Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart Patterns: A Complete Information (PDF Downloadable)

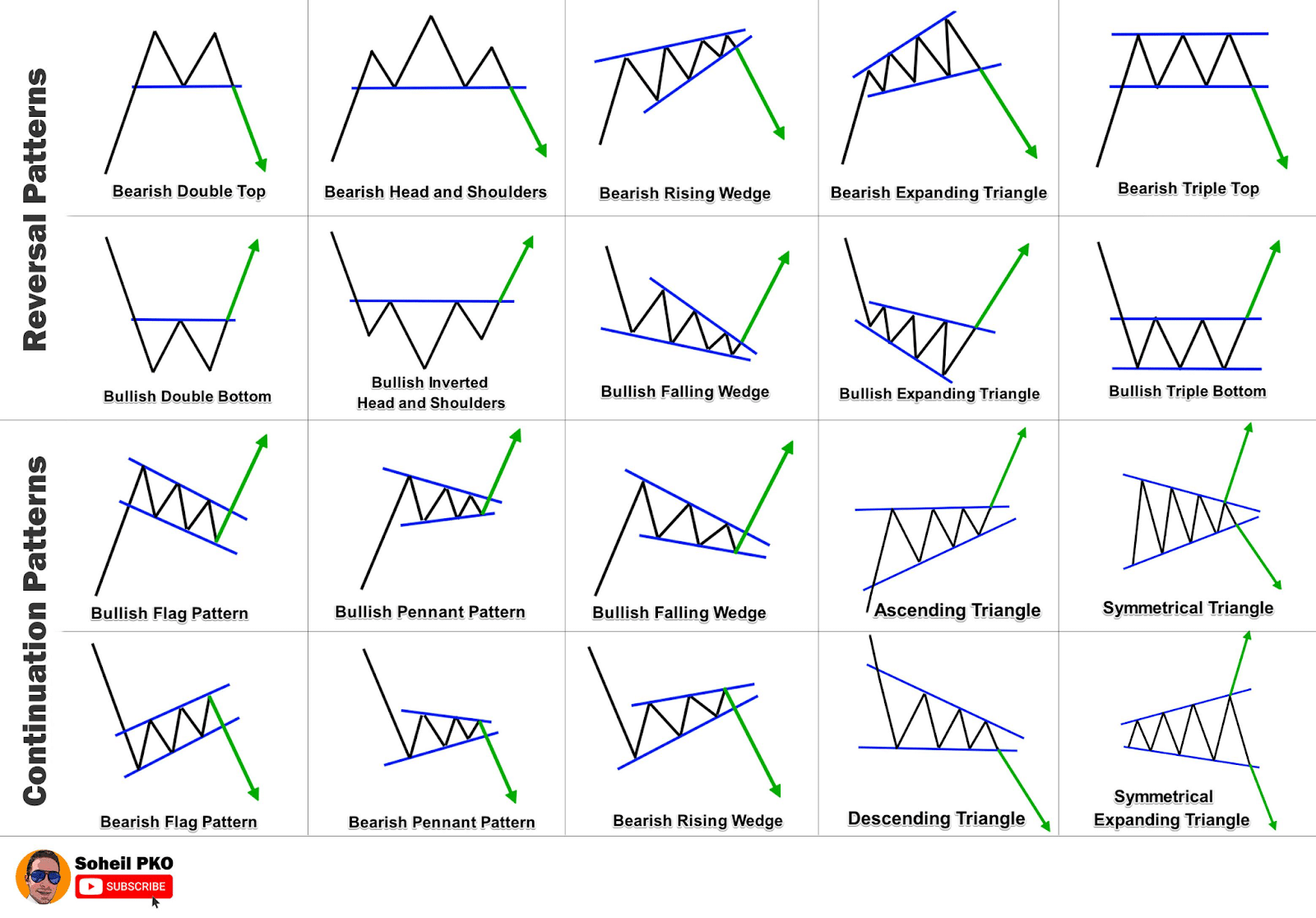

Chart patterns are visible representations of value motion on a chart, revealing potential shifts in market sentiment and predicting future value actions. Skilled merchants make the most of these patterns to determine high-probability buying and selling alternatives, enhancing their decision-making course of and probably enhancing risk-adjusted returns. This complete information explores numerous chart patterns, their formations, and tips on how to interpret them, culminating in a downloadable PDF for simple reference.

Understanding Chart Patterns:

Chart patterns are fashioned by connecting a collection of value highs and lows on a chart, usually utilizing candlestick or bar charts. These patterns usually repeat themselves, suggesting a level of predictability inside the market’s chaotic nature. They are not foolproof indicators, nevertheless; affirmation by different technical indicators and basic evaluation is essential for sturdy buying and selling methods. The effectiveness of a chart sample is closely influenced by the timeframe used (day by day, weekly, month-to-month, and so on.) and the context of the broader market development.

Categorizing Chart Patterns:

Chart patterns might be broadly categorized into two major teams:

-

Continuation Patterns: These patterns recommend a short lived pause or consolidation in an current development earlier than the worth continues in the identical route. They’re characterised by a interval of sideways value motion inside an outlined vary. Examples embrace:

- Triangles: Symmetrical, ascending, and descending triangles point out a interval of consolidation earlier than a breakout within the route of the prevailing development. Symmetrical triangles are impartial, whereas ascending triangles are bullish and descending triangles are bearish.

- Rectangles: Much like triangles, rectangles present consolidation inside a horizontal vary, suggesting a pause earlier than a continuation of the development. Breakouts above the resistance stage are bullish, whereas breakouts beneath the help stage are bearish.

- Flags and Pennants: These patterns are characterised by a short interval of consolidation, usually after a robust value transfer. Flags are rectangular, whereas pennants are triangular. Breakouts from these patterns normally proceed within the route of the preliminary development.

- Wedges: Wedges are characterised by converging trendlines, suggesting a weakening of the development. Rising wedges are bearish, whereas falling wedges are bullish.

-

Reversal Patterns: These patterns point out a possible change within the prevailing development. They recommend a shift in market sentiment, from bullish to bearish or vice versa. Examples embrace:

- Head and Shoulders: A traditional reversal sample characterised by three peaks, with the center peak (the "head") being the very best. A neckline connects the troughs between the peaks. A breakdown beneath the neckline indicators a bearish reversal. The inverse head and shoulders sample signifies a bullish reversal.

- Double Tops and Double Bottoms: These patterns are characterised by two related value peaks (double high) or troughs (double backside). A breakdown beneath the double high or a breakout above the double backside indicators a possible development reversal.

- Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs, indicating stronger affirmation of a reversal.

- Rounded Tops and Bottoms: These patterns exhibit a gradual curving value motion, suggesting a gradual and regular reversal. Rounded tops are bearish, whereas rounded bottoms are bullish.

Decoding Chart Patterns:

The profitable interpretation of chart patterns requires cautious consideration of a number of components:

- Quantity: Quantity evaluation offers essential affirmation of value actions. A powerful breakout from a sample ought to be accompanied by elevated quantity, indicating sturdy shopping for or promoting strain. Low quantity breakouts might be false indicators.

- Trendline Assist and Resistance: Determine and make the most of trendlines to verify the sample’s boundaries and potential breakout factors.

- Fibonacci Retracements: Making use of Fibonacci retracements may help determine potential help and resistance ranges inside the sample, aiding in setting stop-loss and take-profit orders.

- Different Technical Indicators: Combining chart patterns with different technical indicators, corresponding to shifting averages, RSI, MACD, and Bollinger Bands, can improve accuracy and cut back the chance of false indicators.

- Market Context: Take into account the general market setting and the particular asset’s basic components. A bullish sample in a bearish market could also be much less dependable.

Frequent Errors to Keep away from:

- Affirmation Bias: Keep away from decoding patterns based mostly on pre-existing biases. Objectively assess the sample’s formation and affirmation indicators.

- Ignoring Quantity: By no means overlook quantity evaluation. Quantity is essential for confirming the validity of a breakout or breakdown.

- Over-reliance on Patterns: Chart patterns are only one piece of the puzzle. Mix them with different types of evaluation for a extra complete method.

- Ignoring Context: Take into account the broader market situations and the particular asset’s fundamentals earlier than making buying and selling selections.

- Poor Threat Administration: At all times use applicable danger administration strategies, together with stop-loss orders, to guard your capital.

Sensible Software and Threat Administration:

As soon as a dealer identifies a possible chart sample, they have to develop a buying and selling technique incorporating danger administration ideas. This contains:

- Figuring out Entry and Exit Factors: Decide exact entry factors based mostly on the sample’s breakout or breakdown, and set clear exit factors based mostly on revenue targets or stop-loss ranges.

- Setting Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses if the commerce strikes towards you. Place stop-losses simply outdoors the sample’s help or resistance ranges.

- Figuring out Take-Revenue Ranges: Primarily based on the sample’s potential value motion, set reasonable take-profit ranges. Think about using Fibonacci retracements or different technical indicators to find out these ranges.

- Place Sizing: Decide the suitable place dimension based mostly in your danger tolerance and account steadiness. By no means danger greater than a small share of your capital on any single commerce.

Conclusion:

Chart patterns are helpful instruments for merchants looking for to determine potential buying and selling alternatives. Nonetheless, they aren’t a assure of success. Profitable utilization requires an intensive understanding of sample formations, affirmation indicators, and sturdy danger administration methods. By combining chart sample evaluation with different technical and basic evaluation strategies, merchants can considerably improve their buying and selling decision-making and enhance their general efficiency. Keep in mind to at all times apply accountable buying and selling and handle danger successfully.

(Downloadable PDF will likely be accessible right here – This part would comprise a hyperlink or directions for downloading a PDF doc containing a summarized model of the above article with charts and illustrations of the mentioned chart patterns. The PDF could be a visually interesting and concise information for fast reference.)

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has supplied helpful insights into Chart Patterns: A Complete Information (PDF Downloadable). We recognize your consideration to our article. See you in our subsequent article!