Decoding Revenue: The Most Worthwhile Inventory Chart Patterns and The best way to Commerce Them

Associated Articles: Decoding Revenue: The Most Worthwhile Inventory Chart Patterns and The best way to Commerce Them

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding Revenue: The Most Worthwhile Inventory Chart Patterns and The best way to Commerce Them. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding Revenue: The Most Worthwhile Inventory Chart Patterns and The best way to Commerce Them

The attract of the inventory market lies in its potential for substantial returns. Whereas no technique ensures revenue, understanding and successfully using particular chart patterns can considerably enhance your odds of success. This text delves into the world of technical evaluation, exploring among the most worthwhile inventory chart patterns and offering actionable insights into figuring out and buying and selling them. It is essential to do not forget that previous efficiency will not be indicative of future outcomes, and danger administration is paramount in any buying and selling technique.

Defining Chart Patterns:

Chart patterns are visually identifiable formations on value charts that counsel potential future value actions. These patterns are shaped by the interaction of provide and demand, reflecting the collective actions of patrons and sellers. They are not foolproof predictions, however relatively probabilistic indicators that improve buying and selling selections when used along side different types of evaluation (elementary evaluation, financial indicators, and so forth.).

The Contenders for "Most Worthwhile": A nuanced perspective.

There is no single "most worthwhile" chart sample. Profitability relies on varied elements, together with:

- Market Circumstances: Patterns carry out in another way in bull, bear, and sideways markets.

- Entry and Exit Methods: Exact entry and exit factors considerably affect profitability. A wonderfully recognized sample poorly executed will yield poor outcomes.

- Threat Administration: Strict stop-loss orders and place sizing are essential for limiting losses and preserving capital.

- Affirmation Indicators: Combining chart patterns with different indicators (quantity, shifting averages, RSI, and so forth.) will increase the likelihood of success.

Nonetheless, sure patterns constantly exhibit excessive win charges and important revenue potential when executed accurately. We’ll study a few of these high-performing candidates.

1. Head and Shoulders (H&S) Sample:

The Head and Shoulders sample is a basic reversal sample, suggesting a possible shift from an uptrend to a downtrend (Head and Shoulders Prime) or vice versa (Head and Shoulders Backside).

- Head and Shoulders Prime: Characterised by three peaks, with the center peak ("head") being the very best, and two smaller peaks ("shoulders") on both aspect. A neckline connects the troughs between the peaks. A break under the neckline confirms the sample and indicators a possible downtrend.

- Head and Shoulders Backside: The mirror picture of the Head and Shoulders Prime, indicating a possible reversal from a downtrend to an uptrend. A break above the neckline confirms the sample and indicators a possible uptrend.

Revenue Potential: The potential revenue from a profitable H&S commerce may be substantial, as the worth usually drops (or rises) considerably after the neckline break. Nonetheless, false breakouts are potential, emphasizing the necessity for affirmation indicators.

2. Double Prime/Double Backside Patterns:

These patterns are less complicated than H&S however equally efficient.

- Double Prime: Two successive peaks at roughly the identical value stage, adopted by a decline. A break under the assist stage (between the 2 peaks) confirms the sample.

- Double Backside: Two successive troughs at roughly the identical value stage, adopted by an increase. A break above the resistance stage (between the 2 troughs) confirms the sample.

Revenue Potential: Double Tops and Bottoms supply good risk-reward ratios. The goal value is commonly calculated based mostly on the peak of the sample. Nonetheless, they’re much less dependable than H&S patterns, particularly in uneven markets.

3. Triangles:

Triangles are continuation patterns, suggesting a continuation of the prevailing pattern after a interval of consolidation. There are a number of sorts:

- Symmetrical Triangles: Costs oscillate inside converging trendlines, with neither patrons nor sellers dominating. A breakout above or under the converging strains confirms the sample and signifies the continuation of the earlier pattern.

- Ascending Triangles: The higher trendline is horizontal, whereas the decrease trendline slopes upward. Breakouts are usually bullish.

- Descending Triangles: The decrease trendline is horizontal, whereas the higher trendline slopes downward. Breakouts are usually bearish.

Revenue Potential: Triangles supply average revenue potential, however their reliability is excessive, particularly when mixed with different indicators. The breakout usually supplies a transparent entry level with an outlined stop-loss.

4. Flags and Pennants:

These are continuation patterns that seem throughout sturdy tendencies.

- Flags: Characterised by a short interval of consolidation inside parallel trendlines, resembling an oblong flag. A breakout within the path of the prior pattern confirms the sample.

- Pennants: Much like flags, however the consolidation interval varieties a triangular form. A breakout within the path of the prior pattern confirms the sample.

Revenue Potential: Flags and Pennants supply glorious alternatives for short-term merchants to capitalize on pattern continuation. The revenue goal is commonly based mostly on the flagpole (the earlier pattern’s value motion).

5. Cup and Deal with Sample:

The Cup and Deal with sample is a bullish continuation sample.

- The Cup: A U-shaped curve resembling a cup.

- The Deal with: A brief downward trendline following the cup.

Revenue Potential: A breakout above the deal with’s resistance stage confirms the sample and signifies a possible value enhance. The potential revenue is commonly important.

Buying and selling Methods and Threat Administration:

Efficiently buying and selling these patterns requires a strong technique incorporating:

- Affirmation Indicators: Do not rely solely on chart patterns. Mix them with quantity evaluation, shifting averages, RSI, MACD, or different indicators to substantiate potential breakouts.

- Entry and Exit Factors: Exact entry and exit factors are essential. Use stop-loss orders to restrict potential losses and take-profit orders to safe earnings.

- Place Sizing: By no means danger greater than a small share of your buying and selling capital on any single commerce.

- Backtesting: Backtest your buying and selling technique on historic information to guage its effectiveness earlier than utilizing it with actual cash.

- Persistence: Not each sample will lead to a worthwhile commerce. Be affected person and selective in your trades.

- Adaptability: Market circumstances change consistently. Be ready to regulate your technique as wanted.

Conclusion:

Whereas no chart sample ensures revenue, mastering the identification and execution of those high-probability patterns can considerably enhance your buying and selling efficiency. Keep in mind that profitable buying and selling requires a mix of technical evaluation, danger administration, self-discipline, and steady studying. Mix chart sample recognition with different types of evaluation and at all times observe correct danger administration to extend your probabilities of success within the dynamic world of inventory buying and selling. Take into account consulting with a monetary advisor earlier than making any funding selections. The data offered on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation.

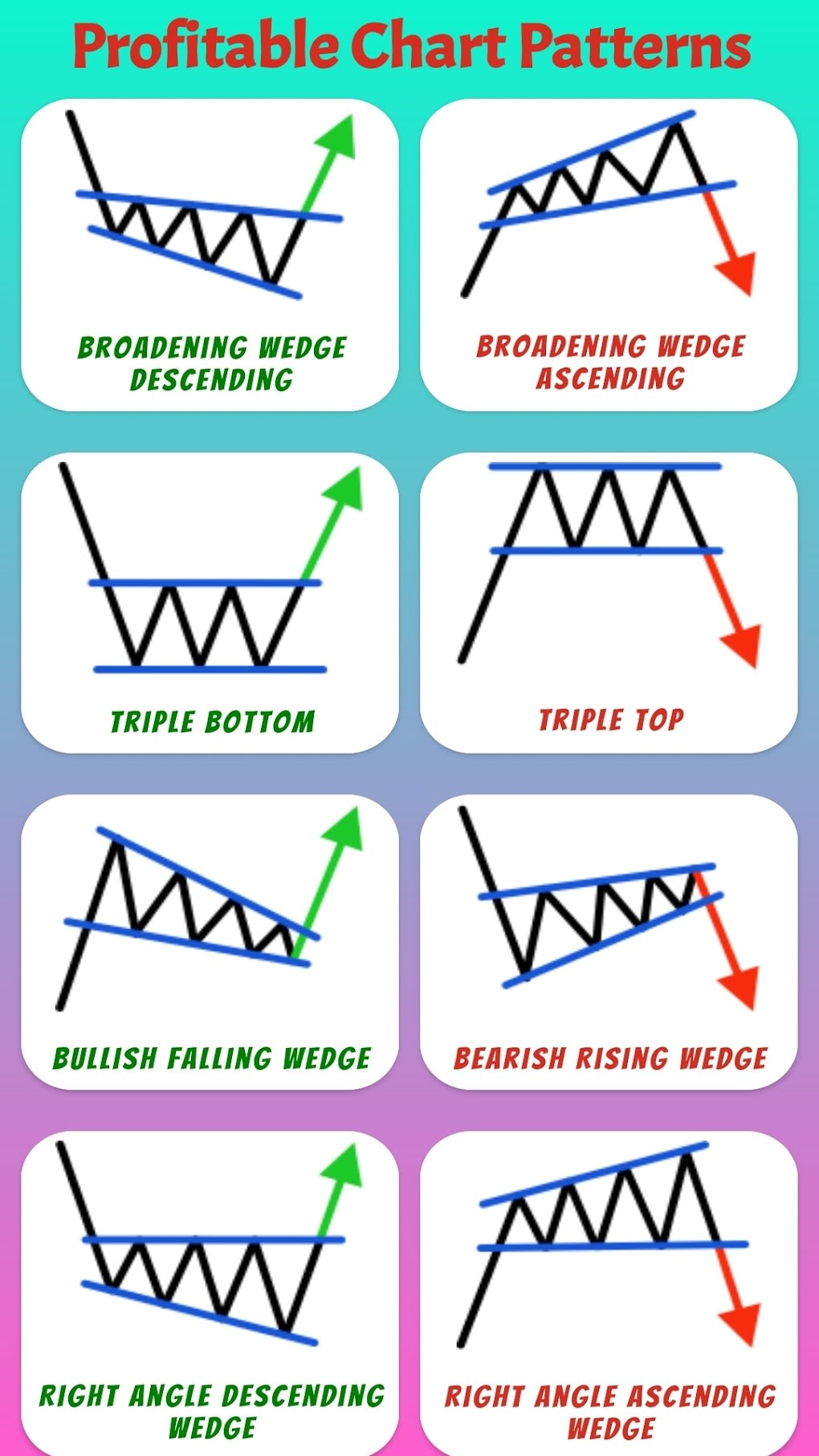

![10 Most Profitable Chart Patterns Analysis [PDF]](https://forexpops.com/wp-content/uploads/2023/01/Most-Profitable-Chart-Patterns.jpg)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding Revenue: The Most Worthwhile Inventory Chart Patterns and The best way to Commerce Them. We thanks for taking the time to learn this text. See you in our subsequent article!