Deciphering the Nifty July Future Chart: A Complete Evaluation

Associated Articles: Deciphering the Nifty July Future Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Deciphering the Nifty July Future Chart: A Complete Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Deciphering the Nifty July Future Chart: A Complete Evaluation

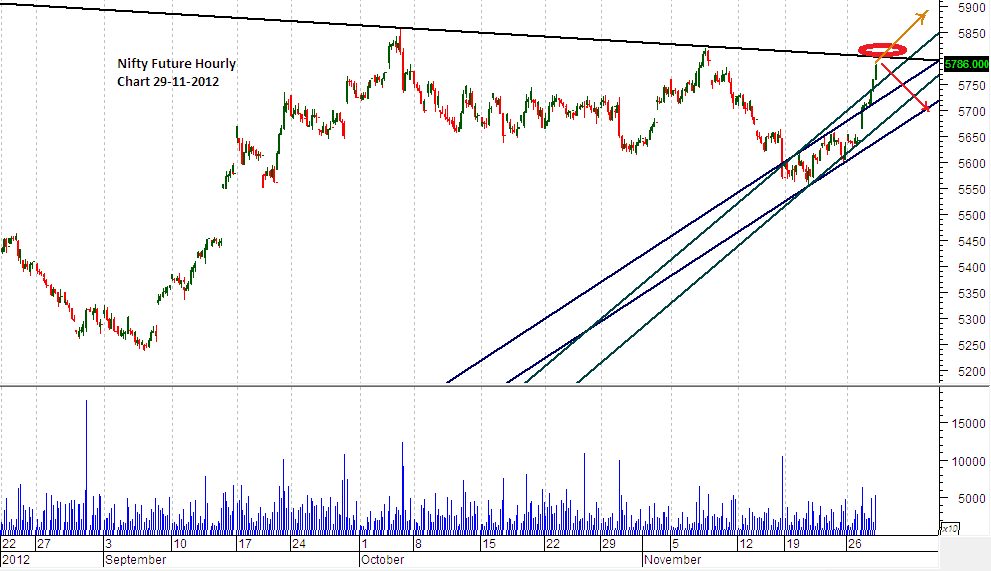

The Nifty 50 July futures contract is an important instrument for merchants and buyers in search of publicity to India’s benchmark index. Analyzing its chart gives worthwhile insights into market sentiment, potential value actions, and alternatives for strategic buying and selling. This text gives a complete evaluation of the Nifty July future chart, protecting key technical indicators, potential assist and resistance ranges, and numerous buying and selling methods. We are going to discover totally different timeframes, acknowledging that interpretations can range relying on the chosen perspective.

Understanding the Context:

Earlier than diving into the chart specifics, it is essential to know the broader macroeconomic and geopolitical panorama impacting the Nifty. Components comparable to international inflation, rate of interest hikes by central banks (particularly the US Federal Reserve), crude oil costs, and home financial indicators (GDP progress, inflation, monsoon predictions) considerably affect the index’s efficiency. Moreover, any main geopolitical occasions or regulatory adjustments inside India could cause vital volatility. An intensive understanding of those components is important for contextualizing the chart evaluation.

Technical Evaluation of the Nifty July Future Chart:

Technical evaluation depends on historic value and quantity knowledge to foretell future value actions. We are going to look at a number of key features:

1. Development Identification:

The first step includes figuring out the prevailing development. Is the Nifty July future in an uptrend, downtrend, or sideways consolidation? This may be decided by observing the course of upper highs and better lows (uptrend), decrease highs and decrease lows (downtrend), or a range-bound motion (sideways). Transferring averages, such because the 20-day, 50-day, and 200-day exponential shifting averages (EMAs), are worthwhile instruments for confirming the development. A bullish development is indicated when shorter-term EMAs are above longer-term EMAs, whereas a bearish development is indicated by the other.

2. Help and Resistance Ranges:

Help ranges signify value factors the place shopping for stress is anticipated to beat promoting stress, stopping additional value declines. Resistance ranges are the other – value factors the place promoting stress is anticipated to outweigh shopping for stress, hindering additional value will increase. These ranges will be recognized utilizing earlier swing highs and lows, Fibonacci retracement ranges, and pivot factors. Breakouts above resistance ranges usually sign bullish momentum, whereas breakdowns under assist ranges counsel bearish momentum. The energy of those ranges is set by the variety of occasions they’ve been examined and the amount traded at these ranges. A powerful assist/resistance degree will maintain even with substantial quantity.

3. Candlestick Patterns:

Candlestick patterns present worthwhile insights into the market’s sentiment and potential value actions. Bullish patterns, comparable to hammer, bullish engulfing, and morning star, counsel a possible value reversal to the upside. Bearish patterns, comparable to hanging man, bearish engulfing, and night star, point out a possible value reversal to the draw back. Figuring out and deciphering these patterns can improve buying and selling selections. Nonetheless, it is essential to contemplate candlestick patterns along with different technical indicators for affirmation.

4. Quantity Evaluation:

Quantity evaluation enhances value motion. Excessive quantity confirms value actions, whereas low quantity suggests weak momentum. For instance, a breakout above resistance with excessive quantity is a stronger bullish sign than a breakout with low quantity. Conversely, a breakdown under assist with excessive quantity is a stronger bearish sign than a breakdown with low quantity. Analyzing quantity might help filter out false breakouts and determine potential buying and selling alternatives.

5. Indicators:

Varied technical indicators can present further insights:

- Relative Power Index (RSI): The RSI measures the magnitude of latest value adjustments to guage overbought (above 70) and oversold (under 30) circumstances.

- Transferring Common Convergence Divergence (MACD): The MACD identifies adjustments in momentum by evaluating two shifting averages. Bullish crossovers (MACD line crossing above the sign line) counsel growing momentum, whereas bearish crossovers counsel reducing momentum.

- Bollinger Bands: Bollinger Bands measure volatility and determine potential overbought and oversold circumstances. Worth actions outdoors the bands usually counsel robust momentum.

- Stochastic Oscillator: This indicator measures momentum by evaluating a safety’s closing value to its value vary over a given interval. Much like RSI, it may well determine overbought and oversold circumstances.

Buying and selling Methods based mostly on the Nifty July Future Chart:

The Nifty July future chart can be utilized to implement numerous buying and selling methods:

- Development Following: This technique includes figuring out the prevailing development and buying and selling within the course of the development. Transferring averages and different trend-following indicators are essential for this technique.

- Imply Reversion: This technique includes figuring out overbought or oversold circumstances and buying and selling in anticipation of a value reversal in the direction of the imply. RSI, MACD, and Bollinger Bands are helpful instruments for this technique.

- Breakout Buying and selling: This technique includes figuring out and buying and selling breakouts above resistance ranges or breakdowns under assist ranges. Quantity evaluation is essential for confirming the energy of the breakout.

- Scalping: This short-term technique includes profiting from small value fluctuations inside a brief interval. It requires shut monitoring of the chart and fast decision-making.

- Swing Buying and selling: This technique includes holding positions for a number of days or even weeks, aiming to capitalize on bigger value swings. It requires a very good understanding of assist and resistance ranges and technical indicators.

Danger Administration:

Whatever the chosen technique, danger administration is essential. This includes setting stop-loss orders to restrict potential losses and place sizing to handle general danger publicity. Diversification throughout totally different property can be beneficial to cut back general portfolio danger.

Disclaimer:

This text gives a normal overview of the Nifty July future chart and isn’t monetary recommendation. Buying and selling includes inherent dangers, and previous efficiency isn’t indicative of future outcomes. It’s essential to conduct thorough analysis and seek the advice of with a professional monetary advisor earlier than making any funding selections. The interpretation of the chart can range considerably relying on the dealer’s expertise, danger tolerance, and chosen timeframe. All the time use applicable danger administration strategies to guard your capital. The market is dynamic, and the evaluation offered here’s a snapshot in time and should not mirror the present market circumstances. Steady monitoring and adaptation are important for profitable buying and selling.

Closure

Thus, we hope this text has offered worthwhile insights into Deciphering the Nifty July Future Chart: A Complete Evaluation. We respect your consideration to our article. See you in our subsequent article!