Decoding the 2000-Tick Chart: A Deep Dive into Excessive-Frequency Buying and selling and Market Microstructure

Associated Articles: Decoding the 2000-Tick Chart: A Deep Dive into Excessive-Frequency Buying and selling and Market Microstructure

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the 2000-Tick Chart: A Deep Dive into Excessive-Frequency Buying and selling and Market Microstructure. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the 2000-Tick Chart: A Deep Dive into Excessive-Frequency Buying and selling and Market Microstructure

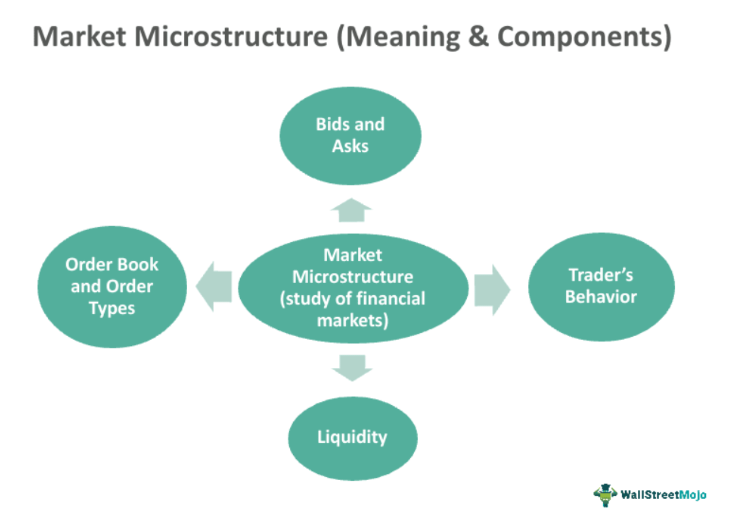

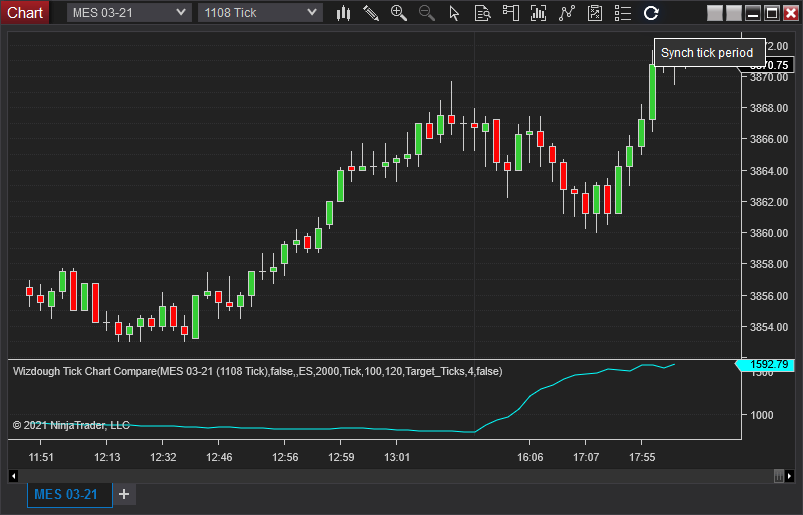

The 2000-tick chart, a comparatively unusual however more and more related charting device on the earth of high-frequency buying and selling (HFT) and market microstructure evaluation, represents a dramatic departure from conventional time-based charts. As an alternative of plotting worth information in opposition to mounted time intervals (e.g., 1-minute, 5-minute, or each day bars), a 2000-tick chart plots information factors for each 2000 worth modifications in a given asset. This basically shifts the main target from time to volume-weighted worth motion, revealing granular particulars typically obscured by the smoothing impact of time-based charts.

This text will discover the intricacies of the 2000-tick chart, discussing its benefits and downsides, its purposes in numerous buying and selling methods, and the technological concerns concerned in its implementation and interpretation. We’ll delve into the way it illuminates market microstructure dynamics, together with order ebook dynamics, liquidity fluctuations, and the influence of algorithmic buying and selling.

Understanding the Fundamentals: Tick Information and its Significance

Earlier than delving into the specifics of the 2000-tick chart, it is essential to know the idea of "tick information." A tick represents a single change within the worth of an asset. This variation might be a rise (uptick) or a lower (downtick) of the minimal worth increment allowed by the trade. For instance, if the minimal worth motion for a inventory is $0.01, every $0.01 change represents a single tick.

Tick information offers a high-resolution view of worth actions, capturing each incremental change. That is in stark distinction to time-based charts, which combination worth data over particular time intervals, doubtlessly masking vital worth fluctuations inside these intervals. The sheer quantity of tick information, nevertheless, necessitates specialised instruments and analytical strategies for efficient evaluation. That is the place the 2000-tick chart comes into play.

The 2000-Tick Chart: A Quantity-Weighted Perspective

The 2000-tick chart basically creates a bar for each 2000 worth modifications. Every bar represents a major quantity of buying and selling exercise, providing a singular perspective on worth motion pushed by order stream. The opening, excessive, low, and shutting costs of every bar are decided by the precise worth ranges in the beginning, highest level, lowest level, and finish of that 2000-tick interval.

This strategy gives a number of key benefits:

-

Diminished Noise: By aggregating information primarily based on ticks slightly than time, the 2000-tick chart filters out a lot of the "noise" typically related to high-frequency worth fluctuations. This noise might be brought on by fleeting order imbalances, momentary liquidity points, and even the actions of particular person merchants.

-

Emphasis on Order Circulate: The chart straight displays the cumulative influence of purchase and promote orders. Important worth actions are highlighted, indicating intervals of robust shopping for or promoting strain. This makes it notably helpful for understanding order ebook dynamics and figuring out potential development reversals.

-

Identification of Hidden Liquidity: By observing the worth actions inside every 2000-tick bar, merchants can doubtlessly establish hidden liquidity swimming pools. Massive worth modifications adopted by intervals of consolidation may point out the presence of enormous orders ready to be executed.

-

Algorithmic Buying and selling Insights: The 2000-tick chart can reveal patterns and traits of algorithmic buying and selling methods. These methods typically contain speedy order placement and cancellation, leaving distinct footprints on the tick information that may be analyzed utilizing this chart kind.

Disadvantages and Limitations

Whereas the 2000-tick chart gives precious insights, it additionally has limitations:

-

Time Variability: The length of every bar isn’t mounted; it relies on the buying and selling quantity and volatility of the asset. Excessive volatility results in shorter bars, whereas low volatility ends in longer bars. This makes direct time comparisons between bars tough.

-

Information Depth: Analyzing 2000-tick charts requires substantial computational assets and specialised software program able to dealing with the massive quantity of tick information.

-

Interpretation Complexity: Deciphering the chart requires a stable understanding of market microstructure and order stream dynamics. Novices may discover it difficult to discern significant patterns.

-

Not Appropriate for All Property: The 2000-tick chart is best for extremely liquid property with frequent worth modifications. It is likely to be much less informative for illiquid property with rare trades.

Purposes in Buying and selling Methods

The 2000-tick chart finds utility in a number of buying and selling methods:

-

Excessive-Frequency Buying and selling (HFT): HFT algorithms closely depend on tick information to establish fleeting arbitrage alternatives and execute trades at optimum costs. The 2000-tick chart might help refine these algorithms by offering a clearer image of order stream dynamics.

-

Scalping: Scalpers, who goal to revenue from small worth actions over brief intervals, can use the chart to establish entry and exit factors primarily based on order stream imbalances.

-

Market Making: Market makers, who present liquidity to the market, can use the chart to regulate their bid and ask costs primarily based on real-time order stream data.

-

Algorithmic Buying and selling Technique Improvement: The chart can be utilized to backtest and optimize algorithmic buying and selling methods by offering a extra real looking illustration of market situations.

Technological Issues

Implementing and using 2000-tick charts requires superior technological infrastructure:

-

Excessive-Velocity Information Feed: Entry to a high-speed, low-latency information feed is crucial to seize each tick.

-

Highly effective Computing Sources: Analyzing massive volumes of tick information calls for vital computing energy and reminiscence.

-

Specialised Charting Software program: Commonplace charting software program will not be able to dealing with the info quantity and distinctive traits of 2000-tick charts. Specialised software program designed for market microstructure evaluation is usually mandatory.

-

Information Storage and Administration: Environment friendly information storage and retrieval mechanisms are important for managing the massive quantities of tick information generated.

Conclusion:

The 2000-tick chart gives a singular and highly effective perspective on market dynamics, transferring past the constraints of conventional time-based charts. By specializing in volume-weighted worth motion, it reveals granular particulars of order stream, liquidity, and the influence of algorithmic buying and selling. Whereas it requires specialised instruments and experience, its potential for enhancing buying and selling methods and understanding market microstructure makes it a precious device for stylish merchants and researchers. Nevertheless, it is essential to grasp its limitations and use it together with different analytical instruments for a complete market evaluation. The way forward for high-frequency buying and selling and market microstructure analysis will probably see elevated reliance on such volume-based charting strategies, additional emphasizing the significance of understanding and mastering their intricacies.

Closure

Thus, we hope this text has supplied precious insights into Decoding the 2000-Tick Chart: A Deep Dive into Excessive-Frequency Buying and selling and Market Microstructure. We hope you discover this text informative and useful. See you in our subsequent article!