Deciphering the USD/JPY Chart: A Deep Dive into the Greenback-Yen Relationship

Associated Articles: Deciphering the USD/JPY Chart: A Deep Dive into the Greenback-Yen Relationship

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Deciphering the USD/JPY Chart: A Deep Dive into the Greenback-Yen Relationship. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Deciphering the USD/JPY Chart: A Deep Dive into the Greenback-Yen Relationship

The USD/JPY chart, representing the change charge between the USA greenback (USD) and the Japanese yen (JPY), is a cornerstone of the foreign exchange market. Its actions replicate a posh interaction of financial, political, and geopolitical components, making it an enchanting and infrequently risky instrument for merchants and traders alike. Understanding the dynamics behind this pair requires analyzing the basic forces impacting each the US and Japanese economies, in addition to the technical indicators that form its value motion. This text will present a complete overview of the USD/JPY chart, exploring its historic developments, key drivers, and implications for world markets.

Historic Context: A Journey By the USD/JPY Relationship

The USD/JPY change charge has skilled important fluctuations all through its historical past. Within the post-World Battle II period, the yen was initially pegged to the greenback at a set charge. Nevertheless, the Bretton Woods system’s collapse within the early Nineteen Seventies ushered in a interval of floating change charges, resulting in elevated volatility within the USD/JPY pair.

The Nineteen Eighties witnessed a interval of considerable yen appreciation, pushed by Japan’s financial ascendancy and a rising commerce surplus with the US. This led to issues about Japanese competitiveness and triggered interventions by the authorities to handle the change charge. The Plaza Accord of 1985, a coordinated intervention by main economies, intentionally pushed the yen greater in opposition to the greenback.

The following many years noticed intervals of each appreciation and depreciation for the yen. The Asian monetary disaster of 1997-98 noticed the yen strengthen quickly as traders sought secure haven belongings. The worldwide monetary disaster of 2008 led to a pointy decline within the yen as traders sought greater yields in riskier belongings. Extra not too long ago, the COVID-19 pandemic and subsequent world financial uncertainty have additionally considerably impacted the USD/JPY change charge, with intervals of each yen power and weak point.

Analyzing historic charts reveals a number of key developments. Intervals of US financial power usually correlate with a stronger greenback and a weaker yen, whereas intervals of uncertainty or threat aversion can result in yen appreciation, reflecting its safe-haven standing. Moreover, rate of interest differentials between the US and Japan play an important position. Increased US rates of interest relative to Japan have a tendency to draw capital inflows into the US, strengthening the greenback in opposition to the yen.

Key Drivers of USD/JPY Actions:

A number of elementary components affect the USD/JPY change charge:

-

Curiosity Price Differentials: Essentially the most important driver is the distinction in rates of interest between the US and Japan. Increased US rates of interest entice international funding, growing demand for the greenback and pushing the USD/JPY change charge greater. Conversely, decrease US rates of interest or greater Japanese rates of interest can result in yen appreciation. The Federal Reserve’s financial coverage selections and the Financial institution of Japan’s actions are carefully watched by merchants.

-

Financial Development Differentials: Stronger US financial development relative to Japan tends to strengthen the greenback. It’s because sturdy US financial efficiency attracts funding and boosts demand for the greenback. Conversely, weaker US development or stronger Japanese development can result in yen appreciation. Key financial indicators like GDP development, employment knowledge, and inflation figures for each international locations are carefully monitored.

-

Threat Urge for food: The yen is commonly thought-about a safe-haven forex. In periods of world uncertainty or threat aversion, traders have a tendency to maneuver in the direction of safer belongings, resulting in elevated demand for the yen and a stronger JPY in opposition to the USD. Conversely, in periods of heightened threat urge for food, traders might transfer away from safe-haven belongings just like the yen, resulting in a weaker JPY. Geopolitical occasions, market volatility, and world financial information all contribute to shifts in threat urge for food.

-

Authorities Intervention: The Japanese authorities has traditionally intervened within the foreign exchange market to handle the yen’s change charge. Interventions usually contain shopping for or promoting yen within the international change market to affect its worth. Such interventions are normally made in response to speedy and probably destabilizing actions within the USD/JPY change charge.

-

Commerce Balances: The commerce stability between the US and Japan additionally performs a job. A big US commerce deficit with Japan can put downward stress on the yen, because it suggests a weaker Japanese economic system. Nevertheless, this issue is commonly overshadowed by different, extra dominant forces.

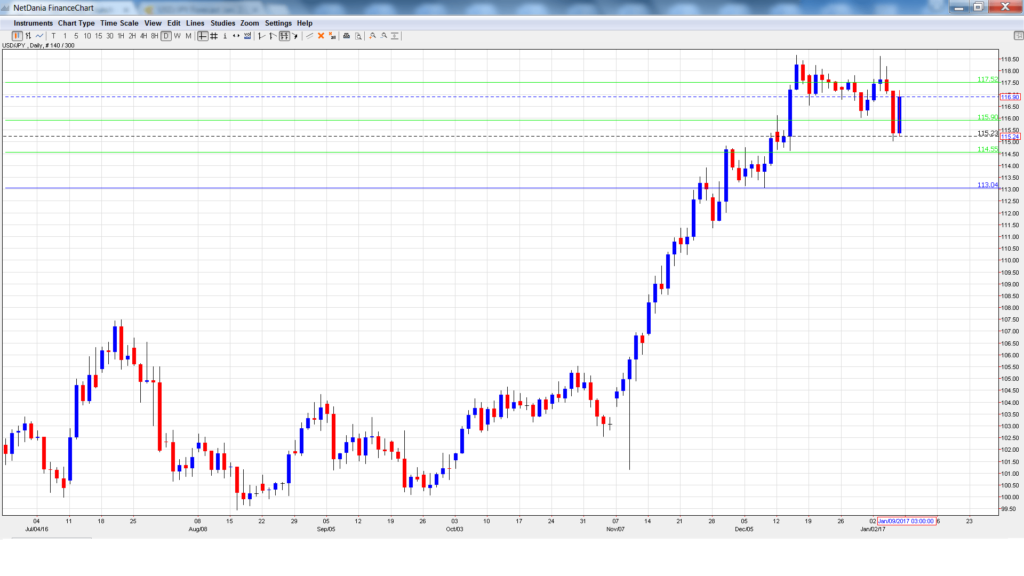

Technical Evaluation of the USD/JPY Chart:

Technical evaluation supplies one other lens by which to grasp USD/JPY actions. Merchants use numerous technical indicators and chart patterns to establish potential buying and selling alternatives. Some generally used instruments embrace:

-

Shifting Averages: Shifting averages easy out value fluctuations and assist establish developments. Crossovers between completely different shifting averages can sign potential purchase or promote alerts.

-

Relative Power Index (RSI): The RSI measures the magnitude of current value adjustments to judge overbought or oversold circumstances. Readings above 70 usually recommend the market is overbought, whereas readings under 30 recommend it’s oversold.

-

Assist and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by. Assist ranges characterize potential shopping for alternatives, whereas resistance ranges characterize potential promoting alternatives.

-

Chart Patterns: Numerous chart patterns, resembling head and shoulders, double tops/bottoms, and triangles, can present insights into potential future value actions.

Implications for International Markets:

The USD/JPY change charge has important implications for world markets. Fluctuations within the pair can affect:

-

Worldwide Commerce: Adjustments within the USD/JPY change charge immediately have an effect on the price of Japanese items for US shoppers and the price of US items for Japanese shoppers.

-

Funding Flows: The change charge influences funding selections, affecting capital flows between the US and Japan.

-

Company Earnings: Multinational companies with operations in each international locations are considerably impacted by adjustments within the change charge.

-

International Financial Coverage: The USD/JPY change charge is a key indicator of world financial coverage dynamics and may affect central financial institution selections in different international locations.

Conclusion:

The USD/JPY chart is a dynamic and complicated reflection of the financial and political panorama. Understanding its actions requires a complete evaluation of elementary components impacting each the US and Japanese economies, in addition to a eager eye for technical indicators. Whereas predicting future actions with certainty is unimaginable, a radical understanding of the historic developments, key drivers, and technical evaluation instruments might help merchants and traders navigate the complexities of this significant forex pair and make extra knowledgeable selections. Steady monitoring of financial knowledge, geopolitical occasions, and central financial institution insurance policies is essential for staying forward within the ever-evolving panorama of the USD/JPY market.

Closure

Thus, we hope this text has supplied precious insights into Deciphering the USD/JPY Chart: A Deep Dive into the Greenback-Yen Relationship. We thanks for taking the time to learn this text. See you in our subsequent article!