Decoding Medicare: A Complete Information to Components A, B, C, and D

Associated Articles: Decoding Medicare: A Complete Information to Components A, B, C, and D

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Medicare: A Complete Information to Components A, B, C, and D. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding Medicare: A Complete Information to Components A, B, C, and D

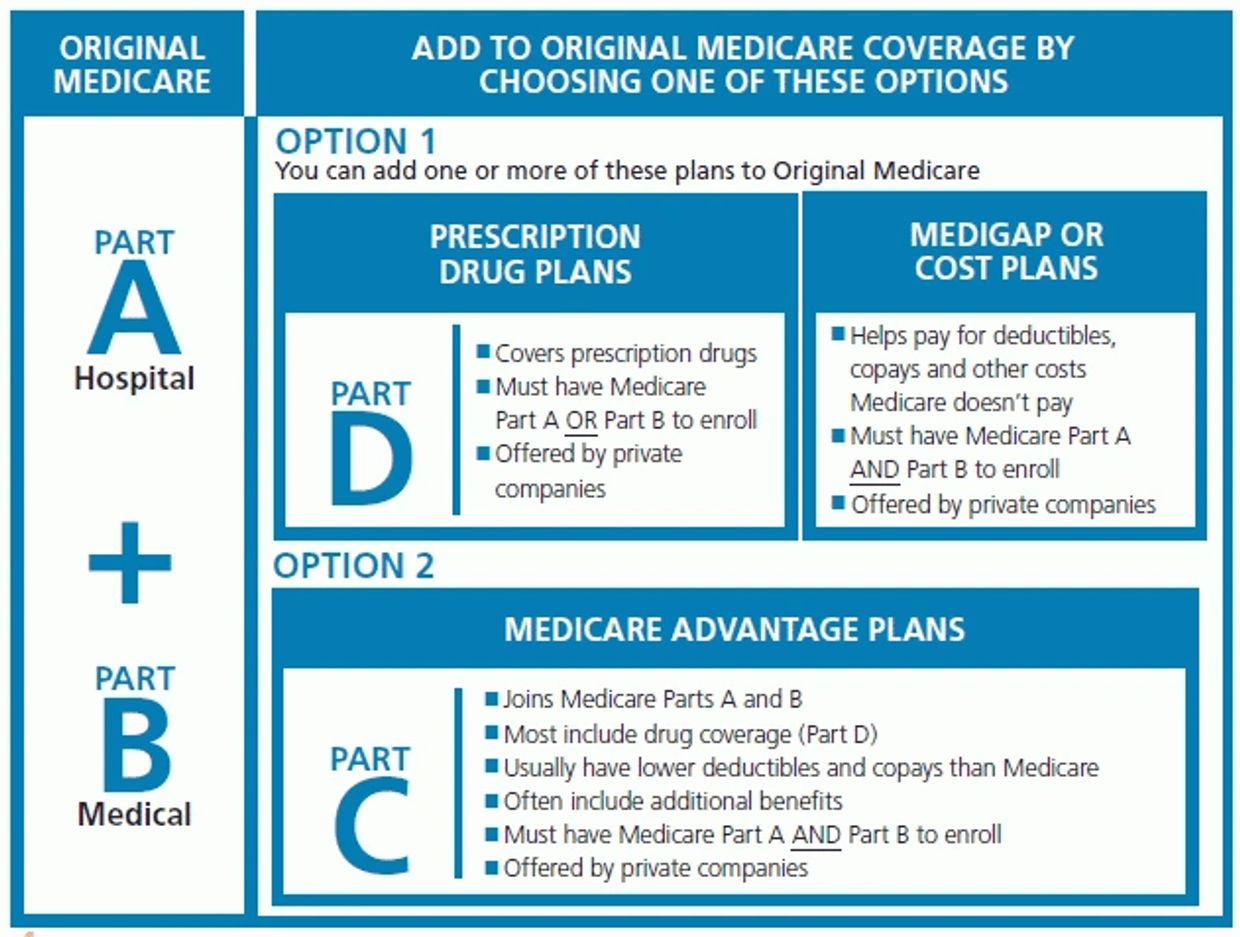

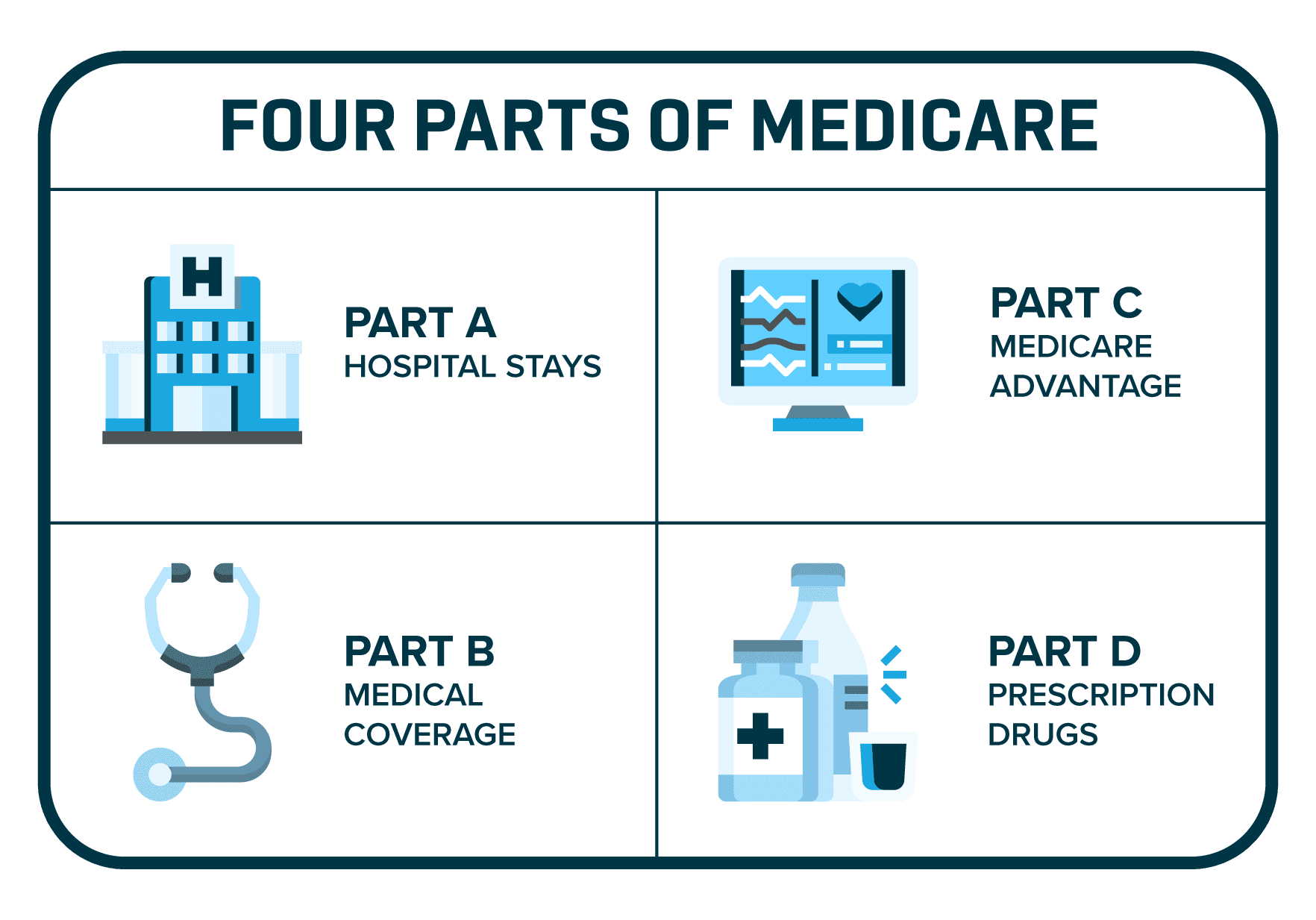

Medicare, the federal medical insurance program for individuals 65 or older and sure youthful individuals with disabilities, could be a complicated system to navigate. Understanding its 4 components – A, B, C, and D – is essential for beneficiaries to entry the correct protection and keep away from expensive errors. This text supplies an in depth overview of every half, highlighting key options, prices, and enrollment concerns, offered in a transparent and accessible method.

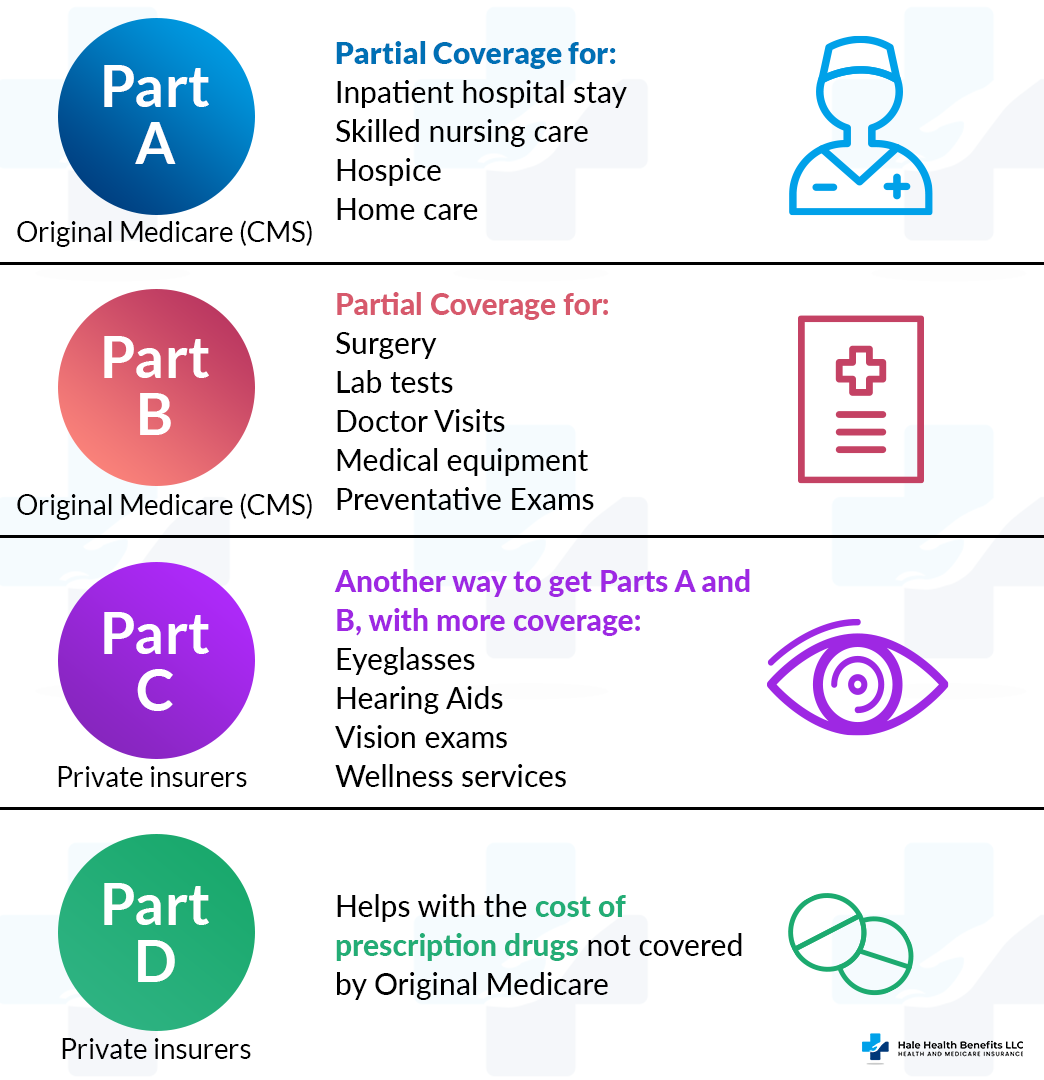

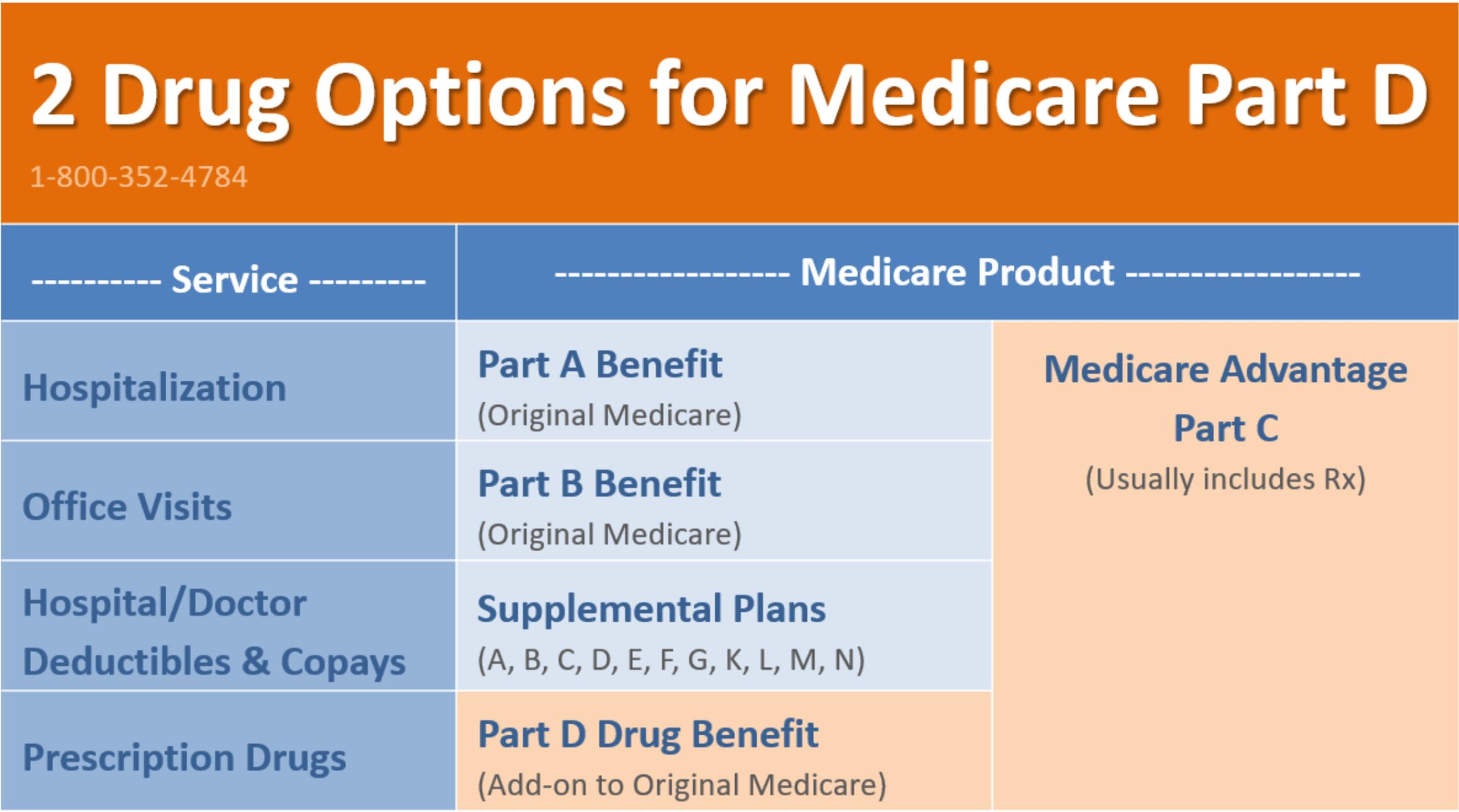

Medicare Half A: Hospital Insurance coverage

Half A primarily covers inpatient hospital care, expert nursing facility (SNF) care, hospice care, and a few forms of house healthcare. It is largely financed via payroll taxes, that means most individuals do not pay a month-to-month premium for Half A in the event that they’ve labored and paid Medicare taxes for a ample interval (usually 10 years). Nonetheless, there are cost-sharing necessities, together with:

- Deductible: A hard and fast quantity you pay for every "profit interval." A profit interval begins the day you are admitted to a hospital or expert nursing facility and ends when you have not acquired any hospital or expert nursing facility look after 60 consecutive days. The deductible quantity modifications yearly.

- Coinsurance: After your deductible is met, you may sometimes pay a each day coinsurance quantity for hospital stays past a sure variety of days. This quantity additionally varies yearly.

- Expert Nursing Facility Coinsurance: Half A helps cowl expert nursing care after a qualifying hospital keep, however you may pay coinsurance for days past a sure restrict.

- No Premium (Normally): As talked about, most people qualify for premium-free Half A protection primarily based on their work historical past. Those that have not labored lengthy sufficient could must pay a month-to-month premium.

Understanding Half A Advantages:

Half A’s protection just isn’t limitless. It is designed to cowl a particular period of look after every profit interval. Exceeding these limits typically results in vital out-of-pocket bills. It is important to know the constraints and plan accordingly. Moreover, Half A doesn’t cowl all healthcare companies. For instance, it usually does not cowl long-term care in a nursing house, custodial care, or most outpatient companies.

Medicare Half B: Medical Insurance coverage

Half B covers a broader vary of companies than Half A, together with physician visits, outpatient care, preventive companies (like annual wellness visits), some house healthcare, and sturdy medical gear (DME). In contrast to Half A, Half B requires a month-to-month premium, the quantity of which relies on your revenue. Increased-income people pay greater premiums. Along with the month-to-month premium, Half B additionally has:

- Annual Deductible: A hard and fast quantity you pay annually earlier than Half B begins to pay its share of lined companies.

- Coinsurance: After assembly the deductible, you sometimes pay a share of the Medicare-approved quantity for many companies. This share can fluctuate relying on the service.

- Premium Variation Primarily based on Earnings: The month-to-month premium is adjusted primarily based in your modified adjusted gross revenue (MAGI) reported in your tax return two years prior.

Key Issues for Half B:

Half B does not cowl every part. For instance, it sometimes does not cowl imaginative and prescient, listening to, or dental care (though some preventive companies could also be lined). Understanding what’s lined and what is not is essential to keep away from sudden payments. Moreover, selecting a physician who accepts Medicare project is vital to reduce out-of-pocket prices. Medicare project means the physician agrees to simply accept Medicare’s authorised quantity as full fee.

Medicare Half C: Medicare Benefit (MA)

Half C, also called Medicare Benefit, is an alternate strategy to obtain your Medicare advantages. As an alternative of receiving protection immediately from Medicare, you enroll in a personal well being plan that contracts with Medicare to supply your Half A and Half B advantages, and sometimes Half D as effectively. These plans supply varied choices, together with:

- Well being Upkeep Organizations (HMOs): Require you to decide on a major care doctor (PCP) who coordinates your care and sometimes want referrals to see specialists.

- Most popular Supplier Organizations (PPOs): Supply extra flexibility; you’ll be able to see specialists and not using a referral, however you may usually pay much less for those who use in-network suppliers.

- Personal Payment-for-Service (PFFS) Plans: Assist you to see any physician or hospital that accepts the plan’s fee.

Understanding Half C Prices and Advantages:

Half C plans sometimes have a month-to-month premium, which can be greater or decrease than the usual Half B premium. In addition they typically have an annual deductible and will require coinsurance or copays for companies. Nonetheless, many Medicare Benefit plans supply extra advantages not lined underneath conventional Medicare, resembling imaginative and prescient, listening to, and dental care. The precise advantages and prices fluctuate extensively relying on the plan and your location.

Medicare Half D: Prescription Drug Insurance coverage

Half D covers prescription drugs. It is administered by non-public firms that Medicare has authorised. Enrollment is voluntary, however most individuals with Medicare select to enroll to keep away from excessive prescription drug prices. Half D plans have a number of key options:

- Month-to-month Premium: The price varies extensively primarily based on the plan and the medication it covers.

- Annual Deductible: The quantity you pay earlier than the plan begins to cowl your prescribed drugs.

- Preliminary Protection Section: After the deductible, you pay a coinsurance quantity in your medication.

- Protection Hole (Donut Gap): When you and your plan have spent a specific amount on lined medication, you enter the protection hole. Throughout this part, you pay the next share of your prescription drug prices.

- Catastrophic Protection: After you and your plan have spent a major quantity on lined medication, you enter catastrophic protection, the place your out-of-pocket prices are significantly decreased.

Navigating Half D:

Selecting the best Half D plan requires cautious consideration of your drugs and their prices. The Medicare Plan Finder web site is a invaluable software for evaluating plans primarily based in your particular person wants. Switching plans is feasible throughout the annual enrollment interval (October 15 to December 7) and through sure different enrollment intervals.

Selecting the Proper Medicare Protection:

The perfect Medicare plan for you relies on your particular person well being wants, price range, and life-style. Elements to contemplate embody:

- Your well being standing: Do you’ve got persistent situations requiring frequent medical care?

- Your prescription drug wants: What number of prescription drugs do you’re taking, and what are their prices?

- Your price range: How a lot are you able to afford to pay in month-to-month premiums and out-of-pocket prices?

- Your geographic location: The supply of plans varies by location.

Assets for Medicare Beneficiaries:

A number of sources can be found that can assist you perceive and navigate Medicare:

- Medicare.gov: The official web site for Medicare supplies complete data on all features of this system.

- State Well being Insurance coverage Help Packages (SHIPs): These applications supply free, unbiased counseling that can assist you perceive your Medicare choices.

- Your physician or different healthcare suppliers: They will supply steerage primarily based in your particular person wants.

This complete information supplies a basis for understanding the intricacies of Medicare Components A, B, C, and D. Keep in mind that this data is for common steerage solely, and particular person circumstances could fluctuate. All the time seek the advice of official Medicare sources and search skilled recommendation when making choices about your Medicare protection. Commonly reviewing your protection wants is crucial to make sure you have the perfect plan in your present circumstances. Do not hesitate to make the most of the accessible sources and search assist to make knowledgeable decisions about your healthcare future.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding Medicare: A Complete Information to Components A, B, C, and D. We hope you discover this text informative and useful. See you in our subsequent article!