chart of accounts vs price facilities

Associated Articles: chart of accounts vs price facilities

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to chart of accounts vs price facilities. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart of Accounts vs. Value Facilities: Understanding the Basis of Monetary Administration

Efficient monetary administration hinges on a strong system for monitoring and analyzing monetary knowledge. Two essential elements of this technique are the chart of accounts and price facilities. Whereas typically utilized in conjunction, they serve distinct functions and supply totally different views on a corporation’s monetary efficiency. Understanding their variations and the way they work collectively is crucial for correct monetary reporting, price management, and knowledgeable decision-making.

The Chart of Accounts: A Hierarchical Construction of Monetary Accounts

The chart of accounts (COA) is a complete checklist of all of the accounts utilized by a corporation to report its monetary transactions. It acts as a structured framework, organizing accounts hierarchically primarily based on their nature and performance. Consider it because the spine of an organization’s accounting system, offering a constant and standardized technique for classifying monetary data. This standardized strategy is essential for correct monetary reporting and comparability of information over time.

A typical COA consists of accounts categorized into main teams, equivalent to:

- Property: Assets owned by the corporate, together with money, accounts receivable, stock, and stuck property (property, plant, and gear).

- Liabilities: Obligations owed by the corporate to others, together with accounts payable, loans payable, and accrued bills.

- Fairness: The residual curiosity within the property of the corporate after deducting liabilities, representing the homeowners’ stake.

- Income: Inflows of financial advantages ensuing from the atypical actions of the corporate, equivalent to gross sales income, service income, and curiosity income.

- Bills: Outflows of financial advantages ensuing from the atypical actions of the corporate, together with price of products bought, salaries, hire, and utilities.

Inside every main class, accounts are additional subdivided into extra particular accounts. As an example, "Income" may be damaged down into "Gross sales Income," "Service Income," and "Different Income," whereas "Bills" may be categorized into "Value of Items Offered," "Promoting Bills," "Administrative Bills," and "Analysis and Growth Bills." This detailed breakdown permits for granular evaluation of various elements of the enterprise.

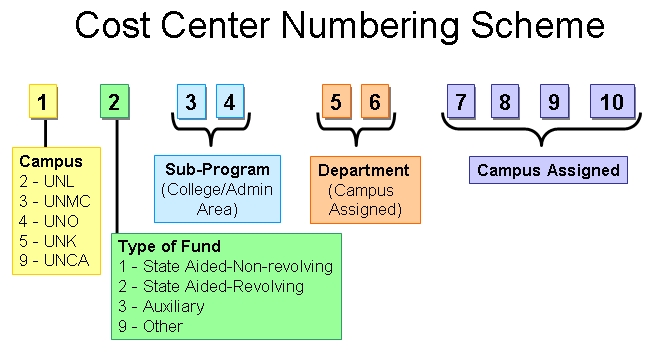

The construction of a COA can differ relying on the dimensions and complexity of the group, its business, and its particular accounting wants. Nevertheless, the basic precept stays the identical: to supply a scientific and arranged technique for recording and classifying all monetary transactions. Consistency in the usage of the COA is essential for sustaining the integrity of the monetary information and making certain correct reporting. Adjustments to the COA must be rigorously deliberate and documented to keep away from disrupting the monetary reporting course of.

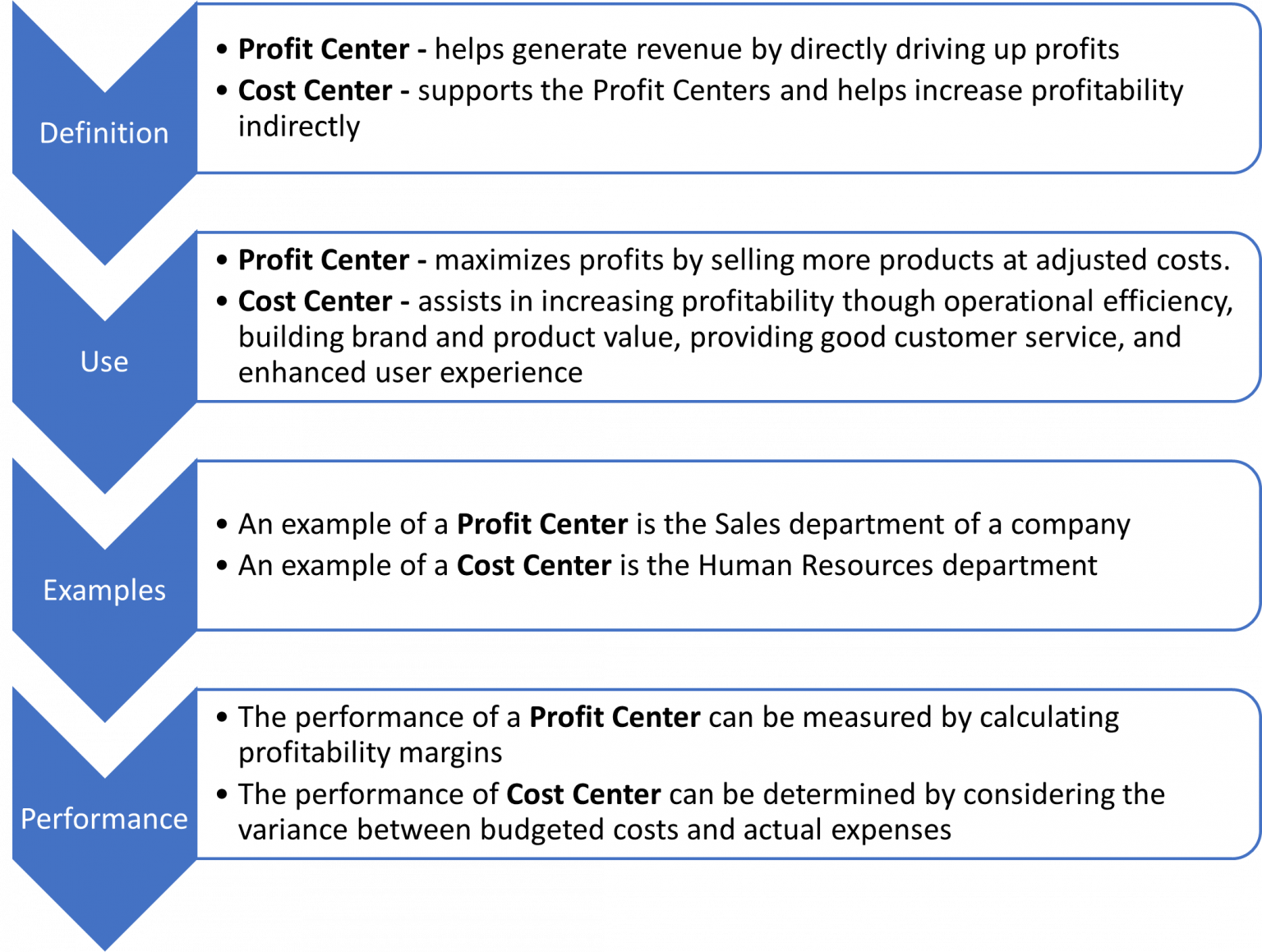

Value Facilities: Figuring out and Monitoring Prices by Duty

In contrast to the COA, which focuses on the character of monetary transactions, price facilities concentrate on the placement or operate inside a corporation the place prices are incurred. A value middle is a unit or division inside a corporation that’s accountable for incurring and controlling prices. They aren’t revenue facilities; they do not generate income immediately. As a substitute, their main function is to effectively handle the bills related to their particular operations.

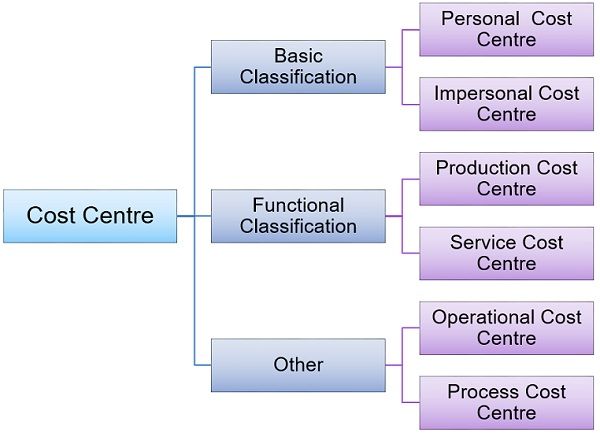

Examples of price facilities embody:

- Departmental Value Facilities: Advertising, Gross sales, Manufacturing, Analysis & Growth, Human Assets, and so forth.

- Geographical Value Facilities: Totally different branches or places of work positioned in numerous geographical areas.

- Mission Value Facilities: Particular tasks undertaken by the group.

- Course of Value Facilities: Distinct processes inside a bigger operation, equivalent to meeting, packaging, or high quality management.

Value facilities enable organizations to trace and analyze prices at a extra granular degree than the COA alone. By assigning prices to particular price facilities, administration can establish areas of excessive expenditure, pinpoint inefficiencies, and implement cost-saving measures. This allows higher price management and improved useful resource allocation. The info generated by price facilities is essential for efficiency analysis, budgeting, and strategic decision-making.

The Interaction Between Chart of Accounts and Value Facilities

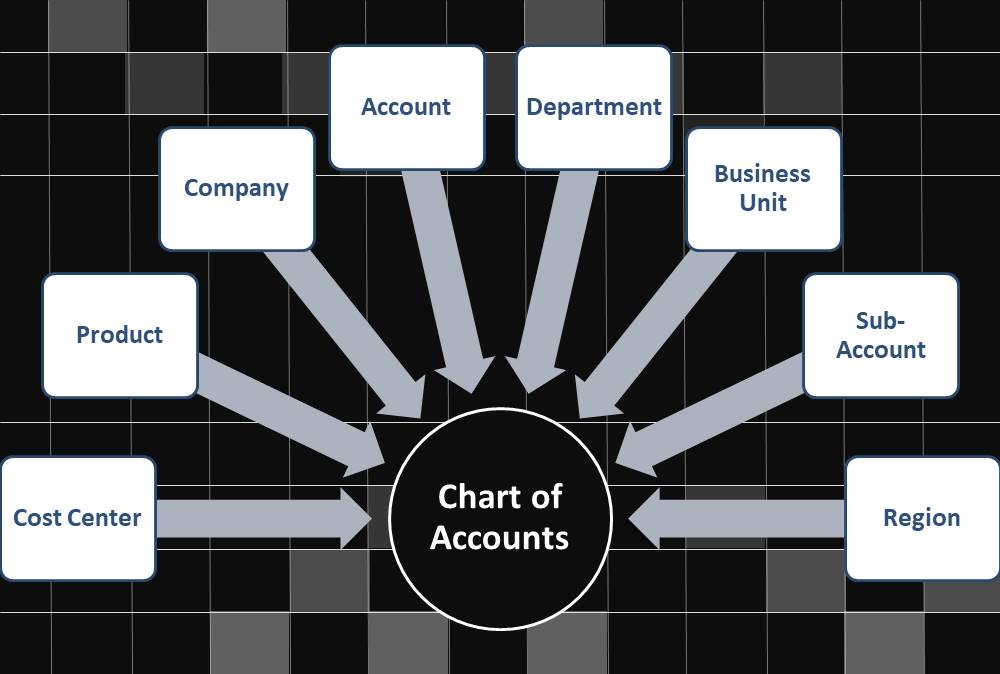

The COA and price facilities are interconnected however distinct components of the monetary administration system. The COA gives the framework for classifying all monetary transactions, whereas price facilities present a mechanism for assigning these transactions to particular areas of duty inside the group.

The connection works as follows: when a transaction happens, it’s recorded within the related accounts inside the COA. Concurrently, the transaction can also be assigned to the suitable price middle. This twin recording permits for a complete evaluation of monetary knowledge from each a practical (COA) and a duty (price middle) perspective.

For instance, the wage expense of a manufacturing employee can be recorded within the "Salaries Expense" account inside the COA and concurrently allotted to the "Manufacturing" price middle. This permits administration to trace the overall wage expense for the whole group (via the COA) and the wage expense particularly attributable to the manufacturing division (via the fee middle).

Advantages of Utilizing Each Chart of Accounts and Value Facilities:

The mixed use of a COA and price facilities gives a number of important advantages:

- Improved Value Management: By monitoring prices on the price middle degree, administration can establish areas of inefficiency and implement cost-reduction methods.

- Enhanced Efficiency Analysis: Value middle knowledge permits for a extra correct evaluation of the efficiency of various departments or items inside the group.

- Higher Useful resource Allocation: Understanding price patterns on the price middle degree allows simpler allocation of assets to high-performing areas.

- Extra Correct Budgeting: Value middle knowledge gives a strong basis for creating extra lifelike and correct budgets.

- Improved Resolution-Making: The great monetary knowledge generated by each programs helps knowledgeable decision-making throughout all ranges of the group.

- Facilitated Inner Reporting: Detailed reviews will be generated to point out price efficiency by division, undertaking, or different related price middle classifications.

Challenges and Concerns:

Implementing and sustaining a strong COA and price middle system requires cautious planning and ongoing administration. Some challenges embody:

- Complexity: Establishing and sustaining an in depth COA and price middle construction will be advanced, notably for bigger organizations.

- Knowledge Accuracy: Correct knowledge entry is essential for the reliability of the knowledge generated. Errors in knowledge entry can result in inaccurate evaluation and flawed decision-making.

- Integration with different programs: The COA and price middle system must be built-in with different monetary and operational programs to make sure seamless knowledge move.

- Value of implementation and upkeep: Implementing and sustaining a complete system requires funding in software program, coaching, and personnel.

Conclusion:

The chart of accounts and price facilities are important instruments for efficient monetary administration. Whereas distinct of their focus, they work collectively to supply a complete view of a corporation’s monetary efficiency. By understanding the distinctive capabilities of every and their interaction, organizations can leverage their capabilities to enhance price management, improve efficiency analysis, and make extra knowledgeable strategic choices. The funding in establishing and sustaining a well-structured COA and price middle system is essential for the long-term monetary well being and success of any group.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

:max_bytes(150000):strip_icc()/chart-of-accounts-984cd9454c364932b0cba045f56a6bb1.jpg)

Closure

Thus, we hope this text has supplied precious insights into chart of accounts vs price facilities. We hope you discover this text informative and helpful. See you in our subsequent article!