Decoding the Ascending Triangle: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Ascending Triangle: A Complete Information to This Highly effective Chart Sample

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Ascending Triangle: A Complete Information to This Highly effective Chart Sample. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Ascending Triangle: A Complete Information to This Highly effective Chart Sample

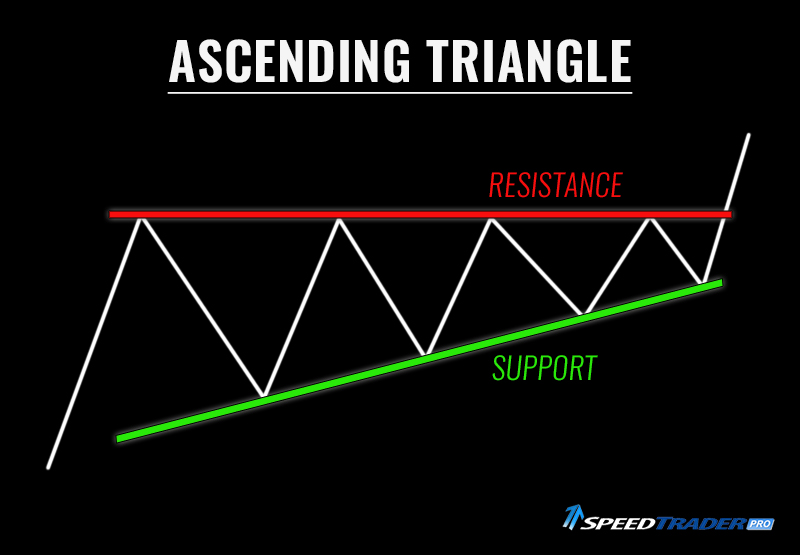

The ascending triangle, a prevalent chart sample in technical evaluation, signifies a interval of consolidation characterised by growing worth highs and persistently flat, or barely rising, lows. This sample, usually seen as bullish, suggests a possible breakout to the upside, providing merchants a helpful device for figuring out potential entry and exit factors. Nevertheless, understanding its nuances, variations, and potential pitfalls is essential for profitable implementation. This text delves deep into the ascending triangle, exploring its formation, identification, affirmation, buying and selling methods, and threat administration methods.

Formation and Identification:

The ascending triangle is shaped by two converging trendlines:

-

Higher Trendline (Resistance): This line connects a sequence of progressively increased highs. It represents the worth ceiling that patrons are struggling to beat.

-

Decrease Trendline (Help): This line connects a sequence of persistently flat or barely rising lows. It signifies a degree of help the place patrons are stepping in to forestall additional worth declines.

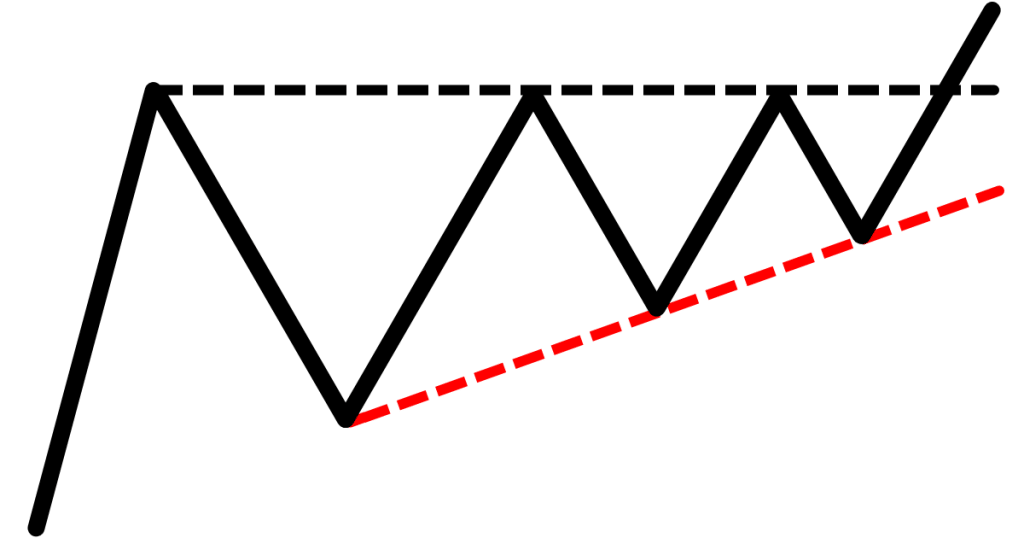

The important thing attribute differentiating the ascending triangle from different patterns is the comparatively flat or barely upward sloping decrease trendline. This signifies a steadiness between shopping for and promoting stress, with patrons persistently absorbing promoting stress close to the help degree. The higher trendline, representing the resistance, exhibits growing shopping for curiosity, however not sufficient to interrupt by the resistance degree instantly. This era of consolidation can final for a number of weeks and even months, relying on the underlying asset’s volatility and market circumstances.

Figuring out a Legitimate Ascending Triangle:

Whereas the visible illustration is essential, a number of components contribute to confirming a sound ascending triangle formation:

-

Clear Trendlines: The trendlines needs to be drawn utilizing at the very least two clear swing highs and two clear swing lows. The extra factors that align neatly alongside the trendlines, the stronger the sample’s validity. Subjectivity in drawing trendlines exists, so totally different analysts would possibly draw barely totally different traces. Nevertheless, the final form and course needs to be constant.

-

Convergence: The trendlines ought to step by step converge, indicating a narrowing of the worth vary. This convergence amplifies the anticipation of a breakout, as the worth turns into more and more constrained.

-

Quantity Evaluation: Whereas not all the time a definitive indicator, observing quantity patterns can strengthen the interpretation of an ascending triangle. Sometimes, quantity tends to lower as the worth consolidates inside the sample, reflecting a decline in buying and selling exercise. A surge in quantity accompanying the breakout confirms the sample’s validity.

-

Contextual Evaluation: Analyzing the broader market context is important. Think about the general market development, the asset’s particular sector efficiency, and any related information or occasions that might affect the worth motion. A bullish ascending triangle is extra probably to reach a bullish market atmosphere.

Affirmation and Breakout:

Probably the most essential side of buying and selling an ascending triangle is figuring out the breakout. A breakout is taken into account confirmed when the worth decisively breaks above the higher trendline, accompanied by elevated quantity. This breakout signifies that patrons have overcome the resistance, probably triggering a big worth upswing.

A number of components can assist verify a breakout:

-

Quantity Surge: A big enhance in buying and selling quantity through the breakout confirms the power of the transfer and reduces the chance of a false breakout. Low quantity breakouts are sometimes unreliable and may shortly reverse.

-

Worth Motion Affirmation: Search for candlestick patterns confirming the breakout, reminiscent of a powerful bullish candle (e.g., a bullish engulfing sample) piercing the higher trendline.

-

Retest of the Breakout Degree: After the preliminary breakout, a pullback to retest the damaged higher trendline can present a helpful entry alternative for merchants who missed the preliminary transfer. This retest acts as a affirmation of the breakout’s validity.

Buying and selling Methods:

A number of buying and selling methods could be employed when buying and selling an ascending triangle:

-

Breakout Technique: This includes getting into a protracted place after a decisive breakout above the higher trendline, with a stop-loss order positioned just under the decrease trendline. The revenue goal could be decided utilizing numerous strategies, reminiscent of measuring the peak of the triangle and projecting that distance past the breakout level.

-

Pullback Technique: This includes ready for a pullback to the damaged higher trendline after the preliminary breakout, offering a probably decrease entry level with decreased threat. The stop-loss order stays under the decrease trendline.

-

Mixture Technique: This technique combines components of each the breakout and pullback methods, permitting for a number of entry factors and threat administration alternatives.

Threat Administration:

Efficient threat administration is essential when buying and selling ascending triangles:

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Inserting the stop-loss order just under the decrease trendline is a standard follow.

-

Place Sizing: Decide the suitable place dimension primarily based in your threat tolerance and account steadiness. Keep away from over-leveraging, as this will result in important losses in case of a false breakout or surprising market actions.

-

Trailing Cease-Loss: As soon as the worth strikes in your favor, think about using a trailing stop-loss order to guard your income as the worth continues to rise.

False Breakouts:

False breakouts are a big threat when buying and selling ascending triangles. A false breakout happens when the worth briefly breaks above the higher trendline however shortly reverses, trapping merchants who entered lengthy positions. To mitigate this threat:

-

Quantity Affirmation: Solely enter trades if the breakout is accompanied by a big enhance in quantity.

-

Candlestick Affirmation: Search for robust bullish candlestick patterns confirming the breakout.

-

Keep away from Coming into on Marginal Breakouts: Solely enter trades if the worth decisively breaks above the higher trendline.

Variations and Limitations:

Whereas the basic ascending triangle shows a comparatively flat decrease trendline, variations exist:

-

Barely Rising Decrease Trendline: A barely upward-sloping decrease trendline suggests stronger underlying shopping for stress.

-

Prolonged Consolidation: Extended consolidation intervals can result in elevated uncertainty and probably scale back the reliability of the sample.

Conclusion:

The ascending triangle is a robust chart sample that may present helpful insights into potential worth actions. Nevertheless, it is important to know its nuances, limitations, and potential dangers. By combining technical evaluation, quantity evaluation, and efficient threat administration, merchants can leverage this sample to establish probably worthwhile buying and selling alternatives. Keep in mind that no chart sample ensures success, and thorough analysis and threat administration are essential for mitigating potential losses. All the time think about the broader market context and use a number of indicators to verify your evaluation earlier than getting into any commerce.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Ascending Triangle: A Complete Information to This Highly effective Chart Sample. We hope you discover this text informative and useful. See you in our subsequent article!