Decoding the 30-12 months Mounted Mortgage Price Chart: A Complete Information for 2024 and Past

Associated Articles: Decoding the 30-12 months Mounted Mortgage Price Chart: A Complete Information for 2024 and Past

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the 30-12 months Mounted Mortgage Price Chart: A Complete Information for 2024 and Past. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the 30-12 months Mounted Mortgage Price Chart: A Complete Information for 2024 and Past

The 30-year fixed-rate mortgage (FRM) stays the gold commonplace for homebuyers, providing the predictability of a constant month-to-month fee over three many years. Understanding the present panorama of 30-year mounted mortgage charges is essential for making knowledgeable monetary choices. This text will delve into the intricacies of decoding 30-year mounted mortgage charge charts, exploring the components influencing charges, offering historic context, and providing recommendation on tips on how to navigate the market successfully.

Understanding the Chart:

A typical 30-year mounted mortgage charge chart shows the rate of interest provided for a 30-year fixed-rate mortgage at varied time limits. The chart’s horizontal axis normally represents time (days, weeks, months, or years), whereas the vertical axis reveals the rate of interest. The road itself depicts the fluctuation of charges over the chosen interval. Some charts may additionally embrace further data, comparable to common charges, excessive and low charges for the interval, and presumably even predictions for future charges.

Key Elements Influencing 30-12 months Mounted Mortgage Charges:

Quite a few financial components intertwine to find out the prevailing 30-year mounted mortgage charges. Understanding these components is paramount for decoding the chart and anticipating future developments:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a pivotal function. By way of its financial coverage instruments, primarily the federal funds charge, the Fed influences borrowing prices throughout the economic system. Elevating the federal funds charge usually results in greater mortgage charges, whereas decreasing it tends to lower them. The Fed’s actions are sometimes mirrored virtually instantly within the chart, with charges shifting in tandem with the Fed’s bulletins and subsequent actions.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to lift rates of interest to curb inflation. This instantly impacts mortgage charges, as lenders alter their charges to compensate for the diminished worth of future repayments. Charts displaying inflation alongside mortgage charges can reveal a robust correlation.

-

Financial Progress: Robust financial progress can result in elevated demand for loans, pushing mortgage charges upward. Conversely, sluggish or damaging financial progress can lower demand and doubtlessly decrease charges. Observing financial indicators like GDP progress and employment figures alongside the speed chart gives useful context.

-

Authorities Intervention: Authorities insurance policies and rules regarding the housing market can influence mortgage charges. As an example, adjustments in government-sponsored enterprise (GSE) tips or tax insurance policies associated to mortgages can affect the general price of borrowing.

-

Investor Sentiment and Market Situations: Investor confidence and total market situations considerably have an effect on mortgage charges. Durations of uncertainty or financial downturn can result in greater charges as lenders search to mitigate threat. Conversely, durations of stability and progress can result in decrease charges.

-

Provide and Demand of Mortgages: The stability between the provision of accessible mortgages and the demand from homebuyers additionally impacts charges. Excessive demand in a restricted provide market can drive charges greater.

Historic Context: A Look Again at 30-12 months Mounted Mortgage Charges:

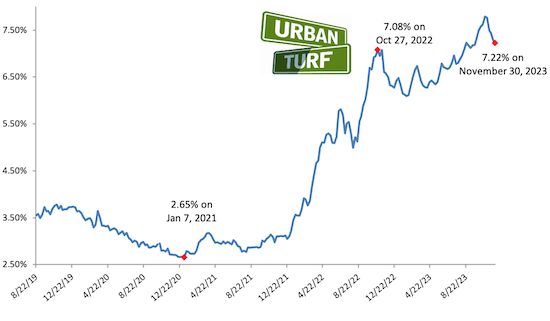

Analyzing historic 30-year mounted mortgage charge charts gives useful insights into long-term developments and cyclical patterns. As an example, charges have traditionally fluctuated considerably, starting from beneath 3% to over 18% all through completely different many years.

-

The Nineteen Seventies and Eighties: These many years witnessed exceptionally excessive mortgage charges, typically exceeding 15%, pushed by excessive inflation and unstable financial situations.

-

The Nineteen Nineties and 2000s: Charges usually declined throughout this era, reaching traditionally low ranges within the early 2000s. Nevertheless, the housing bubble and subsequent monetary disaster led to a interval of volatility.

-

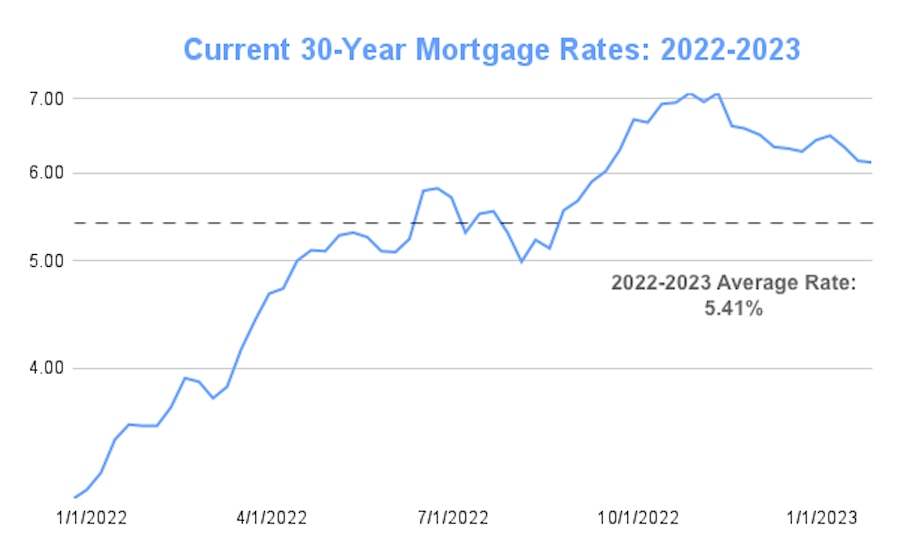

The 2010s and 2020s: Charges remained comparatively low within the early 2010s, fueled by accommodative financial coverage. The COVID-19 pandemic initially precipitated a brief dip, adopted by a big enhance in 2022 and early 2023 earlier than a slight decline in late 2023.

By finding out historic information, potential homebuyers can achieve a greater understanding of the cyclical nature of mortgage charges and keep away from making choices based mostly solely on short-term fluctuations.

Decoding the Chart and Making Knowledgeable Selections:

When decoding a 30-year mounted mortgage charge chart, contemplate the next:

-

Look past the present charge: Do not solely concentrate on the present charge. Contemplate historic developments and anticipate potential future actions based mostly on financial indicators.

-

Contemplate your private monetary scenario: The "greatest" charge is subjective and is dependent upon your particular person monetary circumstances, together with your credit score rating, down fee, and debt-to-income ratio.

-

Store round: Evaluate charges from a number of lenders to seek out probably the most aggressive provide. Totally different lenders might provide various charges based mostly on their threat evaluation and pricing methods.

-

Perceive the related charges: Mortgage charges aren’t the one price concerned. Consider closing prices, factors, and different charges when evaluating provides.

-

Seek the advice of a monetary advisor: Looking for recommendation from a professional monetary advisor might help you make knowledgeable choices based mostly in your particular monetary objectives and threat tolerance.

Predicting Future Charges: A Difficult Job:

Predicting future 30-year mounted mortgage charges is inherently difficult as a result of complexity of financial components concerned. Whereas financial forecasts and evaluation can present insights, they don’t seem to be ensures. Many components are unpredictable, together with geopolitical occasions and unexpected financial shocks. Due to this fact, relying solely on predictions may be dangerous.

Conclusion:

Understanding and decoding 30-year mounted mortgage charge charts is important for homebuyers. By contemplating the varied financial components influencing charges, finding out historic developments, and punctiliously evaluating your private monetary scenario, you can also make knowledgeable choices and safe a mortgage that aligns along with your long-term monetary objectives. Keep in mind to at all times store round, evaluate provides, and search skilled recommendation to navigate the complexities of the mortgage market successfully. The data offered on this article is for basic information and informational functions solely, and doesn’t represent monetary recommendation. At all times seek the advice of with a professional monetary skilled earlier than making any vital monetary choices.

Closure

Thus, we hope this text has offered useful insights into Decoding the 30-12 months Mounted Mortgage Price Chart: A Complete Information for 2024 and Past. We thanks for taking the time to learn this text. See you in our subsequent article!