Chart Sample Cheat Sheet: A Complete Information to German-Language Assets and Technical Evaluation

Associated Articles: Chart Sample Cheat Sheet: A Complete Information to German-Language Assets and Technical Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart Sample Cheat Sheet: A Complete Information to German-Language Assets and Technical Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Chart Sample Cheat Sheet: A Complete Information to German-Language Assets and Technical Evaluation

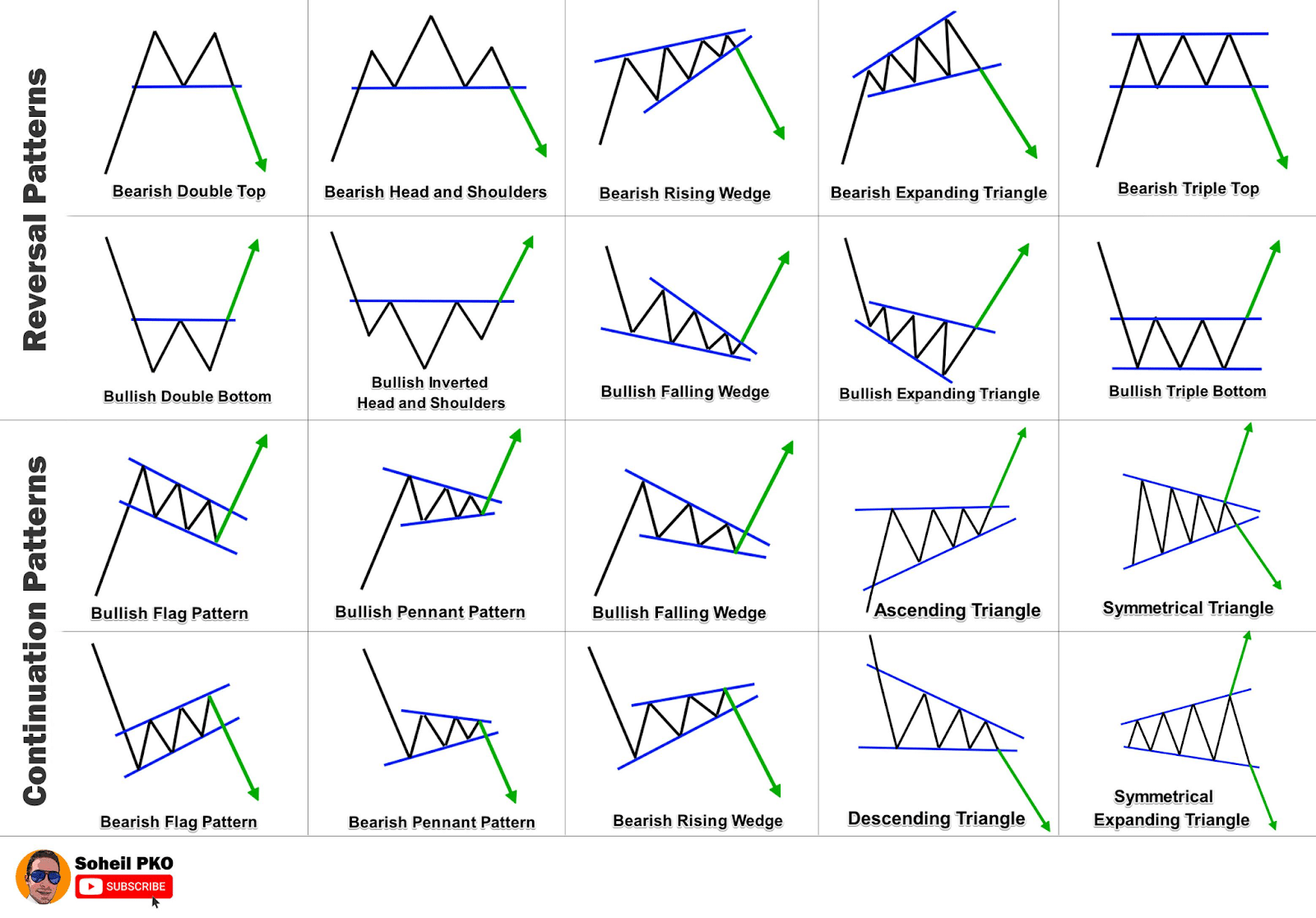

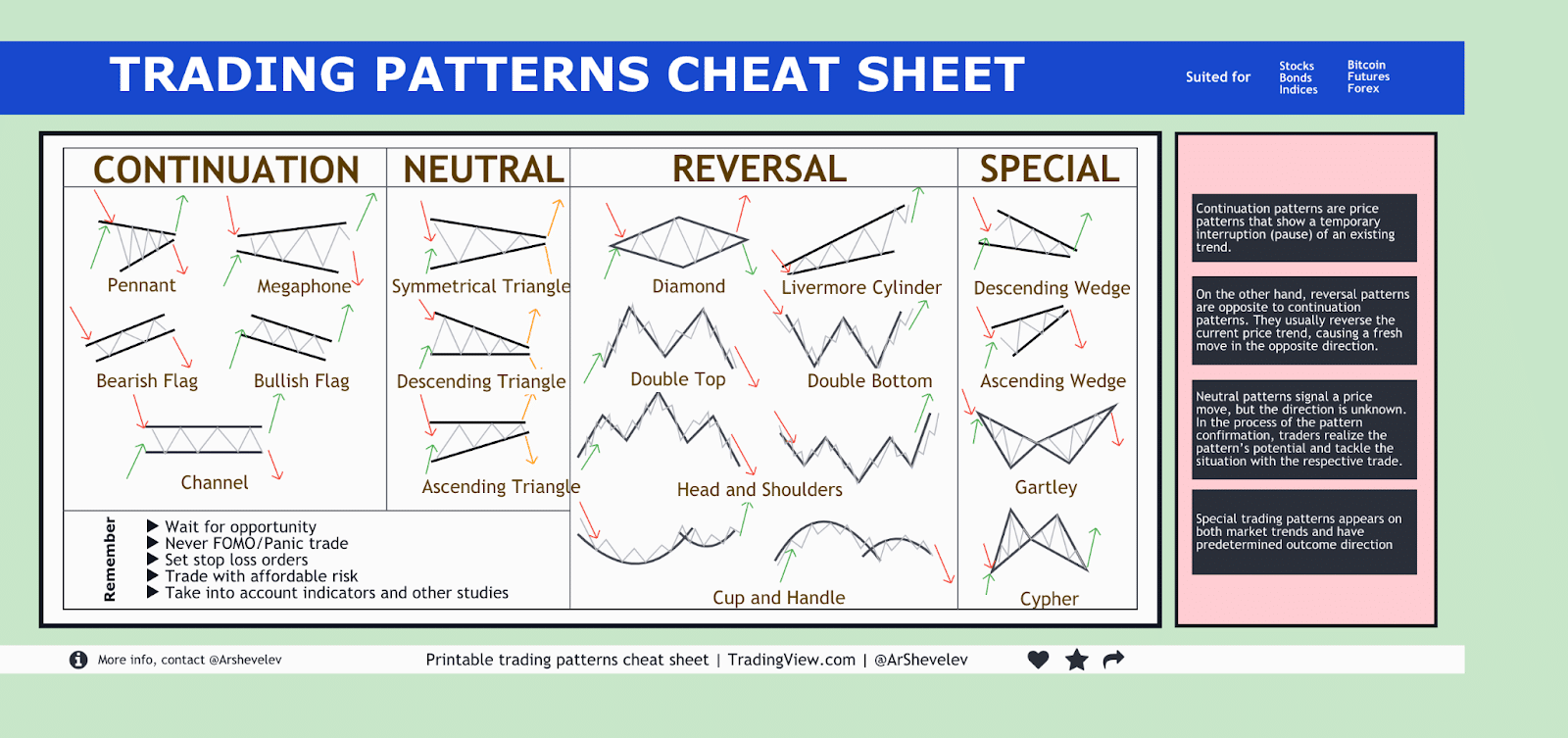

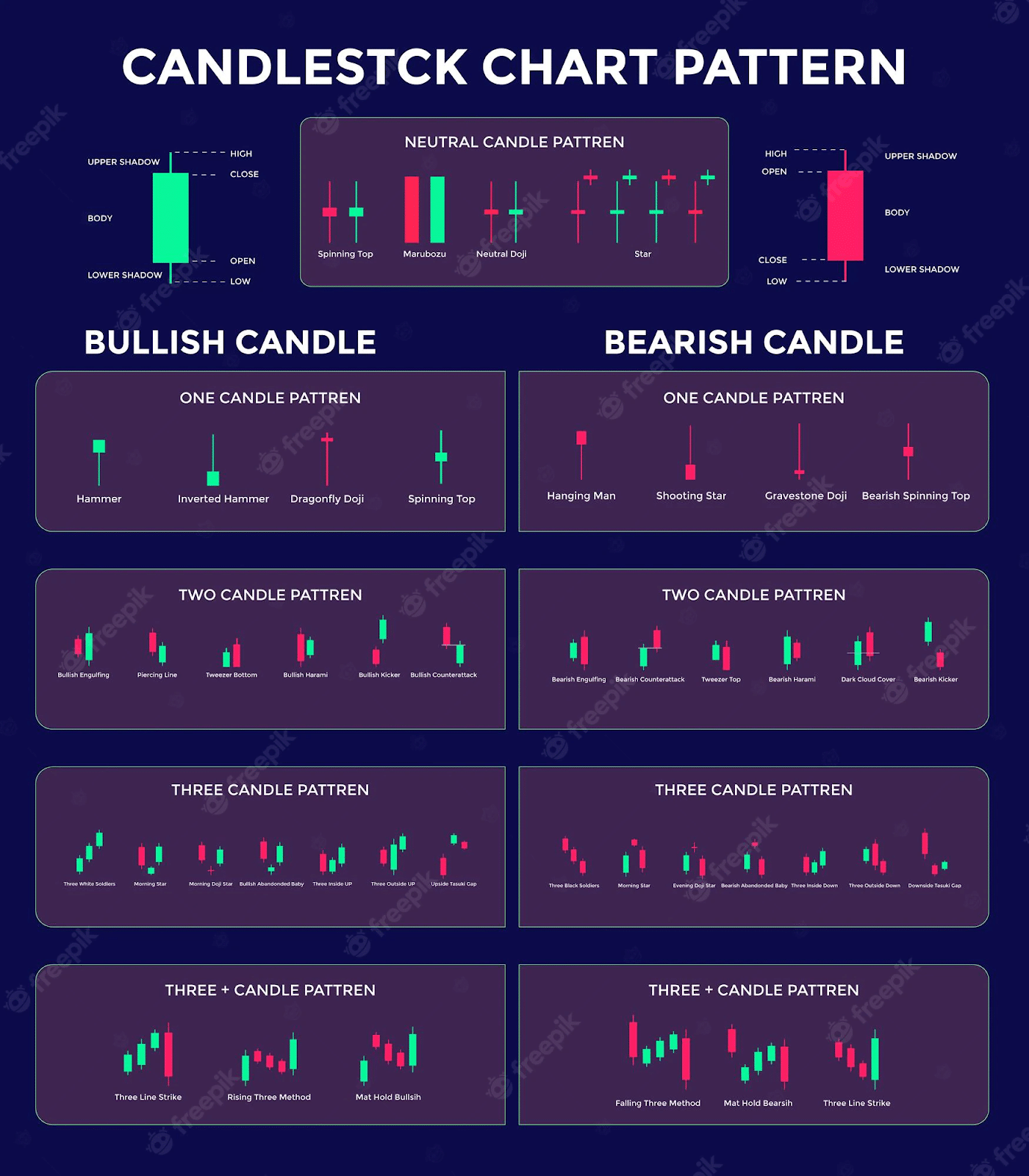

Technical evaluation, the research of previous market information to foretell future worth actions, depends closely on recognizing recurring chart patterns. Whereas many sources exist in English, merchants utilizing German-language supplies would possibly discover a devoted "Chart Sample Cheat Sheet Deutsch" useful. This text serves as a complete information to understanding widespread chart patterns, supplementing the necessity for such a cheat sheet by offering detailed explanations and linking them to potential German-language sources the place relevant. We’ll discover each bullish and bearish patterns, their identification standards, and potential buying and selling methods.

I. Understanding the Want for a "Chart Sample Cheat Sheet Deutsch"

The German-speaking buying and selling neighborhood, like some other, advantages from concise, readily accessible info. A "Chart Sample Cheat Sheet Deutsch" would ideally present a fast reference information to the commonest chart patterns, together with visible representations and concise descriptions in German. Whereas quite a few English-language sources exist, a German-language model gives a number of benefits:

- Accessibility: Merchants snug primarily with German profit from info offered of their native language. Technical phrases might be nuanced, and a direct translation is not at all times enough for correct understanding.

- Terminology Consistency: A devoted cheat sheet ensures constant use of German terminology for chart patterns, avoiding confusion stemming from varied translations.

- Contextual Relevance: A German-language cheat sheet would possibly embody examples drawn from German markets or incorporate particular buying and selling practices prevalent inside the German-speaking neighborhood.

II. Key Bullish Chart Patterns:

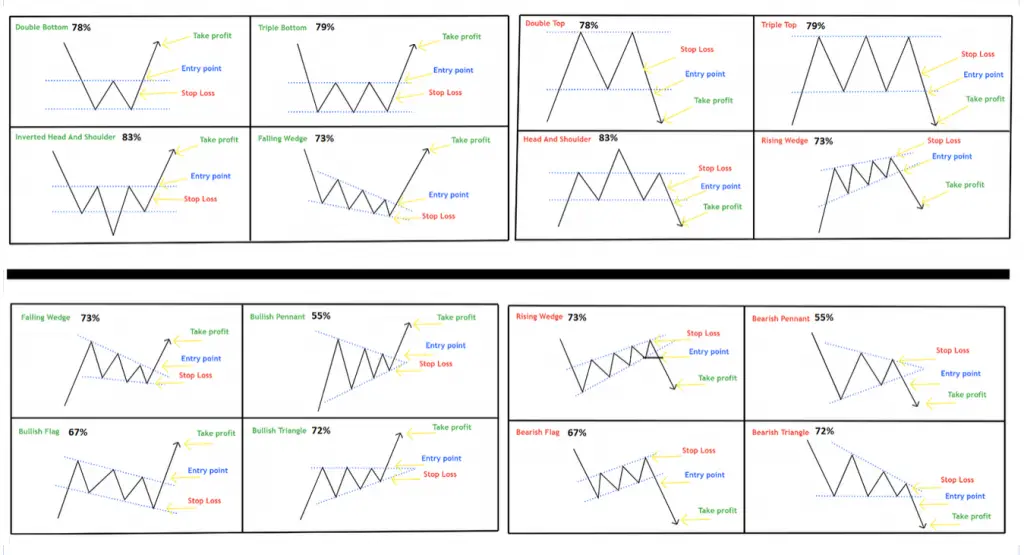

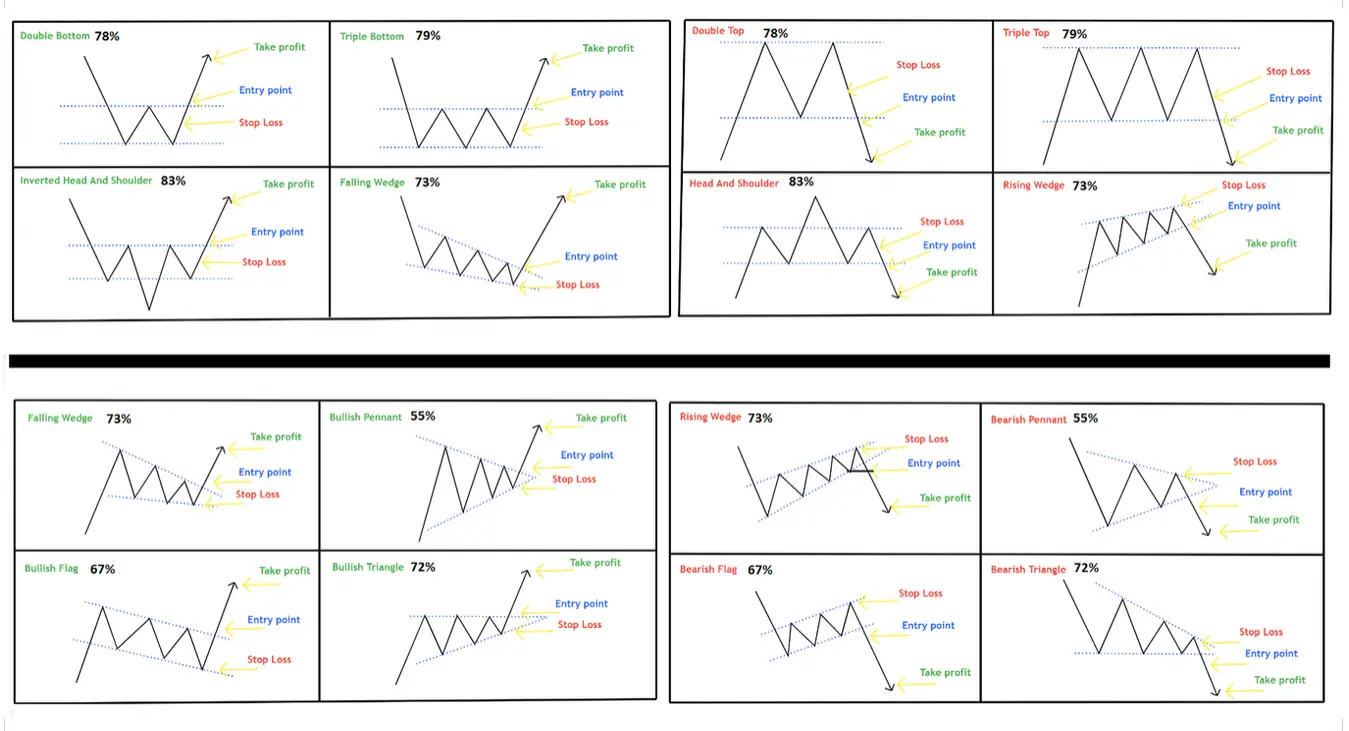

Bullish patterns counsel an upward worth motion is probably going. A German-language cheat sheet would come with visible representations and descriptions of those patterns, doubtlessly utilizing phrases like "bullisch" (bullish) and "aufwärts" (upward).

-

Head and Shoulders Backside: This reversal sample varieties after a downtrend. It consists of a low level ("Kopf" – head), flanked by two greater lows ("Schulter" – shoulders). A breakout above the neckline confirms the bullish sign. A German useful resource would possibly consult with this as a "Kopf-und-Schulter-Boden."

-

Double Backside: This sample exhibits two consecutive lows at roughly the identical worth stage, adopted by an increase. The neckline is the road connecting the 2 lows. A breakout above the neckline is a purchase sign. A German equal may very well be "Doppelboden."

-

Triple Backside: Much like a double backside, however with three lows. The power of the sign will increase with every further backside. This is likely to be translated as "Dreifachboden."

-

Inverse Head and Shoulders: The mirror picture of the top and shoulders backside, this sample indicators a bullish reversal after an uptrend. The breakout above the neckline confirms the bullish sign. The German time period may very well be "Inverse Kopf-und-Schulter."

-

Cup and Deal with: This sample resembles a cup with a small deal with. The "cup" is a U-shaped curve, and the "deal with" is a brief, downward pattern. A breakout above the deal with’s resistance line confirms a bullish sign. A attainable German translation could be "Tasse mit Henkel."

-

Ascending Triangle: This sample exhibits a sequence of upper highs and constant lows, forming an ascending triangle. A breakout above the higher trendline is a bullish sign. A German time period may very well be "Aufsteigendes Dreieck."

III. Key Bearish Chart Patterns:

Bearish patterns counsel a downward worth motion is probably going. A German cheat sheet would incorporate phrases like "bärisch" (bearish) and "abwärts" (downward).

-

Head and Shoulders Prime: This reversal sample varieties after an uptrend, displaying a excessive level ("Kopf" – head) flanked by two decrease highs ("Schulter" – shoulders). A breakout under the neckline confirms the bearish sign. This can be a "Kopf-und-Schulter-Spitze" in German.

-

Double Prime: This sample exhibits two consecutive highs at roughly the identical worth stage, adopted by a decline. The neckline connects the 2 highs. A breakout under the neckline is a promote sign. The German time period is "Doppelspitze."

-

Triple Prime: Much like a double prime, however with three highs. The power of the sign will increase with every further prime. This might be a "Dreifachspitze."

-

Descending Triangle: This sample exhibits a sequence of decrease lows and constant highs, forming a descending triangle. A breakout under the decrease trendline is a bearish sign. The German time period may very well be "Absteigendes Dreieck."

-

Rounding Prime: This sample exhibits a gradual curve forming a rounded prime, suggesting a reversal from an uptrend. A breakout under the help line confirms the bearish sign. A German equal may very well be "Abrundende Spitze" or "Rundungsboden."

IV. Different Essential Chart Patterns:

A number of different patterns are neither strictly bullish nor bearish, however quite present insights into potential worth actions or consolidation phases.

-

Rectangles: These patterns present a worth vary bounded by horizontal help and resistance traces. Breakouts above or under these traces can point out future worth path. A German translation may very well be "Rechteck."

-

Triangles (Symmetrical): These patterns present converging trendlines, indicating a interval of consolidation. The breakout path (up or down) determines the longer term worth motion. This may very well be a "Symmetrisches Dreieck."

-

Flags and Pennants: These short-term continuation patterns point out a brief pause in a pattern. The breakout often follows the path of the previous pattern. German phrases may very well be "Flaggen" and "Wimpel."

V. Discovering German-Language Assets:

Whereas a devoted "Chart Sample Cheat Sheet Deutsch" won’t be available as a single, universally acknowledged doc, a number of avenues can present the required info:

-

German-language buying and selling web sites and blogs: Many monetary web sites and blogs in German supply academic supplies on technical evaluation, together with explanations of chart patterns. Trying to find phrases like "Chartmuster," "Technische Analyse," or "Candlestick-Muster" (Candlestick patterns) can yield related outcomes.

-

Buying and selling books in German: A number of books on technical evaluation can be found in German, providing detailed explanations and illustrations of chart patterns. Checking on-line bookstores like Amazon.de can assist discover appropriate sources.

-

On-line programs and webinars: A number of on-line platforms supply buying and selling programs in German, a few of which cowl chart patterns intimately.

-

Buying and selling communities and boards: German-speaking buying and selling communities and on-line boards might be invaluable sources of data and discussions about chart patterns.

VI. Past the Cheat Sheet: Essential Issues

A cheat sheet offers a fast reference, however mastering technical evaluation requires extra than simply sample recognition. A number of essential facets ought to be thought of:

-

Affirmation: Chart patterns ought to be confirmed by different technical indicators or elementary evaluation earlier than making buying and selling choices.

-

Context: The context of the sample inside the broader market pattern is essential. A bullish sample in a powerful bearish market won’t be dependable.

-

Danger Administration: All the time implement correct danger administration methods, together with stop-loss orders, to guard your capital.

-

Apply: Constant observe and expertise are important to precisely determine and interpret chart patterns.

VII. Conclusion:

Whereas a single, available "Chart Sample Cheat Sheet Deutsch" could not exist, the knowledge offered right here, mixed with a proactive seek for German-language sources, can present German-speaking merchants with the information and instruments essential to successfully make the most of chart patterns of their buying and selling methods. Bear in mind to at all times mix sample recognition with different types of evaluation and rigorous danger administration for profitable buying and selling. The pursuit of information and steady studying are important for navigating the complexities of the monetary markets. By actively looking for out and using German-language sources, merchants can construct a powerful basis in technical evaluation and enhance their buying and selling efficiency.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-860x608.png)

Closure

Thus, we hope this text has supplied invaluable insights into Chart Sample Cheat Sheet: A Complete Information to German-Language Assets and Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!