Chart of Accounts Numbering: Greatest Practices for Enhanced Monetary Reporting and Information Administration

Associated Articles: Chart of Accounts Numbering: Greatest Practices for Enhanced Monetary Reporting and Information Administration

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts Numbering: Greatest Practices for Enhanced Monetary Reporting and Information Administration. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts Numbering: Greatest Practices for Enhanced Monetary Reporting and Information Administration

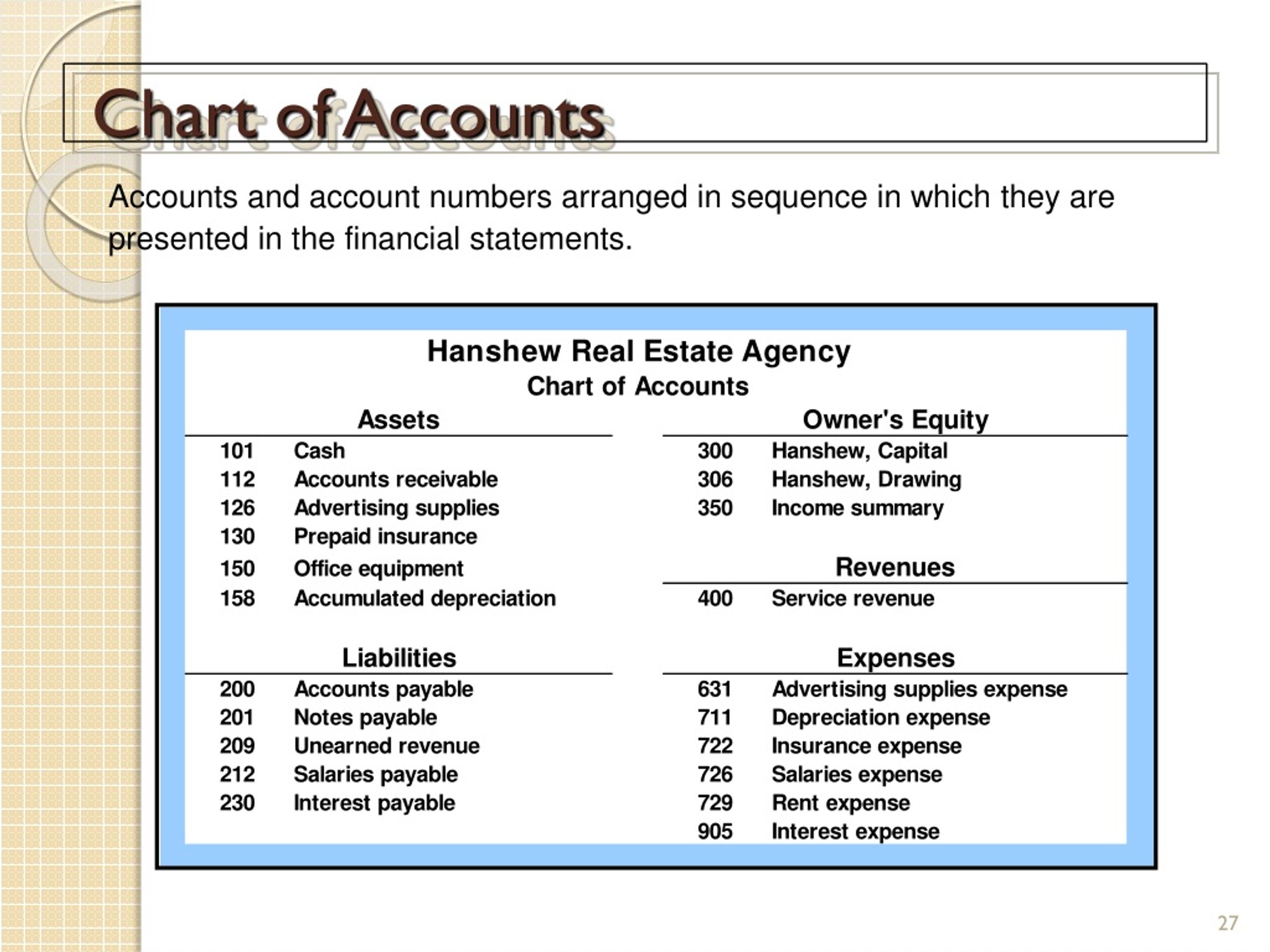

A well-structured chart of accounts (COA) is the spine of any sturdy accounting system. It is the organizational framework that categorizes and tracks all monetary transactions inside a enterprise. Whereas seemingly easy, the numbering system employed throughout the COA is essential for its effectiveness. A poorly designed numbering system can result in information inconsistencies, errors in reporting, and difficulties in analyzing monetary efficiency. Conversely, a thoughtfully designed numbering system facilitates correct reporting, simplifies information evaluation, and improves the general effectivity of the accounting course of. This text delves into greatest practices for chart of accounts numbering, exploring varied methodologies and issues to assist companies optimize their monetary information administration.

Understanding the Objective of COA Numbering:

The first objective of COA numbering is to create a singular identifier for every account. This identifier permits for environment friendly sorting, filtering, and aggregation of knowledge. A well-structured numbering system also needs to facilitate:

- Information Group: Accounts needs to be logically grouped and simply identifiable based mostly on their quantity.

- Reporting Flexibility: The numbering system ought to enable for the era of varied studies based mostly on totally different ranges of element.

- Error Discount: A transparent and constant numbering system minimizes the chance of errors in information entry and reporting.

- Scalability: The system needs to be versatile sufficient to accommodate future progress and modifications within the enterprise.

- Auditing Effectivity: A well-organized COA simplifies the audit course of, making it simpler to confirm the accuracy of economic information.

Frequent Numbering Techniques and Their Benefits & Disadvantages:

A number of numbering methods can be utilized for a COA. Your best option relies on the dimensions and complexity of the enterprise, its particular reporting wants, and the accounting software program getting used.

1. Easy Numerical System:

That is essentially the most primary system, utilizing sequential numbers (e.g., 1000, 1001, 1002…). It is easy to know and implement, nevertheless it lacks the flexibleness to categorize accounts meaningfully. It turns into unwieldy for bigger organizations with quite a few accounts.

- Benefits: Simplicity, ease of implementation.

- Disadvantages: Restricted flexibility, poor group, tough to scale.

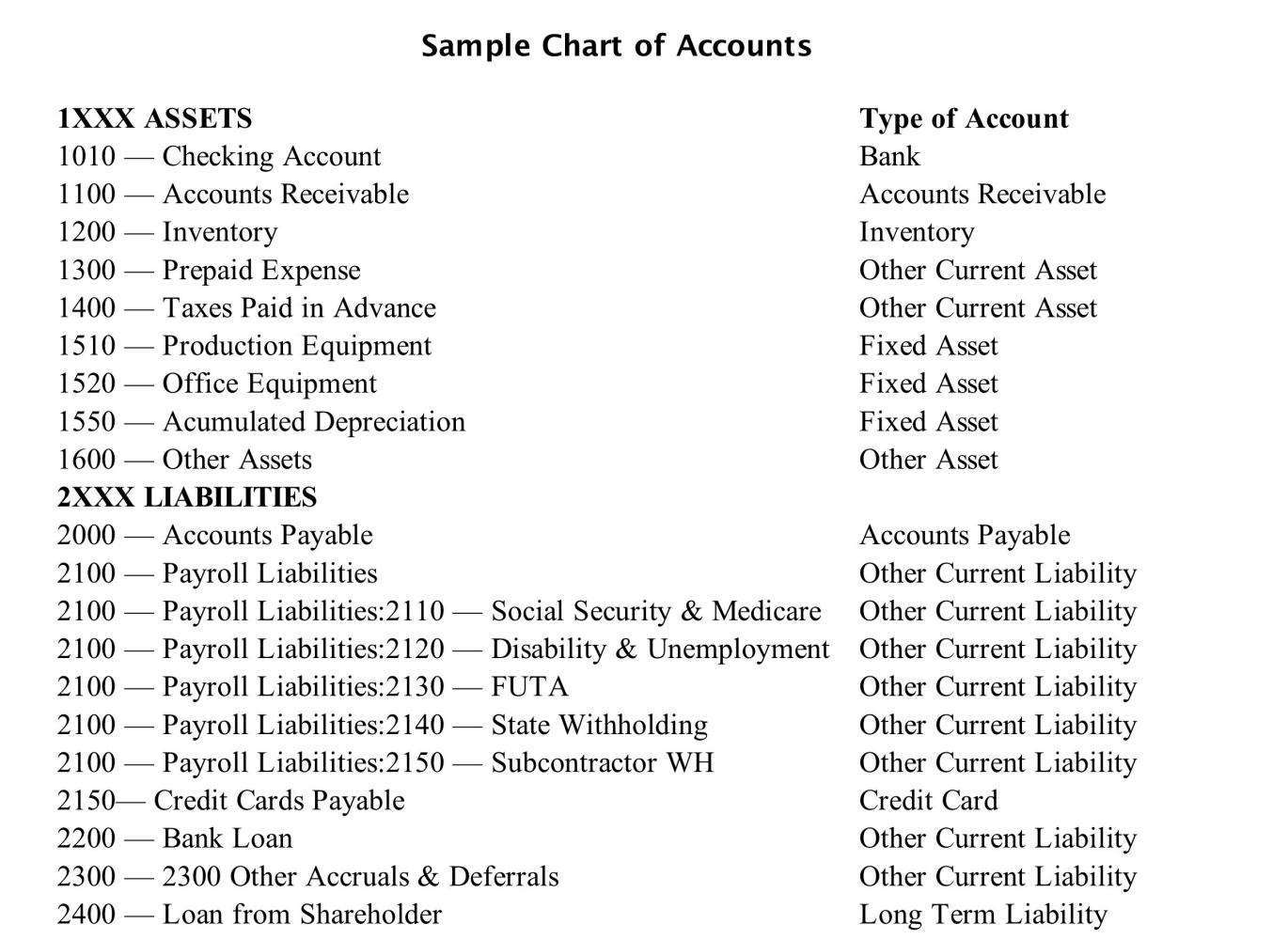

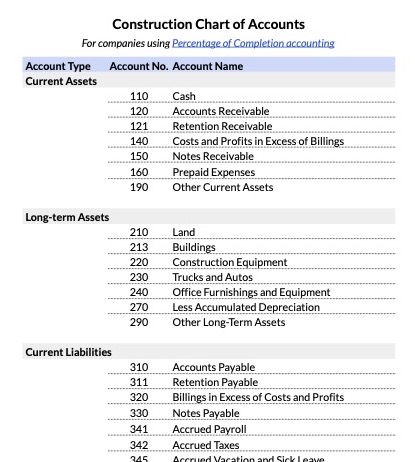

2. Hierarchical Numbering System:

This technique makes use of a hierarchical construction, usually using a set variety of digits for every stage of the hierarchy. Every digit or group of digits represents a selected class or sub-category. For instance:

- 1000 – Property

- 1100 – Present Property

- 1110 – Money

- 1120 – Accounts Receivable

This technique permits for a extra logical grouping of accounts and facilitates extra detailed reporting.

- Benefits: Improved group, enhanced reporting flexibility, scalability.

- Disadvantages: Can develop into advanced with many ranges, requires cautious planning.

3. Alphanumeric Numbering System:

This technique combines numbers and letters to create distinctive identifiers. This permits for better flexibility in categorizing accounts and will be notably helpful for companies with numerous operations. As an illustration:

-

1000-A – Property – Fastened Property

-

1000-B – Property – Present Property

-

2000-A – Liabilities – Lengthy-Time period Liabilities

-

2000-B – Liabilities – Present Liabilities

-

Benefits: Excessive flexibility, permits for detailed categorization.

-

Disadvantages: Could be much less intuitive than purely numerical methods, requires cautious planning to take care of consistency.

4. Hybrid Numbering System:

This method combines components of various methods to leverage their strengths. For instance, a enterprise may use a hierarchical numerical system for main classes and an alphanumeric system for sub-categories inside these main classes.

- Benefits: Combines the advantages of a number of methods, tailor-made to particular wants.

- Disadvantages: Requires cautious planning and coordination to make sure consistency.

Greatest Practices for Designing a COA Numbering System:

Whatever the chosen system, a number of greatest practices needs to be adopted to make sure the effectiveness of the COA numbering:

- Set up a Clear Chart of Accounts Construction: Start by defining the foremost classes and sub-categories of accounts related to your online business. This kinds the idea on your numbering system.

- Use a Constant Variety of Digits: Sustaining a constant variety of digits for every stage of the hierarchy enhances readability and consistency. For instance, utilizing three digits for every stage (e.g., 100, 101, 102) offers a transparent construction.

- Reserve Account Numbers: Allocate unused numbers for future enlargement to keep away from disrupting the present construction because the enterprise grows.

- Use Main Zeros: Use main zeros to take care of constant digit size, particularly when utilizing sequential numbering. This prevents inconsistencies when sorting numerically. (e.g., 001 as an alternative of 1).

- Doc the COA: Create a complete doc that explains the construction and which means of every account quantity. That is essential for coaching new staff and sustaining consistency.

- Common Evaluation and Updates: Periodically overview and replace the COA to make sure it precisely displays the enterprise’s present operations and reporting necessities.

- Take into account Trade Requirements: Familiarize your self with industry-specific requirements and greatest practices for COA numbering. This could guarantee compatibility with {industry} benchmarks and facilitate comparability with rivals.

- Software program Compatibility: Select a numbering system that’s appropriate along with your accounting software program. Some software program packages have limitations on the size or format of account numbers.

- Segmenting for Evaluation: Design the numbering system to allow detailed evaluation by segmenting accounts based mostly on related components like division, product line, or mission. This improves the granularity of economic reporting.

- Future-Proofing: Anticipate future progress and modifications within the enterprise when designing the COA. A versatile system can adapt to evolving wants with out requiring main restructuring.

Examples of Efficient Numbering Techniques:

Instance 1 (Hierarchical Numerical):

- 1000 – Property

- 1100 – Present Property

- 1110 – Money

- 1120 – Accounts Receivable

- 1130 – Stock

- 1200 – Non-Present Property

- 1210 – Property, Plant, and Gear

- 2000 – Liabilities

- … and so forth

Instance 2 (Hybrid System):

- 1000 – Property (Numerical)

- 1000-CA – Present Property (Alphanumeric sub-category)

- 1000-CA-001 – Money (Alphanumeric sub-category with sequential numbering)

- 1000-CA-002 – Accounts Receivable

- 1000-NCA – Non-Present Property (Alphanumeric sub-category)

- 1000-NCA-001 – Property, Plant, and Gear

Conclusion:

A well-designed chart of accounts numbering system is a important element of efficient monetary administration. By following greatest practices and selecting a system that aligns with the enterprise’s particular wants and progress trajectory, organizations can considerably enhance the accuracy, effectivity, and insightfulness of their monetary reporting. Cautious planning and a transparent understanding of the long-term implications are key to making a COA numbering system that serves the enterprise successfully for years to return. Common overview and adaptation will be sure that the system stays related and helps the evolving wants of the group.

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts Numbering: Greatest Practices for Enhanced Monetary Reporting and Information Administration. We thanks for taking the time to learn this text. See you in our subsequent article!