Chart of Accounts Pattern for a Service Enterprise: A Complete Information

Associated Articles: Chart of Accounts Pattern for a Service Enterprise: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Chart of Accounts Pattern for a Service Enterprise: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts Pattern for a Service Enterprise: A Complete Information

A well-structured chart of accounts (COA) is the spine of any profitable enterprise, particularly for service-based corporations. It gives a scientific framework for recording monetary transactions, enabling correct monetary reporting, tax compliance, and knowledgeable decision-making. This text delves into making a complete chart of accounts pattern particularly tailor-made for a service enterprise, explaining the varied account sorts and offering sensible examples.

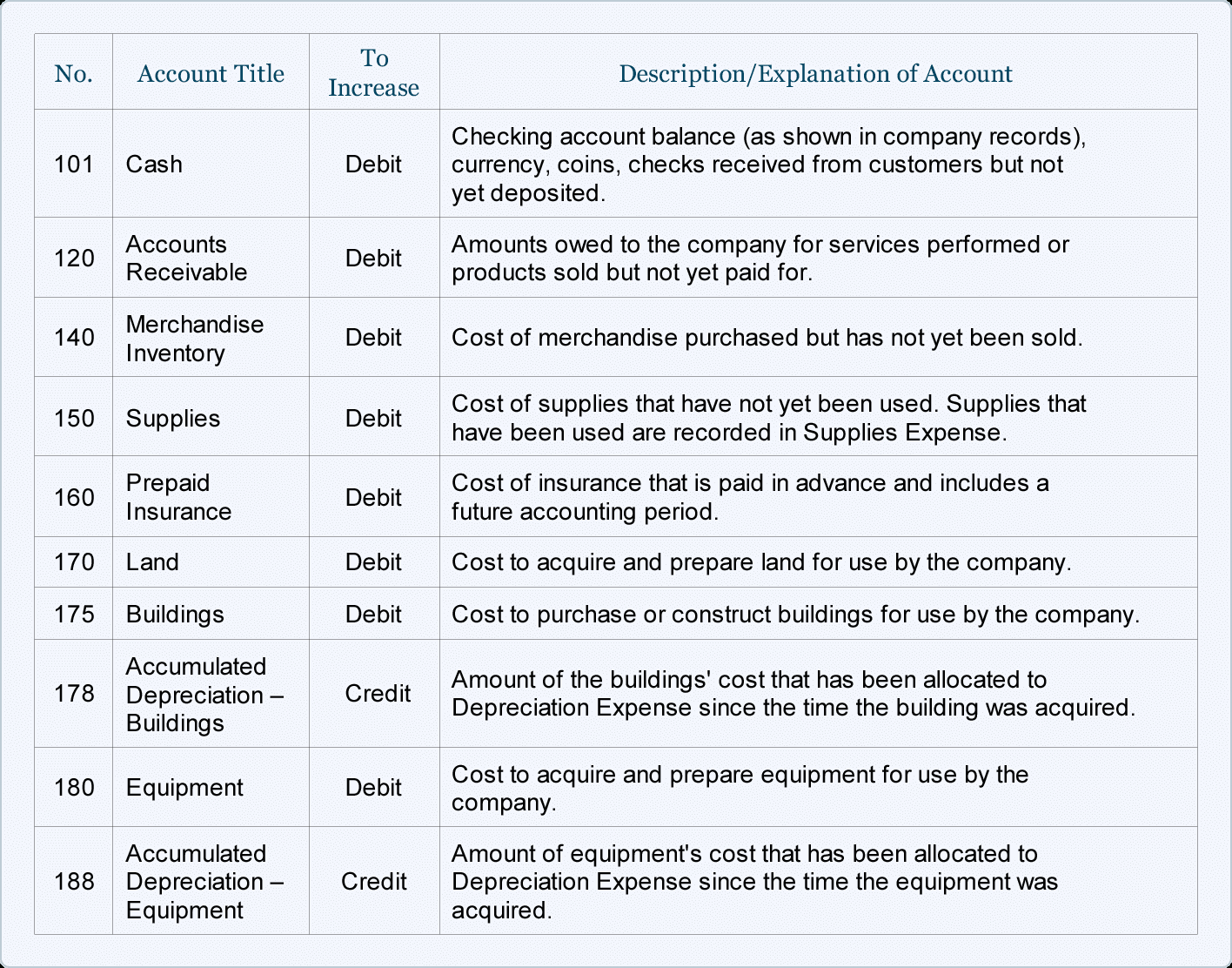

Understanding the Chart of Accounts

A chart of accounts is a listing of all of the accounts a enterprise makes use of to file its monetary transactions. Every account represents a selected aspect of the enterprise’s monetary exercise, categorized to offer a transparent and arranged image of its monetary well being. The COA follows a standardized numbering system, usually utilizing a hierarchical construction to group associated accounts. This permits for simple monitoring and reporting.

Key Account Sorts for a Service Enterprise:

The precise accounts wanted will differ based mostly on the dimensions and complexity of the service enterprise, however a number of core account sorts are widespread:

I. Property: These symbolize what the enterprise owns.

-

Present Property: Property anticipated to be transformed into money inside one yr.

- Money: Contains checking accounts, financial savings accounts, and petty money.

- Accounts Receivable: Cash owed to the enterprise by shoppers for providers rendered.

- Stock (if relevant): Provides, supplies, or items utilized in service supply. This may be minimal for purely service-based companies.

- Pay as you go Bills: Bills paid prematurely, akin to insurance coverage premiums or hire.

-

Non-Present Property: Property anticipated to be held for longer than one yr.

- Mounted Property (Property, Plant, and Gear – PP&E): Tangible belongings akin to workplace tools (computer systems, printers), autos, and furnishings. These are depreciated over their helpful life.

- Intangible Property: Non-physical belongings akin to copyrights, patents, emblems (if relevant).

- Lengthy-Time period Investments: Investments anticipated to be held for multiple yr.

II. Liabilities: These symbolize what the enterprise owes to others.

-

Present Liabilities: Obligations due inside one yr.

- Accounts Payable: Cash owed to suppliers for items or providers acquired.

- Salaries Payable: Wages owed to staff.

- Utilities Payable: Excellent payments for utilities (electrical energy, water, fuel).

- Brief-Time period Loans Payable: Loans due inside one yr.

-

Non-Present Liabilities: Obligations due after one yr.

- Lengthy-Time period Loans Payable: Loans due after one yr.

- Deferred Income: Funds acquired for providers not but rendered.

III. Fairness: This represents the proprietor’s stake within the enterprise.

- Proprietor’s Fairness: For sole proprietorships and partnerships, this displays the proprietor’s capital contribution and retained earnings.

- Retained Earnings: Collected income that haven’t been distributed to house owners.

IV. Income: Earnings generated from the enterprise’s operations.

- Service Income: Earnings earned from offering providers. This account needs to be additional damaged down by service kind (e.g., consulting charges, design charges, coaching charges).

- Different Income: Earnings from sources apart from core providers, akin to curiosity earnings or rental earnings.

V. Bills: Prices incurred in producing income.

- Value of Items Bought (COGS): Direct prices related to offering providers (minimal or absent in lots of pure service companies).

- Salaries and Wages Expense: Compensation paid to staff.

- Hire Expense: Value of renting workplace house or different services.

- Utilities Expense: Prices of electrical energy, water, fuel, and web.

- Insurance coverage Expense: Value of insurance coverage protection.

- Advertising and Promoting Expense: Prices related to selling providers.

- Workplace Provides Expense: Value of workplace provides.

- Depreciation Expense: Allocation of the price of mounted belongings over their helpful life.

- Skilled Charges: Prices of hiring exterior professionals (e.g., legal professionals, accountants).

- Journey Expense: Prices related to enterprise journey.

- Restore and Upkeep Expense: Prices of repairing and sustaining tools.

- Dangerous Debt Expense: Losses from uncollectible accounts receivable.

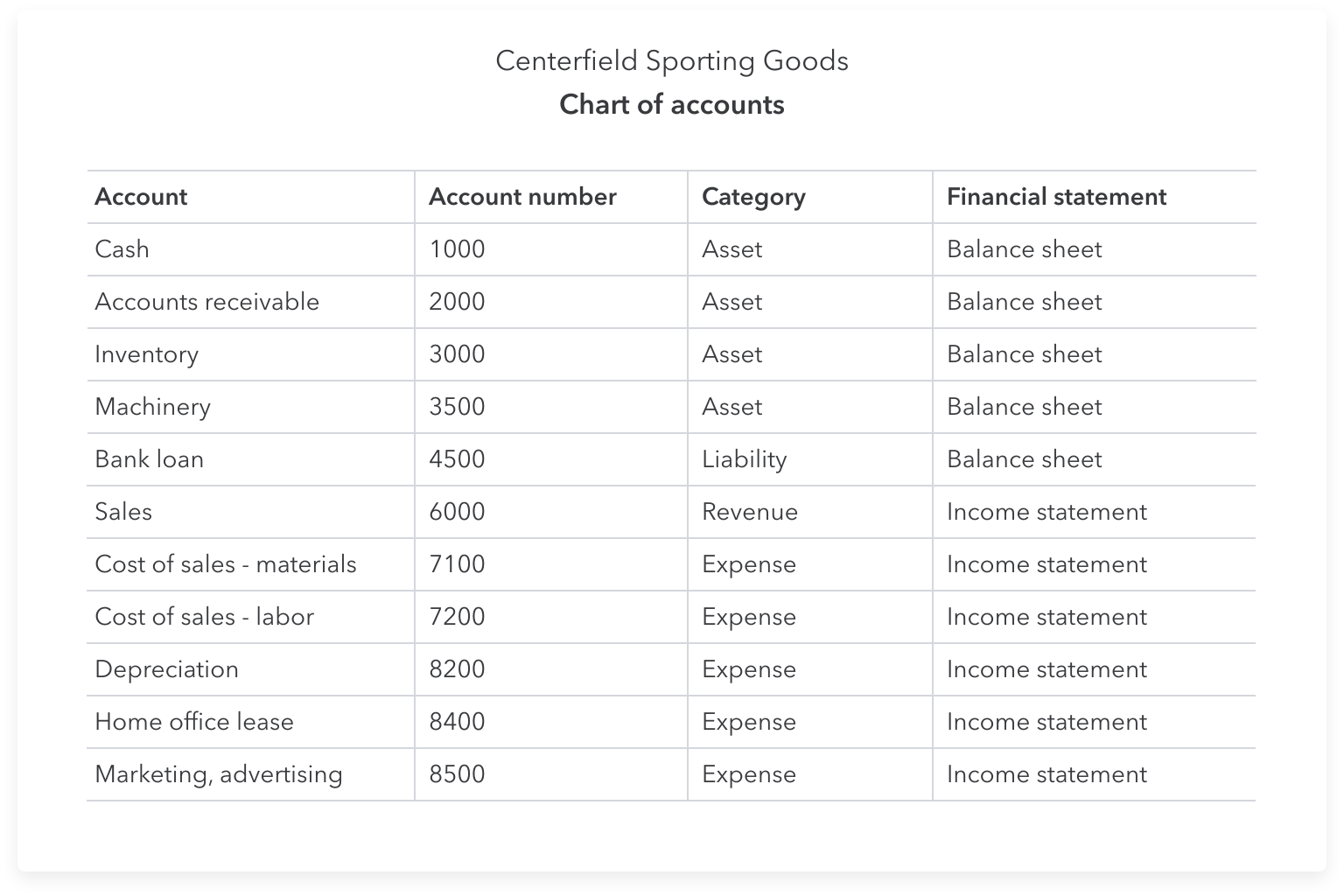

Pattern Chart of Accounts for a Service Enterprise:

This instance makes use of a simplified numbering system. A extra complicated enterprise may make the most of a extra detailed system with sub-accounts beneath every main class.

| Account Quantity | Account Title | Account Kind |

|---|---|---|

| 101 | Money | Asset |

| 102 | Accounts Receivable | Asset |

| 103 | Pay as you go Insurance coverage | Asset |

| 104 | Workplace Gear | Asset |

| 105 | Collected Depreciation | Asset |

| 201 | Accounts Payable | Legal responsibility |

| 202 | Salaries Payable | Legal responsibility |

| 203 | Utilities Payable | Legal responsibility |

| 301 | Proprietor’s Fairness | Fairness |

| 302 | Retained Earnings | Fairness |

| 401 | Service Income – Consulting | Income |

| 402 | Service Income – Design | Income |

| 501 | Salaries and Wages Expense | Expense |

| 502 | Hire Expense | Expense |

| 503 | Utilities Expense | Expense |

| 504 | Insurance coverage Expense | Expense |

| 505 | Advertising Expense | Expense |

| 506 | Workplace Provides Expense | Expense |

| 507 | Depreciation Expense | Expense |

| 508 | Skilled Charges | Expense |

| 509 | Journey Expense | Expense |

| 510 | Restore & Upkeep Exp. | Expense |

| 511 | Dangerous Debt Expense | Expense |

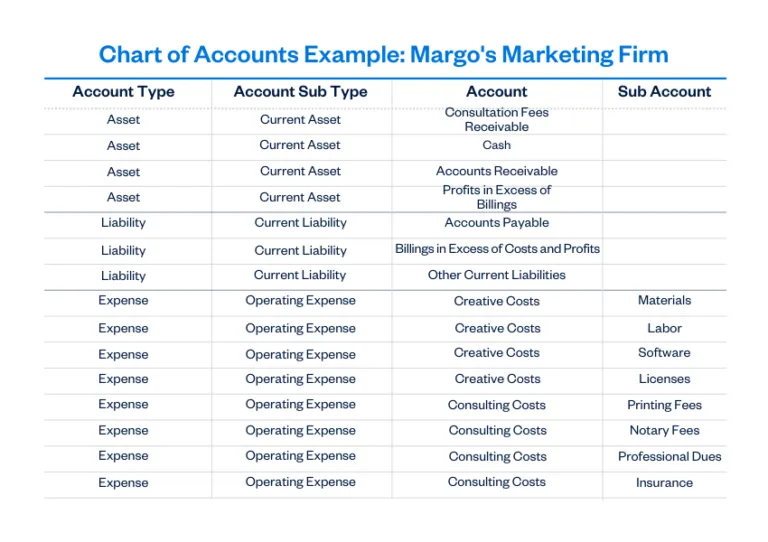

Concerns for Particular Service Companies:

- Consulting Corporations: Would possibly want accounts for particular consulting initiatives, client-related bills, and doubtlessly journey bills.

- Design Corporations: Might have accounts for particular design initiatives, software program subscriptions, and doubtlessly royalty funds.

- IT Companies: May require accounts for software program licenses, {hardware} upkeep, and shopper help prices.

- Authorized Companies: Would possibly embody accounts for courtroom prices, authorized analysis, and specialised software program.

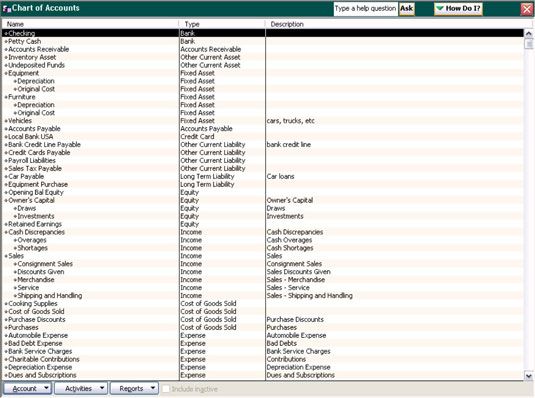

Selecting an Accounting Software program:

Implementing a chart of accounts is considerably simpler with accounting software program. Software program like QuickBooks, Xero, or Zoho Books automates many accounting processes and gives instruments for producing stories based mostly on the COA. These platforms usually include pre-built chart of accounts templates that may be personalized to suit your particular wants.

Common Overview and Updates:

The chart of accounts will not be a static doc. Because the enterprise grows and evolves, the COA needs to be reviewed and up to date to mirror modifications in operations and monetary actions. Including new accounts for brand new providers or eradicating out of date accounts ensures the accuracy and relevance of economic reporting.

Conclusion:

A well-designed chart of accounts is essential for the monetary well being of any service enterprise. By rigorously categorizing accounts and utilizing acceptable accounting software program, companies can achieve priceless insights into their monetary efficiency, make knowledgeable choices, and guarantee compliance with tax rules. The pattern COA supplied serves as a place to begin; it is important to tailor it to the particular wants and complexities of your particular person service enterprise. Keep in mind to seek the advice of with an accountant or monetary advisor for personalised steerage in creating and sustaining your chart of accounts.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied priceless insights into Chart of Accounts Pattern for a Service Enterprise: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!