Chart Sample Indicators: Decoding the Market’s Visible Language

Associated Articles: Chart Sample Indicators: Decoding the Market’s Visible Language

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Chart Sample Indicators: Decoding the Market’s Visible Language. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart Sample Indicators: Decoding the Market’s Visible Language

Chart patterns, the recurring formations of worth motion on a chart, have lengthy been a cornerstone of technical evaluation. Whereas not foolproof predictors of future worth actions, they provide priceless insights into market sentiment and potential shifts in momentum. Chart sample indicators, both constructed into buying and selling platforms or created by way of customized scripting, improve the dealer’s potential to establish these patterns, quantify their significance, and probably enhance buying and selling choices. This text delves into the world of chart sample indicators, exploring their sorts, strengths, weaknesses, and efficient utilization methods.

Understanding Chart Patterns: The Basis of Visible Evaluation

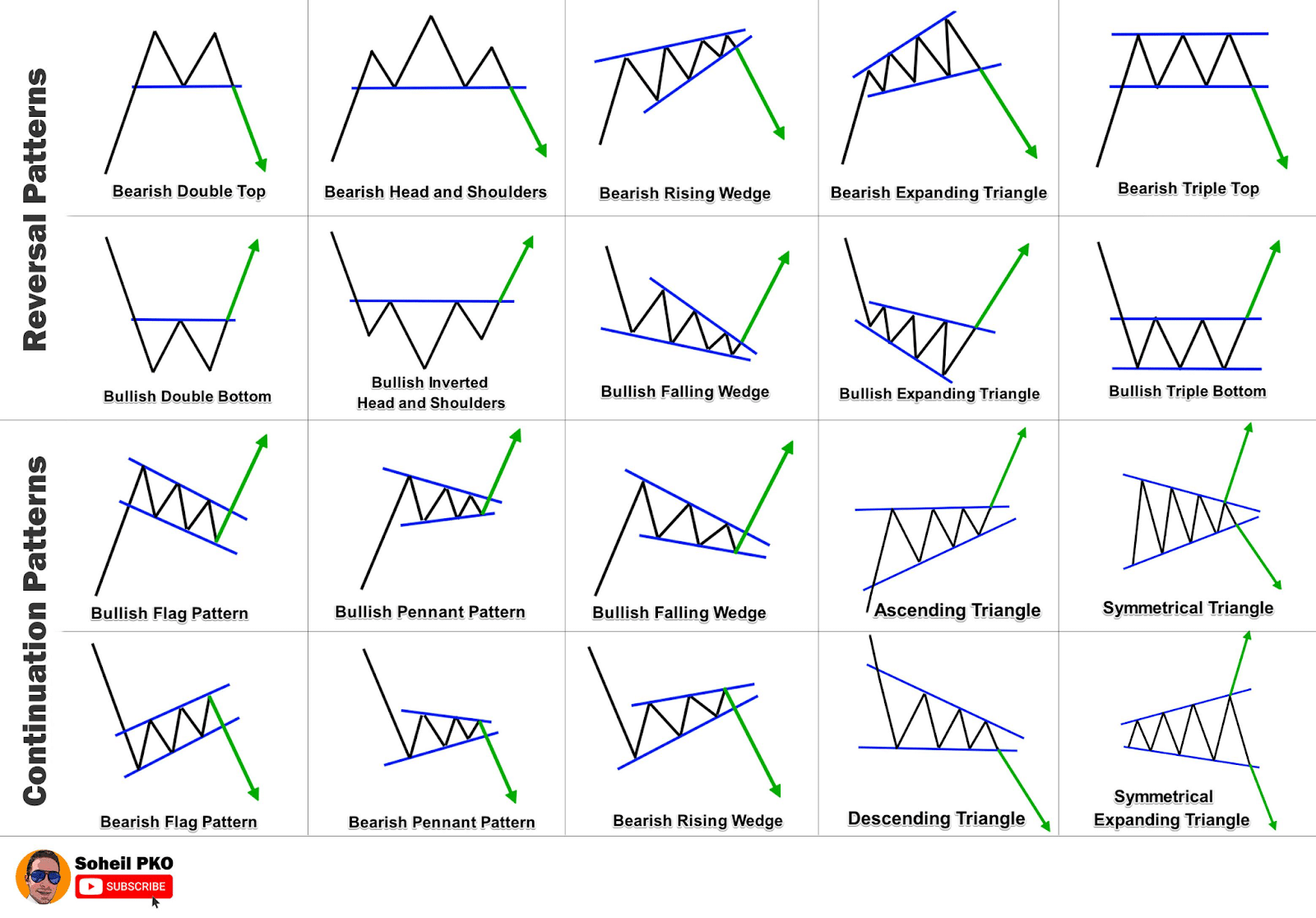

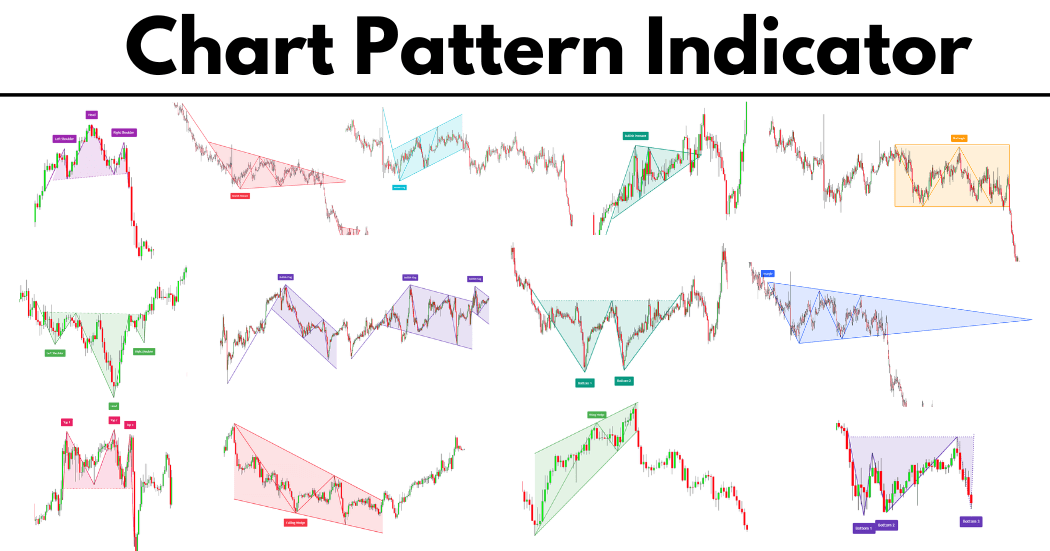

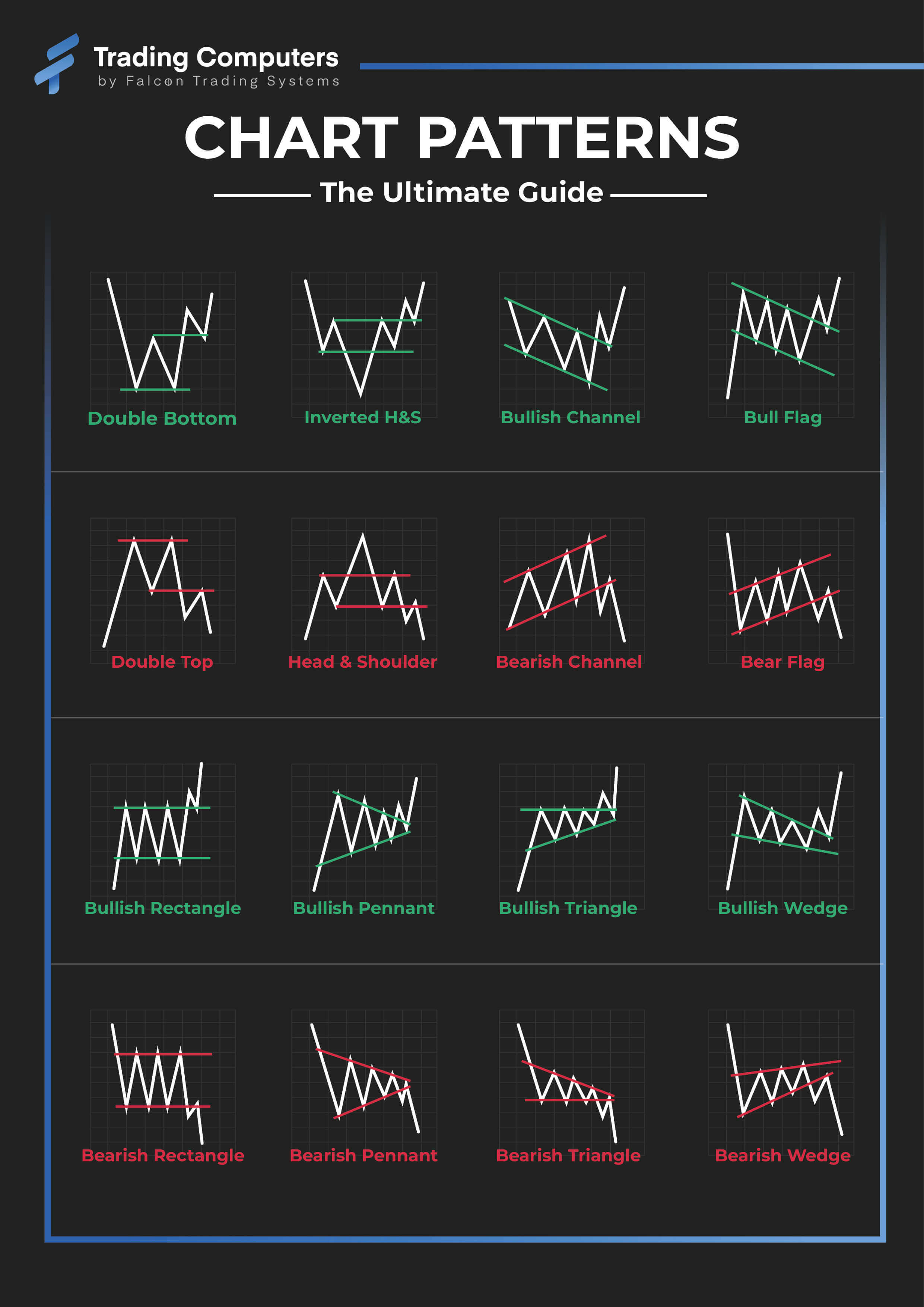

Earlier than diving into indicators, understanding the underlying chart patterns is essential. These patterns, shaped by the interaction of provide and demand, usually manifest as predictable shapes on worth charts. Key classes embrace:

-

Continuation Patterns: These recommend a short lived pause in an current development earlier than its resumption. Examples embrace:

- Triangles: Symmetrical, ascending, and descending triangles point out consolidation earlier than a breakout within the route of the previous development.

- Flags and Pennants: These resemble small rectangles or triangles, signifying a quick pause in a robust development.

- Rectangles: Horizontal worth consolidations, usually suggesting a interval of sideways buying and selling earlier than a breakout.

-

Reversal Patterns: These trace at a possible change within the prevailing development. Examples embrace:

- Head and Shoulders: A traditional reversal sample characterised by three peaks, with the center peak (the pinnacle) being the best.

- Inverse Head and Shoulders: A bullish reversal sample, mirroring the Head and Shoulders however inverted.

- Double Tops and Bottoms: Two related worth peaks (tops) or troughs (bottoms), indicating potential development reversals.

- Wedges: These sloping patterns, both ascending or descending, usually sign a development reversal.

-

Different Notable Patterns: Past these core patterns, others exist, together with:

- Rounded Tops and Bottoms: These gradual curves recommend a chronic interval of consolidation earlier than a development reversal.

- Diamond Patterns: These resemble a diamond form, usually indicating a major reversal.

The Function of Chart Sample Indicators:

Whereas skilled merchants can usually visually establish these patterns, chart sample indicators provide a number of benefits:

- Objectivity: Human interpretation might be subjective. Indicators present goal standards for sample recognition, decreasing bias.

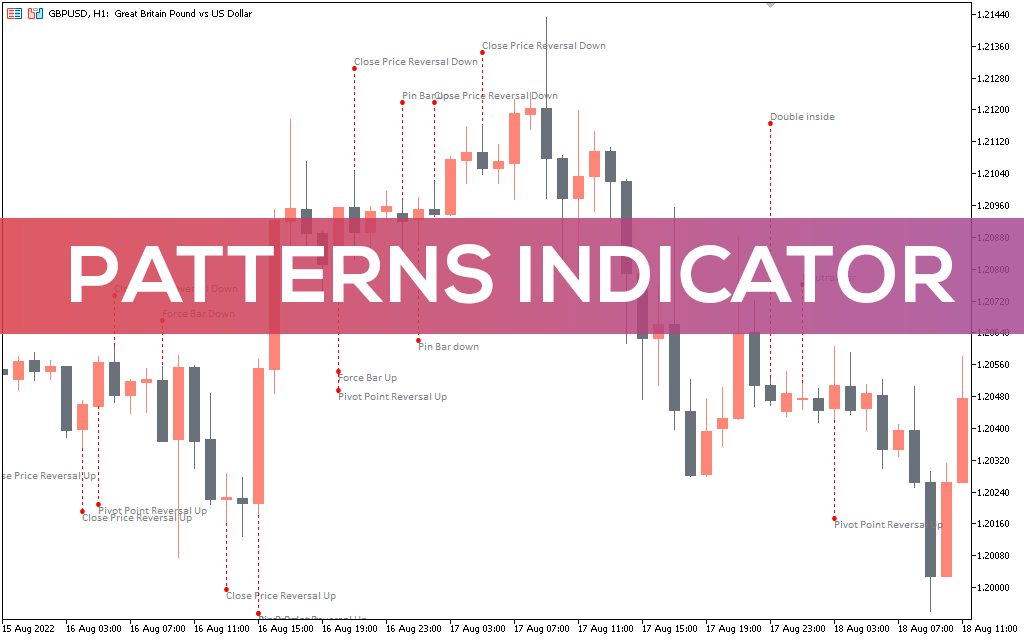

- Automation: Indicators routinely scan charts, figuring out potential patterns that is likely to be missed by visible inspection, particularly in high-frequency buying and selling environments.

- Quantification: Some indicators present metrics to quantify the energy and reliability of a detected sample, such because the sample’s depth, length, and quantity affirmation.

- Alert Technology: Many indicators can generate alerts when a particular sample is recognized, permitting merchants to react promptly to potential alternatives.

Kinds of Chart Sample Indicators:

Chart sample indicators might be broadly categorized based mostly on their strategy:

-

Rule-Primarily based Indicators: These indicators depend on pre-defined guidelines and algorithms to establish patterns. They usually contain evaluating worth information to predefined thresholds and geometrical shapes. For instance, a rule-based Head and Shoulders indicator may establish the sample based mostly on the relative heights of the peaks and the neckline’s break. The benefit is simplicity and clear logic, whereas the drawback is rigidity; they may miss patterns that deviate barely from the perfect form.

-

Machine Studying-Primarily based Indicators: These make the most of machine studying algorithms to be taught and establish patterns from historic worth information. They’re extra versatile than rule-based indicators, able to adapting to variations in sample formations. Nonetheless, they require in depth coaching information and might be extra advanced to grasp and implement. Overfitting, the place the indicator performs effectively on coaching information however poorly on new information, is a possible concern.

-

Hybrid Indicators: These mix rule-based and machine studying strategies, leveraging the strengths of each approaches. They may use rule-based strategies for preliminary sample identification and machine studying for refinement and validation.

Strengths and Weaknesses of Chart Sample Indicators:

Strengths:

- Enhanced Sample Recognition: Improved accuracy and velocity in figuring out patterns, particularly in unstable markets.

- Goal Evaluation: Reduces subjectivity and emotional bias in buying and selling choices.

- Automated Alerting: Well timed alerts present alternatives for immediate motion.

- Backtesting Capabilities: Many indicators enable for backtesting on historic information to evaluate their effectiveness.

Weaknesses:

- False Indicators: Indicators can generate false indicators, resulting in incorrect buying and selling choices.

- Lagging Indicators: Some indicators may lag behind precise worth actions, decreasing their effectiveness in fast-moving markets.

- Over-Reliance: Over-reliance on indicators with out contemplating different components (basic evaluation, market sentiment) might be detrimental.

- Complexity: Some superior indicators might be obscure and implement.

- Information Dependency: The effectiveness of indicators is closely reliant on the standard and accuracy of the underlying information.

Efficient Utilization Methods:

- Mix with Different Indicators: Use chart sample indicators along side different technical indicators (e.g., shifting averages, RSI, MACD) for affirmation and improved accuracy.

- Think about Quantity Affirmation: Validate sample breakouts with elevated buying and selling quantity.

- Handle Threat: Implement correct danger administration strategies (stop-loss orders, place sizing) to mitigate potential losses.

- Backtest Completely: Earlier than utilizing any indicator in reside buying and selling, backtest it extensively on historic information to evaluate its efficiency and reliability.

- Perceive Limitations: Acknowledge that indicators aren’t good predictors and may generate false indicators.

- Deal with Sample High quality: Prioritize high-quality patterns with clear formations and robust quantity affirmation.

- Adapt to Market Situations: The effectiveness of sure patterns can range relying on market situations (bullish vs. bearish markets, excessive volatility vs. low volatility).

Conclusion:

Chart sample indicators signify a robust software for technical analysts, enhancing their potential to establish and interpret worth patterns. Whereas not a assured path to revenue, their strategic use, mixed with different analytical strategies and sound danger administration, can considerably enhance buying and selling choices. Nonetheless, merchants should strategy these indicators with warning, understanding their limitations and avoiding over-reliance. Steady studying, rigorous backtesting, and a disciplined strategy are key to successfully leveraging the potential of chart sample indicators within the dynamic world of monetary markets. The selection between rule-based, machine studying, or hybrid indicators is dependent upon the dealer’s technical experience, danger tolerance, and buying and selling type. Finally, the simplest strategy entails a mix of technical evaluation, basic evaluation, and a deep understanding of market dynamics.

Closure

Thus, we hope this text has supplied priceless insights into Chart Sample Indicators: Decoding the Market’s Visible Language. We hope you discover this text informative and helpful. See you in our subsequent article!