Chartiq Reside Chart: Revolutionizing the Indian Monetary Markets

Associated Articles: Chartiq Reside Chart: Revolutionizing the Indian Monetary Markets

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Chartiq Reside Chart: Revolutionizing the Indian Monetary Markets. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chartiq Reside Chart: Revolutionizing the Indian Monetary Markets

India’s monetary markets are experiencing a interval of fast development and technological development. As buyers change into more and more refined and demand extra superior instruments, the necessity for sturdy and dependable charting options is paramount. Enter Chartiq, a robust charting library that is making waves within the Indian monetary panorama, providing reside charting capabilities which are reworking how merchants and buyers analyze market information. This text delves deep into Chartiq’s influence on the Indian market, exploring its options, advantages, and the general implications for the way forward for monetary know-how within the nation.

Understanding Chartiq’s Capabilities:

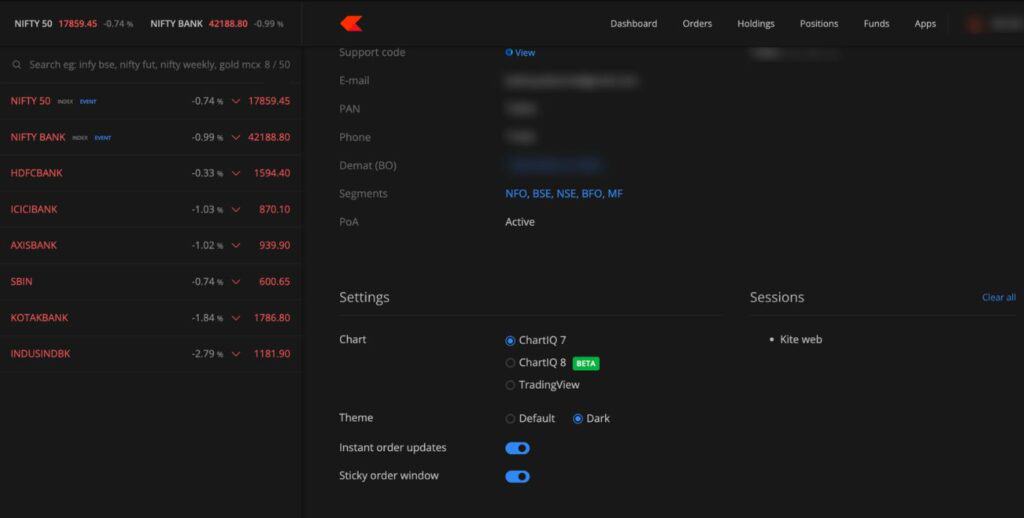

Chartiq is not simply one other charting platform; it is a extremely customizable and scalable charting library that empowers builders to combine superior charting capabilities into their buying and selling platforms, web sites, and functions. This flexibility is a big benefit within the numerous Indian market, the place varied brokerage corporations, monetary establishments, and fintech startups cater to a variety of investor wants.

Key options that make Chartiq stand out within the Indian context embrace:

-

Actual-time Information Integration: Seamless integration with varied information suppliers ensures that customers obtain reside, up-to-the-minute market information, essential for making knowledgeable buying and selling choices within the dynamic Indian inventory market, together with NSE, BSE, and MCX. This real-time functionality permits for speedy responses to market fluctuations and alternatives.

-

Superior Charting Instruments: Chartiq provides a wide selection of charting instruments, together with candlestick charts, line charts, bar charts, and quite a few technical indicators (RSI, MACD, Bollinger Bands, and so forth.). This complete suite permits for in-depth technical evaluation, catering to each novice and skilled merchants. The flexibility to customise chart layouts and add customized indicators additional enhances its enchantment.

-

Customizable Interfaces: Chartiq’s adaptability is a key energy. It may be seamlessly built-in into present buying and selling platforms, adapting to the precise design and performance necessities of every brokerage or fintech firm. That is particularly essential in India, the place numerous platforms cater to completely different person preferences and technological capabilities.

-

Cross-Platform Compatibility: Chartiq is suitable with varied units and working techniques, together with net browsers, cellular apps, and desktop functions. This ensures accessibility for a broader vary of customers throughout India, no matter their most popular units or technological infrastructure.

-

Scalability and Efficiency: Chartiq is constructed to deal with massive volumes of knowledge effectively, guaranteeing clean efficiency even during times of excessive market volatility. That is very important within the quickly rising Indian market, the place buying and selling volumes are constantly rising.

-

A number of Asset Class Assist: Chartiq’s versatility extends past equities. It may well deal with information from varied asset lessons, together with derivatives, foreign exchange, and commodities, making it a complete resolution for numerous buying and selling methods inside the Indian context. That is particularly essential contemplating the rising reputation of derivatives buying and selling in India.

Advantages for Indian Traders and Monetary Establishments:

The mixing of Chartiq brings a number of advantages to the Indian monetary ecosystem:

-

Enhanced Buying and selling Selections: Entry to real-time information and superior charting instruments empowers buyers to make extra knowledgeable and well timed buying and selling choices, doubtlessly resulting in improved funding outcomes.

-

Improved Danger Administration: The flexibility to carry out in-depth technical evaluation permits buyers to raised assess and handle their danger, decreasing potential losses.

-

Elevated Effectivity: Streamlined charting capabilities improve buying and selling effectivity, permitting buyers to investigate market information and execute trades rapidly and successfully.

-

Aggressive Benefit for Brokerages: Brokerage corporations and monetary establishments that combine Chartiq into their platforms acquire a aggressive edge by providing their purchasers a superior buying and selling expertise. That is significantly essential in a market as aggressive as India’s.

-

Increase to Fintech Innovation: Chartiq’s versatile API empowers fintech startups to develop progressive buying and selling functions and providers, fostering development and competitors within the Indian fintech sector.

Challenges and Future Outlook:

Whereas Chartiq provides vital benefits, some challenges stay:

-

Information Prices: Accessing real-time market information may be costly, doubtlessly limiting adoption amongst smaller buyers and brokerage corporations.

-

Technical Experience: Integrating and customizing Chartiq requires technical experience, which may be a hurdle for some builders.

-

Regulatory Compliance: Guaranteeing compliance with SEBI laws is essential for any monetary know-how working in India.

Regardless of these challenges, the way forward for Chartiq in India seems vibrant. The rising demand for superior buying and selling instruments, coupled with the nation’s rising digital economic system, creates a fertile floor for its adoption. We are able to count on to see extra brokerages and fintech corporations integrating Chartiq into their platforms, resulting in a extra refined and environment friendly Indian monetary market. Moreover, steady enhancements and updates to Chartiq, together with enhanced options and higher integration with Indian information suppliers, will additional solidify its place.

Conclusion:

Chartiq’s reside charting capabilities are reworking the Indian monetary panorama. Its flexibility, superior options, and scalability are addressing the wants of each particular person buyers and monetary establishments. Whereas challenges stay, the general influence of Chartiq is constructive, contributing to a extra environment friendly, clear, and technologically superior Indian monetary market. Because the nation continues its fast financial development and digital transformation, platforms like Chartiq will play a vital position in shaping the way forward for finance in India. The seamless integration of superior charting applied sciences into the Indian market is a testomony to the nation’s rising sophistication and its embrace of cutting-edge monetary know-how. The longer term holds the promise of much more progressive functions constructed upon Chartiq’s highly effective basis, additional enhancing the buying and selling expertise for tens of millions of Indian buyers.

Closure

Thus, we hope this text has supplied priceless insights into Chartiq Reside Chart: Revolutionizing the Indian Monetary Markets. We thanks for taking the time to learn this text. See you in our subsequent article!