Decoding Market Whispers: A Complete Information to Worth Motion Chart Patterns (PDF-Pleasant)

Associated Articles: Decoding Market Whispers: A Complete Information to Worth Motion Chart Patterns (PDF-Pleasant)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Market Whispers: A Complete Information to Worth Motion Chart Patterns (PDF-Pleasant). Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding Market Whispers: A Complete Information to Worth Motion Chart Patterns (PDF-Pleasant)

Worth motion buying and selling, a way that focuses on deciphering worth actions and their visible representations on charts, is a cornerstone of technical evaluation. In contrast to indicator-heavy approaches, worth motion buying and selling emphasizes the uncooked information – the highs, lows, and closes – to establish potential buying and selling alternatives. A big a part of this entails recognizing and understanding chart patterns. These patterns, typically recurring formations, provide beneficial insights into market sentiment and potential future worth actions. This text will delve into varied worth motion chart patterns, explaining their formation, interpretation, and sensible software, making it appropriate for each novices and skilled merchants. This data could be simply downloaded and saved as a PDF for future reference.

I. Understanding the Basis: Candlestick Fundamentals

Earlier than diving into particular chart patterns, it is essential to grasp the constructing blocks of worth motion evaluation: candlestick charts. Every candlestick represents a particular time interval (e.g., someday, one hour, one minute). Key parts embrace:

- Open: The worth at the start of the interval.

- Excessive: The very best worth reached through the interval.

- Low: The bottom worth reached through the interval.

- Shut: The worth on the finish of the interval.

The physique of the candlestick signifies the distinction between the open and shut costs. A bullish (inexperienced or white) candlestick exhibits the next shut than the open, whereas a bearish (purple or black) candlestick signifies a decrease shut than the open. The wicks (or shadows) lengthen from the physique and signify the excessive and low costs that weren’t reached through the buying and selling session. The size and place of the physique and wicks present essential clues in regards to the energy and path of the value motion.

II. Reversal Patterns: Figuring out Potential Turning Factors

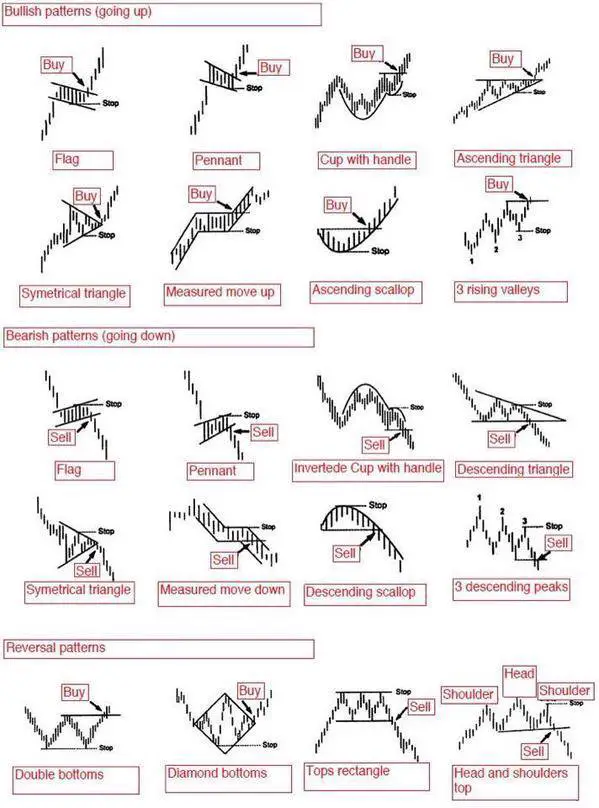

Reversal patterns sign a possible change within the prevailing development. These patterns are characterised by a interval of worth consolidation adopted by a breakout in the wrong way. Some key reversal patterns embrace:

-

Head and Shoulders: This basic sample consists of three peaks, with the center peak (the "head") being considerably greater than the opposite two ("shoulders"). A neckline connects the lows of the left and proper shoulders. A break under the neckline confirms the bearish reversal.

-

Inverted Head and Shoulders: The mirror picture of the pinnacle and shoulders sample, this means a possible bullish reversal. Three troughs type, with the center trough being the bottom. A break above the neckline confirms the bullish reversal.

-

Double Prime/Double Backside: A double prime varieties when the value reaches two related highs, adopted by a decline. A double backside is the alternative, with two related lows adopted by an increase. Breakouts under the double prime or above the double backside affirm the reversal.

-

Triple Prime/Triple Backside: Just like double tops/bottoms, however with three cases of comparable highs/lows. These patterns typically recommend stronger reversal indicators because of the elevated affirmation.

III. Continuation Patterns: Signaling Pattern Persistence

Continuation patterns recommend that the present development is more likely to proceed. These patterns sometimes contain a brief pause or consolidation earlier than the value resumes its authentic path. Essential continuation patterns embrace:

-

Flags: Characterised by a interval of consolidation inside a channel, normally at a 45-degree angle to the prevailing development. A breakout from the flag confirms the continuation of the development.

-

Pennants: Just like flags, however the consolidation interval varieties a tighter, symmetrical triangle. Breakouts affirm the continuation.

-

Triangles: These patterns contain converging trendlines, making a triangle form. There are three most important sorts: symmetrical, ascending, and descending. Symmetrical triangles are typically thought-about continuation patterns, whereas ascending triangles are bullish and descending triangles are bearish.

-

Rectangles: Worth consolidates inside a horizontal channel, indicating indecision. Breakouts above or under the rectangle affirm the continuation of the prior development.

IV. Decoding Chart Patterns: Past Visible Recognition

Whereas visually figuring out patterns is essential, profitable worth motion buying and selling requires extra than simply sample recognition. A number of components improve the reliability of sample interpretations:

-

Quantity Affirmation: Excessive quantity through the breakout confirms the energy of the transfer and will increase the likelihood of a profitable commerce. Low quantity breakouts are sometimes weak and unreliable.

-

Help and Resistance Ranges: Patterns typically type round key help and resistance ranges. Breakouts above resistance or under help considerably strengthen the sign.

-

Pattern Context: The general development performs a significant position. Reversal patterns are extra dependable after they happen inside a longtime development, whereas continuation patterns are extra important after they seem inside a powerful, ongoing development.

-

Threat Administration: Whatever the sample recognized, correct danger administration is important. Cease-loss orders ought to be positioned to restrict potential losses, and place sizing ought to be fastidiously thought-about.

V. Superior Methods and Issues

-

Combining Patterns: Skilled merchants typically mix a number of patterns to extend the accuracy of their evaluation. As an example, a head and shoulders sample forming close to a key help stage can present a stronger bearish sign.

-

Fibonacci Retracements: Combining chart patterns with Fibonacci retracements can assist establish potential entry and exit factors. Retracements typically happen inside continuation patterns, providing merchants alternatives to enter at favorable worth ranges.

-

A number of Timeframes: Analyzing patterns throughout totally different timeframes (e.g., day by day, hourly, and minute charts) gives a extra complete perspective and helps filter out noise.

-

Contextual Consciousness: Information occasions, financial information, and geopolitical components can considerably affect worth actions. Contemplating these components provides one other layer of research and improves buying and selling selections.

VI. Conclusion: Mastering the Artwork of Worth Motion

Worth motion chart patterns provide a robust instrument for understanding market dynamics and figuring out potential buying and selling alternatives. Nonetheless, mastering this talent requires dedication, observe, and a disciplined strategy. By combining sample recognition with quantity evaluation, help/resistance ranges, danger administration, and an consciousness of the broader market context, merchants can considerably enhance their buying and selling efficiency. This information serves as a place to begin; steady studying and expertise are key to efficiently using worth motion chart patterns in your buying and selling technique. Bear in mind to at all times backtest your methods and modify your strategy based mostly in your outcomes. This detailed understanding, coupled with sensible software and steady refinement, will empower you to successfully decode the whispers of the market and make knowledgeable buying and selling selections. Bear in mind to at all times observe danger administration and by no means make investments greater than you may afford to lose.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding Market Whispers: A Complete Information to Worth Motion Chart Patterns (PDF-Pleasant). We hope you discover this text informative and helpful. See you in our subsequent article!