Chart Buying and selling Saham: Mastering the Visible Language of the Market

Associated Articles: Chart Buying and selling Saham: Mastering the Visible Language of the Market

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Chart Buying and selling Saham: Mastering the Visible Language of the Market. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Chart Buying and selling Saham: Mastering the Visible Language of the Market

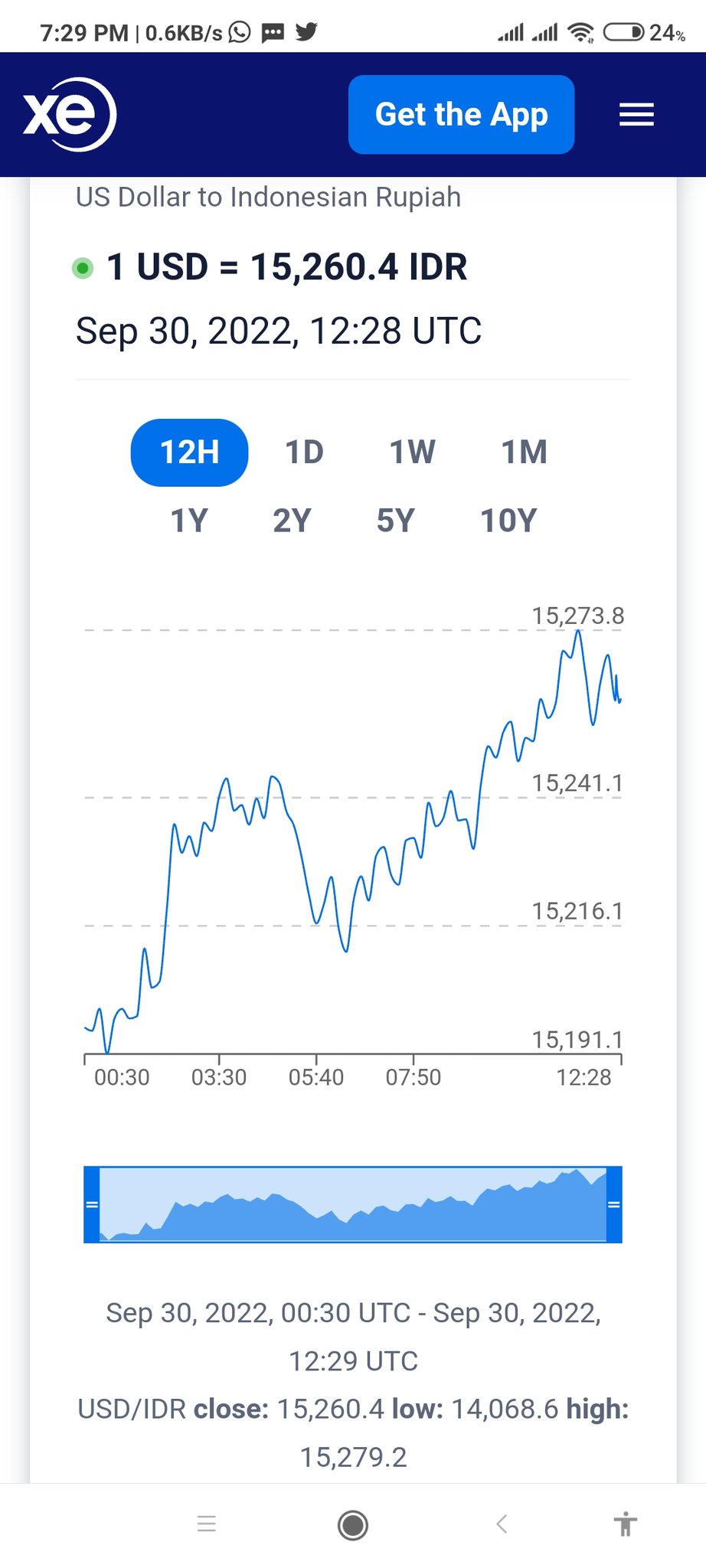

Chart buying and selling, a cornerstone of technical evaluation, empowers traders to decipher market sentiment and predict value actions by learning historic value knowledge represented visually on charts. For saham (shares) buying and selling, mastering chart patterns and indicators is essential for navigating the complexities of the market and bettering buying and selling choices. This text delves into the world of chart buying and selling saham, exploring varied chart sorts, indicators, and techniques, whereas emphasizing threat administration and self-discipline.

Understanding Chart Varieties:

The muse of chart buying and selling lies in understanding completely different chart sorts, every providing distinctive views on value motion:

-

Line Charts: The only kind, connecting closing costs over time. Whereas easy, they lack the element offered by different chart sorts and are greatest suited to long-term pattern evaluation.

-

Bar Charts: These show the open, excessive, low, and shutting costs for a particular interval (e.g., day by day, weekly). The vertical bar’s size displays the value vary, and the place of the traces throughout the bar signifies the opening and shutting costs. Bar charts supply a extra complete view of value fluctuations than line charts.

-

Candlestick Charts: A extremely well-liked alternative, candlestick charts present the identical data as bar charts however in a extra visually intuitive method. The "physique" of the candlestick represents the value vary between the open and shut, whereas "wicks" or "shadows" lengthen to the excessive and low costs. The colour of the physique (usually inexperienced for up and crimson for down) rapidly conveys whether or not the value closed greater or decrease than it opened. Candlestick patterns, shaped by particular mixtures of candles, are incessantly used to establish potential reversals or continuations of tendencies.

-

Level & Determine Charts: Not like the earlier sorts, level & determine charts disregard time. They focus solely on value actions, plotting X’s for value will increase and O’s for value decreases. This chart kind filters out noise and highlights vital value adjustments, making it helpful for figuring out help and resistance ranges.

Key Technical Indicators for Saham Chart Buying and selling:

Technical indicators are mathematical calculations utilized to cost knowledge to generate indicators that assist merchants establish potential buying and selling alternatives. Some generally used indicators in saham chart buying and selling embrace:

-

Transferring Averages (MA): MAs easy out value fluctuations, revealing underlying tendencies. Frequent sorts embrace easy transferring averages (SMA), exponential transferring averages (EMA), and weighted transferring averages (WMA). Merchants typically use a number of MAs (e.g., 50-day and 200-day SMA) to establish pattern route and potential crossover indicators.

-

Relative Power Index (RSI): An oscillator that measures the magnitude of current value adjustments to judge overbought and oversold situations. RSI values above 70 typically point out overbought situations, suggesting a possible value reversal, whereas values beneath 30 recommend oversold situations and a possible rebound.

-

MACD (Transferring Common Convergence Divergence): One other oscillator that identifies adjustments in momentum by evaluating two transferring averages. MACD crossovers (when the MACD line crosses the sign line) can sign potential purchase or promote alternatives.

-

Bollinger Bands: These bands plot normal deviations round a transferring common, visually representing value volatility. Value actions exterior the bands can sign potential breakouts or reversals.

-

Quantity: Whereas not strictly an indicator, buying and selling quantity offers essential context for value actions. Excessive quantity throughout value will increase confirms the power of the uptrend, whereas excessive quantity throughout value decreases confirms the power of the downtrend. Low quantity throughout vital value actions can recommend a weak pattern and potential reversal.

Chart Patterns in Saham Buying and selling:

Recognizing chart patterns is a vital ability for profitable chart buying and selling. These patterns signify recurring value formations that always precede particular value actions. Some widespread patterns embrace:

-

Head and Shoulders: A reversal sample suggesting a possible pattern change from uptrend to downtrend.

-

Inverse Head and Shoulders: A bullish reversal sample suggesting a possible pattern change from downtrend to uptrend.

-

Double Tops and Double Bottoms: Reversal patterns just like head and shoulders however with two peaks or troughs as an alternative of three.

-

Triangles: Continuation patterns that recommend a interval of consolidation earlier than a breakout within the route of the previous pattern.

-

Flags and Pennants: Continuation patterns that resemble small triangles, suggesting a brief pause in a powerful pattern.

-

Cup and Deal with: A bullish continuation sample that means a interval of consolidation earlier than an extra value improve.

Methods for Chart Buying and selling Saham:

Chart buying and selling provides a variety of methods, every tailor-made to completely different threat tolerances and time horizons:

-

Development Following: Figuring out and driving established tendencies. This technique entails shopping for when the value is trending upward and promoting when it is trending downward.

-

Imply Reversion: Capitalizing on value fluctuations round a mean. This technique entails shopping for when the value falls beneath a sure stage and promoting when it rises above a sure stage.

-

Breakout Buying and selling: Figuring out and buying and selling on value breakouts from established ranges or patterns.

-

Swing Buying and selling: Holding positions for a number of days or even weeks to capitalize on intermediate-term value swings.

-

Day Buying and selling: Holding positions for only some hours and even minutes, aiming to revenue from short-term value fluctuations.

Danger Administration and Self-discipline:

Profitable chart buying and selling requires rigorous threat administration and unwavering self-discipline. Key facets embrace:

-

Place Sizing: Figuring out the suitable quantity to put money into every commerce to restrict potential losses.

-

Cease-Loss Orders: Setting predetermined exit factors to robotically promote a place if the value strikes in opposition to your prediction.

-

Take-Revenue Orders: Setting predetermined exit factors to robotically promote a place when it reaches a goal revenue stage.

-

Diversification: Spreading investments throughout completely different shares to scale back general threat.

-

Emotional Management: Avoiding impulsive choices primarily based on worry or greed. Sticking to a well-defined buying and selling plan is essential.

Conclusion:

Chart buying and selling saham is a strong method for navigating the inventory market, nevertheless it requires dedication, apply, and a deep understanding of technical evaluation. Mastering chart sorts, indicators, and patterns, coupled with rigorous threat administration and self-discipline, considerably enhances the probabilities of profitable buying and selling. Keep in mind that no technique ensures income, and losses are an inevitable a part of buying and selling. Steady studying, adaptation, and self-reflection are important for long-term success on this dynamic market. All the time conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Chart Buying and selling Saham: Mastering the Visible Language of the Market. We thanks for taking the time to learn this text. See you in our subsequent article!