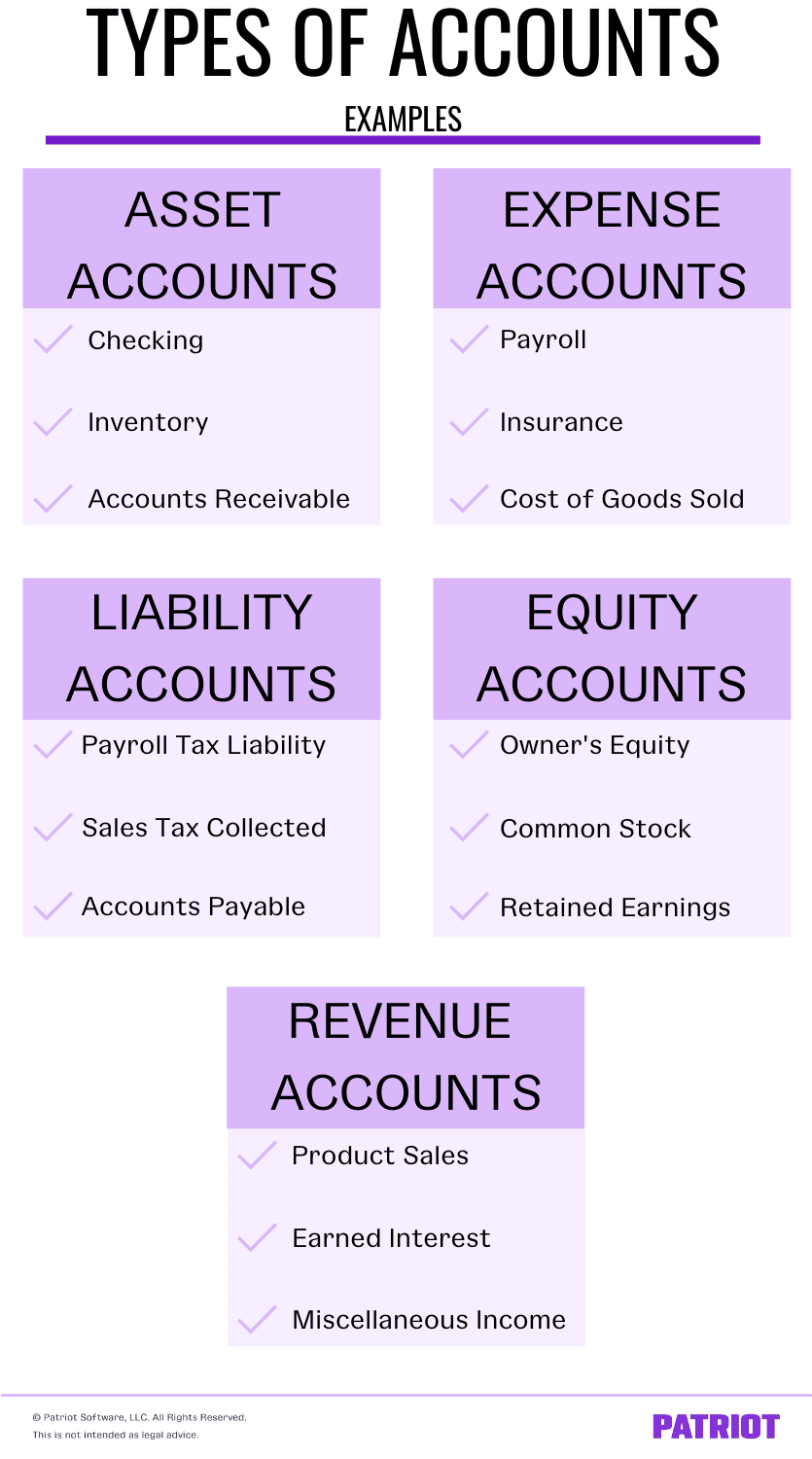

Expense classes are sometimes grouped into broader classifications to supply a hierarchical construction. These classifications can fluctuate relying on the trade and the precise wants of the enterprise, however some frequent groupings embody:

-

Value of Items Offered (COGS): This class encompasses the direct prices related to producing items offered by a enterprise. It consists of uncooked supplies, direct labor, and manufacturing overhead. COGS is an important component in calculating gross revenue.

-

Working Bills: These are the prices incurred within the day-to-day operation of the enterprise. They’re additional subdivided into varied classes, which we are going to discover intimately under.

-

Non-Working Bills: These are bills unrelated to the core operations of the enterprise. Examples embody curiosity expense, losses from the sale of belongings, and authorized charges associated to non-operating actions.

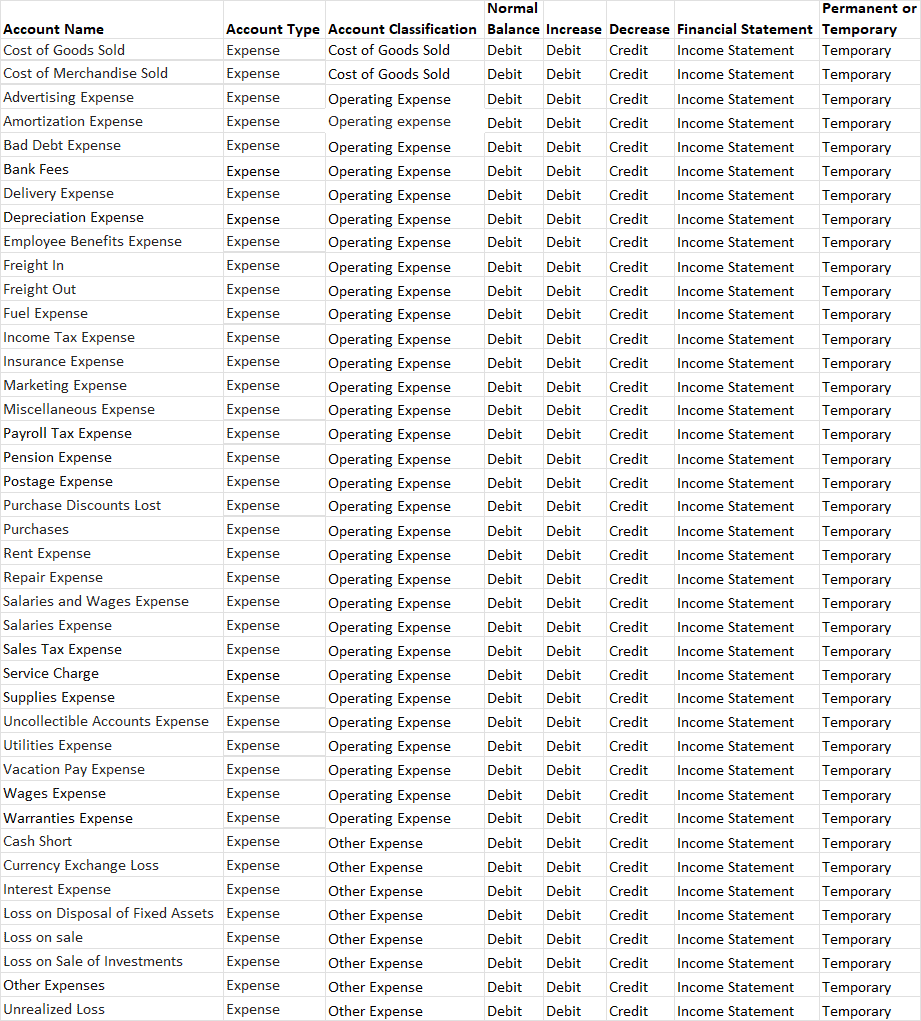

Detailed Breakdown of Widespread Working Expense Classes:

The working expense class is probably the most in depth and requires cautious consideration when designing a chart of accounts. This is a breakdown of frequent subcategories:

1. Promoting, Common, and Administrative Bills (SG&A): This broad class encompasses bills associated to promoting services or products, basic enterprise operations, and administrative features. It is additional divided into:

-

Promoting Bills: Prices immediately related to promoting services or products. This consists of:

- Gross sales Salaries and Commissions: Compensation paid to gross sales workers.

- Promoting and Advertising and marketing: Prices associated to selling services or products.

- Gross sales Journey and Leisure: Bills incurred for business-related journey and shopper leisure.

- Gross sales Provides: Supplies used within the gross sales course of.

- Delivery and Dealing with: Prices related to delivering merchandise to clients.

-

Common and Administrative Bills: Prices associated to the general administration and administration of the enterprise. This consists of:

- Salaries and Wages: Compensation paid to administrative workers.

- Hire and Utilities: Prices related to workplace area and utilities.

- Workplace Provides: Supplies used within the workplace.

- Insurance coverage: Premiums paid for varied varieties of insurance coverage.

- Authorized and Skilled Charges: Prices incurred for authorized, accounting, and consulting providers.

- Depreciation and Amortization: Allocation of the price of belongings over their helpful life.

- Dangerous Debt Expense: Losses incurred from uncollectible accounts receivable.

- Analysis and Improvement (R&D): Prices related to growing new services or products (generally a separate class).

- Data Expertise (IT): Prices associated to laptop {hardware}, software program, and IT help.

- Payroll Taxes: Taxes paid on worker wages and salaries.

- Worker Advantages: Prices related to worker advantages equivalent to medical insurance and retirement plans.

2. Analysis and Improvement (R&D): In lots of corporations, R&D is a separate and important expense class, reflecting investments in innovation and future progress. This consists of salaries of R&D personnel, supplies, and gear used within the analysis course of.

3. Curiosity Expense: The price of borrowing cash. This consists of curiosity funds on loans, strains of credit score, and different debt devices.

4. Depreciation and Amortization: Non-cash bills that allocate the price of tangible and intangible belongings over their helpful lives. Depreciation applies to tangible belongings (e.g., gear, buildings), whereas amortization applies to intangible belongings (e.g., patents, copyrights).

5. Taxes: Bills associated to varied taxes, together with earnings taxes, property taxes, and gross sales taxes. It is essential to categorize taxes precisely to make sure compliance with tax rules.

6. Repairs and Upkeep: Prices related to sustaining and repairing gear, buildings, and different belongings.

7. Journey Bills: Prices associated to enterprise journey, together with airfare, lodging, and transportation.

8. Utilities: Prices related to electrical energy, gasoline, water, and different utilities.

Designing Your Chart of Accounts:

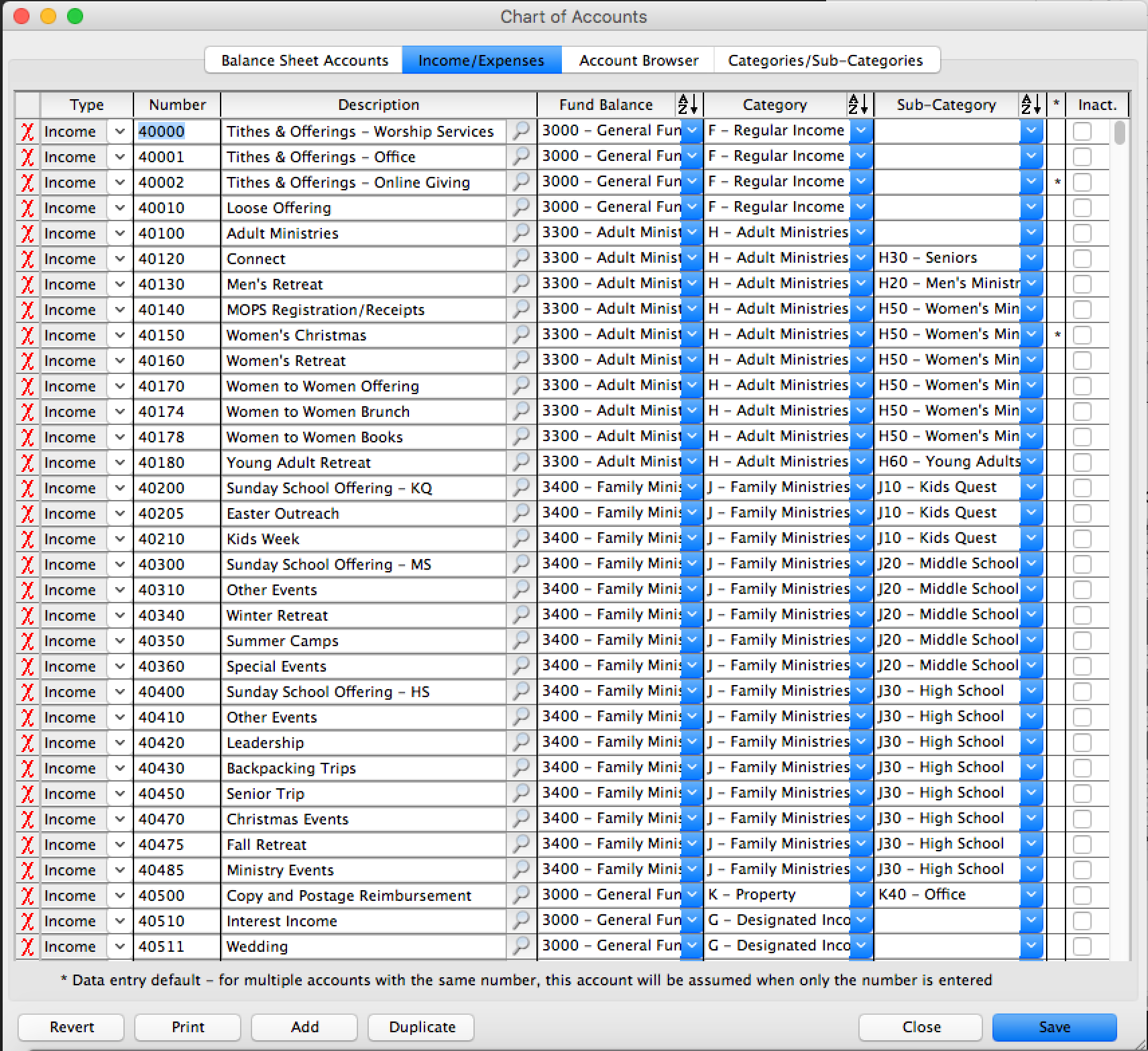

When designing your chart of accounts, take into account the next:

- Business Finest Practices: Analysis frequent expense classes utilized in your trade.

- Enterprise Dimension and Complexity: The extent of element required will fluctuate relying on the scale and complexity of your enterprise.

- Future Wants: Take into account how your chart of accounts would possibly must evolve as your enterprise grows.

- Software program Compatibility: Guarantee your chart of accounts is appropriate together with your accounting software program.

- Consistency: Preserve consistency in your expense categorization to make sure correct reporting and evaluation.

Conclusion:

A well-structured chart of accounts with detailed expense classes is important for efficient monetary administration. By fastidiously categorizing bills, companies can acquire precious insights into their spending patterns, establish cost-saving alternatives, and make knowledgeable selections that contribute to their total success. Whereas the precise classes could fluctuate relying on the trade and enterprise mannequin, the ideas of accuracy, consistency, and future scalability stay paramount. Common evaluation and changes to your chart of accounts will guarantee it continues to satisfy the evolving wants of your enterprise. Investing effort and time in creating a sturdy and complete chart of accounts is an funding within the long-term monetary well being and stability of your group.

Closure

Thus, we hope this text has offered precious insights into Chart of Accounts Expense Classes: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!