Decoding SBI Charts on TradingView: A Complete Information for Merchants

Associated Articles: Decoding SBI Charts on TradingView: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding SBI Charts on TradingView: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding SBI Charts on TradingView: A Complete Information for Merchants

State Financial institution of India (SBI), one in all India’s largest public sector banks, is a big participant within the Indian inventory market. Understanding its value motion and predicting its future actions is essential for a lot of merchants. TradingView, a well-liked charting platform, provides a wealth of instruments and indicators to research SBI’s efficiency. This text will delve into varied facets of utilizing TradingView for analyzing SBI charts, overlaying technical evaluation, basic issues, threat administration, and sensible methods.

I. Understanding the SBI Chart on TradingView:

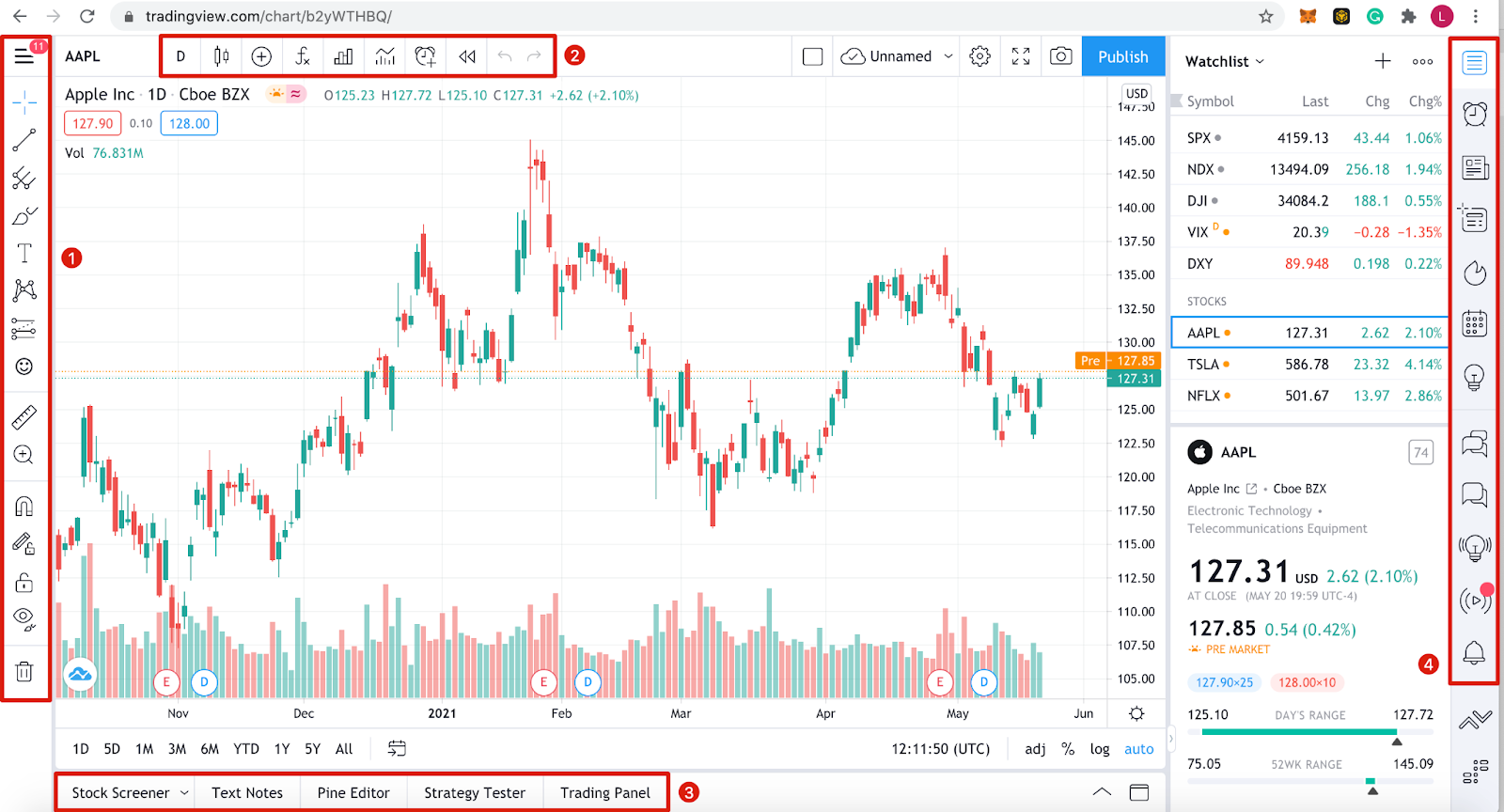

TradingView offers a user-friendly interface for charting SBI’s inventory value. You may entry the chart by trying to find "SBIN.NS" (NSE) or "SBIN.BO" (BSE) – relying on the alternate you are involved in – within the search bar. The chart shows SBI’s historic value information, sometimes together with open, excessive, low, and shut (OHLC) values. You may customise the chart’s timeframe (from intraday to yearly) to fit your buying and selling model.

Key Chart Parts to Focus On:

- Worth Candles: These visually symbolize the OHLC information for a selected timeframe. The colour (sometimes inexperienced for up and purple for down) signifies whether or not the closing value was increased or decrease than the opening value. The physique of the candle exhibits the vary between the open and shut, whereas the wicks symbolize the excessive and low costs.

- Shifting Averages (MA): These clean out value fluctuations and assist determine developments. Frequent MAs embrace the Easy Shifting Common (SMA) and the Exponential Shifting Common (EMA). Merchants typically use a number of MAs (e.g., 50-day SMA and 200-day SMA) to determine assist and resistance ranges and make sure developments.

- Relative Power Index (RSI): This momentum indicator helps gauge the power of value actions. RSI values above 70 typically recommend overbought circumstances, whereas values under 30 recommend oversold circumstances. These ranges can sign potential reversals.

- Quantity: Buying and selling quantity offers insights into the power of value actions. Excessive quantity confirms a pattern, whereas low quantity can recommend weak point.

- Assist and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt via. Assist ranges act as potential shopping for alternatives, whereas resistance ranges act as potential promoting alternatives.

- Bollinger Bands: These bands present value volatility. When costs contact the higher band, it could recommend overbought circumstances, and once they contact the decrease band, it could recommend oversold circumstances.

- MACD (Shifting Common Convergence Divergence): This momentum indicator helps determine pattern adjustments and potential purchase/promote alerts primarily based on the convergence and divergence of two transferring averages.

II. Technical Evaluation of SBI utilizing TradingView:

Technical evaluation focuses on previous value motion and quantity to foretell future value actions. TradingView lets you apply varied technical indicators and drawing instruments to research SBI’s chart.

Pattern Identification: Establish the general pattern (uptrend, downtrend, or sideways) utilizing transferring averages, trendlines, and candlestick patterns. An uptrend is characterised by increased highs and better lows, whereas a downtrend is characterised by decrease highs and decrease lows.

Assist and Resistance Ranges: Establish key assist and resistance ranges by observing previous value motion. Breaks above resistance ranges can sign bullish momentum, whereas breaks under assist ranges can sign bearish momentum.

Candlestick Patterns: Acknowledge candlestick patterns like hammer, hanging man, engulfing patterns, and doji to anticipate potential reversals or confirmations of current developments. TradingView’s drawing instruments make figuring out these patterns simpler.

Indicator Mixtures: Mix a number of indicators to verify alerts. For instance, a bullish crossover of the 50-day and 200-day SMA, coupled with an RSI above 50 and growing quantity, can recommend a powerful purchase sign.

III. Elementary Evaluation and its Affect on SBI Charts:

Whereas technical evaluation focuses on value motion, basic evaluation considers the underlying monetary well being and prospects of SBI. Elements to think about embrace:

- Monetary Efficiency: Analyze SBI’s monetary statements (revenue assertion, steadiness sheet, money movement assertion) to evaluate its profitability, liquidity, and solvency.

- Financial Situations: Contemplate the general financial atmosphere in India, together with rates of interest, inflation, and GDP development. These components can considerably affect SBI’s efficiency.

- Authorities Insurance policies: Authorities rules and insurance policies associated to the banking sector can affect SBI’s operations and profitability.

- Competitors: Assess the aggressive panorama inside the Indian banking sector. SBI’s market share and aggressive benefits are vital components.

- Information and Occasions: Keep up to date on information and occasions associated to SBI, comparable to new initiatives, mergers and acquisitions, and regulatory adjustments. These occasions can considerably affect the inventory value.

Integrating basic evaluation with technical evaluation offers a extra holistic view of SBI’s prospects and helps make extra knowledgeable buying and selling choices.

IV. Danger Administration Methods for SBI Buying and selling on TradingView:

Danger administration is essential for profitable buying and selling. TradingView provides instruments that can assist you handle threat:

- Place Sizing: Decide the suitable quantity to spend money on SBI primarily based in your threat tolerance and account measurement. By no means threat greater than you possibly can afford to lose.

- Cease-Loss Orders: Place stop-loss orders to restrict potential losses. These orders mechanically promote your SBI shares if the value falls to a predetermined degree.

- Take-Revenue Orders: Place take-profit orders to lock in earnings when your goal value is reached.

- Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio by investing in different property apart from SBI.

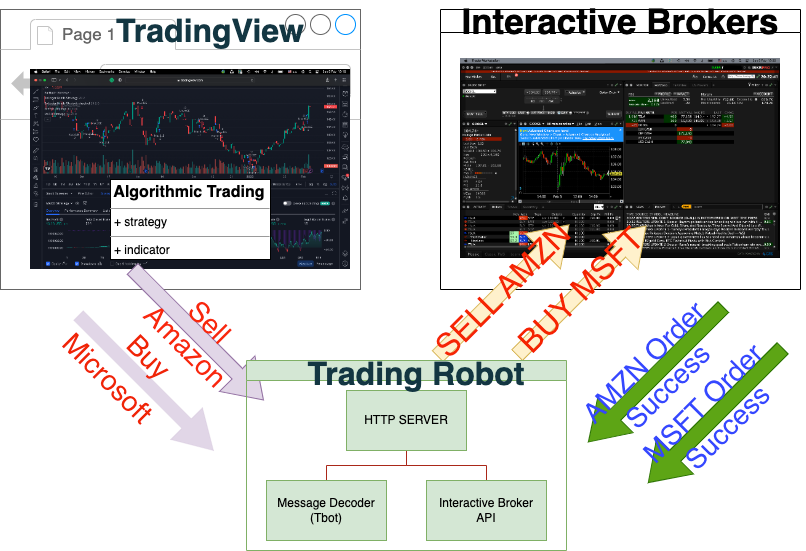

- Backtesting: Use TradingView’s backtesting capabilities to check your buying and selling methods on historic information. This helps consider the effectiveness of your methods and determine potential weaknesses.

V. Sensible Buying and selling Methods for SBI on TradingView:

A number of buying and selling methods will be employed when buying and selling SBI on TradingView:

- Pattern Following: Establish a transparent uptrend or downtrend and enter trades within the route of the pattern. Use transferring averages and trendlines to verify the pattern.

- Imply Reversion: Establish overbought or oversold circumstances utilizing indicators like RSI or Bollinger Bands and anticipate a value reversal.

- Breakout Buying and selling: Establish potential breakouts above resistance ranges or under assist ranges and enter trades within the route of the breakout.

- Swing Buying and selling: Maintain positions for a number of days or perhaps weeks, aiming to seize bigger value swings.

- Day Buying and selling: Enter and exit trades inside the identical buying and selling day, aiming to revenue from short-term value fluctuations.

VI. Conclusion:

TradingView offers a strong platform for analyzing SBI charts and growing efficient buying and selling methods. By combining technical evaluation with basic issues and implementing strong threat administration methods, merchants can enhance their probabilities of success. Do not forget that buying and selling includes threat, and no technique ensures earnings. Steady studying, adaptation, and disciplined execution are important for long-term success within the inventory market. All the time conduct thorough analysis and think about in search of recommendation from a certified monetary advisor earlier than making any funding choices. The knowledge offered on this article is for instructional functions solely and shouldn’t be construed as monetary recommendation.

Closure

Thus, we hope this text has offered helpful insights into Decoding SBI Charts on TradingView: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!