Chart of Accounts T-Codes: Navigating the Coronary heart of SAP Monetary Accounting

Associated Articles: Chart of Accounts T-Codes: Navigating the Coronary heart of SAP Monetary Accounting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts T-Codes: Navigating the Coronary heart of SAP Monetary Accounting. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts T-Codes: Navigating the Coronary heart of SAP Monetary Accounting

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

The Chart of Accounts (CoA) is the spine of any monetary accounting system, serving because the organizational construction for all monetary transactions. In SAP, this important factor is managed by a collection of transaction codes (T-codes), offering customers with numerous instruments to create, keep, and analyze the CoA construction. Understanding these T-codes is prime for anybody working with SAP’s Monetary Accounting (FI) module. This text will delve into probably the most generally used T-codes associated to the Chart of Accounts, explaining their functionalities and providing sensible insights into their utility.

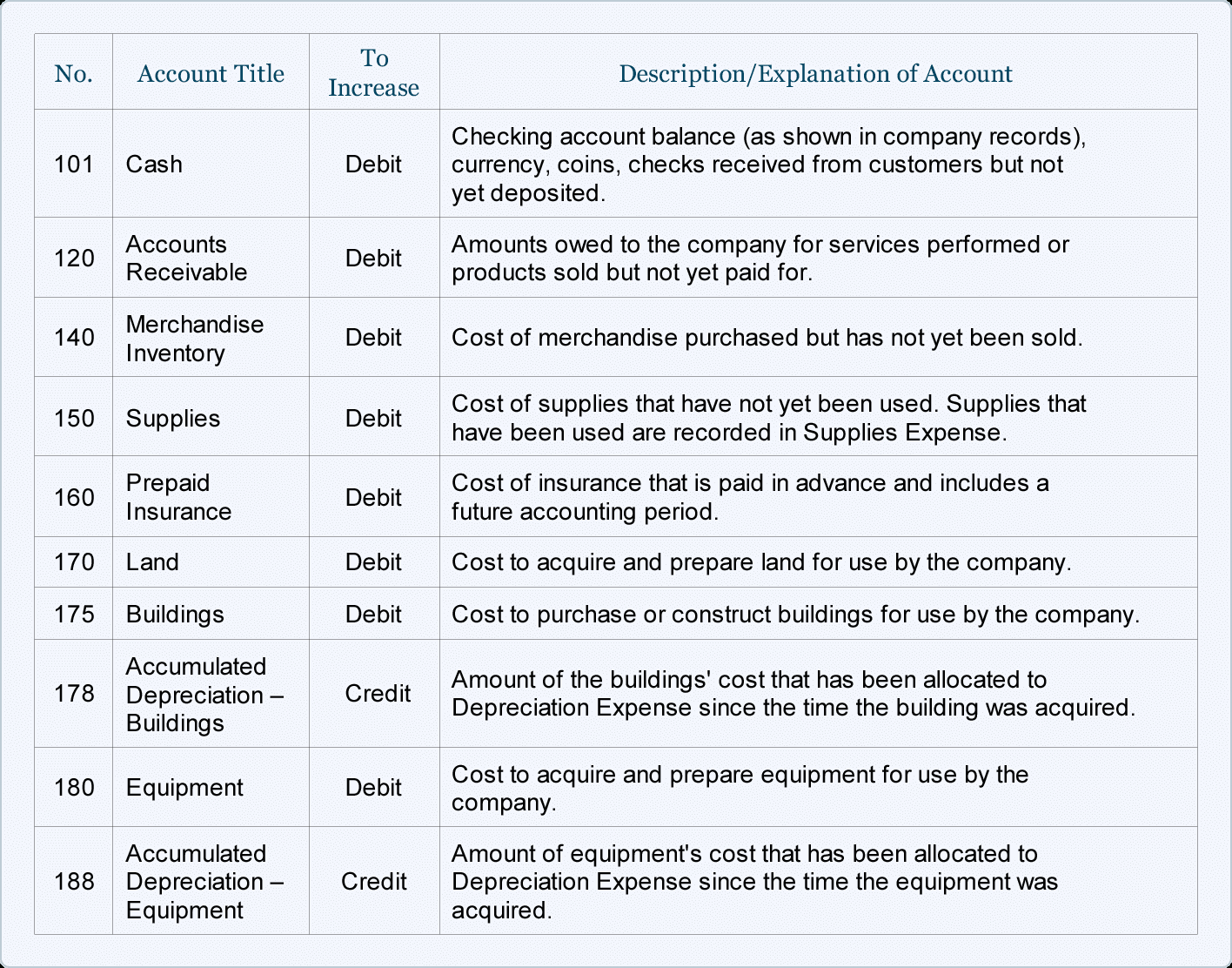

Understanding the SAP Chart of Accounts:

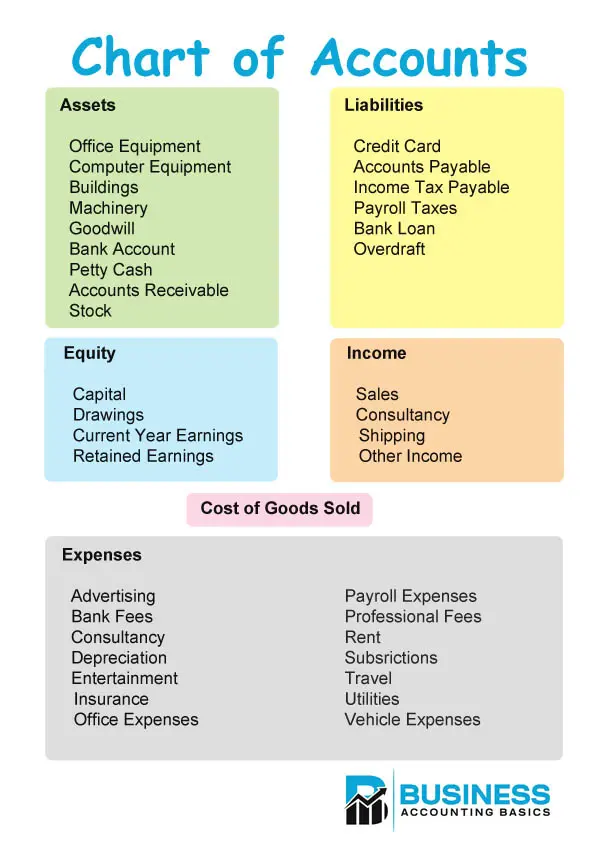

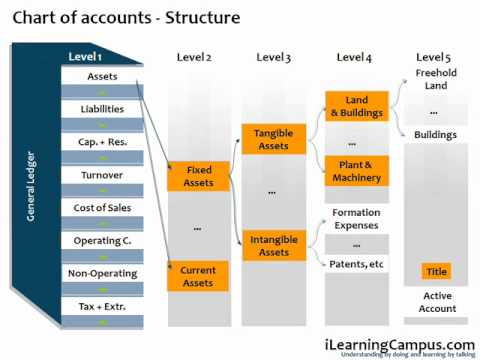

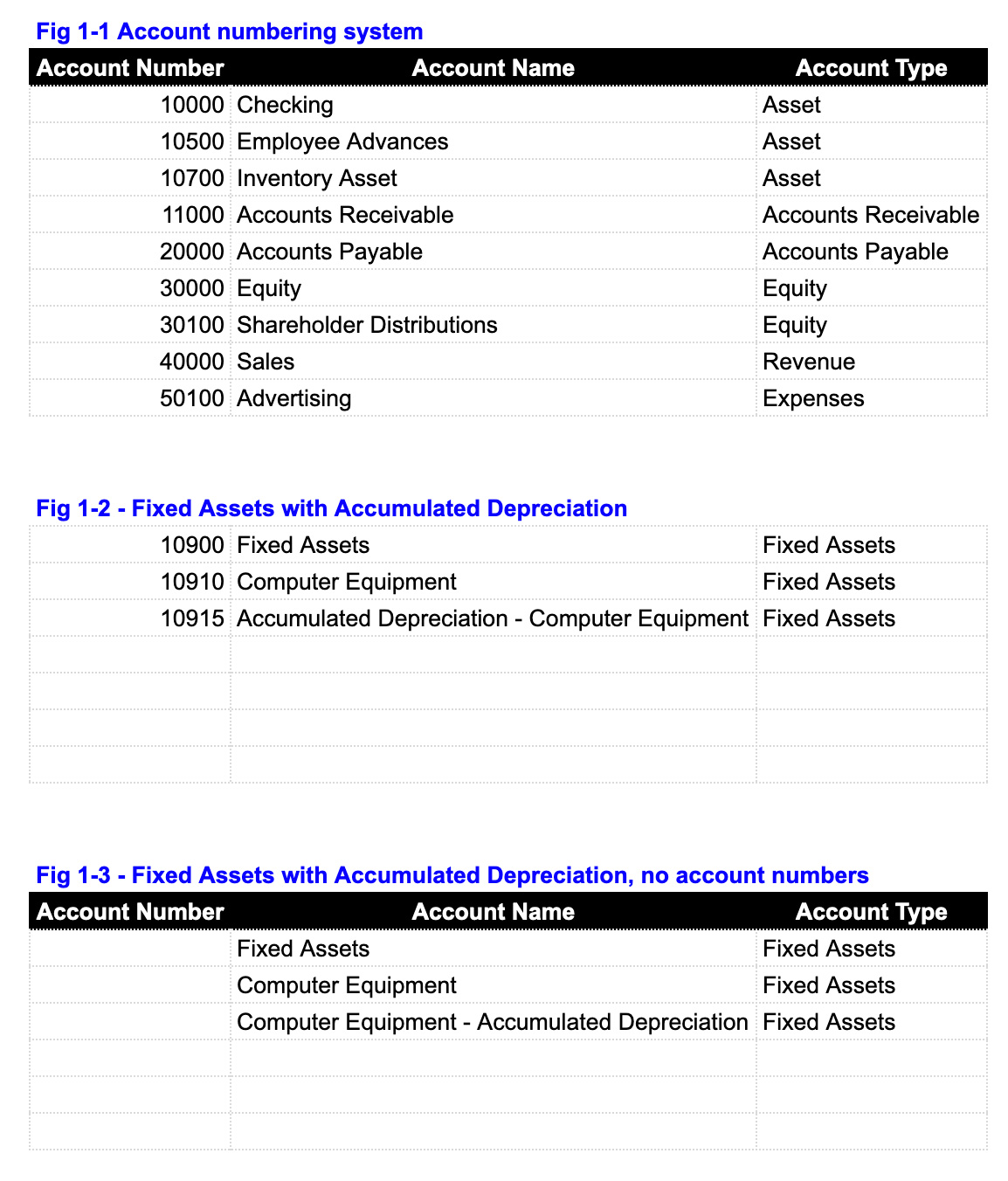

Earlier than diving into the T-codes, it is important to understand the idea of the SAP CoA. It is a hierarchical construction that categorizes all common ledger accounts inside a corporation. This hierarchy sometimes displays the corporate’s organizational construction and reporting necessities. A CoA could be outlined at numerous ranges, together with:

- Firm Code: The elemental organizational unit in SAP FI, every firm code requires its personal Chart of Accounts.

- Chart of Accounts (COA): The precise construction containing the accounts. This is usually a custom-made or a predefined template.

- Account Teams: Accounts are grouped primarily based on their traits (e.g., steadiness sheet accounts, revenue and loss accounts).

- G/L Accounts: The person accounts used to report monetary transactions.

Key T-Codes for Chart of Accounts Administration:

A number of T-codes are very important for managing the Chart of Accounts in SAP. These could be broadly categorized into creation, upkeep, and evaluation functionalities.

1. Creation and Configuration:

-

OBY6 (Outline Chart of Accounts): That is the first T-code for creating a brand new Chart of Accounts. Right here, you specify the chart of accounts quantity, description, and assign it to an organization code. You may select to create a very new chart of accounts from scratch or copy an current one as a template. This T-code is essential for establishing the foundational construction for monetary accounting inside an organization code. Deciding on the right chart of accounts kind (e.g., operational, group reporting) is essential at this stage.

-

OBY7 (Assign Chart of Accounts to Firm Code): As soon as a chart of accounts is created, this T-code is used to assign it to a particular firm code. This hyperlinks the chart of accounts to the operational accounting unit. With out this project, the chart of accounts can’t be used for monetary transactions inside the firm code.

-

OBY8 (Copy Chart of Accounts): This T-code supplies a fast and environment friendly option to create a brand new chart of accounts primarily based on an current one. It permits you to copy the whole construction, together with account teams and G/L accounts, making it ultimate for creating charts of accounts for subsidiaries or new entities primarily based on a confirmed mannequin. Nevertheless, cautious consideration is required to make sure that the copied chart of accounts aligns with the particular wants of the brand new entity.

-

OBB1 (Preserve Account Teams): Account teams outline the traits of G/L accounts. This T-code permits you to create, modify, or delete account teams. Defining account teams precisely is essential for making certain that the accounts are appropriately categorized and processed in keeping with their nature (e.g., asset, legal responsibility, income, expense). Incorrect account group project can result in errors in monetary reporting.

2. Upkeep and Modification:

-

KSB1 (Preserve Account Willpower): This T-code is used to outline the automated account dedication guidelines for numerous transactions. It permits the system to robotically assign G/L accounts primarily based on predefined standards, streamlining the transaction posting course of and decreasing handbook intervention. That is notably helpful for high-volume transactions. Defining correct and complete account dedication guidelines is crucial for sustaining knowledge integrity.

-

KS02 (Change G/L Account): This T-code permits you to modify the main points of an current G/L account. This contains altering the account description, account group, discipline standing group, and different related attributes. Modifications made right here needs to be fastidiously reviewed to make sure consistency and accuracy in monetary reporting.

-

KS01 (Create G/L Account): This T-code is used to create new G/L accounts inside the current chart of accounts. It requires specifying the account quantity, account title, account group, and different related attributes. The account quantity ought to adhere to the outlined numbering scheme of the chart of accounts. Correct account creation is prime for correct monetary record-keeping.

-

KSA1 (Preserve Subject Standing Variants): This T-code helps in defining which fields are obligatory or non-compulsory for various G/L accounts. This management permits for flexibility in knowledge entry whereas making certain knowledge consistency. Correct discipline standing configuration is essential for managing the extent of element required for various account sorts.

3. Evaluation and Reporting:

-

OB52 (Show Chart of Accounts): This T-code supplies a complete overview of the chart of accounts construction. It permits customers to view the hierarchy of accounts, account teams, and their related attributes. This can be a priceless device for understanding the general construction and figuring out particular accounts.

-

FS00 (Show G/L Account): This T-code shows the main points of a particular G/L account, together with its steadiness, transaction historical past, and different related data. This can be a great tool for analyzing the exercise of particular person accounts.

Greatest Practices for Chart of Accounts Administration:

- Cautious Planning: Totally plan the chart of accounts construction earlier than implementation. Think about the corporate’s organizational construction, reporting necessities, and future development.

- Constant Numbering: Preserve a constant and logical numbering system for G/L accounts to facilitate straightforward identification and retrieval.

- Common Upkeep: Frequently assessment and replace the chart of accounts to replicate adjustments within the enterprise surroundings and reporting wants.

- Correct Documentation: Preserve complete documentation of the chart of accounts construction, together with account descriptions and their function.

- Consumer Coaching: Present satisfactory coaching to customers on the right use and upkeep of the chart of accounts.

Conclusion:

The Chart of Accounts is a essential element of SAP FI, and mastering the associated T-codes is crucial for efficient monetary administration. By understanding the functionalities of those T-codes and following greatest practices, organizations can make sure the accuracy, consistency, and reliability of their monetary knowledge. This complete understanding permits for environment friendly monetary reporting, evaluation, and decision-making. Common assessment and upkeep of the CoA, coupled with thorough person coaching, contribute considerably to the general well being and effectiveness of the SAP monetary system. Do not forget that consulting SAP documentation and searching for professional help when wanted is essential for optimum utilization of those highly effective instruments.

Closure

Thus, we hope this text has offered priceless insights into Chart of Accounts T-Codes: Navigating the Coronary heart of SAP Monetary Accounting. We thanks for taking the time to learn this text. See you in our subsequent article!