Decoding the Aluminium Worth Chart: A Complete Evaluation

Associated Articles: Decoding the Aluminium Worth Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Aluminium Worth Chart: A Complete Evaluation. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Aluminium Worth Chart: A Complete Evaluation

Aluminium, a light-weight but robust metallic with distinctive conductivity and corrosion resistance, performs a vital position in varied industries, from transportation and development to packaging and shopper electronics. Understanding its value fluctuations is subsequently vital for companies and buyers alike. This text delves into the complexities of the aluminium value chart, analyzing the components driving its value actions and providing insights into decoding its tendencies.

Understanding the Worth Chart’s Panorama:

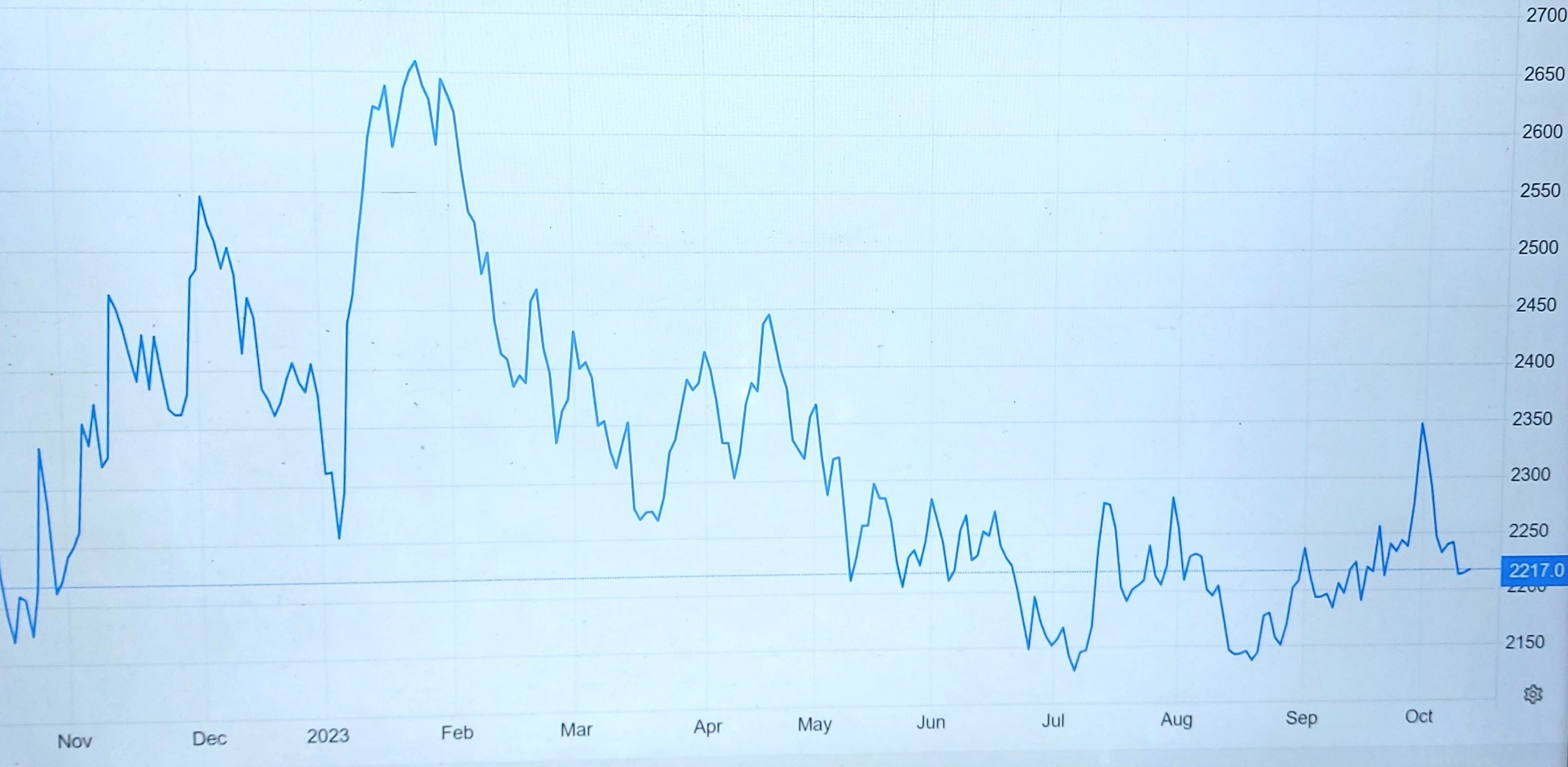

Aluminium costs are primarily quoted on the London Metallic Trade (LME), the world’s largest market for industrial metals. The LME value displays the value of three-month futures contracts, that means the value agreed upon for supply three months into the long run. This forward-looking nature introduces a level of hypothesis into the market, as costs replicate not solely present provide and demand but additionally market contributors’ expectations for future circumstances. The value is usually expressed in US {dollars} per metric tonne.

Analyzing the aluminium value chart requires contemplating a number of key features:

- Timeframe: Charts will be seen on varied timeframes, from intraday to yearly, every providing a distinct perspective. Brief-term charts reveal volatility and intraday fluctuations, whereas long-term charts illustrate broader tendencies and cycles.

- Indicators: Technical evaluation instruments, corresponding to shifting averages, relative power index (RSI), and Bollinger Bands, might help determine potential help and resistance ranges, pattern reversals, and overbought/oversold circumstances.

- Basic Evaluation: Understanding the underlying financial and geopolitical components influencing provide and demand is essential for decoding value actions.

Elements Driving Aluminium Worth Fluctuations:

The aluminium value chart is a dynamic reflection of the interaction between a number of key components:

1. Provide-Demand Dynamics: That is essentially the most basic driver. A worldwide scarcity of aluminium, pushed by elevated demand and constrained provide, usually pushes costs larger. Conversely, an oversupply results in value declines.

- Demand-Facet Elements: World financial progress is a big driver of aluminium demand. Sturdy progress in sectors like development, automotive, and packaging interprets into larger aluminium consumption. Technological developments and the rise of electrical automobiles (EVs) additionally enhance demand, as aluminium is a vital part in EV batteries and light-weight automobile components. Authorities insurance policies selling sustainable infrastructure and renewable vitality additional affect demand.

- Provide-Facet Elements: Aluminium manufacturing is energy-intensive, making vitality costs a vital issue. Excessive vitality prices enhance manufacturing bills, probably resulting in larger aluminium costs. Geopolitical instability, significantly in main aluminium-producing areas, can disrupt provide chains and affect costs. Manufacturing capability expansions or shutdowns additionally considerably have an effect on the market’s supply-demand stability. Moreover, environmental rules geared toward lowering carbon emissions can affect manufacturing prices and availability.

2. Vitality Costs: As talked about, aluminium manufacturing is energy-intensive, primarily counting on electrical energy. Fluctuations in electrical energy costs, significantly in areas with vital aluminium manufacturing, instantly affect manufacturing prices and, consequently, aluminium costs. The value of pure gasoline, one other vital vitality supply, additionally performs a task, particularly in areas the place it’s used for aluminium smelting.

3. Uncooked Materials Prices: Bauxite, the first ore from which alumina is extracted, and alumina itself, are essential uncooked supplies in aluminium manufacturing. Modifications of their costs instantly affect the general value of manufacturing aluminium, affecting its market value.

4. Trade Charges: The aluminium market is world, with costs quoted in US {dollars}. Fluctuations in change charges, significantly between the US greenback and the currencies of main aluminium-producing and -consuming nations, can affect the value. A stronger US greenback could make aluminium costlier for consumers utilizing different currencies, probably dampening demand.

5. Hypothesis and Funding: The LME is a futures market, that means that a good portion of buying and selling includes hypothesis on future value actions. Investor sentiment, pushed by macroeconomic components, geopolitical occasions, and market expectations, can considerably affect costs, resulting in each upward and downward value swings, typically no matter underlying provide and demand fundamentals.

6. Geopolitical Elements: Political instability, commerce disputes, and sanctions in main aluminium-producing or -consuming nations can disrupt provide chains and affect costs. For instance, sanctions imposed on a serious producer can result in provide shortages and value will increase.

7. Stock Ranges: LME warehouse inventories present insights into the market’s supply-demand stability. Excessive stock ranges usually counsel an oversupply, probably main to cost declines, whereas low stock ranges point out a good market and probably larger costs.

Deciphering the Aluminium Worth Chart:

Analyzing the aluminium value chart successfully requires a mix of technical and basic evaluation. Technical evaluation includes figuring out patterns, tendencies, and help/resistance ranges utilizing chart indicators. Basic evaluation focuses on understanding the underlying financial and geopolitical components driving provide and demand.

By combining each approaches, buyers and companies can develop a extra complete understanding of the aluminium market and make knowledgeable choices. For instance, a rising value chart supported by robust world financial progress and low stock ranges suggests a bullish outlook, whereas a declining value chart coupled with weak demand and excessive stock ranges signifies a bearish pattern.

Conclusion:

The aluminium value chart is a fancy tapestry woven from varied financial, geopolitical, and market-driven components. Understanding these components and using each technical and basic evaluation is essential for decoding value actions and making knowledgeable choices. Staying knowledgeable about world financial tendencies, vitality costs, uncooked materials prices, geopolitical occasions, and stock ranges is important for navigating the dynamic panorama of the aluminium market. Whereas predicting future value actions with certainty is unimaginable, an intensive understanding of those components can considerably improve the flexibility to anticipate potential tendencies and mitigate dangers. The aluminium value chart, subsequently, serves not simply as a report of previous efficiency however as an important device for understanding the current and anticipating the way forward for this significant metallic within the world economic system.

Closure

Thus, we hope this text has offered precious insights into Decoding the Aluminium Worth Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!