Chart Sample Testing: A Deep Dive into Figuring out and Validating Technical Evaluation Indicators

Associated Articles: Chart Sample Testing: A Deep Dive into Figuring out and Validating Technical Evaluation Indicators

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Sample Testing: A Deep Dive into Figuring out and Validating Technical Evaluation Indicators. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Sample Testing: A Deep Dive into Figuring out and Validating Technical Evaluation Indicators

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Chart patterns, these recurring formations on value charts, are a cornerstone of technical evaluation. They provide merchants and traders visible representations of market sentiment and potential future value actions. Nevertheless, merely figuring out a chart sample is not sufficient; rigorous testing is essential to validate its predictive energy and keep away from counting on spurious correlations. This text delves into the method of chart sample testing, overlaying identification, validation, and the essential function of backtesting in establishing a sturdy buying and selling technique.

I. Figuring out Chart Patterns: A Visible Artwork and Scientific Strategy

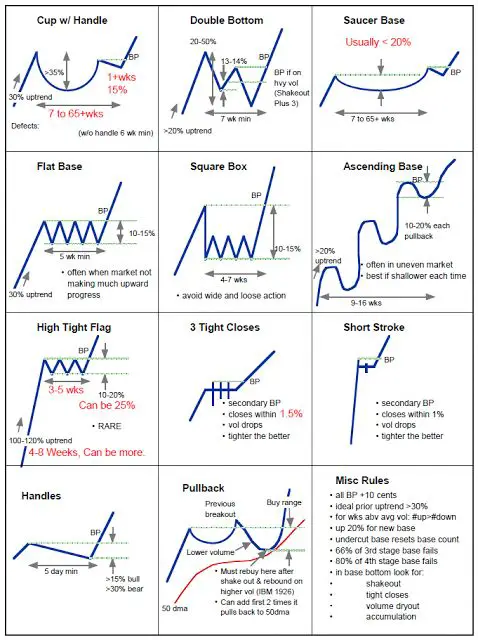

Recognizing chart patterns requires a eager eye and a scientific method. Whereas subjective interpretation performs a job, a structured methodology enhances accuracy and consistency. Frequent patterns embody:

-

Head and Shoulders: This reversal sample suggests a shift from an uptrend to a downtrend (or vice versa for an inverse head and shoulders). It consists of three peaks, with the center peak (the top) being the best. Neckline assist/resistance is essential for affirmation.

-

Triangles: These consolidation patterns, together with symmetrical, ascending, and descending triangles, point out a interval of indecision earlier than a possible breakout. The path of the breakout typically determines the following value motion.

-

Double Tops/Bottoms: These patterns include two comparable value peaks (tops) or troughs (bottoms), suggesting a possible reversal. The neckline acts as a vital assist/resistance degree.

-

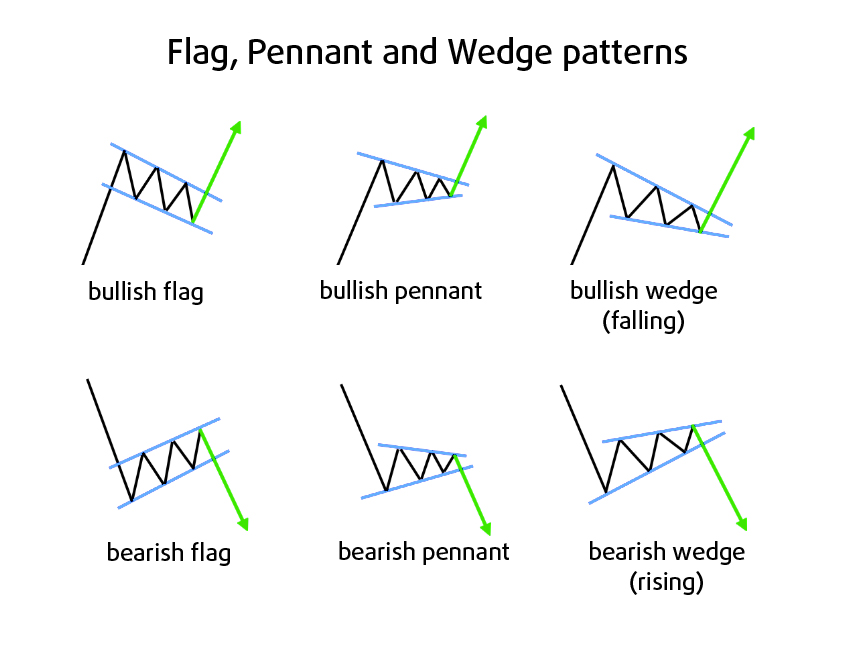

Flags and Pennants: These continuation patterns seem throughout sturdy traits. They characterize a short lived pause earlier than the pattern resumes in its unique path.

-

Cup and Deal with: This bullish continuation sample resembles a cup with a small deal with. The deal with represents a slight pullback earlier than the value resumes its upward trajectory.

Figuring out these patterns entails extra than simply visually recognizing the shapes. Key parts to think about embody:

-

Quantity: Modifications in buying and selling quantity typically affirm sample formations and breakouts. Excessive quantity throughout a breakout usually strengthens the sign.

-

Assist and Resistance Ranges: These ranges act as essential boundaries for value actions and can be utilized to venture potential value targets.

-

Trendlines: Connecting important value factors helps determine the general pattern and ensure sample formations.

-

Fibonacci Retracements: These instruments can assist determine potential assist and resistance ranges throughout the sample and venture potential value targets.

II. Validating Chart Patterns: Past Visible Inspection

Whereas visible identification is step one, relying solely on visible interpretation is dangerous. Sturdy validation requires a multi-faceted method:

-

Statistical Evaluation: This entails utilizing statistical strategies to evaluate the historic efficiency of a specific chart sample. This might embody calculating the success fee of breakouts, common value actions after breakouts, and the frequency of false indicators.

-

Backtesting: That is arguably probably the most essential validation technique. It entails simulating trades based mostly on historic knowledge to evaluate the profitability of a buying and selling technique using the recognized chart sample. Backtesting parameters must be clearly outlined, together with entry and exit guidelines, stop-loss ranges, and place sizing. Think about using totally different timeframes and datasets to make sure robustness.

-

Ahead Testing: After profitable backtesting, ahead testing is important. This entails making use of the technique to new, unseen knowledge to guage its efficiency in real-time market situations. This helps determine potential weaknesses and biases not revealed throughout backtesting.

-

Out-of-Pattern Testing: It is a essential step to keep away from overfitting. The technique is examined on a dataset that was not used through the growth or backtesting section. This supplies a extra life like evaluation of the technique’s generalizability.

-

Monte Carlo Simulations: These simulations can assist assess the statistical significance of the outcomes obtained from backtesting. They contain operating quite a few simulations with randomly generated knowledge to find out the likelihood of attaining the noticed outcomes by probability.

III. The Function of Backtesting in Chart Sample Testing

Backtesting is the cornerstone of validating any buying and selling technique, together with these based mostly on chart patterns. Efficient backtesting entails:

-

Defining Clear Entry and Exit Guidelines: Exactly defining when to enter and exit a commerce based mostly on the chart sample is essential. This contains specifying the standards for figuring out the sample, figuring out the breakout level, and setting stop-loss and take-profit ranges.

-

Choosing Applicable Knowledge: The standard and amount of historic knowledge used considerably influence backtesting outcomes. Guarantee the info is dependable, covers a adequate interval, and is consultant of the market situations you plan to commerce.

-

Accounting for Transaction Prices: Backtesting ought to embody life like transaction prices, resembling commissions and slippage, to supply a extra correct illustration of potential earnings and losses.

-

Place Sizing: Figuring out the suitable place measurement for every commerce is essential for danger administration. Backtesting ought to incorporate a place sizing technique to optimize danger and reward.

-

Evaluating Efficiency Metrics: A number of metrics can be utilized to guage the efficiency of a backtested technique, together with Sharpe Ratio, Sortino Ratio, most drawdown, win fee, and common revenue/loss.

IV. Challenges and Limitations in Chart Sample Testing

Regardless of its significance, chart sample testing faces a number of challenges:

-

Subjectivity: Figuring out chart patterns may be subjective, resulting in inconsistencies in interpretation. Clear, goal standards for sample identification are essential to mitigate this.

-

Overfitting: Overfitting happens when a technique performs properly on historic knowledge however poorly on new knowledge. Rigorous out-of-sample testing is important to keep away from this.

-

Knowledge Mining Bias: This bias arises from trying to find patterns in knowledge till a seemingly worthwhile one is discovered. This typically results in false positives and methods that fail in real-world situations.

-

Market Regime Modifications: Market situations can change considerably over time, rendering a beforehand profitable technique ineffective. Usually reviewing and adapting the technique is essential.

-

Lack of Financial Rationale: Some chart patterns lack a robust financial rationale, making their predictive energy questionable. Understanding the underlying market forces driving value actions is important.

V. Conclusion: A Balanced Strategy to Chart Sample Buying and selling

Chart patterns supply worthwhile insights into market sentiment and potential value actions. Nevertheless, relying solely on visible identification is inadequate. A rigorous testing course of, together with statistical evaluation, backtesting, ahead testing, and out-of-sample testing, is essential to validate the predictive energy of chart patterns and develop a sturdy buying and selling technique. By acknowledging the restrictions and incorporating a balanced method that mixes visible interpretation with quantitative evaluation, merchants can leverage chart patterns successfully whereas mitigating the dangers related to subjective interpretation and overfitting. Do not forget that no technique ensures success, and steady monitoring, adaptation, and danger administration are important for long-term profitability in any buying and selling endeavor.

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Sample Testing: A Deep Dive into Figuring out and Validating Technical Evaluation Indicators. We thanks for taking the time to learn this text. See you in our subsequent article!