Deciphering the Gold Commerce Chart: A Complete Information

Associated Articles: Deciphering the Gold Commerce Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Gold Commerce Chart: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Deciphering the Gold Commerce Chart: A Complete Information

Gold, a timeless image of wealth and stability, has captivated buyers for millennia. Its value, nonetheless, is something however static, fluctuating based mostly on a posh interaction of financial, geopolitical, and market forces. Understanding the gold commerce chart, subsequently, is essential for anybody navigating the valuable metals market, whether or not a seasoned dealer or a curious novice. This text will delve into the intricacies of gold charts, exploring their numerous sorts, the indications used to interpret them, and the elements influencing gold’s value actions.

Understanding Chart Sorts:

Gold commerce charts visually symbolize the value of gold over a specified interval. Completely different chart sorts provide distinctive views, every with its strengths and weaknesses:

-

Line Charts: The only type, line charts join closing costs over time, offering a transparent overview of value tendencies. They are perfect for figuring out long-term tendencies and main help and resistance ranges. Nonetheless, they lack the element of different chart sorts.

-

Bar Charts: These charts show the excessive, low, open, and shut (OHLC) costs for a particular interval (e.g., every day, weekly, month-to-month). The vertical bar represents the value vary, with the horizontal line indicating the open and shut costs. Bar charts provide extra data than line charts, making them helpful for figuring out value reversals and volatility.

-

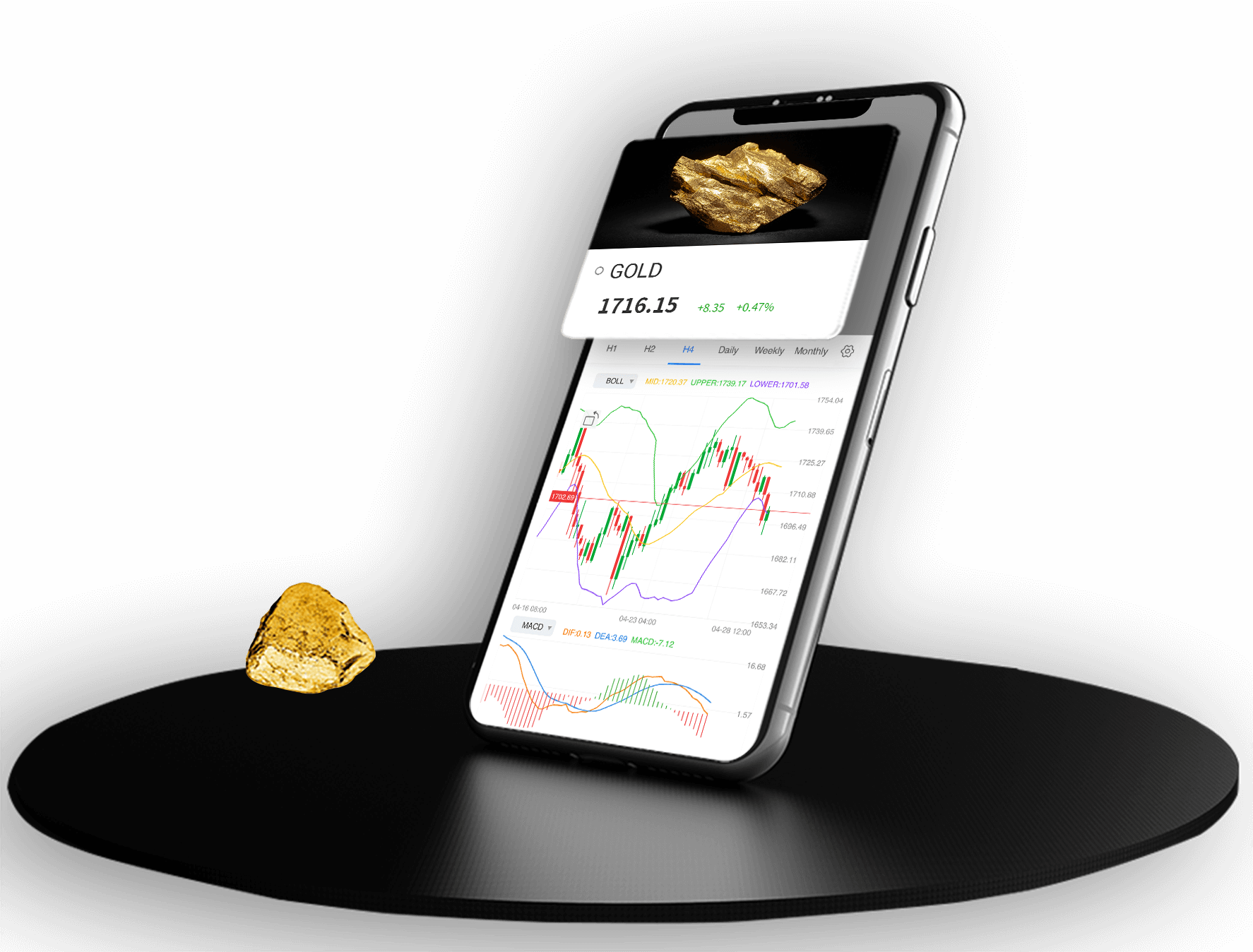

Candlestick Charts: Just like bar charts, candlestick charts show OHLC information, however in a extra visually interesting and informative method. The "physique" of the candlestick represents the value vary between the open and shut, whereas the "wicks" (higher and decrease shadows) symbolize the excessive and low costs. The colour of the candlestick (usually inexperienced or white for bullish and crimson or black for bearish) signifies whether or not the value closed larger or decrease than it opened. Candlestick charts are extensively most well-liked for his or her capability to shortly convey value motion and determine candlestick patterns.

-

Level & Determine Charts: In contrast to the earlier chart sorts, level & determine charts don’t take into account time. They focus solely on value actions, plotting an "X" for a value enhance and an "O" for a value lower, based mostly on a predefined value change (e.g., $1, $5). Level & determine charts filter out noise and spotlight important value modifications, making them helpful for figuring out potential breakout factors.

Key Indicators and Instruments for Chart Evaluation:

Decoding gold commerce charts successfully requires utilizing numerous technical indicators and instruments:

-

Shifting Averages: These clean out value fluctuations, revealing underlying tendencies. Generally used shifting averages embrace the easy shifting common (SMA) and the exponential shifting common (EMA). Crossovers between completely different shifting averages (e.g., a 50-day SMA crossing above a 200-day SMA) can sign potential pattern modifications.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of current value modifications to guage overbought or oversold circumstances. RSI values above 70 usually counsel an overbought market, whereas values under 30 point out an oversold market. These ranges can sign potential value reversals.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies modifications within the power, route, momentum, and period of a pattern. MACD makes use of the distinction between two shifting averages to generate a sign line. Crossovers between the MACD line and the sign line can point out potential purchase or promote indicators.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, indicating value volatility. Costs touching or breaking by way of the higher or decrease bands can sign potential value reversals or continuation of the pattern.

-

Fibonacci Retracement: This software identifies potential help and resistance ranges based mostly on Fibonacci ratios. These ranges are sometimes used to determine potential entry and exit factors for trades.

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by way of. Help ranges symbolize value flooring, whereas resistance ranges symbolize value ceilings. Breaks above resistance or under help can sign important value actions.

Elements Influencing Gold Costs:

The value of gold is influenced by a posh interaction of things:

-

US Greenback Energy: Gold is inversely correlated with the US greenback. A stronger greenback usually results in decrease gold costs, as gold is priced in US {dollars} and turns into dearer for holders of different currencies.

-

Inflation and Curiosity Charges: Gold is usually seen as a hedge towards inflation. In periods of excessive inflation, buyers usually flock to gold as a retailer of worth, driving up its value. Conversely, rising rates of interest could make gold much less engaging, as buyers can earn larger returns on different belongings.

-

Geopolitical Occasions: Geopolitical instability and uncertainty usually result in elevated demand for gold as a safe-haven asset, driving up its value. Wars, political upheavals, and terrorist assaults are examples of occasions that may considerably affect gold costs.

-

Provide and Demand: Like every commodity, the value of gold is set by the interaction of provide and demand. Elevated mining manufacturing can put downward stress on costs, whereas sturdy demand from buyers and central banks can drive costs larger.

-

Funding Demand: Central banks, institutional buyers, and particular person buyers all play a big position in influencing gold costs. Massive purchases by central banks can considerably affect costs, whereas shifts in investor sentiment can result in value volatility.

-

Speculative Buying and selling: Speculative buying and selling performs a big position in gold value fluctuations. Futures and choices contracts enable merchants to wager on the longer term route of gold costs, creating volatility out there.

Analyzing the Gold Commerce Chart in Observe:

Analyzing a gold commerce chart includes combining technical indicators with basic evaluation. For instance, a dealer may observe a bearish candlestick sample (e.g., a taking pictures star) close to a resistance stage, coupled with a weakening US greenback and rising inflation. This mix of technical and basic elements may counsel a possible short-selling alternative.

Nonetheless, it is essential to keep in mind that no indicator or evaluation is foolproof. Markets are inherently unpredictable, and even essentially the most refined evaluation may be unsuitable. Threat administration is paramount in gold buying and selling, and merchants ought to all the time use stop-loss orders to restrict potential losses.

Conclusion:

The gold commerce chart is a robust software for understanding and navigating the valuable metals market. By understanding the varied chart sorts, technical indicators, and basic elements that affect gold costs, merchants could make extra knowledgeable choices. Nonetheless, it is important to strategy gold buying and selling with a disciplined strategy, using threat administration strategies and acknowledging the inherent uncertainties of the market. Steady studying, staying up to date on market information, and working towards accountable buying and selling are key to success within the dynamic world of gold buying and selling. Bear in mind, the gold commerce chart is merely a information; its interpretation requires expertise, data, and a wholesome dose of warning.

Closure

Thus, we hope this text has supplied priceless insights into Deciphering the Gold Commerce Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!