Deciphering the Kite Zerodha Financial institution Nifty Chart: A Complete Information

Associated Articles: Deciphering the Kite Zerodha Financial institution Nifty Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the Kite Zerodha Financial institution Nifty Chart: A Complete Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Deciphering the Kite Zerodha Financial institution Nifty Chart: A Complete Information

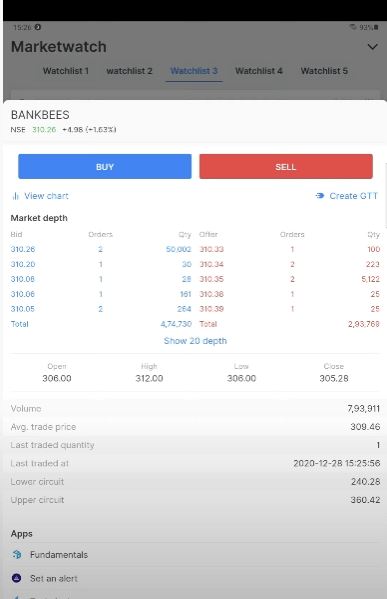

The Financial institution Nifty, an index monitoring the efficiency of the highest 12 private and non-private sector banks listed on the Nationwide Inventory Change (NSE), is a well-liked alternative for merchants and traders. Zerodha’s Kite platform, a extensively used buying and selling terminal, offers a robust and user-friendly interface to research this important index. Understanding find out how to interpret the Kite Zerodha Financial institution Nifty chart is essential for making knowledgeable buying and selling choices. This text delves deep into the assorted facets of chart evaluation on Kite, focusing particularly on the Financial institution Nifty, equipping you with the information to successfully make the most of this instrument.

Understanding the Fundamentals: Chart Varieties and Indicators

Earlier than diving into superior strategies, it is important to understand the elemental parts of the Kite Zerodha Financial institution Nifty chart. The platform provides varied chart sorts, every serving a unique function:

-

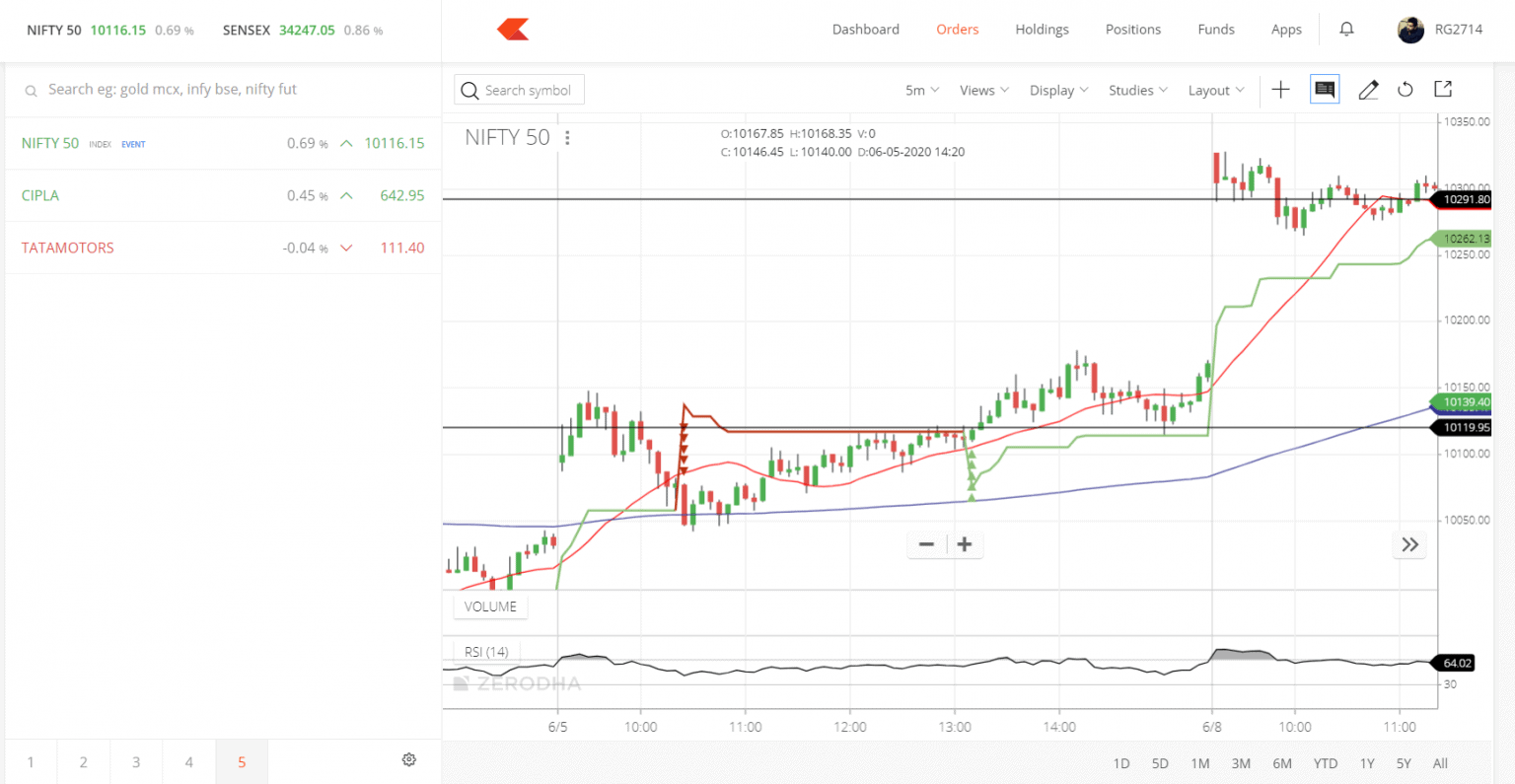

Candlestick Charts: These are the preferred alternative, visually representing worth motion over a selected interval. Every candle exhibits the open, excessive, low, and shutting costs. Bullish candles (inexperienced/white) point out larger closing costs than opening costs, whereas bearish candles (pink/black) present the alternative. Analyzing candlestick patterns can reveal potential development reversals or continuations.

-

Line Charts: These charts merely join the closing costs of every interval, offering a clear visible illustration of worth traits. They’re much less detailed than candlestick charts however are helpful for figuring out long-term traits.

-

Bar Charts: Just like candlestick charts, bar charts show the open, excessive, low, and shutting costs, however in a unique visible format. They’re much less visually intuitive than candlesticks however could be equally efficient for evaluation.

-

Space Charts: These charts spotlight the cumulative worth motion, filling the world between the value line and the x-axis. They’re helpful for visualizing the general magnitude of worth modifications over time.

Past chart sorts, Kite provides an unlimited library of technical indicators. These mathematical calculations present insights into worth momentum, development energy, and potential reversals. Some generally used indicators embody:

-

Transferring Averages (MA): These easy out worth fluctuations, revealing underlying traits. Generally used MAs are Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA). Crossovers between totally different MAs (e.g., a 50-day EMA crossing above a 200-day EMA) can sign potential development modifications.

-

Relative Power Index (RSI): This momentum oscillator measures the velocity and alter of worth actions. RSI values above 70 usually point out overbought circumstances, whereas values under 30 counsel oversold circumstances. These ranges can sign potential development reversals.

-

MACD (Transferring Common Convergence Divergence): This trend-following momentum indicator identifies modifications within the energy, course, momentum, and length of a development. MACD line crossovers (above or under the sign line) can sign purchase or promote alternatives.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, indicating worth volatility. Value breakouts above the higher band or under the decrease band can counsel robust momentum.

Analyzing the Financial institution Nifty Chart on Kite

Successfully utilizing the Kite Zerodha Financial institution Nifty chart includes combining chart patterns, technical indicators, and basic evaluation. Here is a breakdown of the method:

-

Defining Your Buying and selling Technique: Earlier than analyzing the chart, decide your buying and selling model (scalping, day buying and selling, swing buying and selling, or investing) and danger tolerance. This may affect your alternative of indicators and timeframes.

-

Selecting the Proper Timeframe: The timeframe you choose relies on your buying and selling technique. Scalpers may use 1-minute or 5-minute charts, whereas swing merchants may desire every day or weekly charts. Analyzing the Financial institution Nifty throughout a number of timeframes (e.g., evaluating a every day chart with a 1-hour chart) offers a extra holistic view.

-

Figuring out Tendencies: Search for overarching traits within the Financial institution Nifty chart. Are costs trending upwards (bullish), downwards (bearish), or sideways (consolidating)? This kinds the idea on your buying and selling choices. Assist and resistance ranges, recognized as areas the place worth has traditionally reversed or stalled, are essential in figuring out potential entry and exit factors.

-

Utilizing Technical Indicators: Choose related indicators based mostly in your technique and the present market circumstances. For instance, for those who’re searching for momentum alerts, RSI or MACD may very well be useful. When you’re specializing in development identification, shifting averages may very well be extra appropriate. Keep in mind that indicators are instruments, not definitive alerts. They need to be used at the side of worth motion evaluation.

-

Decoding Candlestick Patterns: Recognizing candlestick patterns can present precious insights into potential worth actions. Frequent patterns embody hammers, hanging males, engulfing patterns, and doji stars. Understanding these patterns may also help anticipate reversals or continuations of traits.

-

Quantity Evaluation: Whereas Kite shows worth information, being attentive to quantity is essential. Excessive quantity throughout worth will increase confirms bullish momentum, whereas excessive quantity throughout worth decreases confirms bearish momentum. Low quantity throughout worth actions can point out weak traits and potential reversals.

-

Elementary Evaluation: Whereas chart evaluation is essential, incorporating basic evaluation provides one other layer of perspective. Think about macroeconomic elements (rates of interest, inflation, GDP development), banking sector-specific information, and the general well being of the financial system when deciphering the Financial institution Nifty chart.

-

Danger Administration: All the time implement a sturdy danger administration technique. Use stop-loss orders to restrict potential losses and place sizing to manage your general danger publicity. By no means danger greater than you may afford to lose.

Superior Strategies and Issues

Past the fundamentals, a number of superior strategies can improve your Financial institution Nifty chart evaluation on Kite:

-

Fibonacci Retracements and Extensions: These instruments establish potential help and resistance ranges based mostly on Fibonacci ratios. They may also help predict worth reversals or extensions of present traits.

-

Elliott Wave Principle: This idea means that market costs transfer in particular wave patterns, which can be utilized to foretell future worth actions.

-

Harmonics Patterns: These are particular chart patterns based mostly on Fibonacci ratios, which might establish potential reversal factors.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it utilizing historic Financial institution Nifty information on Kite. This helps consider the technique’s effectiveness and establish potential flaws.

Limitations and Cautions

Whereas Kite’s charting instruments are highly effective, it is essential to acknowledge their limitations:

-

Previous efficiency just isn’t indicative of future outcomes: Chart evaluation depends on historic information, however market circumstances can change quickly. No technique ensures income.

-

Over-reliance on indicators could be deceptive: Indicators must be used as instruments to verify worth motion, not as standalone alerts.

-

Market sentiment can affect worth actions: Information occasions, investor psychology, and broader market traits can considerably impression the Financial institution Nifty, regardless of technical indicators.

Conclusion

The Kite Zerodha Financial institution Nifty chart is a precious instrument for merchants and traders. By mastering the fundamentals of chart sorts, technical indicators, and worth motion evaluation, you may considerably enhance your buying and selling choices. Keep in mind to mix chart evaluation with basic evaluation, implement a sturdy danger administration technique, and constantly study and adapt to the ever-changing market dynamics. Whereas the platform offers highly effective instruments, profitable buying and selling requires self-discipline, endurance, and a deep understanding of each technical and basic facets of the market. All the time strategy buying and selling with warning and a sensible evaluation of your danger tolerance. The data offered on this article is for instructional functions solely and shouldn’t be thought of monetary recommendation. Seek the advice of with a certified monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered precious insights into Deciphering the Kite Zerodha Financial institution Nifty Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!