Deciphering the Language of Candles: A Complete Information to Candlestick Charting

Associated Articles: Deciphering the Language of Candles: A Complete Information to Candlestick Charting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Language of Candles: A Complete Information to Candlestick Charting. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Deciphering the Language of Candles: A Complete Information to Candlestick Charting

Candlestick charts, with their visually hanging illustration of value motion, have develop into a cornerstone of technical evaluation for merchants throughout varied asset lessons. Not like bar charts that merely present the excessive, low, open, and shut costs, candlestick charts current this knowledge in a extra intuitive and readily interpretable format. This text will delve into the intricacies of studying candlestick charts, exploring particular person candle formations, frequent patterns, and their implications for buying and selling selections.

Understanding the Anatomy of a Candlestick:

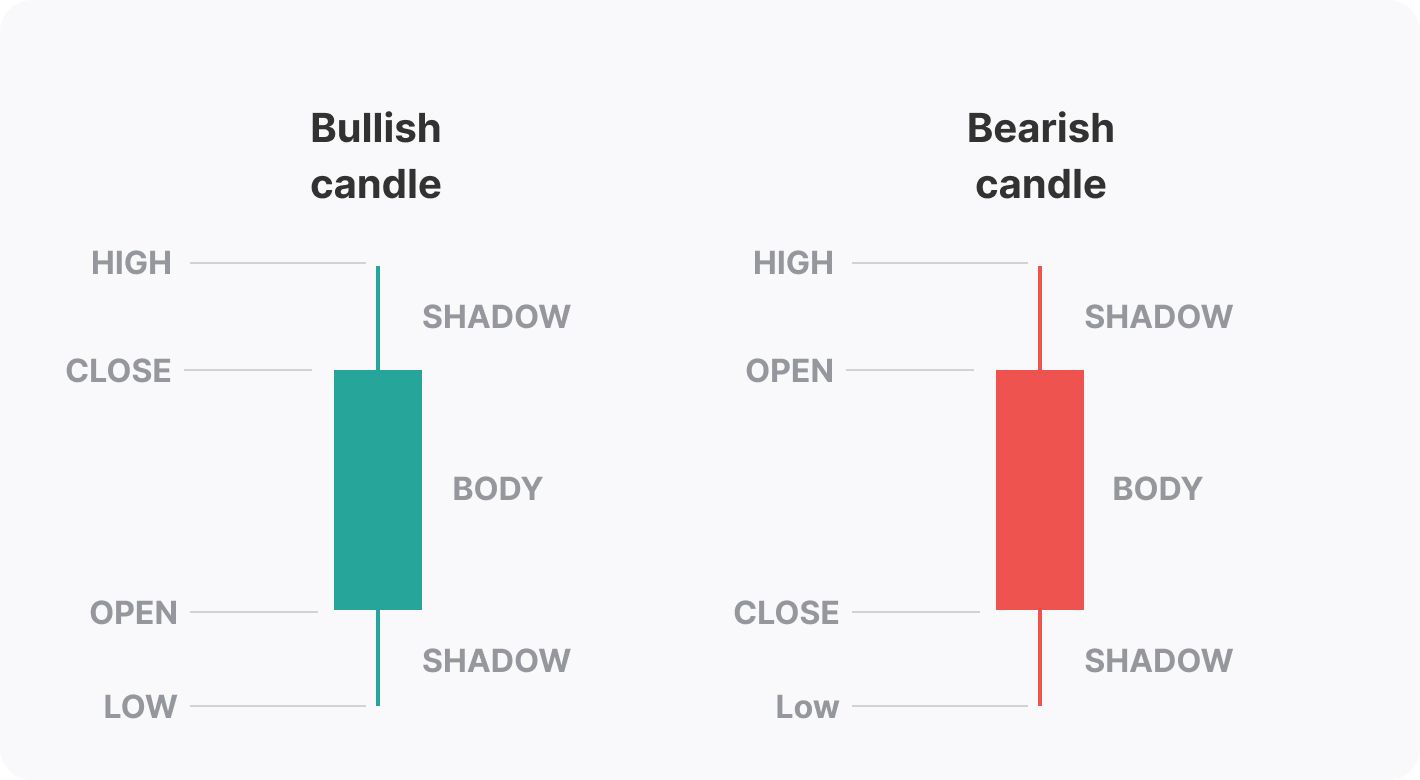

Every candlestick represents the worth motion of an asset over a selected time interval (e.g., in the future, one hour, one minute). The core elements are:

-

The Physique (Actual Physique): That is the oblong portion of the candlestick and signifies the vary between the opening and shutting costs.

- Bullish Candle (Inexperienced or White): The closing value is increased than the opening value, indicating shopping for strain. The physique is often stuffed in inexperienced or white.

- Bearish Candle (Crimson or Black): The closing value is decrease than the opening value, signifying promoting strain. The physique is often stuffed in pink or black.

-

The Wicks (Shadows or Tails): These are the skinny strains extending above and beneath the physique.

- Higher Wick (Higher Shadow): Reveals the best value reached in the course of the interval. A protracted higher wick suggests promoting strain close to the excessive.

- Decrease Wick (Decrease Shadow): Reveals the bottom value reached in the course of the interval. A protracted decrease wick signifies shopping for strain close to the low.

Deciphering Particular person Candlestick Patterns:

Whereas the person candlestick itself gives precious info, the true energy of candlestick evaluation lies in figuring out patterns fashioned by sequences of candles. Let’s discover some elementary candlestick patterns:

1. Doji: A doji is characterised by a really small or non-existent physique, with the open and shut costs being nearly an identical. It represents indecision out there, a battle between consumers and sellers. Several types of dojis exist, together with:

- Common Doji: Open and shut are almost an identical.

- Dragonfly Doji: Open and shut are on the backside of the candle, with an extended higher wick. Suggests robust shopping for strain.

- Headstone Doji: Open and shut are on the high of the candle, with an extended decrease wick. Suggests robust promoting strain.

- Lengthy-Legged Doji: Lengthy higher and decrease wicks, indicating important value fluctuations with indecision.

2. Hammer: A hammer is a bullish reversal sample characterised by a small physique on the high of the candle with an extended decrease wick, not less than twice the size of the physique. It suggests consumers stepped in to forestall additional value declines. A "hanging man" is the bearish equal, showing on the high of an uptrend.

3. Engulfing Sample: This sample consists of two candles. A bearish engulfing sample includes a big bearish candle utterly engulfing the earlier bullish candle, suggesting a possible development reversal. A bullish engulfing sample is the alternative, with a big bullish candle engulfing the earlier bearish candle.

4. Piercing Sample: Much like the bullish engulfing sample, however the bullish candle solely partially covers the earlier bearish candle. It is a weaker bullish sign.

5. Darkish Cloud Cowl: A bearish reversal sample showing on the high of an uptrend. It consists of a giant bullish candle adopted by a bearish candle that opens above the earlier candle’s shut and closes beneath its midpoint.

6. Night Star: A 3-candle bearish reversal sample. It begins with a bullish candle, adopted by a doji or small physique candle, after which a big bearish candle that gaps decrease.

7. Morning Star: The bullish counterpart to the Night Star. It consists of a bearish candle, adopted by a doji or small physique candle, after which a big bullish candle that gaps increased.

8. Three White Troopers: A bullish sample consisting of three consecutive bullish candles, every opening increased and shutting increased than the earlier one. It indicators robust shopping for strain.

9. Three Black Crows: The bearish equal of Three White Troopers, displaying three consecutive bearish candles, every opening decrease and shutting decrease than the earlier one.

Deciphering Candlestick Patterns in Context:

It is essential to keep in mind that candlestick patterns shouldn’t be interpreted in isolation. Their significance is amplified when thought of throughout the broader context of the market:

-

Pattern Evaluation: Candlestick patterns are most dependable when confirming current developments or figuring out potential reversals. A bullish sample in a powerful downtrend is much less dependable than one in a sideways or barely bullish market.

-

Quantity: Combining candlestick patterns with quantity evaluation gives a extra strong interpretation. Robust candlestick patterns accompanied by excessive quantity usually point out stronger indicators.

-

Assist and Resistance Ranges: Figuring out assist and resistance ranges helps decide the potential influence of candlestick patterns. A breakout above resistance with a bullish sample is a powerful affirmation of a bullish development.

-

Indicators: Integrating candlestick patterns with different technical indicators (e.g., shifting averages, RSI, MACD) can improve buying and selling selections and supply extra complete insights.

Superior Candlestick Charting Strategies:

Past fundamental patterns, superior strategies embrace:

-

Harami: A two-candle sample the place the second candle’s physique is totally contained throughout the first candle’s physique. It suggests indecision and potential development reversal.

-

Spinning Prime: Much like a doji, however with a small physique and comparatively equal higher and decrease wicks. It indicators indecision and a possible pause within the development.

-

Island Reversal: A spot between two candles, adopted by a reversal candle. It suggests a big change in momentum.

-

Mixture Patterns: Skilled merchants usually search for combos of patterns to verify indicators and enhance confidence of their buying and selling selections.

Limitations of Candlestick Evaluation:

Whereas candlestick charting is a robust device, it is important to acknowledge its limitations:

-

Subjectivity: Deciphering candlestick patterns could be subjective, resulting in completely different interpretations amongst merchants.

-

Affirmation Bias: Merchants may selectively concentrate on patterns that verify their current biases, ignoring contradictory proof.

-

False Indicators: Candlestick patterns can generate false indicators, resulting in inaccurate predictions.

-

Over-reliance: Over-reliance on candlestick patterns with out contemplating different elements could be detrimental to buying and selling success.

Conclusion:

Candlestick charting gives a wealthy and insightful strategy to technical evaluation. By understanding the anatomy of candlesticks, recognizing frequent patterns, and decoding them inside a broader market context, merchants can improve their decision-making course of and probably enhance their buying and selling outcomes. Nevertheless, it is essential to keep in mind that candlestick evaluation is only one piece of the puzzle. Combining it with different types of technical evaluation, elementary evaluation, and danger administration methods is crucial for profitable buying and selling. Steady studying and follow are key to mastering the artwork of studying and decoding candlestick charts successfully. Bear in mind to at all times backtest your methods and regulate your strategy based mostly in your expertise and market circumstances. The language of candles is wealthy and rewarding, however requires diligent research and cautious software.

Closure

Thus, we hope this text has offered precious insights into Deciphering the Language of Candles: A Complete Information to Candlestick Charting. We respect your consideration to our article. See you in our subsequent article!