Chart of Accounts for a Building Firm: A Complete Information

Associated Articles: Chart of Accounts for a Building Firm: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Chart of Accounts for a Building Firm: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Chart of Accounts for a Building Firm: A Complete Information

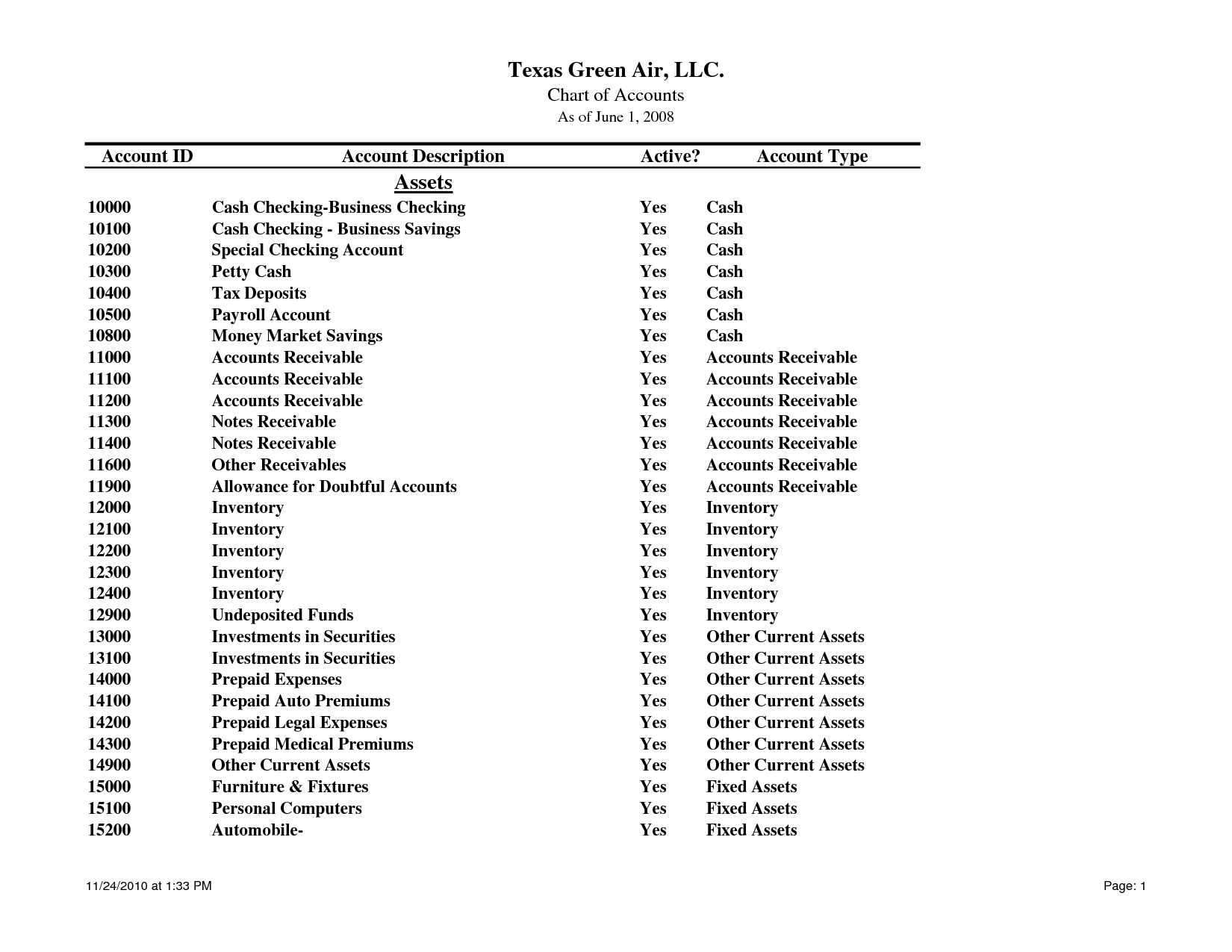

A well-structured chart of accounts (COA) is the spine of any profitable enterprise, and for building corporations, it is much more crucial. The complexity of building tasks, involving a number of phases, subcontractors, and supplies, necessitates an in depth and meticulously organized COA to precisely monitor funds, handle prices, and guarantee profitability. This text supplies a complete information to growing a strong chart of accounts tailor-made to the particular wants of a building firm.

Understanding the Significance of a Building-Particular COA

A generic chart of accounts merely will not suffice for a building firm. The distinctive nature of the business calls for a system that may deal with:

- A number of Initiatives: A building agency typically juggles a number of tasks concurrently, every requiring its personal value monitoring and income recognition.

- Price Segregation: Correct value allocation is essential for bidding, progress billing, and finally, profitability evaluation. The COA should distinguish between direct prices (supplies, labor, tools), oblique prices (overhead, permits), and common and administrative bills.

- Progress Billing: Building tasks are sometimes billed in phases based mostly on accomplished work. The COA must facilitate correct monitoring of accomplished work and related income.

- Subcontractor Administration: Monitoring funds and bills associated to subcontractors is a big side of building accounting. The COA ought to enable for straightforward categorization and reconciliation of those transactions.

- Stock Administration: Building corporations typically preserve important stock of supplies. The COA must accommodate monitoring of stock ranges, prices, and utilization.

- Compliance: The development business is topic to numerous rules and reporting necessities. A well-designed COA ensures compliance with these guidelines.

Designing Your Building Firm’s Chart of Accounts:

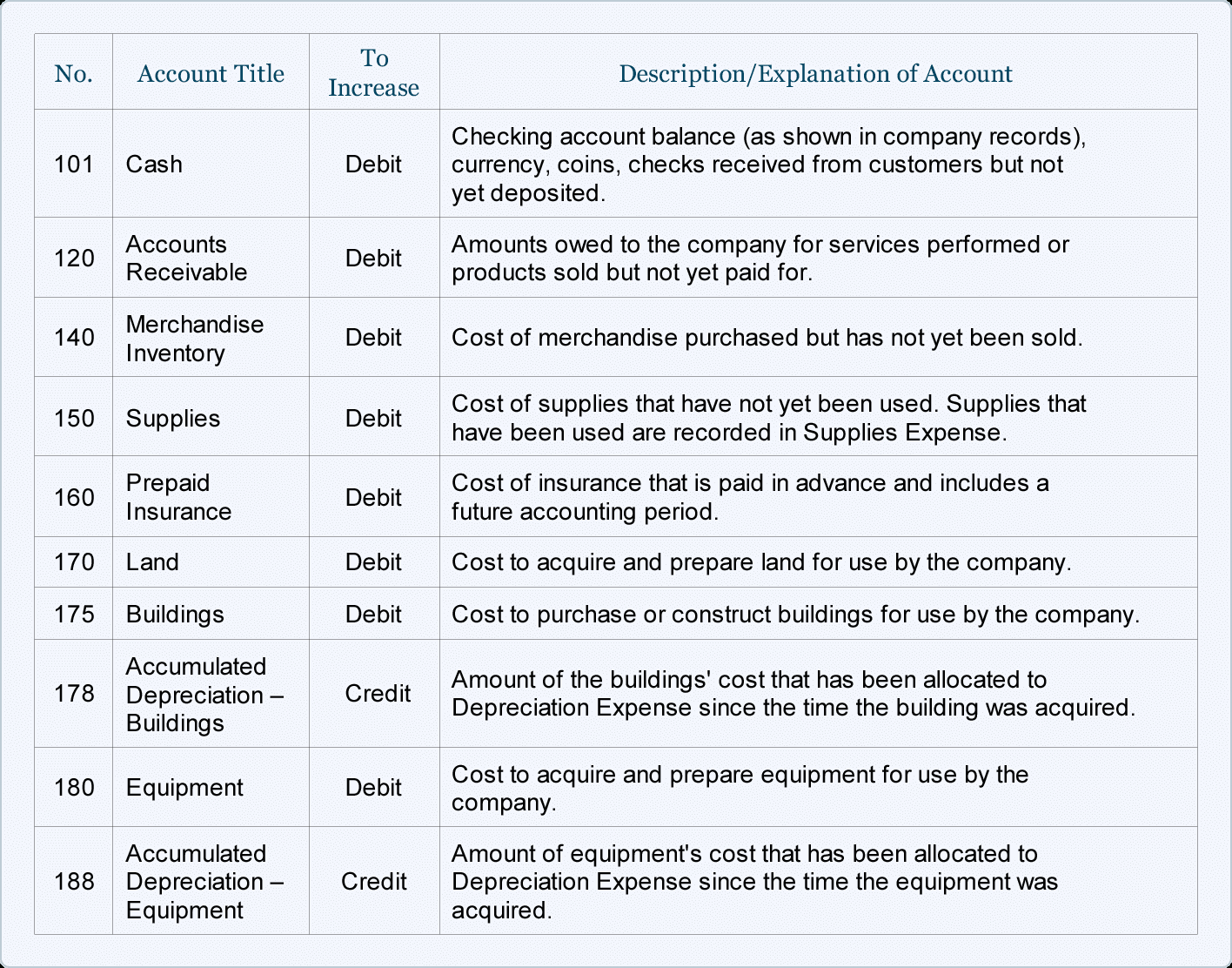

A sturdy COA for a building firm sometimes makes use of a numbered system, typically with a hierarchical construction, permitting for detailed categorization and reporting. This is a instructed framework, incorporating widespread account classes:

I. Belongings:

-

1000 – Present Belongings:

- 1100 – Money and Money Equivalents (Checking, Financial savings, Cash Market)

- 1200 – Accounts Receivable (Quantities owed by shoppers)

- 1210 – Progress Billings Receivable (Quantities owed for accomplished work)

- 1220 – Retention Receivable (Quantities held again by shoppers till undertaking completion)

- 1300 – Stock (Supplies, provides)

- 1400 – Pay as you go Bills (Insurance coverage, lease, and so on.)

- 1500 – Different Present Belongings

-

2000 – Non-Present Belongings:

- 2100 – Property, Plant, and Tools (PPE) (Land, buildings, tools)

- 2110 – Building Tools

- 2120 – Autos

- 2130 – Workplace Tools

- 2200 – Gathered Depreciation (Contra-asset account for PPE)

- 2300 – Investments (Lengthy-term investments)

- 2400 – Intangible Belongings (Patents, copyrights)

II. Liabilities:

-

3000 – Present Liabilities:

- 3100 – Accounts Payable (Quantities owed to suppliers and subcontractors)

- 3200 – Salaries Payable

- 3300 – Payroll Taxes Payable

- 3400 – Quick-Time period Loans Payable

- 3500 – Different Present Liabilities

-

4000 – Non-Present Liabilities:

- 4100 – Lengthy-Time period Loans Payable

- 4200 – Bonds Payable

- 4300 – Different Lengthy-Time period Liabilities

III. Fairness:

-

5000 – Proprietor’s Fairness:

- 5100 – Capital Inventory

- 5200 – Retained Earnings

IV. Income:

-

6000 – Income:

- 6100 – Building Income (Particular undertaking accounts could be created inside this class, e.g., 6110 – Challenge A, 6120 – Challenge B)

- 6200 – Different Income (e.g., rental revenue from tools)

V. Bills:

-

7000 – Price of Items Bought (COGS): That is essential for building. It consists of:

- 7100 – Direct Supplies

- 7200 – Direct Labor

- 7300 – Subcontractor Prices

- 7400 – Tools Rental

- 7500 – Different Direct Prices

-

8000 – Working Bills:

- 8100 – Salaries and Wages (Administrative and workplace employees)

- 8200 – Payroll Taxes

- 8300 – Lease

- 8400 – Utilities

- 8500 – Insurance coverage

- 8600 – Advertising and marketing and Promoting

- 8700 – Journey and Leisure

- 8800 – Skilled Charges (Authorized, accounting)

- 8900 – Workplace Provides

- 8910 – Depreciation Expense

- 8920 – Dangerous Debt Expense

- 8990 – Different Working Bills

-

9000 – Normal and Administrative Bills (G&A): These are oblique prices allotted to tasks.

Challenge-Particular Accounts:

Inside the income and expense sections, creating separate accounts for every undertaking is important. This permits for correct monitoring of prices and income for particular person tasks, enabling exact profitability evaluation. For instance:

- 6110 – Challenge Alpha Income

- 7110 – Challenge Alpha – Direct Supplies

- 7210 – Challenge Alpha – Direct Labor

- 8810 – Challenge Alpha – Skilled Charges

Selecting an Accounting Software program:

Implementing a strong COA requires the correct accounting software program. Building-specific accounting software program packages supply options like:

- Job costing: Monitoring prices related to particular tasks.

- Progress billing: Producing invoices based mostly on accomplished work.

- Subcontractor administration: Monitoring funds and bills associated to subcontractors.

- Stock administration: Monitoring supplies and provides.

- Reporting and evaluation: Producing monetary stories tailor-made to the development business.

Common Evaluate and Updates:

The chart of accounts will not be a static doc. Recurrently evaluate and replace it to mirror adjustments within the enterprise, new tasks, and evolving accounting requirements. This ensures its continued accuracy and relevance.

Conclusion:

A well-designed chart of accounts is a crucial device for the monetary success of any building firm. By fastidiously contemplating the distinctive elements of the business and implementing an in depth, organized system, building companies can successfully monitor prices, handle tasks, and make knowledgeable enterprise selections. Investing effort and time in creating and sustaining a strong COA is an funding within the long-term monetary well being and stability of your organization. Keep in mind to seek the advice of with an accountant or monetary skilled to make sure your COA aligns with greatest practices and regulatory necessities.

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts for a Building Firm: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!