Charting the US Greenback: A Two-Decade Journey By means of Foreign money Volatility and International Affect

Associated Articles: Charting the US Greenback: A Two-Decade Journey By means of Foreign money Volatility and International Affect

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Charting the US Greenback: A Two-Decade Journey By means of Foreign money Volatility and International Affect. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Charting the US Greenback: A Two-Decade Journey By means of Foreign money Volatility and International Affect

The US greenback (USD) reigns supreme because the world’s reserve forex, a place cemented over a long time of world financial dominance. Nonetheless, its worth is not static; it fluctuates continuously, influenced by a posh interaction of home and worldwide components. Charting the USD’s efficiency over the previous 20 years reveals an interesting story of booms and busts, reflecting shifts in world energy dynamics, financial insurance policies, and geopolitical occasions. This text will delve into the important thing drivers influencing the USD’s trajectory for the reason that 12 months 2000, analyzing its efficiency in opposition to main currencies and exploring the implications for world markets.

The Early 2000s: A Interval of Relative Stability and the Dot-com Bubble Burst

The start of the millennium noticed the USD having fun with a interval of relative power, albeit punctuated by the bursting of the dot-com bubble in 2000. Whereas the bubble’s collapse had a big affect on the US economic system, its instant impact on the USD was comparatively muted. This may be attributed to the truth that the Federal Reserve (Fed) was fast to reply with rate of interest cuts, stopping a deeper financial downturn. The USD’s worth, nevertheless, was influenced by different components, together with the continuing globalisation and the growing demand for US belongings as protected havens. Charting the USD in opposition to main currencies just like the Euro and the Japanese Yen throughout this era reveals a comparatively secure, albeit barely declining, pattern.

The Rise of the Euro and the International Monetary Disaster (2008)

The early 2000s additionally witnessed the emergence of the Euro as a big world forex. The introduction of the Euro in 1999 and its subsequent strengthening challenged the USD’s dominance, resulting in elevated competitors and volatility within the overseas trade market. The interval main as much as the 2008 world monetary disaster noticed a gradual weakening of the USD, partly as a result of US’s burgeoning present account deficit and the growing notion of threat related to US belongings.

The 2008 disaster proved to be a watershed second. The collapse of Lehman Brothers and the following world recession triggered a large flight to security, sending buyers flocking to the USD as a protected haven asset. Charts from this era present a pointy appreciation of the USD in opposition to most main currencies. This "protected haven" impact underscored the USD’s enduring standing as a most well-liked forex throughout occasions of uncertainty and threat aversion. The Fed’s aggressive quantitative easing (QE) program, geared toward stimulating the US economic system, nevertheless, ultimately led to a decline within the USD’s worth within the years following the disaster.

The Publish-2008 Period: QE, Diverging Financial Insurance policies, and Geopolitical Occasions

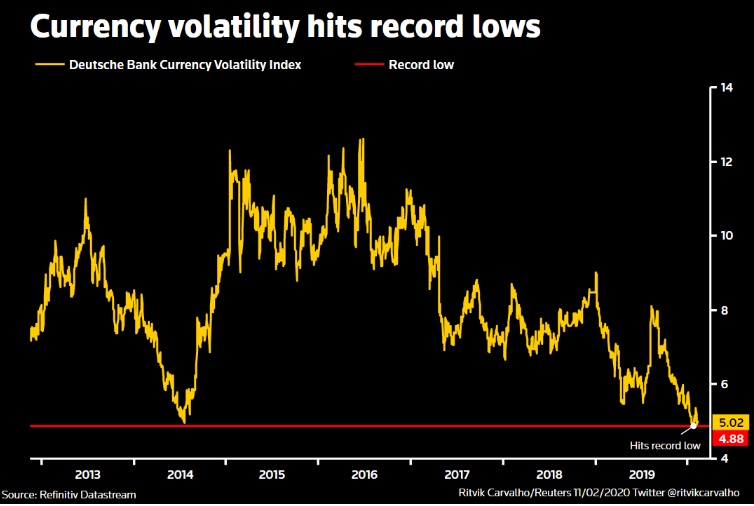

The post-2008 period noticed a posh interaction of things influencing the USD’s trajectory. The Fed’s continued QE applications, geared toward injecting liquidity into the US economic system, put downward stress on the USD’s worth. Concurrently, different central banks, notably the European Central Financial institution (ECB) and the Financial institution of Japan (BOJ), adopted their very own QE applications, resulting in a divergence in financial insurance policies throughout main economies. This divergence, coupled with variations in financial progress charges and inflation ranges, created important volatility within the overseas trade market.

Geopolitical occasions additionally performed a vital position. The Eurozone debt disaster, the rise of populism in varied international locations, and the continuing US-China commerce warfare all contributed to uncertainty and influenced investor sentiment in the direction of the USD. Charts throughout this era mirror the appreciable volatility, with durations of each appreciation and depreciation relying on the prevailing world financial and political local weather.

The Trump Administration and the Rise of Protectionism (2017-2021)

The Trump administration’s insurance policies, notably its protectionist commerce measures, added one other layer of complexity to the USD’s efficiency. Whereas initially, the USD skilled some power because of expectations of fiscal stimulus, the escalating commerce warfare with China and the uncertainty surrounding world commerce agreements led to elevated volatility. The USD’s worth fluctuated considerably relying on market perceptions of the potential affect of those insurance policies on the US economic system and world commerce.

The COVID-19 Pandemic and its Aftermath

The COVID-19 pandemic had a profound affect on the worldwide economic system and the USD’s worth. Initially, the USD skilled a pointy surge as buyers sought security throughout the preliminary market panic. Nonetheless, the next large fiscal and financial stimulus measures carried out by the Fed, together with the worldwide financial downturn, led to a decline within the USD’s worth. The restoration section noticed a combined image, with the USD’s power influenced by components comparable to vaccine rollout, financial restoration charges in several international locations, and ongoing geopolitical tensions.

Present Developments and Future Outlook

At the moment, the USD’s worth continues to be influenced by a variety of things together with inflation charges within the US and different main economies, the tempo of financial restoration, geopolitical developments, and central financial institution insurance policies. The continuing warfare in Ukraine, rising vitality costs, and protracted inflationary pressures globally are creating appreciable uncertainty. The Fed’s efforts to fight inflation by rate of interest hikes are impacting the USD’s worth, making it a topic of intense hypothesis and evaluation.

Predicting the longer term trajectory of the USD is difficult, given the multitude of variables at play. Nonetheless, a number of components will probably proceed to form its efficiency within the coming years. These embody:

- US financial progress: The power of the US economic system will stay a key driver of the USD’s worth. Stronger progress usually results in elevated demand for the USD.

- Inflation and rates of interest: The Fed’s financial coverage response to inflation will considerably affect the USD. Increased rates of interest have a tendency to draw overseas funding, strengthening the USD.

- Geopolitical dangers: International political instability and uncertainty can result in elevated demand for the USD as a protected haven asset.

- International financial progress: The relative efficiency of the US economic system in comparison with different main economies will play a big position.

- US fiscal coverage: Authorities spending and debt ranges can affect investor confidence and the USD’s worth.

In conclusion, charting the US greenback over the previous 20 years reveals a posh and dynamic image. Its worth has been influenced by a mess of things, starting from financial cycles and financial insurance policies to geopolitical occasions and investor sentiment. Whereas the USD’s place because the world’s reserve forex stays sturdy, its future trajectory will depend upon the interaction of those varied components, making it a topic of ongoing scrutiny and evaluation for buyers, policymakers, and economists alike. Cautious statement of financial indicators, central financial institution actions, and world occasions will probably be essential for understanding and navigating the fluctuations of this important world forex.

/world-currency-3305931_final-030cd0835c7f421fb21dfcdc65d16136.png)

Closure

Thus, we hope this text has offered precious insights into Charting the US Greenback: A Two-Decade Journey By means of Foreign money Volatility and International Affect. We thanks for taking the time to learn this text. See you in our subsequent article!