Chartink Screener: A Deep Dive into Intraday Buying and selling Methods

Associated Articles: Chartink Screener: A Deep Dive into Intraday Buying and selling Methods

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chartink Screener: A Deep Dive into Intraday Buying and selling Methods. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Chartink Screener: A Deep Dive into Intraday Buying and selling Methods

Chartink, a preferred on-line platform, gives a strong screener that has change into a beneficial instrument for intraday merchants. Its means to sift by way of huge quantities of market knowledge, making use of customisable filters and indicators, permits merchants to establish potential buying and selling alternatives rapidly and effectively. This text delves into the intricacies of utilizing Chartink’s screener for intraday buying and selling, exploring its options, methods, and limitations.

Understanding the Energy of Chartink’s Intraday Screener:

Chartink’s screener stands out as a result of its flexibility and customizability. Not like many pre-packaged screeners, it permits customers to construct their very own screening standards utilizing a variety of technical indicators, basic knowledge factors, and price-based filters. This empowers merchants to design methods tailor-made to their particular buying and selling model and threat tolerance. The platform helps a number of exchanges, providing a broader scope for figuring out alternatives throughout varied market segments.

Key Options and Performance:

-

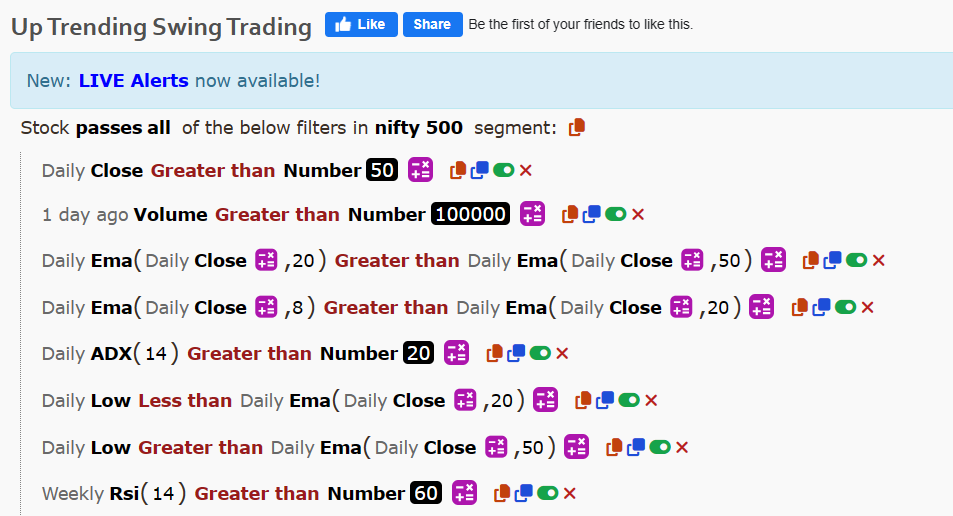

Intensive Indicator Library: Chartink boasts a complete library of technical indicators, together with transferring averages (SMA, EMA, WMA), relative energy index (RSI), MACD, Bollinger Bands, quantity indicators, and plenty of extra. This enables for the creation of advanced screening standards primarily based on a number of indicator mixtures.

-

Customizable Filters: Past indicators, Chartink permits customers to filter shares primarily based on value actions (e.g., proportion change, excessive/low values), quantity traded, market capitalization, and different basic knowledge. This enables for granular management over the screening course of, specializing in particular traits related to the dealer’s technique.

-

A number of Change Help: Chartink helps a number of exchanges, enabling merchants to scan for alternatives throughout totally different markets concurrently. That is notably useful for many who diversify their portfolios throughout varied indices or asset courses.

-

Backtesting Capabilities: Whereas not as strong as devoted backtesting platforms, Chartink gives primary backtesting functionalities, permitting customers to evaluate the historic efficiency of their custom-built screeners. This helps refine methods and establish potential weaknesses earlier than deploying them in reside buying and selling.

-

Alerting System: The platform supplies an alert system that notifies merchants when a inventory meets their predefined screening standards. This real-time notification is essential for intraday buying and selling, permitting merchants to react swiftly to rising alternatives.

-

Information Visualization: Chartink integrates seamlessly with charting instruments, permitting customers to visualise the information and make sure the validity of the screened shares earlier than getting into a commerce. This helps in verifying the alerts generated by the screener and reduces the danger of false positives.

Creating Intraday Buying and selling Methods with Chartink:

The true energy of Chartink’s screener lies in its means to facilitate the event and implementation of custom-made intraday buying and selling methods. Listed here are some examples:

-

Breakout Methods: Merchants can create screeners that establish shares breaking above or under particular resistance or help ranges. Combining this with quantity affirmation (excessive quantity on the breakout) can considerably improve the accuracy of the alerts. Indicators like Bollinger Bands or transferring common crossovers can additional improve the effectiveness of this technique.

-

Momentum Buying and selling: Chartink permits the creation of screeners specializing in shares exhibiting robust momentum. This may contain utilizing indicators like RSI, MACD, or stochastic oscillators to establish shares with excessive relative energy and potential for additional value appreciation. Combining momentum indicators with quantity filters might help to establish shares with real momentum moderately than short-lived value spikes.

-

Imply Reversion Methods: Merchants can design screeners that establish shares which have deviated considerably from their transferring averages, suggesting a possible imply reversion. This technique usually makes use of Bollinger Bands or different volatility indicators to establish overbought or oversold situations.

-

Quantity-Based mostly Methods: Specializing in quantity could be a highly effective part of intraday buying and selling. Screeners might be designed to establish shares with unusually excessive or low quantity in comparison with their common, probably indicating important shopping for or promoting strain.

-

Hole-and-Go Methods: Chartink can be utilized to establish shares that open with a big hole up or down, suggesting a robust directional transfer. This technique usually requires fast decision-making and a robust understanding of market dynamics.

Limitations and Issues:

Whereas Chartink’s screener is a strong instrument, it is essential to acknowledge its limitations:

-

False Alerts: No screener is ideal. Even essentially the most subtle methods can generate false alerts as a result of market noise or sudden occasions. Subsequently, it is essential to mix screener outcomes with different types of evaluation, together with chart patterns and basic knowledge.

-

Information Dependency: The accuracy of the screener’s outcomes relies upon closely on the standard and accuracy of the underlying knowledge. It is important to make sure that the information supply is dependable and up-to-date.

-

Over-Optimization: Over-optimizing a screener to historic knowledge can result in poor efficiency in reside buying and selling. It is essential to check methods rigorously and keep away from overfitting the parameters to previous outcomes.

-

Complexity: Constructing advanced screening standards might be difficult, requiring a robust understanding of technical evaluation and programming ideas.

-

Value: Whereas Chartink gives a free plan, accessing superior options and knowledge usually requires a paid subscription.

Conclusion:

Chartink’s intraday screener is a beneficial asset for merchants who’re comfy with technical evaluation and perceive the complexities of the market. Its flexibility and customizability permit for the creation of subtle buying and selling methods tailor-made to particular person wants and preferences. Nevertheless, it is essential to do not forget that the screener is a instrument, not a magic bullet. Profitable intraday buying and selling requires a mix of technical ability, threat administration, and self-discipline, together with a radical understanding of the restrictions of any automated screening system. By combining the facility of Chartink’s screener with sound buying and selling ideas and threat administration methods, merchants can considerably improve their means to establish and capitalize on intraday buying and selling alternatives. All the time do not forget that thorough analysis and threat administration are essential for fulfillment in any buying and selling endeavor.

Closure

Thus, we hope this text has offered beneficial insights into Chartink Screener: A Deep Dive into Intraday Buying and selling Methods. We hope you discover this text informative and useful. See you in our subsequent article!