CharterQuest FLP: A Deep Dive into the Fractional Possession Mannequin

Associated Articles: CharterQuest FLP: A Deep Dive into the Fractional Possession Mannequin

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to CharterQuest FLP: A Deep Dive into the Fractional Possession Mannequin. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

CharterQuest FLP: A Deep Dive into the Fractional Possession Mannequin

CharterQuest Fractional Non-public Restricted Partnership (FLP) represents a singular strategy to personal aviation possession, providing a mix of personal jet entry with the monetary structuring of a restricted partnership. This text will delve into the intricacies of CharterQuest FLPs, analyzing their construction, advantages, drawbacks, and total suitability for several types of high-net-worth people (HNWIs) and companies. Understanding the nuances of this mannequin is essential for anybody contemplating this path to personal aviation.

Understanding the Fractional Possession Mannequin:

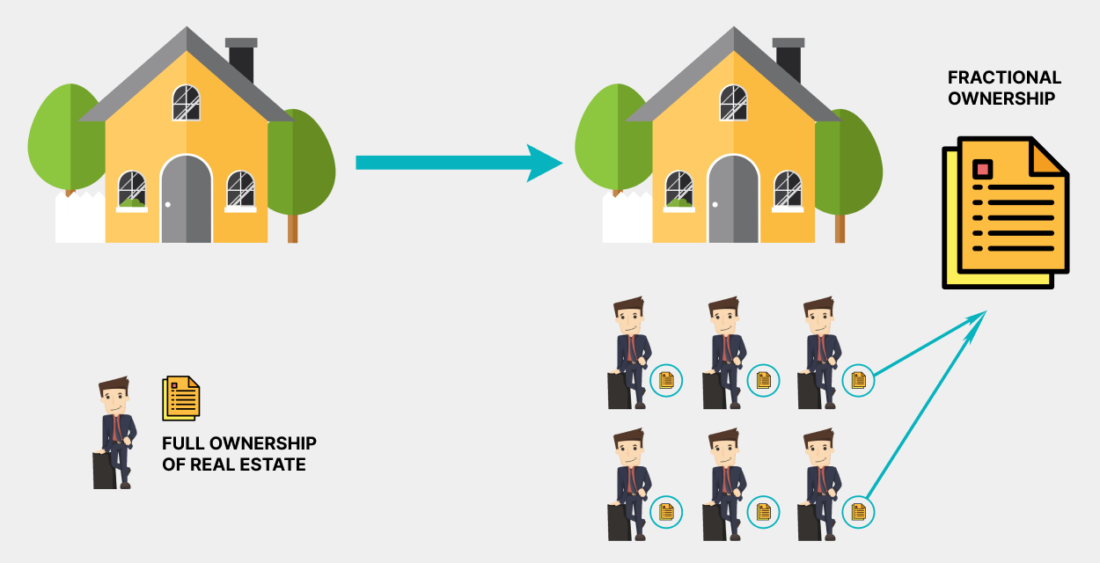

Earlier than diving into the specifics of CharterQuest FLPs, it’s important to know the elemental idea of fractional possession. In contrast to complete plane possession, which requires important upfront capital and ongoing upkeep prices, fractional possession permits people or firms to buy a share of an plane. This share grants entry to the plane for a specified variety of hours per yr, considerably decreasing the monetary burden related to sole possession. The fractional supplier manages all elements of plane upkeep, insurance coverage, and operational prices.

The CharterQuest FLP Distinction:

CharterQuest’s strategy makes use of the authorized construction of a Restricted Partnership (FLP) to additional refine the fractional possession mannequin. This construction separates the possession and administration of the plane. The restricted companions (traders) share within the possession and advantages of the plane, whereas the final associate manages the operational elements. This segregation supplies a number of key benefits, which we’ll discover intimately.

Advantages of Investing in a CharterQuest FLP:

-

Lowered Capital Expenditure: Essentially the most important profit is the diminished upfront funding in comparison with complete plane possession. Traders buy a fractional share, thereby spreading the preliminary value throughout a number of events. This lowers the entry barrier for personal aviation entry.

-

Shared Operational Prices: Upkeep, insurance coverage, hangar charges, crew salaries, and different operational bills are shared amongst the restricted companions, additional decreasing particular person monetary burdens. This shared accountability minimizes the unpredictable prices related to plane possession.

-

Tax Benefits (Seek the advice of a Tax Skilled): The particular tax implications of investing in an FLP fluctuate relying on jurisdiction and particular person circumstances. Nonetheless, the construction can doubtlessly supply tax advantages, akin to depreciation deductions and different tax-efficient methods. It’s essential to seek the advice of with a certified tax advisor to grasp the complete tax implications earlier than investing.

-

Skilled Administration: The overall associate in a CharterQuest FLP handles all operational elements, together with upkeep, scheduling, crew administration, and regulatory compliance. This frees traders from the executive burden of plane possession, permitting them to concentrate on their core companies or private pursuits.

-

Flexibility and Entry: Traders acquire entry to a non-public jet for a pre-determined variety of hours yearly. This supplies flexibility for each enterprise and private journey, providing a big benefit over conventional constitution companies, which will be topic to availability and fluctuating pricing.

-

Potential Appreciation: Relying on market circumstances and plane demand, the worth of the plane (and due to this fact the investor’s share) might respect over time. This gives a possible return on funding past the comfort of personal jet entry.

-

Predictable Prices: In contrast to conventional constitution companies the place prices can fluctuate based mostly on demand and different components, fractional possession by an FLP supplies a extra predictable value construction. Traders sometimes pay a hard and fast month-to-month or annual payment, offering budgetary certainty.

Drawbacks of Investing in a CharterQuest FLP:

-

Restricted Management: As a restricted associate, traders have restricted management over the plane’s operation and administration. Choices are primarily made by the final associate.

-

Lack of Liquidity: Promoting a fractional share in an FLP will be tougher than promoting different investments. There isn’t any assure of a fast and straightforward exit technique. Discovering an acceptable purchaser for a fractional share requires effort and should contain a value negotiation.

-

Potential for Disputes: Disagreements can come up amongst companions concerning plane utilization, upkeep, or different operational issues. Clear communication and a well-defined partnership settlement are important to mitigate such dangers.

-

Depreciation: Whereas there’s potential for appreciation, the plane will inevitably depreciate over time. This depreciation must be factored into the general funding evaluation.

-

Administration Charges: The overall associate costs administration charges to cowl their operational prices. These charges must be factored into the general value of possession.

-

Complexity: Understanding the authorized and monetary elements of an FLP will be complicated. In search of skilled recommendation from authorized and monetary consultants is essential earlier than investing.

-

Market Fluctuations: The worth of the plane and the general attractiveness of fractional possession will be influenced by market components, akin to financial circumstances and modifications within the personal aviation trade.

Suitability of CharterQuest FLPs:

CharterQuest FLPs are greatest fitted to HNWIs and companies with constant and important personal aviation wants. People or firms that require frequent air journey and worth the comfort and effectivity of personal jet entry will discover this mannequin enticing. Nonetheless, it is important to rigorously weigh the advantages and disadvantages in opposition to particular person monetary circumstances and journey patterns. These with much less frequent journey wants or restricted capital may discover different personal aviation choices, akin to constitution companies or jet playing cards, extra appropriate.

Due Diligence and Concerns:

Earlier than investing in a CharterQuest FLP, potential traders ought to conduct thorough due diligence. This contains:

- Reviewing the partnership settlement: Fastidiously look at the phrases and circumstances of the partnership settlement, together with obligations, liabilities, and exit methods.

- Vetting the final associate: Assess the final associate’s expertise, status, and monetary stability.

- Analyzing the plane’s situation: Conduct a radical inspection of the plane to make sure it is in good situation and meets the investor’s wants.

- Understanding the working prices: Receive a transparent understanding of all working prices, together with administration charges, upkeep bills, and insurance coverage premiums.

- In search of skilled recommendation: Seek the advice of with authorized, monetary, and tax professionals to make sure the funding aligns with particular person targets and threat tolerance.

Conclusion:

CharterQuest FLPs supply a compelling various to complete plane possession for these searching for personal aviation entry. The shared possession mannequin reduces monetary burdens and simplifies operational complexities. Nonetheless, potential traders should rigorously take into account the advantages and disadvantages, conduct thorough due diligence, and search skilled recommendation earlier than committing to this funding. Understanding the authorized construction, operational elements, and monetary implications is essential for making an knowledgeable choice that aligns with particular person wants and monetary aims. The success of investing in a CharterQuest FLP hinges on a cautious evaluation of particular person necessities and a radical understanding of the intricacies concerned.

%20in%206%20months!%20(5).png?access_token=878c67bf-5546-49a9-add2-64d27f9fec4c)

Closure

Thus, we hope this text has offered useful insights into CharterQuest FLP: A Deep Dive into the Fractional Possession Mannequin. We respect your consideration to our article. See you in our subsequent article!