Charting the Course: A Yr-by-Yr Evaluation of the Share Market’s Journey

Associated Articles: Charting the Course: A Yr-by-Yr Evaluation of the Share Market’s Journey

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Charting the Course: A Yr-by-Yr Evaluation of the Share Market’s Journey. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Charting the Course: A Yr-by-Yr Evaluation of the Share Market’s Journey

The share market, a barometer of worldwide financial well being and investor sentiment, is a dynamic and infrequently unpredictable entity. Its fluctuations, pushed by a posh interaction of financial indicators, geopolitical occasions, and investor psychology, create an enchanting and generally daunting panorama for each seasoned professionals and novice buyers. Understanding its historic trajectory is essential for knowledgeable decision-making. This text delves right into a year-by-year evaluation of the share market, providing a broad overview of key traits and vital occasions that formed its efficiency over the previous few a long time. Whereas specializing in main indices just like the S&P 500 (a consultant of the US market) and the FTSE 100 (representing the UK), the insights gleaned are relevant to world markets generally. As a result of sheer quantity of information, we’ll give attention to key durations and traits, fairly than a granular year-by-year breakdown for each single yr.

The Dot-Com Bubble and its Burst (2000-2002):

The late Nineteen Nineties witnessed an unprecedented surge in expertise shares, fueled by the burgeoning web trade and a local weather of irrational exuberance. The NASDAQ Composite, a tech-heavy index, soared to dizzying heights. Nevertheless, this bubble inevitably burst in 2000, resulting in a major market correction. 2000 noticed a pointy decline, and the downturn continued into 2001 and 2002, fueled by the collapse of a number of dot-com firms and a normal lack of investor confidence. This era served as a stark reminder of the inherent dangers related to speculative funding and the cyclical nature of the market. The S&P 500 skilled a considerable drop, underscoring the worldwide affect of the tech crash.

The Aftermath and Restoration (2003-2007):

Following the dot-com bust, the market steadily recovered, experiencing a interval of relative stability and development. This era noticed the emergence of latest applied sciences and industries, contributing to the general market rebound. Rate of interest cuts by central banks additionally performed an important position in stimulating financial exercise and investor confidence. Whereas the restoration was not uniform throughout all sectors, the general pattern was optimistic, with each the S&P 500 and FTSE 100 displaying vital positive factors. This era highlights the market’s resilience and its capacity to beat vital setbacks.

The International Monetary Disaster (2008-2009):

The yr 2008 marked the start of essentially the most vital monetary disaster for the reason that Nice Despair. The subprime mortgage disaster in america triggered a series response that introduced down main monetary establishments and plunged the worldwide financial system into recession. The share markets skilled a dramatic and swift decline, with main indices plummeting to multi-year lows. Authorities intervention, together with large bailouts and stimulus packages, was essential in stopping an entire collapse of the monetary system. 2009 noticed a gradual restoration, however the scars of the disaster remained for years to return. This era emphasised the interconnectedness of worldwide markets and the vulnerability of the monetary system to systemic dangers.

Put up-Disaster Restoration and Development (2010-2019):

The last decade following the worldwide monetary disaster witnessed a interval of sustained development and restoration in most main markets. Quantitative easing (QE) insurance policies carried out by central banks, together with low rates of interest, fueled a protracted bull market. The S&P 500, particularly, skilled vital positive factors, reaching file highs. This era additionally noticed the rise of rising markets, notably in Asia, additional diversifying the worldwide funding panorama. Nevertheless, this era was not with out its challenges, together with the European sovereign debt disaster and geopolitical uncertainties. This era demonstrates the market’s long-term development potential, even within the face of ongoing challenges.

The COVID-19 Pandemic and its Impression (2020-2021):

The COVID-19 pandemic triggered an unprecedented market downturn in early 2020, as fears of a worldwide recession gripped buyers. The velocity and severity of the preliminary decline had been exceptional, reflecting the fast unfold of the virus and the uncertainty surrounding its financial affect. Nevertheless, authorities stimulus packages and the fast growth and deployment of vaccines helped to mitigate the financial fallout. The market recovered surprisingly shortly, fueled by technological developments and a shift in the direction of on-line providers. This era underscored the market’s capability to adapt to unexpected circumstances and the significance of diversification and threat administration.

Inflation and Curiosity Price Hikes (2022-Current):

The post-pandemic restoration was adopted by a surge in inflation, pushed by provide chain disruptions and elevated demand. Central banks responded by elevating rates of interest, aiming to curb inflation. This led to elevated borrowing prices and a reassessment of valuations out there. The yr 2022 noticed vital market volatility, with main indices experiencing each positive factors and losses. This era highlights the affect of macroeconomic elements on market efficiency and the significance of monitoring inflation and rate of interest traits. The present atmosphere stays unsure, with ongoing geopolitical tensions and financial headwinds influencing market sentiment.

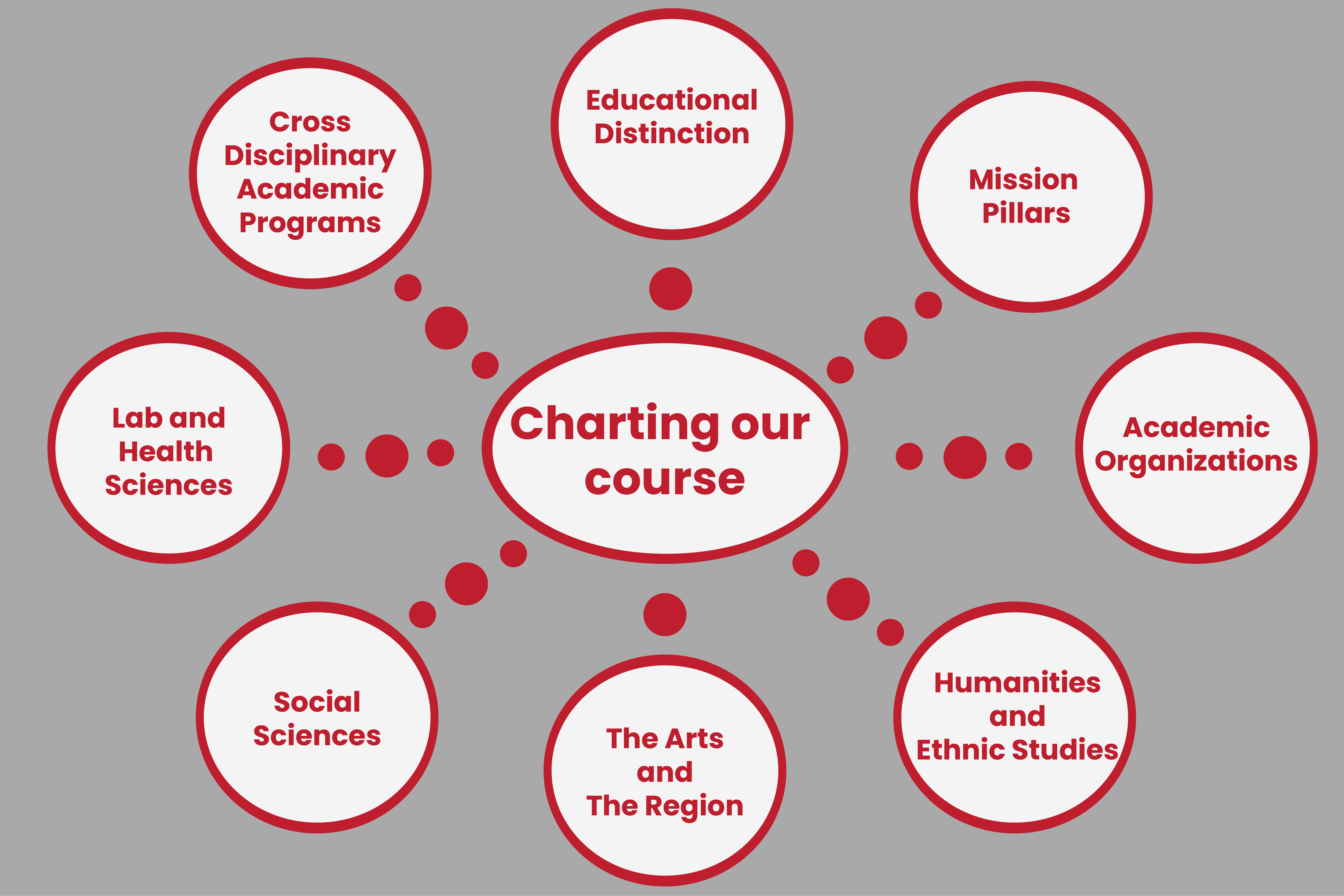

Analyzing the Charts:

Analyzing year-by-year charts of main indices reveals a number of key patterns:

- Cyclical Nature: The market displays a cyclical sample, with durations of development adopted by corrections or bear markets.

- Impression of Macroeconomic Components: Financial indicators like inflation, rates of interest, and GDP development considerably affect market efficiency.

- Geopolitical Occasions: Main geopolitical occasions, equivalent to wars or political instability, can set off market volatility.

- Technological Developments: Technological breakthroughs typically drive new funding alternatives and form market traits.

- Investor Sentiment: Investor psychology performs an important position in market fluctuations, with durations of optimism and pessimism driving value actions.

Conclusion:

The share market’s journey, as depicted via year-by-year charts, is a posh narrative of development, decline, and restoration. Whereas previous efficiency just isn’t indicative of future outcomes, understanding historic traits and the elements which have influenced them is essential for navigating the market’s complexities. Traders ought to undertake a long-term perspective, diversify their portfolios, and thoroughly handle threat to successfully take part out there’s ongoing evolution. Steady monitoring of macroeconomic indicators, geopolitical occasions, and technological developments is important for knowledgeable decision-making on this dynamic and ever-changing panorama. Keep in mind that skilled monetary recommendation ought to all the time be sought earlier than making any funding selections.

Closure

Thus, we hope this text has offered precious insights into Charting the Course: A Yr-by-Yr Evaluation of the Share Market’s Journey. We hope you discover this text informative and helpful. See you in our subsequent article!