Decoding Chart Patterns: A Deep Dive into Ben Gold’s Buying and selling Methods (Hypothetical PDF Content material)

Associated Articles: Decoding Chart Patterns: A Deep Dive into Ben Gold’s Buying and selling Methods (Hypothetical PDF Content material)

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding Chart Patterns: A Deep Dive into Ben Gold’s Buying and selling Methods (Hypothetical PDF Content material). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding Chart Patterns: A Deep Dive into Ben Gold’s Buying and selling Methods (Hypothetical PDF Content material)

The world of buying and selling is rife with methods, indicators, and philosophies. One strategy that constantly garners consideration, significantly amongst these focused on technical evaluation, is using chart patterns. Whereas numerous books and programs delve into this topic, a hypothetical "Ben Gold Dealer PDF" (which we are going to use as a reference level for this text) may supply a novel perspective, probably specializing in particular sample recognition, danger administration, and commerce execution. This text explores the core ideas possible lined in such a hypothetical doc, drawing parallels to established technical evaluation rules.

Understanding Chart Patterns: The Basis

A core tenet of any chart sample evaluation, together with a hypothetical Ben Gold strategy, would undoubtedly be the understanding of how value motion varieties recurring shapes. These shapes, usually reflecting the battle between consumers and sellers, present clues about potential future value actions. Key parts possible mentioned within the hypothetical PDF would come with:

-

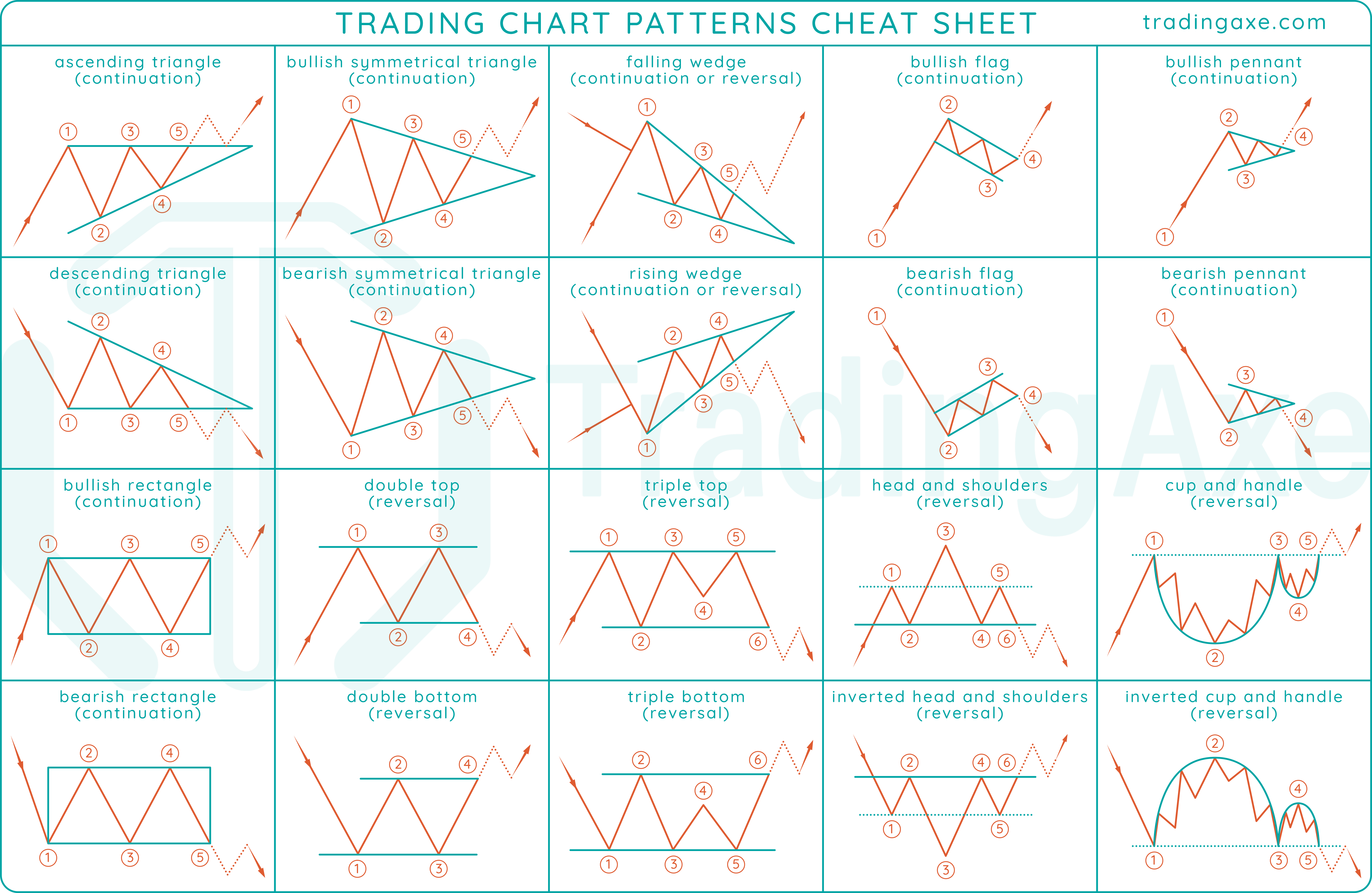

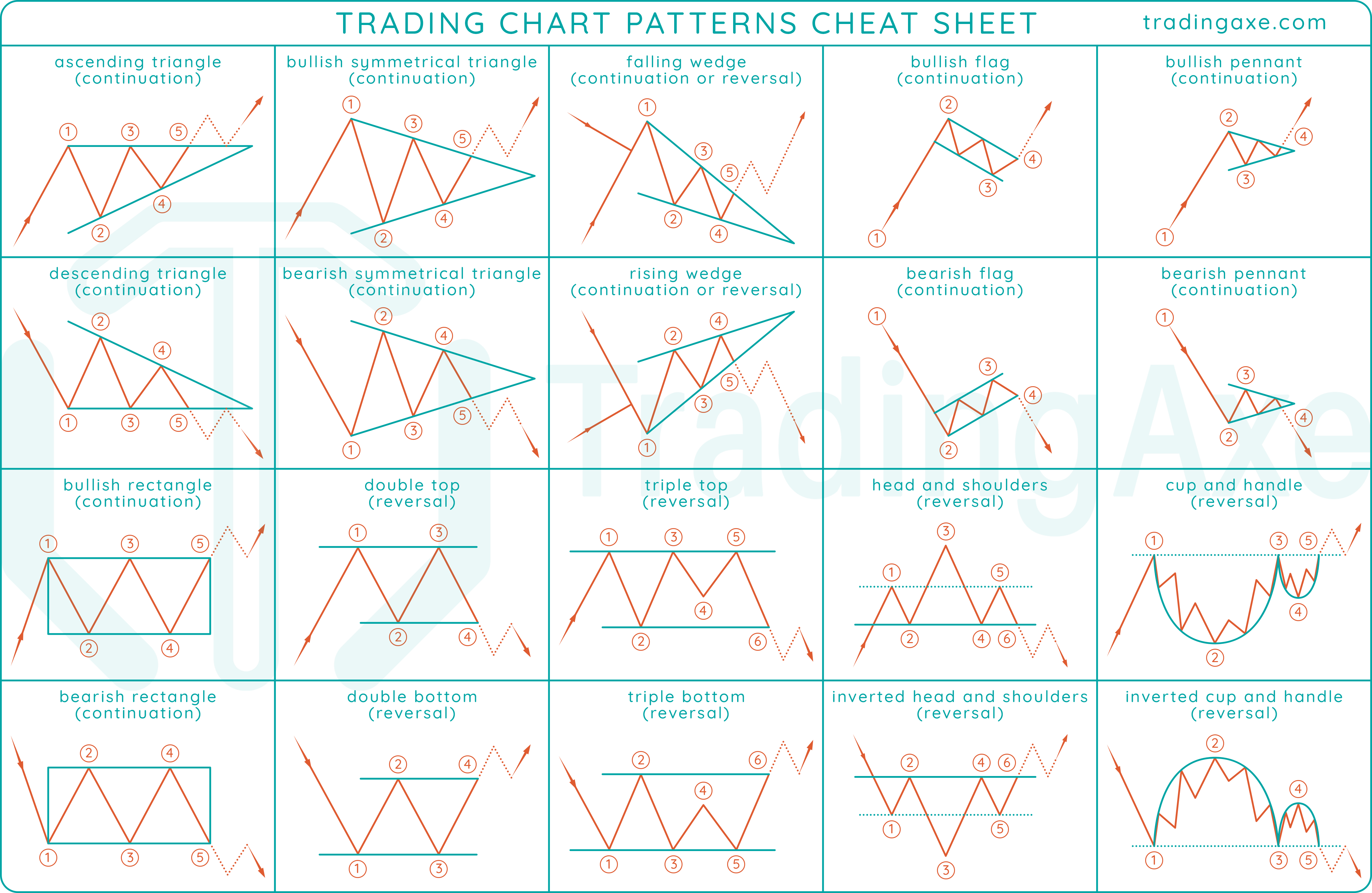

Continuation Patterns: These patterns counsel a continuation of the present pattern. Examples embrace:

- Flags and Pennants: These patterns seem as momentary consolidations inside a robust pattern, characterised by converging trendlines. The hypothetical PDF may element particular measurements (e.g., flagpole size relative to the consolidation) and entry/exit methods.

- Triangles (Symmetrical, Ascending, Descending): Triangles symbolize durations of indecision, with costs consolidating inside converging trendlines. The breakout route usually confirms the pre-existing pattern. Ben Gold’s hypothetical PDF may emphasize figuring out the kind of triangle and its implications for potential value targets.

- Rectangles: These patterns present a range-bound value motion inside parallel horizontal strains. Breakouts above or beneath the rectangle are sometimes thought of important buying and selling indicators. The PDF may talk about quantity evaluation inside rectangles to substantiate breakout energy.

-

Reversal Patterns: These patterns counsel a possible change within the prevailing pattern. Examples embrace:

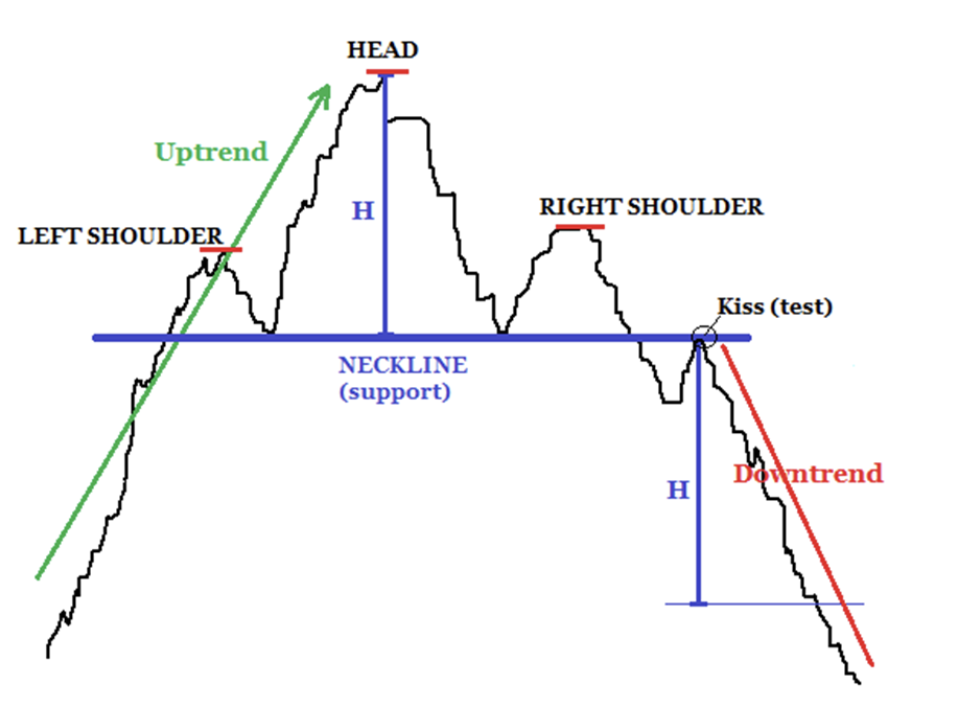

- Head and Shoulders: This basic sample consists of three peaks, with the center peak (the "head") being the best. A break beneath the neckline suggests a bearish reversal. The PDF may delve into figuring out legitimate necklines and setting stop-loss orders.

- Inverse Head and Shoulders: This sample is the mirror picture of the top and shoulders, signaling a possible bullish reversal. The PDF may spotlight the significance of quantity affirmation through the breakout.

- Double Tops/Bottoms: These patterns symbolize two consecutive peaks (tops) or troughs (bottoms) at roughly the identical value stage. A break beneath the assist stage (double high) or above the resistance stage (double backside) indicators a possible pattern reversal. The PDF may element the significance of exact identification of assist and resistance ranges.

Past Sample Recognition: The Ben Gold Method (Hypothetical)

Whereas the above patterns are normal fare in technical evaluation, a hypothetical Ben Gold Dealer PDF may differentiate itself by means of:

-

Emphasis on Danger Administration: A vital factor of profitable buying and selling is efficient danger administration. The PDF may element particular risk-reward ratios (e.g., aiming for a 1:2 or 1:3 risk-reward), stop-loss placement methods, and place sizing strategies. This could possible contain detailed explanations of calculating cease losses based mostly on sample traits and volatility.

-

Quantity Evaluation Integration: Merely figuring out chart patterns is not adequate. The hypothetical PDF would possible stress the significance of integrating quantity evaluation to substantiate sample validity and potential breakout energy. Larger quantity throughout breakouts usually suggests stronger conviction and the next likelihood of a profitable commerce.

-

Affirmation from Different Indicators: Whereas chart patterns are highly effective instruments, the PDF may advocate utilizing different technical indicators (e.g., transferring averages, RSI, MACD) to substantiate potential buying and selling indicators. This layered strategy reduces the danger of false indicators.

-

Particular Commerce Entry and Exit Methods: The PDF may current detailed methods for getting into and exiting trades based mostly on totally different chart patterns. This might embrace particular value ranges, timeframes, and order sorts (e.g., restrict orders, cease orders).

-

Buying and selling Psychology and Self-discipline: Profitable buying and selling requires self-discipline and emotional management. The hypothetical PDF may dedicate sections to managing buying and selling psychology, avoiding emotional decision-making, and adhering to a well-defined buying and selling plan. This could possible contain methods for coping with successful and shedding streaks.

-

Backtesting and Optimization: The PDF may emphasize the significance of backtesting buying and selling methods utilizing historic knowledge to guage their effectiveness and optimize parameters. This could contain rigorous evaluation and probably using buying and selling platforms with backtesting capabilities.

-

Adaptability and Steady Studying: Markets are dynamic, and buying and selling methods have to adapt. The PDF may encourage steady studying, adapting to altering market situations, and refining buying and selling approaches based mostly on expertise and suggestions.

Potential Pitfalls and Issues (Hypothetical PDF Content material)

The hypothetical Ben Gold Dealer PDF would possible additionally handle potential pitfalls related to chart sample buying and selling:

-

Subjectivity in Sample Identification: Figuring out chart patterns may be subjective. The PDF may emphasize the significance of clear, well-defined standards for sample recognition to attenuate bias and enhance consistency.

-

False Breakouts: Typically, value motion may seem to interrupt out of a sample, solely to reverse course. The PDF may talk about methods for mitigating the danger of false breakouts, resembling utilizing quantity affirmation and different technical indicators.

-

Over-reliance on Patterns: Chart patterns are only one piece of the puzzle. The PDF may warning towards over-reliance on patterns with out contemplating basic evaluation or broader market context.

-

Market Regime Modifications: Sure chart patterns could also be more practical in trending markets, whereas others could be extra helpful in range-bound markets. The PDF may talk about adapting buying and selling methods to totally different market regimes.

Conclusion

A hypothetical "Ben Gold Dealer PDF" specializing in chart patterns would possible present a complete information to this highly effective technical evaluation software. By combining sample recognition with strong danger administration, quantity evaluation, and different technical indicators, merchants might probably enhance their buying and selling efficiency. Nonetheless, it is essential to keep in mind that no buying and selling technique ensures success. Thorough analysis, constant follow, and a disciplined strategy are important for navigating the complexities of the monetary markets. The hypothetical content material mentioned right here emphasizes the significance of steady studying, adaptability, and a sensible understanding of the dangers concerned in buying and selling. Do not forget that any buying and selling technique needs to be completely backtested and tailored to your personal danger tolerance and buying and selling fashion.

Closure

Thus, we hope this text has offered helpful insights into Decoding Chart Patterns: A Deep Dive into Ben Gold’s Buying and selling Methods (Hypothetical PDF Content material). We respect your consideration to our article. See you in our subsequent article!