Chart of Accounts Numbering Methods: A Complete Information

Associated Articles: Chart of Accounts Numbering Methods: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts Numbering Methods: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts Numbering Methods: A Complete Information

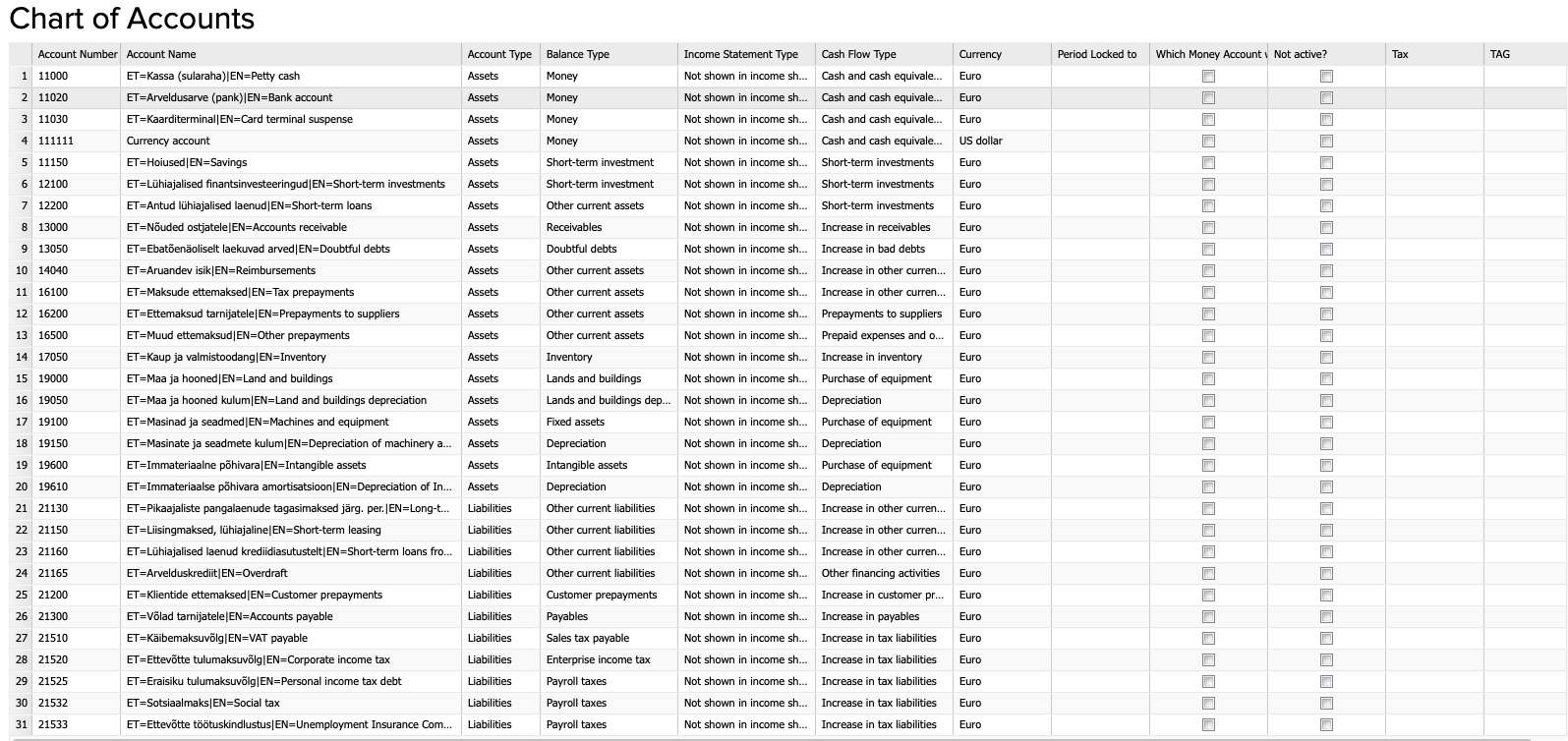

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured checklist of all of the accounts used to file monetary transactions, offering a framework for classifying and summarizing monetary information. A well-designed COA, with a strong numbering system, is essential for accuracy, effectivity, and the technology of significant monetary experiences. This text delves into the intricacies of chart of accounts numbering programs, exploring numerous methodologies, their benefits and downsides, and greatest practices for implementation and upkeep.

The Significance of a Structured Numbering System

A logical and constant numbering system inside the COA is important for a number of causes:

-

Group and Readability: A well-structured system ensures that accounts are simply identifiable and situated. This simplifies the method of recording transactions, producing experiences, and conducting monetary evaluation.

-

Knowledge Integrity: A transparent numbering system minimizes the chance of errors in information entry and reporting. Constant coding reduces ambiguity and ensures information consistency throughout completely different departments and programs.

-

Automation and Effectivity: A standardized numbering system facilitates the automation of accounting processes. Software program programs can simply determine and course of transactions based mostly on the account numbers, streamlining workflows and decreasing guide effort.

-

Reporting and Evaluation: The COA numbering system straight impacts the power to generate significant monetary experiences. A well-designed system permits for the straightforward segregation and summarization of knowledge based on completely different classes, resembling departments, product traces, or initiatives.

-

Scalability and Flexibility: A versatile numbering system permits for the straightforward addition or modification of accounts because the group grows and its monetary wants evolve. This adaptability is essential for long-term monetary administration.

Widespread Chart of Accounts Numbering Methods

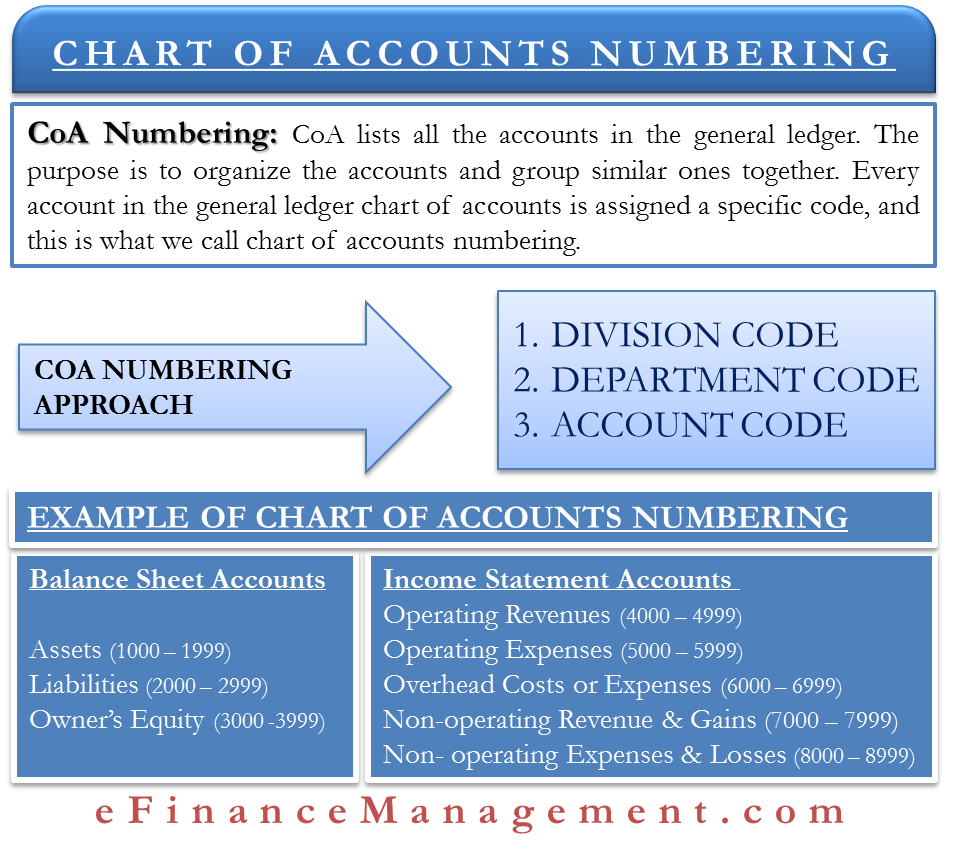

A number of strategies are used for numbering accounts in a COA. The selection will depend on the group’s measurement, complexity, and particular reporting necessities. Probably the most prevalent programs embody:

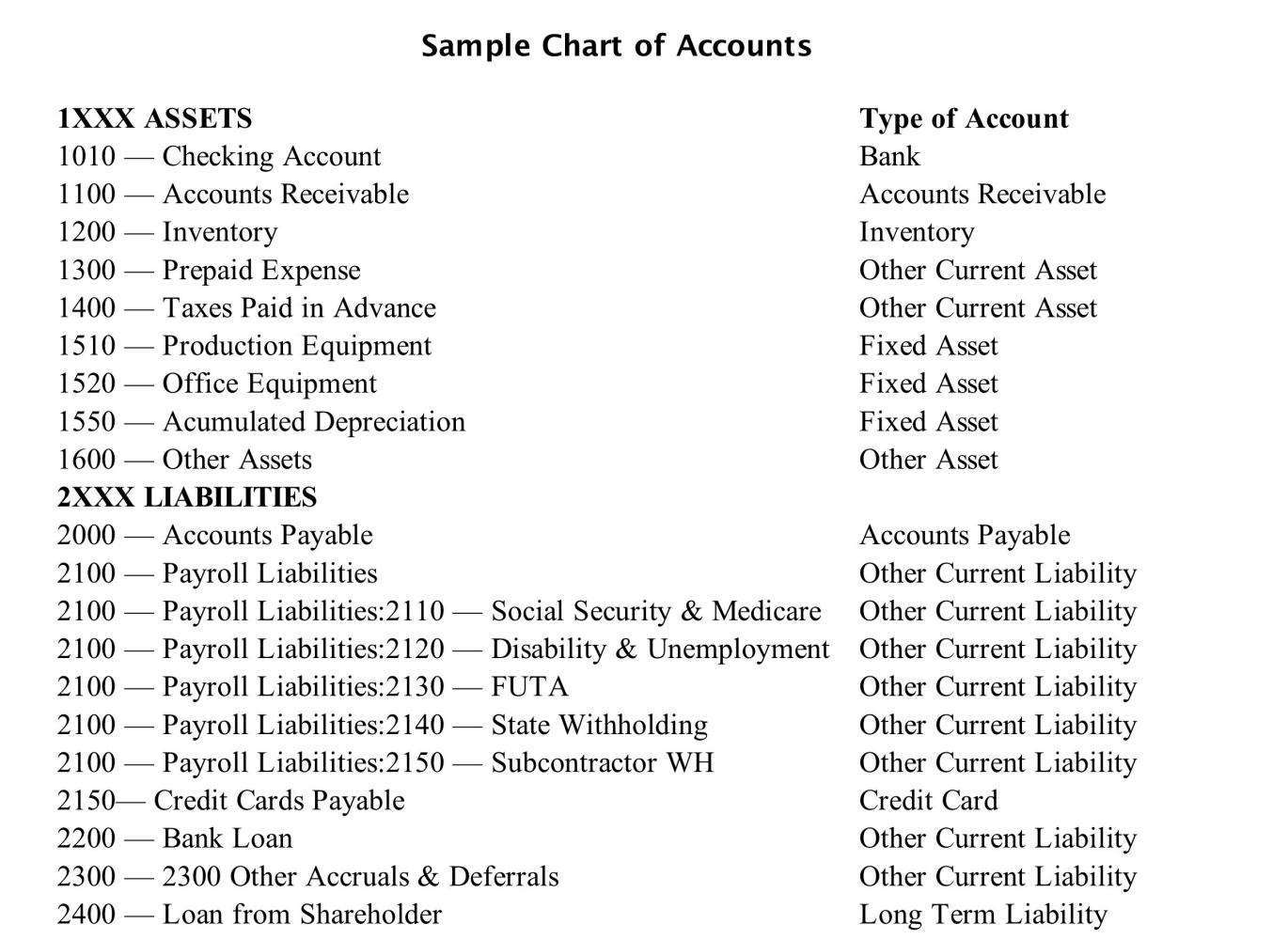

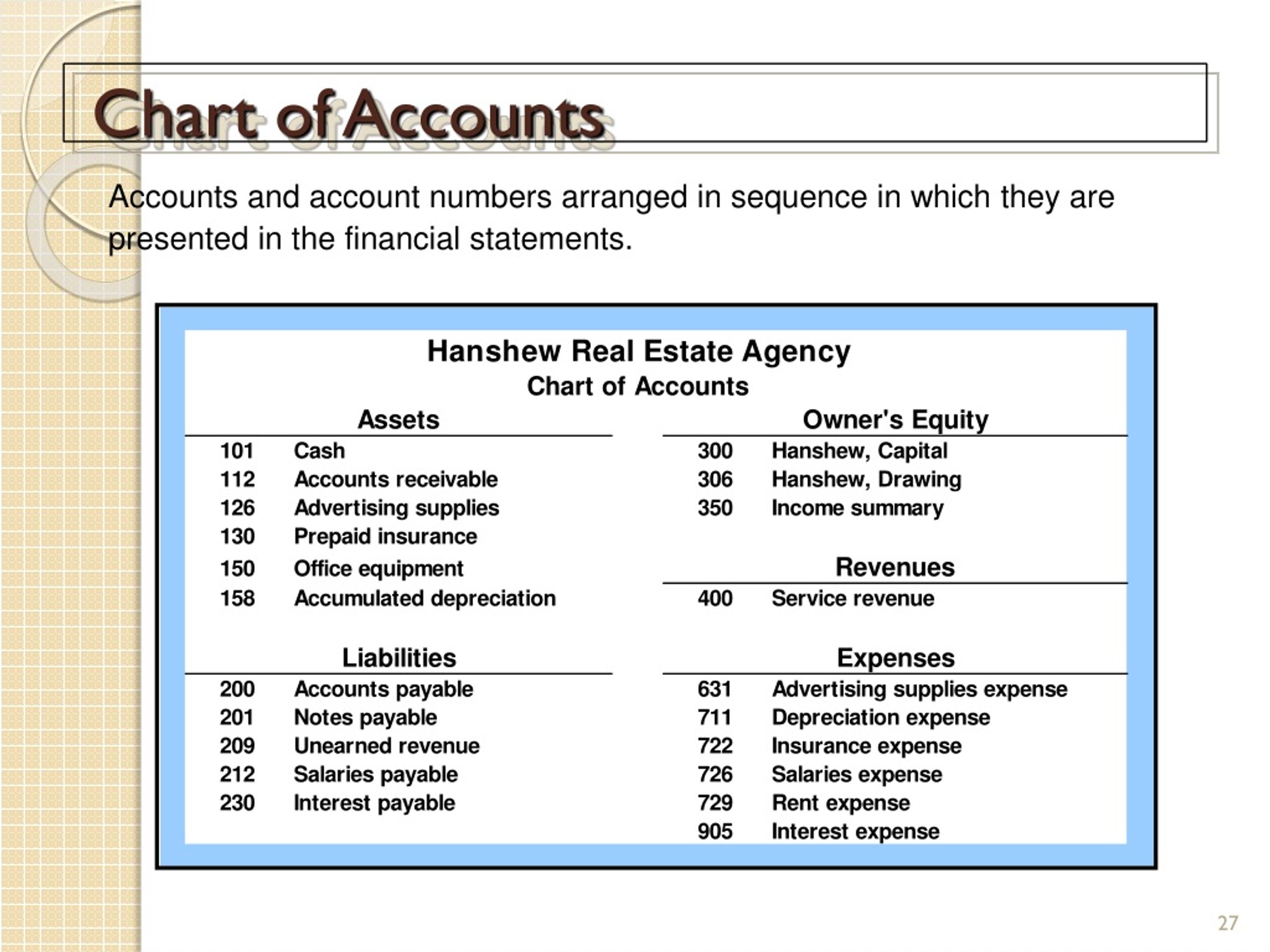

1. Easy Numerical System: That is essentially the most fundamental system, utilizing sequential numbers to determine accounts. For instance, 1000-1999 would possibly characterize property, 2000-2999 liabilities, and so forth. Whereas easy, it lacks the pliability to accommodate detailed sub-accounts and may change into cumbersome because the group grows.

2. Mnemonic System: This technique makes use of letters and numbers to characterize account classes. For instance, "ASS1001" would possibly characterize "Asset – Money – Checking Account 1." Mnemonic programs can enhance readability and supply a level of self-documentation, however they are often much less environment friendly for automated processing.

3. Hierarchical or Segmented System: That is the most typical and versatile system. It makes use of a mixture of numbers and segments to characterize completely different ranges of element inside the account construction. Every section represents a selected attribute, resembling account sort, division, or mission. For instance:

- 1100-1199: Present Belongings

- 1110-1119: Money

- 1110-1111: Checking Account

- 1110-1112: Financial savings Account

This technique permits for detailed reporting and evaluation by section. For instance, you would simply generate experiences exhibiting money balances for every division or mission.

4. Hybrid System: Many organizations use a hybrid system, combining parts of various methodologies. This strategy permits for personalisation to satisfy particular wants, leveraging the strengths of assorted programs whereas mitigating their weaknesses.

Designing an Efficient Chart of Accounts Numbering System:

The design of a COA numbering system requires cautious planning and consideration. Key elements embody:

-

Trade Greatest Practices: Analysis industry-specific requirements and greatest practices to make sure compliance and consistency.

-

Future Development: The system ought to be designed to accommodate future development and growth. Enable for enough area inside the numbering scheme for brand new accounts.

-

Reporting Necessities: The system ought to facilitate the technology of the experiences required by administration, regulatory our bodies, and different stakeholders.

-

Software program Compatibility: Guarantee compatibility with current and future accounting software program programs.

-

Consumer Friendliness: The system ought to be intuitive and straightforward for customers to know and navigate.

-

Account Segmentation: Decide the extent of element required for every account. This can dictate the variety of segments and the size of the account numbers.

-

Consistency and Standardization: Keep consistency all through all the numbering system to keep away from confusion and errors.

Greatest Practices for Implementing and Sustaining a COA:

-

Doc the System: Completely doc the COA numbering system, together with the which means of every section and the principles for assigning account numbers.

-

Common Assessment and Updates: Repeatedly evaluation and replace the COA to make sure it stays related and correct. That is significantly essential because the group grows and its enterprise actions evolve.

-

Coaching and Communication: Present enough coaching to all customers on the correct use of the COA numbering system.

-

Inside Controls: Implement inner controls to stop unauthorized adjustments to the COA and to make sure information integrity.

-

Use of a Chart of Accounts Software program: Leveraging specialised software program can considerably simplify the administration and upkeep of the COA, automating many duties and decreasing the chance of errors.

Challenges and Concerns:

-

Complexity: Extremely detailed programs can change into advanced and tough to handle.

-

Upkeep: Sustaining a big and complicated COA requires ongoing effort and sources.

-

Migration: Migrating to a brand new COA system is usually a difficult and time-consuming course of.

-

Integration: Making certain seamless integration with different programs, resembling ERP and CRM, is essential for environment friendly information circulate.

Conclusion:

A well-designed chart of accounts numbering system is a cornerstone of efficient monetary administration. It considerably impacts the accuracy, effectivity, and reliability of economic reporting. By fastidiously contemplating the varied methodologies, implementing greatest practices, and addressing potential challenges, organizations can create a COA that helps their monetary objectives and allows knowledgeable decision-making. The selection of system ought to be tailor-made to the particular wants of the group, balancing simplicity with the extent of element required for correct and complete monetary reporting. Common evaluation and upkeep are essential to make sure the continued relevance and effectiveness of the COA all through the group’s lifecycle.

Closure

Thus, we hope this text has offered useful insights into Chart of Accounts Numbering Methods: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!