Charts of Accounts PDF: A Complete Information

Associated Articles: Charts of Accounts PDF: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Charts of Accounts PDF: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Charts of Accounts PDF: A Complete Information

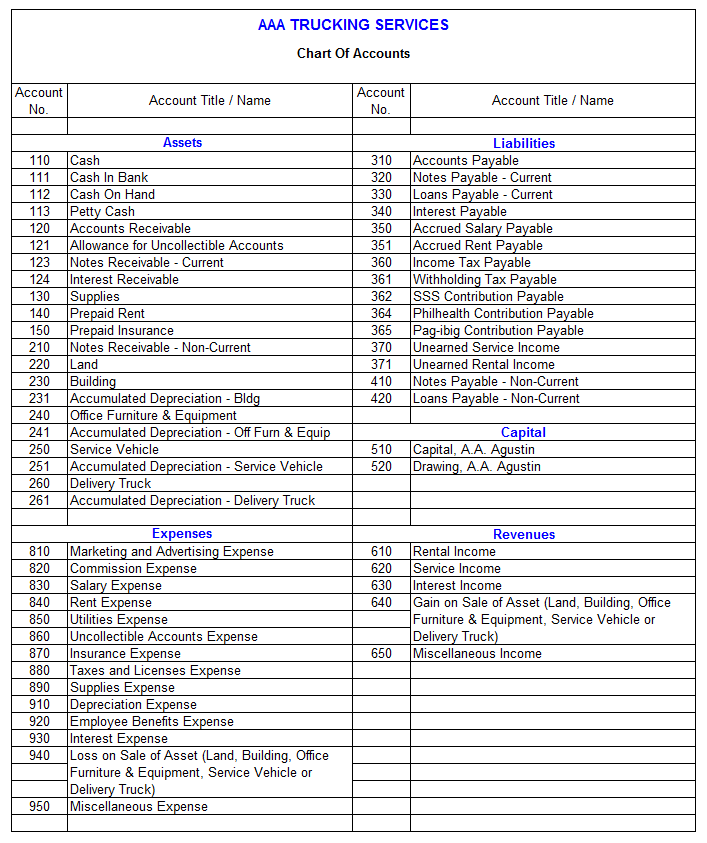

A chart of accounts (COA) is the spine of any accounting system. It is a structured listing of all of the accounts a enterprise makes use of to report its monetary transactions. This detailed information explores the importance of charts of accounts, their construction, finest practices for creation, and the advantages of sustaining them in PDF format.

Understanding the Chart of Accounts

The COA acts as a central repository for all monetary information. Every account represents a selected class of belongings, liabilities, fairness, income, or bills. Transactions are categorized and recorded inside these accounts, permitting for the era of economic statements just like the stability sheet, revenue assertion, and money movement assertion. With out a well-defined COA, monetary reporting turns into chaotic and unreliable.

Consider it like a library cataloging system. Simply as a library makes use of a catalog to arrange books by topic, writer, and title, a enterprise makes use of a COA to arrange its monetary transactions by account kind. This group ensures that monetary info is definitely accessible and available for evaluation and decision-making.

Construction of a Chart of Accounts

Whereas the particular construction of a COA can fluctuate relying on the scale and complexity of a enterprise, most observe a constant framework based mostly on the accounting equation: Belongings = Liabilities + Fairness. This framework sometimes consists of the next account classes:

-

Belongings: These symbolize what a enterprise owns. Examples embrace:

- Present Belongings: Money, accounts receivable, stock, pay as you go bills. These are belongings anticipated to be transformed into money inside one 12 months.

- Non-Present Belongings: Property, plant, and gear (PP&E), intangible belongings (patents, copyrights), long-term investments. These are belongings with a lifespan exceeding one 12 months.

-

Liabilities: These symbolize what a enterprise owes to others. Examples embrace:

- Present Liabilities: Accounts payable, salaries payable, short-term loans. These are obligations due inside one 12 months.

- Non-Present Liabilities: Lengthy-term loans, mortgages, bonds payable. These are obligations due past one 12 months.

-

Fairness: This represents the homeowners’ stake within the enterprise. For sole proprietorships and partnerships, it is usually merely known as "Proprietor’s Fairness." For firms, it consists of:

- Widespread Inventory: Represents the possession shares issued to traders.

- Retained Earnings: Accrued income that haven’t been distributed as dividends.

-

Income: This represents the revenue generated from the enterprise’s main operations. Examples embrace:

- Gross sales Income

- Service Income

- Curiosity Income

-

Bills: These symbolize the prices incurred in producing income. Examples embrace:

- Price of Items Bought (COGS)

- Salaries Expense

- Hire Expense

- Utilities Expense

- Advertising Expense

Chart of Accounts Numbering System

A well-designed COA makes use of a numbering system to supply a transparent hierarchical construction. This technique sometimes makes use of a mixture of digits to symbolize the totally different ranges of element. For instance:

- 1000 – Belongings

- 1100 – Present Belongings

- 1110 – Money

- 1120 – Accounts Receivable

- 2000 – Liabilities

- …and so forth.

This structured numbering system permits for straightforward identification and categorization of accounts. It additionally facilitates the era of stories at totally different ranges of granularity.

Greatest Practices for Making a Chart of Accounts

Creating an efficient COA requires cautious planning and consideration. Listed below are some finest practices:

- Business Requirements: Contemplate industry-specific requirements and finest practices. Sure industries have particular account classifications which are generally used.

- Enterprise Wants: The COA ought to align with the particular wants of the enterprise. A small enterprise may require an easier COA than a big company.

- Future Progress: Design the COA with future progress in thoughts. Permit for the addition of latest accounts because the enterprise expands.

- Consistency: Keep consistency in account names and descriptions. This ensures accuracy and facilitates monetary reporting.

- Common Evaluation: Usually evaluate and replace the COA to make sure it stays related and correct. Adjustments in enterprise operations or accounting requirements might necessitate changes.

- Account Descriptions: Present clear and concise descriptions for every account. This minimizes ambiguity and improves the accuracy of economic reporting.

The Benefits of a Chart of Accounts PDF

Whereas a COA might be maintained in numerous codecs (spreadsheets, databases), utilizing a PDF gives a number of benefits:

- Portability: PDFs are simply shared and accessible throughout totally different units and platforms. That is essential for collaboration amongst group members and exterior stakeholders.

- Model Management: PDFs permit for straightforward model management. Earlier variations might be archived, offering a historic report of adjustments to the COA.

- Readability: PDFs supply a clear and arranged presentation of the COA, enhancing readability and comprehension.

- Safety: PDFs might be password-protected, guaranteeing the confidentiality of delicate monetary info.

- Archiving: PDFs are an acceptable format for long-term archiving of the COA, guaranteeing information preservation.

- Integration: Many accounting software program packages permit for the export of the COA in PDF format.

Making a Chart of Accounts PDF

Making a COA PDF might be performed utilizing numerous strategies:

- Spreadsheet Software program: Create the COA in a spreadsheet program like Microsoft Excel or Google Sheets, then export it as a PDF.

- Accounting Software program: Many accounting software program packages permit for the direct export of the COA in PDF format.

- PDF Editors: You need to use a PDF editor to create a COA from scratch, though that is typically extra time-consuming.

Conclusion

A well-structured and maintained chart of accounts is important for correct monetary reporting and efficient enterprise administration. Using a PDF format gives vital benefits when it comes to portability, model management, readability, safety, and archiving. By following finest practices and using the suitable instruments, companies can create a COA PDF that serves as a worthwhile useful resource for monetary administration and decision-making. Common evaluate and updates are essential to make sure the COA stays a dependable and correct reflection of the enterprise’s monetary actions. Investing time in creating a strong and well-organized chart of accounts is an funding within the long-term monetary well being of the enterprise. A well-designed COA, available in a user-friendly PDF format, empowers companies to make knowledgeable selections based mostly on correct and readily accessible monetary information.

Closure

Thus, we hope this text has supplied worthwhile insights into Charts of Accounts PDF: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!