Chart Patterns in Aktien: Decoding the Market’s Visible Language

Associated Articles: Chart Patterns in Aktien: Decoding the Market’s Visible Language

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Patterns in Aktien: Decoding the Market’s Visible Language. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Chart Patterns in Aktien: Decoding the Market’s Visible Language

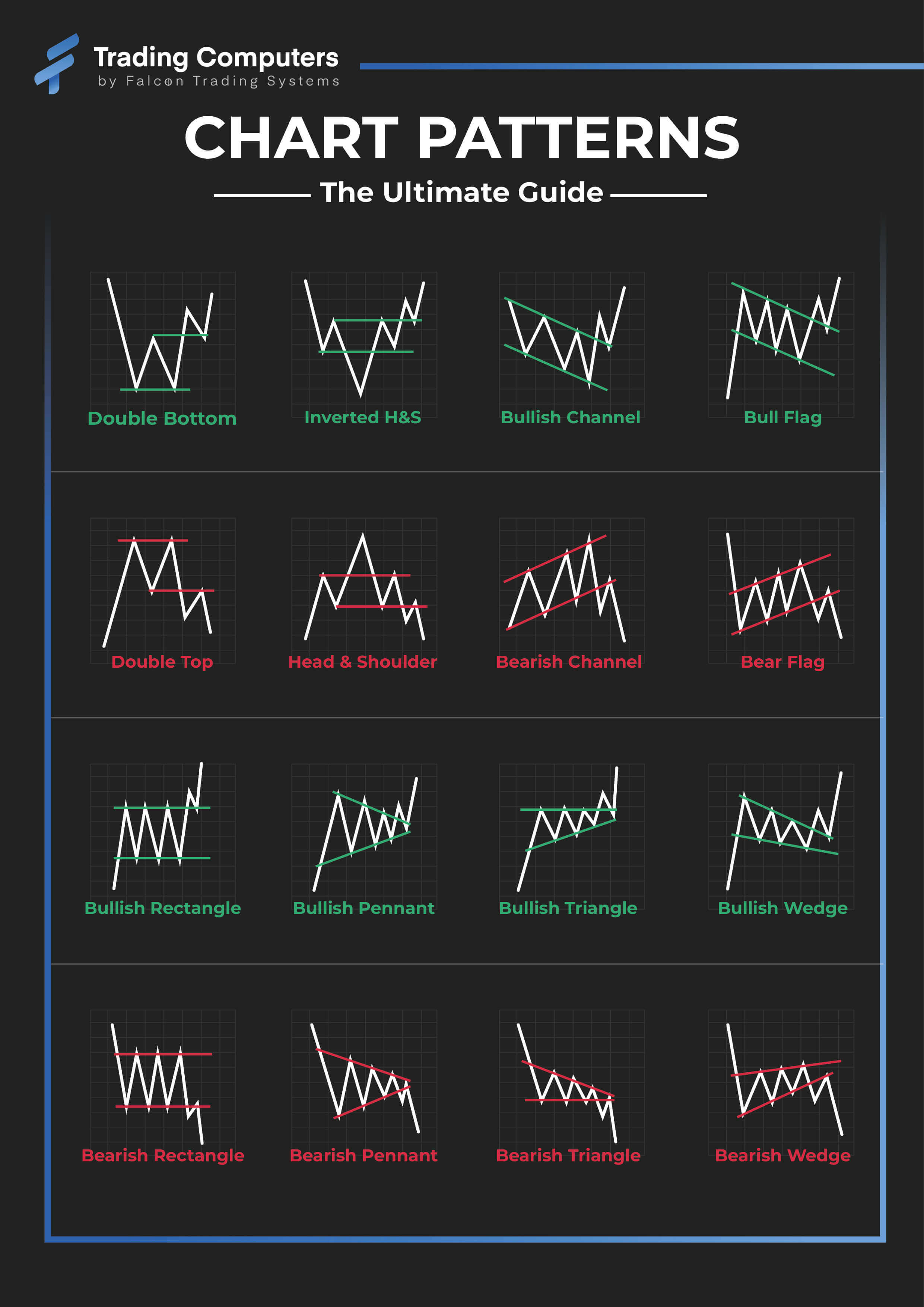

Chart patterns, within the context of Aktien (German for shares), are recurring formations on worth charts that sign potential future worth actions. These patterns, recognized by technical evaluation, aren’t foolproof predictors, however they provide precious insights into market sentiment and potential assist and resistance ranges. Understanding and decoding these patterns can improve a dealer’s decision-making course of, enhancing threat administration and doubtlessly growing profitability. Nevertheless, it is essential to keep in mind that chart patterns must be used at the side of different types of evaluation, reminiscent of basic evaluation and macroeconomic indicators, for a holistic buying and selling technique.

This text delves into numerous widespread chart patterns, explaining their formation, interpretation, and potential implications for Aktien merchants. We’ll discover each bullish and bearish patterns, emphasizing the significance of context and affirmation alerts.

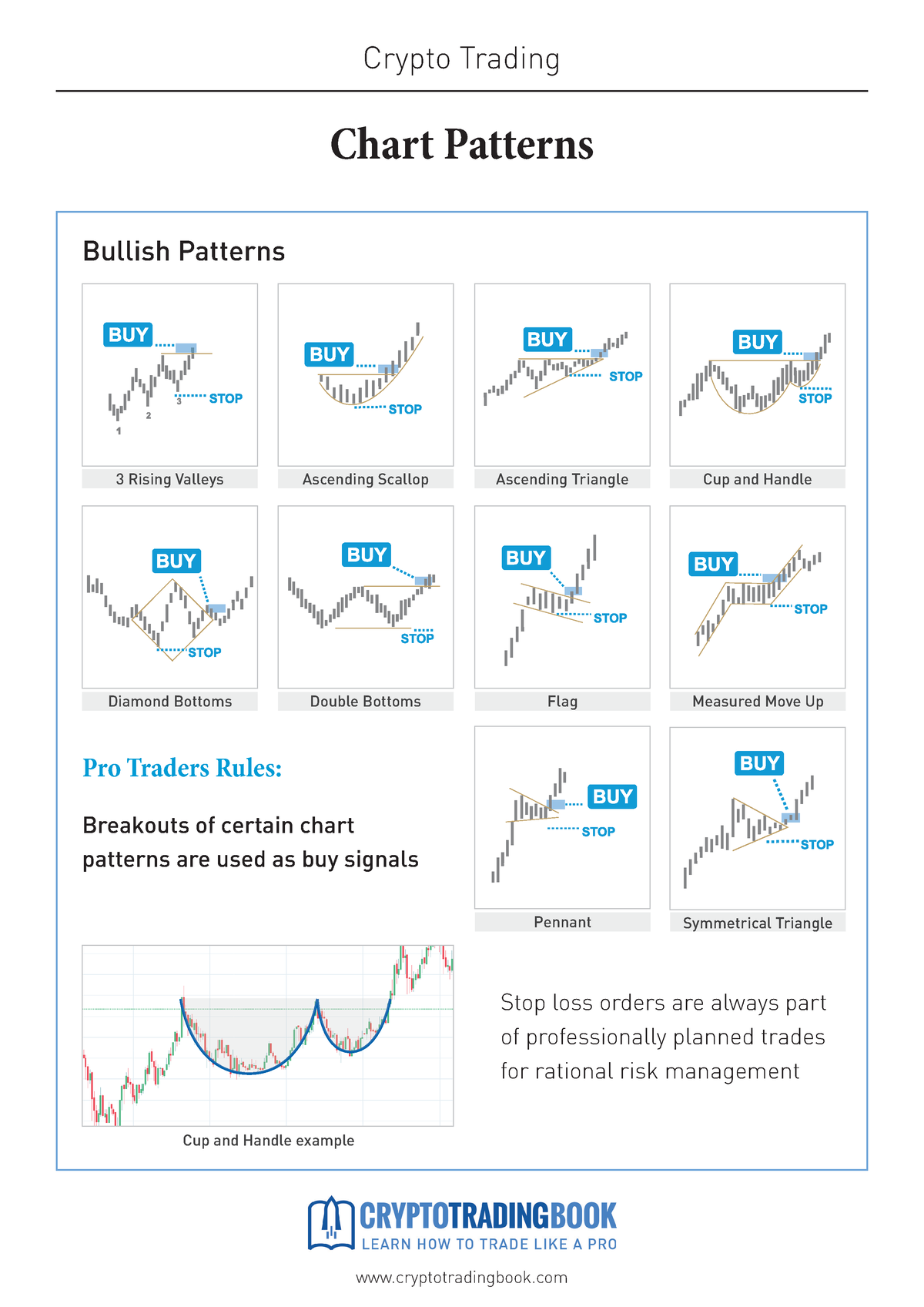

I. Bullish Chart Patterns: Anticipating Uptrends

Bullish chart patterns counsel a possible upward worth motion. Merchants usually search for these patterns to determine potential entry factors for lengthy positions.

-

Head and Shoulders Backside: This reversal sample alerts a possible shift from a downtrend to an uptrend. It is characterised by three distinct troughs: a central low (the "head") flanked by two decrease lows (the "shoulders"). The neckline, a trendline connecting the troughs of the shoulders, acts as essential assist. A breakout above the neckline confirms the sample and alerts a possible bullish transfer. The value goal is usually estimated by measuring the space between the pinnacle and the neckline and projecting it upwards from the breakout level. Nevertheless, it is important to think about quantity affirmation; elevated quantity throughout the breakout strengthens the sign.

-

Double Backside: A less complicated sample than the pinnacle and shoulders, a double backside consists of two consecutive lows at roughly the identical worth degree, adopted by a major upward motion. The neckline is the road connecting the 2 lows. A breakout above this neckline confirms the sample and signifies a possible bullish pattern. Just like the pinnacle and shoulders, quantity affirmation is important. The next quantity throughout the breakout reinforces the bullish sign.

-

Triple Backside: Just like a double backside, however with three lows at roughly the identical worth degree. This sample suggests stronger assist at that degree and will increase the arrogance in a possible uptrend after a breakout above the neckline.

-

Inverse Head and Shoulders: That is the mirror picture of the pinnacle and shoulders backside, indicating a bullish reversal in a longtime downtrend. It options three peaks, with the central peak being the best ("head"). The neckline, connecting the 2 decrease peaks ("shoulders"), acts as resistance. A breakout above the neckline confirms the sample and alerts a possible worth enhance.

-

Cup and Deal with: This sample resembles a cup with a small deal with. The cup is a rounded U-shaped formation, representing a interval of consolidation. The deal with is a brief, downward sloping trendline. A breakout above the deal with’s resistance line confirms the sample and suggests a bullish continuation. The deal with gives a transparent entry level for merchants.

-

Flag and Pennant: These continuation patterns seem inside established traits. Flags are characterised by an oblong or parallelogram-shaped consolidation, whereas pennants are triangular. Each patterns counsel a brief pause within the pattern earlier than a continuation within the unique course. A breakout above the flag or pennant’s resistance line confirms the sample and alerts a continuation of the prevailing pattern.

II. Bearish Chart Patterns: Figuring out Potential Downturns

Bearish chart patterns counsel a possible downward worth motion, offering alerts for merchants to think about quick positions or shield lengthy positions.

-

Head and Shoulders Prime: The inverse of the pinnacle and shoulders backside, this sample signifies a possible reversal from an uptrend to a downtrend. It options three peaks, with the central peak being the best ("head"). The neckline, connecting the 2 decrease peaks ("shoulders"), acts as assist. A breakdown beneath the neckline confirms the sample and alerts a possible bearish transfer.

-

Double Prime: Just like a double backside however in reverse, this sample reveals two consecutive highs at roughly the identical worth degree, adopted by a major downward motion. The neckline is the road connecting the 2 highs. A breakdown beneath this neckline confirms the sample and signifies a possible bearish pattern.

-

Triple Prime: Just like a double high, however with three highs at roughly the identical worth degree. This sample suggests stronger resistance at that degree and will increase the arrogance in a possible downtrend after a breakdown beneath the neckline.

-

Rounding Prime: This sample depicts a gradual curve from a excessive level, resembling a rounded hill. It signifies a weakening of the uptrend and a possible reversal to a downtrend. The affirmation of the sample comes with a breakdown beneath the assist degree shaped throughout the rounding high.

-

Broadening Prime: This sample is characterised by more and more increased highs and decrease lows. The sample expands till it reaches a degree of exhaustion the place a major worth decline happens.

-

Descending Triangle: This sample is characterised by a sequence of decrease highs and flat lows, forming a triangle that slopes downwards. The sample suggests a bearish continuation of the downtrend. A breakdown beneath the decrease trendline confirms the sample.

III. Significance of Quantity and Affirmation

Whereas chart patterns provide precious insights, they should not be solely relied upon. Quantity evaluation gives essential affirmation. A robust breakout from a sample must be accompanied by elevated buying and selling quantity. Low quantity breakouts are sometimes weak and could also be false alerts.

Moreover, affirmation from different technical indicators, reminiscent of transferring averages, RSI (Relative Power Index), MACD (Transferring Common Convergence Divergence), or candlestick patterns, strengthens the validity of a chart sample. Basic evaluation, analyzing the underlying firm’s monetary well being and business traits, also needs to be thought of.

IV. Limitations and Dangers

It is essential to acknowledge the constraints of relying solely on chart patterns:

- Subjectivity: Figuring out chart patterns might be subjective, with totally different merchants doubtlessly decoding the identical chart in a different way.

- False Alerts: Chart patterns can produce false alerts, resulting in inaccurate predictions and potential losses.

- Market Volatility: Sudden market occasions can disrupt established patterns and invalidate predictions.

- Timeframe Dependency: The effectiveness of chart patterns can fluctuate relying on the timeframe used (e.g., every day, weekly, month-to-month).

V. Conclusion:

Chart patterns provide a precious instrument for Aktien merchants to investigate market sentiment and potential worth actions. Nevertheless, they aren’t a assured technique for predicting the longer term. Profitable buying and selling requires a holistic strategy, combining chart sample evaluation with quantity affirmation, different technical indicators, and basic evaluation. Danger administration is paramount, and merchants ought to all the time use stop-loss orders to restrict potential losses. By understanding the strengths and limitations of chart patterns and using a disciplined buying and selling technique, merchants can improve their decision-making course of and doubtlessly enhance their buying and selling outcomes within the dynamic world of Aktien. Steady studying and adaptation are important for fulfillment on this ever-evolving market.

Closure

Thus, we hope this text has offered precious insights into Chart Patterns in Aktien: Decoding the Market’s Visible Language. We recognize your consideration to our article. See you in our subsequent article!