Chart Patterns within the Swiss Market: A Deep Dive into Dubach’s Strategy

Associated Articles: Chart Patterns within the Swiss Market: A Deep Dive into Dubach’s Strategy

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Patterns within the Swiss Market: A Deep Dive into Dubach’s Strategy. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart Patterns within the Swiss Market: A Deep Dive into Dubach’s Strategy

The Swiss inventory market, characterised by its stability and reliance on globally acknowledged firms, presents distinctive alternatives and challenges for technical analysts. Whereas many international chart patterns apply, the nuances of the Swiss market, its comparatively smaller dimension, and its sensitivity to international occasions require a tailor-made strategy. This text delves into the appliance of chart patterns within the Swiss market, exploring the attitude of a hypothetical analyst, "Dubach," who focuses on figuring out and deciphering these patterns inside this particular context. We are going to study a number of key patterns, their strengths and weaknesses within the Swiss context, and the way Dubach may use them to tell buying and selling methods.

Dubach’s Methodology: A Mix of Classical and Contextual Evaluation

Dubach’s strategy to chart sample evaluation just isn’t merely a rote utility of textbook definitions. He acknowledges that whereas established patterns like head and shoulders, triangles, and flags provide invaluable insights, their interpretation should be nuanced by the particular market situations in Switzerland. He incorporates a number of key components into his evaluation:

-

Macroeconomic Elements: Dubach meticulously considers the Swiss Nationwide Financial institution’s (SNB) financial coverage, the energy of the Swiss Franc (CHF), and the general international financial local weather. These components considerably impression Swiss inventory costs, and ignoring them can result in inaccurate predictions.

-

Sector-Particular Evaluation: Switzerland boasts a powerful presence in particular sectors like prescribed drugs, finance, and luxurious items. Dubach acknowledges that patterns in these sectors may behave in another way than these in different industries, demanding a sector-specific strategy.

-

Quantity Affirmation: Dubach locations vital emphasis on quantity. He views quantity as an important affirmation instrument, believing {that a} sample’s validity is strengthened by constant quantity adjustments that corroborate the worth motion. A breakout with out vital quantity, for instance, is perhaps a false sign.

-

Danger Administration: Central to Dubach’s methodology is rigorous threat administration. He employs stop-loss orders and punctiliously calculates place sizing to restrict potential losses, recognizing that even essentially the most dependable patterns can fail.

Key Chart Patterns in Dubach’s Arsenal:

Let’s study a number of chart patterns generally utilized by Dubach and the way he adapts their interpretation for the Swiss market:

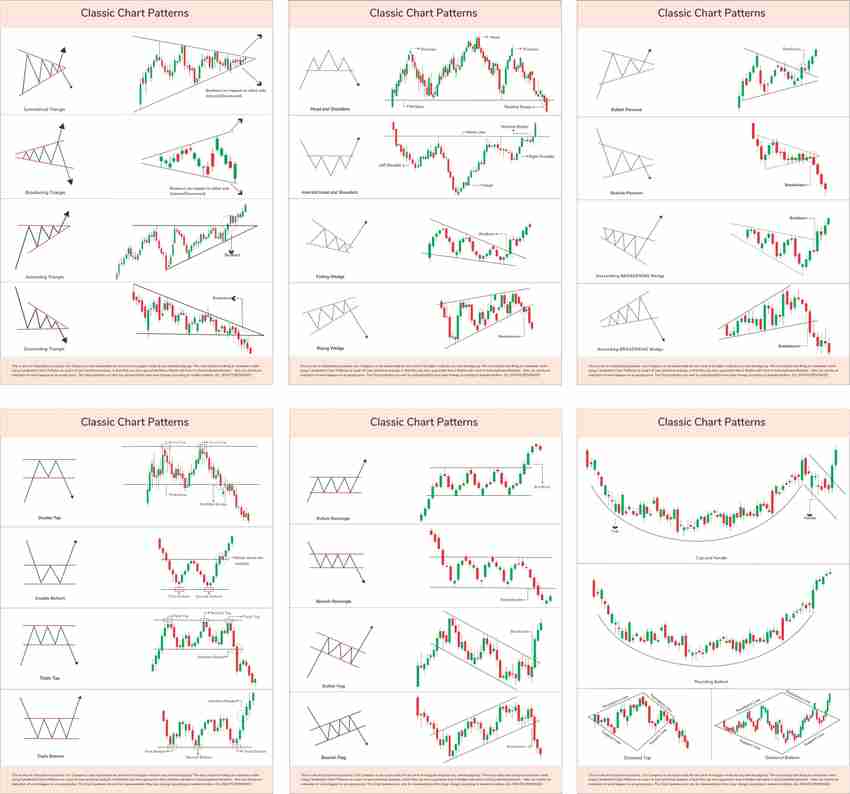

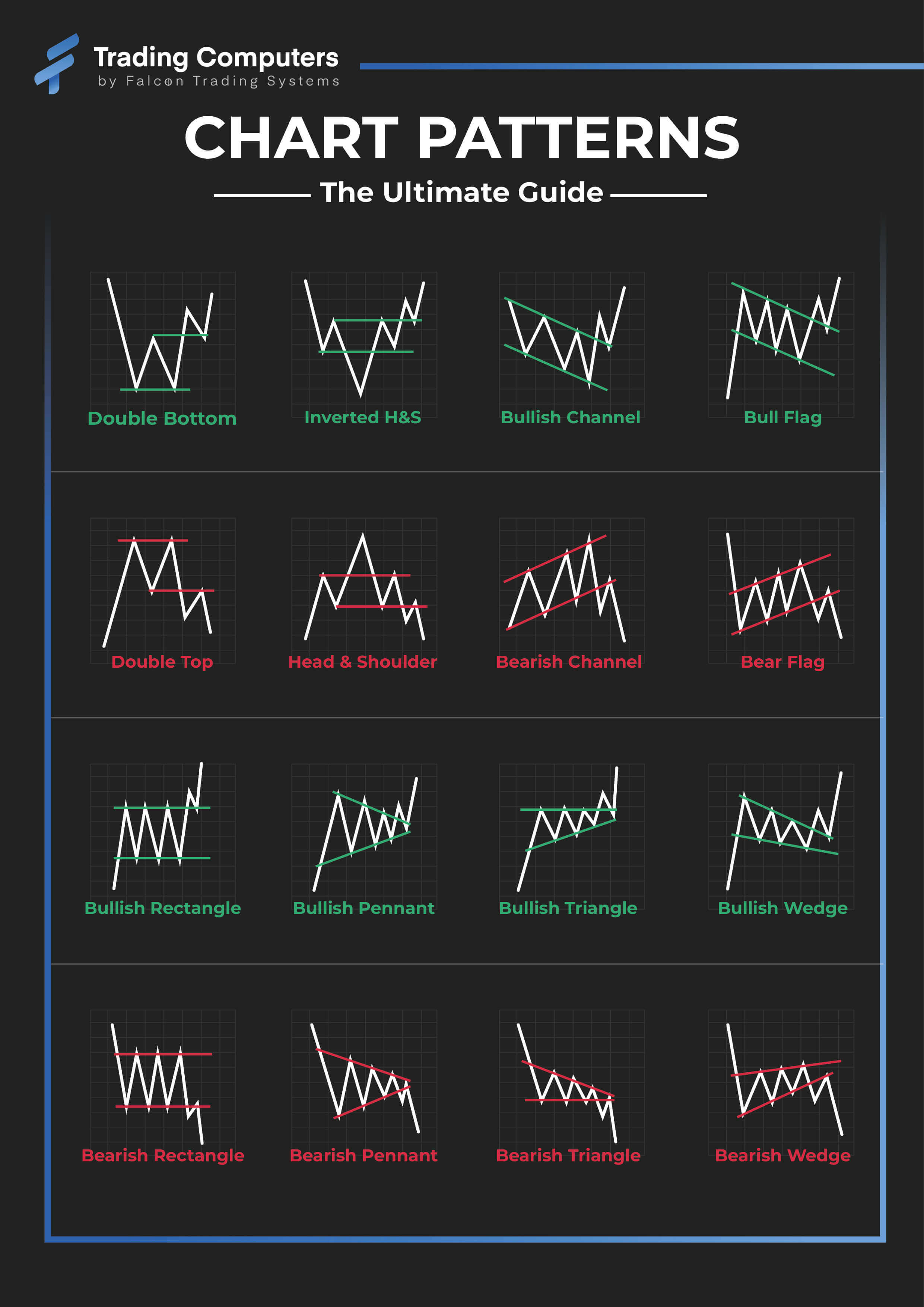

1. Head and Shoulders: This traditional reversal sample is equally related within the Swiss market. Dubach, nevertheless, emphasizes the significance of confirming the sample’s validity by quantity evaluation. A big improve in quantity throughout the appropriate shoulder, coupled with a break under the neckline, would strongly counsel a bearish reversal. He additionally considers the macroeconomic surroundings. If the sample emerges throughout a interval of world financial uncertainty, its bearish implications is perhaps amplified.

2. Triangles (Symmetrical, Ascending, Descending): Triangles signify intervals of consolidation. Dubach analyzes the kind of triangle to foretell the seemingly route of the breakout. A symmetrical triangle, as an example, signifies uncertainty, requiring cautious statement of quantity and different indicators to foretell the route. Ascending triangles are typically bullish, whereas descending triangles are bearish. Nevertheless, the energy of the CHF may affect the result. A robust CHF may negate the bullish implications of an ascending triangle in a sector closely reliant on exports.

3. Flags and Pennants: These continuation patterns sign a short lived pause in a prevailing pattern. Dubach makes use of them to establish potential entry factors for driving the prevailing pattern. He seems for a pointy break from the flag or pennant, confirmed by a surge in quantity, to sign a continuation of the pattern. The length of the flag or pennant, nevertheless, must be thought-about throughout the context of the Swiss market’s shorter buying and selling cycles in comparison with bigger markets.

4. Double Tops and Double Bottoms: These patterns point out potential pattern reversals. Dubach meticulously examines the worth ranges of the tops or bottoms, guaranteeing they’re comparatively shut, and confirms the sample with quantity evaluation. The importance of those patterns might be influenced by information occasions impacting particular Swiss firms or sectors. A adverse information occasion, as an example, may strengthen the bearish sign of a double high.

Dubach’s Danger Administration Methods:

Dubach’s success is not solely reliant on correct sample identification. His rigorous threat administration technique is equally essential:

-

Cease-Loss Orders: He persistently makes use of stop-loss orders to restrict potential losses. The location of those orders is essential, usually under the neckline in head and shoulders patterns or under the help stage in different patterns.

-

Place Sizing: He employs a disciplined strategy to place sizing, guaranteeing that no single commerce exposes him to extreme threat. This entails rigorously contemplating his threat tolerance and the potential volatility of the particular inventory or sector.

-

Diversification: Dubach avoids concentrating his portfolio in a single inventory or sector. He diversifies his investments throughout varied firms and sectors throughout the Swiss market to scale back total threat.

-

Trailing Stops: As soon as a commerce is worthwhile, Dubach usually employs trailing stops to guard income. This enables him to experience profitable trades whereas limiting potential losses if the market reverses.

Challenges and Limitations:

Regardless of the effectiveness of chart patterns, Dubach acknowledges their limitations within the Swiss context:

-

Market Liquidity: The Swiss market is comparatively smaller than main international markets. This will result in much less liquidity in sure shares, making it difficult to execute trades at desired costs, particularly throughout breakouts.

-

International Influences: The Swiss market is very delicate to international occasions. Sudden international financial shocks or geopolitical occasions can override the indicators from chart patterns, resulting in surprising worth actions.

-

False Alerts: Chart patterns will not be foolproof. False breakouts can happen, resulting in losses if not correctly managed with threat administration methods.

-

Overreliance on Technical Evaluation: Dubach emphasizes that chart patterns must be used along with elementary evaluation. Understanding the monetary well being and future prospects of an organization is essential for making knowledgeable funding selections.

Conclusion:

Dubach’s strategy to chart sample evaluation within the Swiss market exemplifies a balanced and nuanced technique. Whereas he leverages the ability of established chart patterns, he integrates macroeconomic components, sector-specific evaluation, rigorous quantity affirmation, and strong threat administration to navigate the complexities of this distinctive market. His success underscores the significance of adapting technical evaluation methods to the particular traits of the market being traded, highlighting the essential position of context and threat administration in attaining constant profitability. It is very important keep in mind that it is a hypothetical evaluation and previous efficiency just isn’t indicative of future outcomes. Any buying and selling technique must be rigorously thought-about and examined earlier than implementation.

Closure

Thus, we hope this text has offered invaluable insights into Chart Patterns within the Swiss Market: A Deep Dive into Dubach’s Strategy. We thanks for taking the time to learn this text. See you in our subsequent article!