Decoding the Chart: A Complete Information to Studying Buying and selling Charts

Associated Articles: Decoding the Chart: A Complete Information to Studying Buying and selling Charts

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Chart: A Complete Information to Studying Buying and selling Charts. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Chart: A Complete Information to Studying Buying and selling Charts

Buying and selling charts are the bedrock of technical evaluation, offering a visible illustration of value actions over time. Understanding learn how to learn them is essential for any aspiring or skilled dealer, whatever the asset class – shares, foreign exchange, cryptocurrencies, or commodities. This complete information will equip you with the information to interpret numerous chart sorts and establish key patterns that may inform your buying and selling selections.

I. Chart Varieties: The Basis of Visible Evaluation

Step one in mastering chart studying is knowing the completely different chart sorts accessible. Every affords a novel perspective on value motion, and choosing the proper one will depend on your buying and selling fashion and the timeframe you’re analyzing.

-

Line Charts: The best kind, line charts join closing costs over a particular interval. They spotlight the general pattern however lack the element of different chart sorts. They’re greatest suited to figuring out long-term traits and main help and resistance ranges.

-

Bar Charts: These charts show the excessive, low, open, and shut (OHLC) costs for a given interval. The vertical line represents the worth vary (excessive to low), whereas a small horizontal line on the left signifies the opening value and an analogous line on the appropriate represents the closing value. Bar charts supply a richer image than line charts, revealing the intraday value volatility.

-

Candlestick Charts: These are the most well-liked chart kind amongst merchants. Just like bar charts, they present OHLC information, however with a visible illustration that enhances sample recognition. A "physique" represents the vary between the open and shut costs. A inexperienced (or white) physique signifies a closing value increased than the opening value (bullish), whereas a crimson (or black) physique signifies a closing value decrease than the opening value (bearish). "Wicks" or "shadows" lengthen above and under the physique, exhibiting the excessive and low costs for the interval. Candlestick charts are perfect for figuring out candlestick patterns, which we’ll talk about later.

II. Key Chart Elements: Understanding the Axes and Scales

Earlier than diving into chart patterns, let’s perceive the fundamental parts:

-

X-Axis (Horizontal): This represents time. The dimensions can vary from seconds (intraday) to years (long-term). The precise timeframe (e.g., 1-minute, 5-minute, every day, weekly) is essential and ought to be chosen primarily based in your buying and selling technique.

-

Y-Axis (Vertical): This represents value. The dimensions is set by the asset’s value vary. You’ll be able to modify the size to zoom in or out, specializing in particular value ranges.

-

Value Scales: Charts can use linear or logarithmic scales. Linear scales present equal value increments, whereas logarithmic scales compress bigger value actions, making it simpler to visualise long-term traits in unstable property.

III. Figuring out Developments: The Basis of Technical Evaluation

Developments are the overarching course of value motion. Figuring out the prevailing pattern is key to profitable buying and selling. There are three most important pattern sorts:

-

Uptrend: A sequence of upper highs and better lows. Costs are typically transferring upwards.

-

Downtrend: A sequence of decrease highs and decrease lows. Costs are typically transferring downwards.

-

Sideways (or Vary-bound) Pattern: Costs fluctuate inside an outlined vary, with out a clear upward or downward bias.

Figuring out traits includes utilizing trendlines, that are traces drawn connecting swing highs (for downtrends) or swing lows (for uptrends). A break of a trendline typically alerts a possible pattern reversal.

IV. Help and Resistance Ranges: Key Value Zones

Help ranges are value factors the place the worth is anticipated to search out shopping for stress and bounce again up. Resistance ranges are value factors the place promoting stress is anticipated, resulting in a value decline. These ranges are sometimes shaped by earlier highs and lows, trendlines, or psychological value factors (e.g., spherical numbers). A break of a help degree typically confirms a bearish sign, whereas a break of a resistance degree confirms a bullish sign.

V. Chart Patterns: Unveiling Predictive Indicators

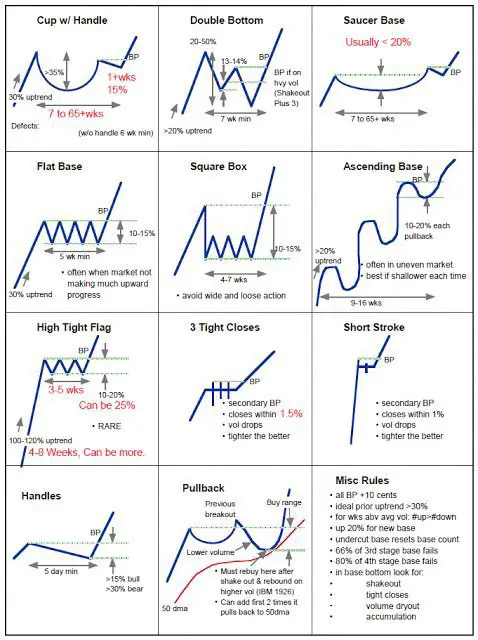

Chart patterns are recurring formations that may predict future value actions. Recognizing these patterns can present beneficial buying and selling alerts. Listed here are some widespread chart patterns:

-

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the very best. A break under the neckline confirms the sample.

-

Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders. A break above the neckline confirms the sample.

-

Double High/Backside: Bearish (double prime) or bullish (double backside) reversal patterns shaped by two consecutive peaks (tops) or troughs (bottoms) at roughly the identical value degree. A break under the neckline (double prime) or above the help line (double backside) confirms the sample.

-

Triangles: Consolidation patterns that may be symmetrical, ascending, or descending. They sometimes precede a breakout within the course of the prevailing pattern.

-

Flags and Pennants: Continuation patterns that happen throughout sturdy traits. They’re characterised by a quick interval of consolidation earlier than the pattern resumes.

-

Wedges: These are sloping patterns that may be ascending (bullish) or descending (bearish). The break typically signifies a continuation or reversal of the pattern.

VI. Indicators: Enhancing Chart Evaluation

Technical indicators are mathematical calculations utilized to cost information to generate alerts. They will improve chart evaluation by confirming traits, figuring out potential reversals, and measuring momentum. Some fashionable indicators embody:

-

Transferring Averages (MA): Calculate the common value over a particular interval (e.g., 20-day MA, 50-day MA, 200-day MA). They clean out value fluctuations and spotlight traits.

-

Relative Energy Index (RSI): Measures the magnitude of current value modifications to guage overbought or oversold situations. Readings above 70 are sometimes thought-about overbought, whereas readings under 30 are thought-about oversold.

-

MACD (Transferring Common Convergence Divergence): Identifies modifications in momentum by evaluating two transferring averages. Crossovers of the MACD traces can generate purchase or promote alerts.

-

Bollinger Bands: Plot normal deviations round a transferring common, indicating volatility. Value actions exterior the bands can counsel overbought or oversold situations.

VII. Timeframes: Adapting to Your Buying and selling Model

The timeframe you select considerably impacts your chart evaluation. Brief-term merchants (scalpers and day merchants) sometimes use charts with shorter timeframes (e.g., 1-minute, 5-minute, 15-minute), specializing in intraday value actions. Swing merchants and long-term buyers make the most of longer timeframes (e.g., every day, weekly, month-to-month), specializing in broader traits. It is essential to pick a timeframe that aligns together with your buying and selling technique and danger tolerance.

VIII. Follow and Refinement: The Key to Mastery

Studying buying and selling charts successfully requires follow and expertise. Begin by analyzing historic information and familiarizing your self with completely different chart sorts and indicators. Experiment with completely different timeframes and methods. Backtesting your buying and selling concepts on historic information is essential to refine your strategy and reduce danger. Keep in mind that no single indicator or sample ensures success. Profitable buying and selling includes combining chart evaluation with danger administration, elementary evaluation, and a disciplined strategy. Steady studying and adaptation are important for navigating the dynamic world of monetary markets.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Chart: A Complete Information to Studying Buying and selling Charts. We respect your consideration to our article. See you in our subsequent article!