Decoding the Chart of Accounts: A Complete Information for US Companies

Associated Articles: Decoding the Chart of Accounts: A Complete Information for US Companies

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Chart of Accounts: A Complete Information for US Companies. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Chart of Accounts: A Complete Information for US Companies

The Chart of Accounts (COA) is the spine of any profitable enterprise’s monetary administration. It is a structured listing of all of the accounts an organization makes use of to file its monetary transactions. Consider it as an in depth organizational map for all of your firm’s cash – the place it comes from, the place it goes, and what it is used for. Whereas seemingly easy at first look, a well-designed Chart of Accounts within the USA is essential for correct monetary reporting, tax compliance, and knowledgeable decision-making. This text will delve into the intricacies of making and sustaining a strong COA tailor-made to US enterprise wants.

Understanding the Fundamentals:

A COA is actually a categorized ledger of all of your firm’s accounts. Every account represents a particular facet of your enterprise’s monetary exercise. These accounts are sometimes grouped into 5 fundamental classes, following usually accepted accounting rules (GAAP):

-

Property: These signify what your organization owns. Examples embrace money, accounts receivable (cash owed to you by prospects), stock, tools, and buildings. Property are listed so as of liquidity, that means how shortly they are often transformed into money.

-

Liabilities: These signify what your organization owes to others. Examples embrace accounts payable (cash you owe to suppliers), loans payable, salaries payable, and taxes payable. Liabilities are listed so as of maturity, that means how quickly they’re due.

-

Fairness: This represents the house owners’ stake within the firm. For sole proprietorships and partnerships, that is usually the proprietor’s capital. For companies, it consists of frequent inventory, retained earnings (earnings reinvested within the enterprise), and treasury inventory (firm’s personal inventory repurchased).

-

Income: This represents the revenue generated from the corporate’s core operations. Examples embrace gross sales income, service income, and curiosity income.

-

Bills: These signify the prices incurred in producing income. Examples embrace price of products offered (COGS), salaries expense, hire expense, utilities expense, and advertising expense.

Creating a Chart of Accounts for US Companies:

Making a COA shouldn’t be a one-size-fits-all course of. The perfect COA for your enterprise will rely upon elements equivalent to your {industry}, measurement, and complexity. Nevertheless, some frequent rules apply:

-

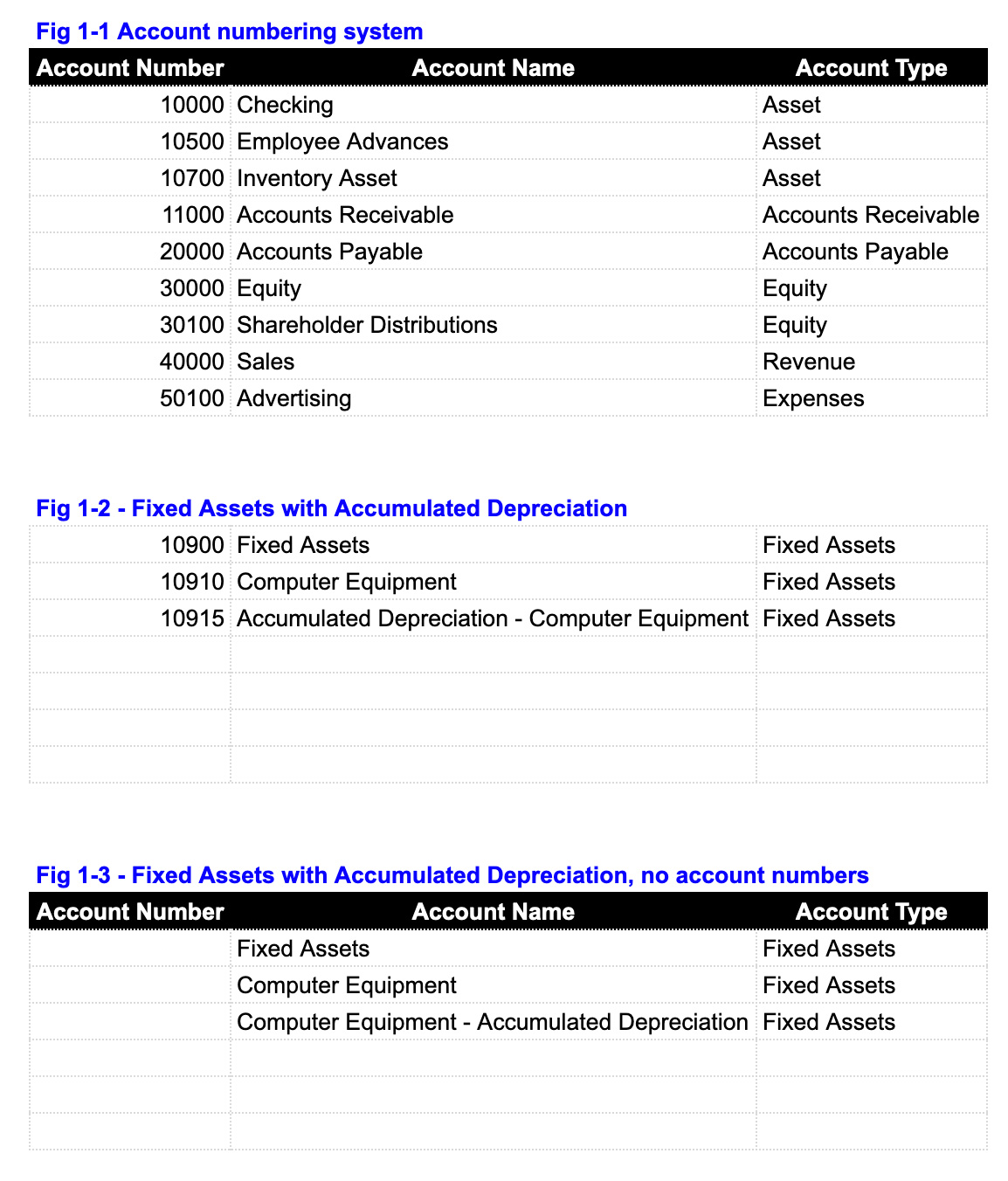

Consistency: Preserve consistency in your account naming conventions and numbering system. This can guarantee readability and facilitate correct reporting. A standard method is utilizing a numerical system, with sub-accounts having extra detailed numbers (e.g., 1000 Money, 1010 Checking Account, 1020 Financial savings Account).

-

Specificity: Use particular account names to trace your monetary actions precisely. As a substitute of a common "Bills" account, create separate accounts for hire, utilities, salaries, and advertising. This granular degree of element supplies useful insights into your enterprise’s efficiency.

-

Business-Particular Accounts: Contemplate incorporating industry-specific accounts related to your enterprise. For instance, a producing firm would possibly want accounts for uncooked supplies, work-in-progress, and completed items. A retail enterprise would possibly want accounts for gross sales reductions and returns.

-

Future-Proofing: Design your COA with future progress in thoughts. Embody accounts that you just would possibly want sooner or later, even in the event you do not presently use them. This can stop the necessity for main COA restructuring later.

-

Compliance: Guarantee your COA complies with US GAAP and related tax rules. That is essential for correct monetary reporting and avoiding potential penalties.

Instance Chart of Accounts:

A simplified instance of a COA for a small retail enterprise would possibly appear like this:

Property:

- 1000 Money

- 1100 Accounts Receivable

- 1200 Stock

- 1300 Pay as you go Bills

- 1400 Tools

- 1500 Amassed Depreciation

Liabilities:

- 2000 Accounts Payable

- 2100 Salaries Payable

- 2200 Gross sales Tax Payable

- 2300 Loans Payable

Fairness:

- 3000 Proprietor’s Fairness

Income:

- 4000 Gross sales Income

- 4100 Gross sales Returns and Allowances

Bills:

- 5000 Value of Items Bought

- 5100 Salaries Expense

- 5200 Lease Expense

- 5300 Utilities Expense

- 5400 Advertising Expense

- 5500 Depreciation Expense

Software program and Automation:

Fashionable accounting software program considerably simplifies COA administration. Software program like QuickBooks, Xero, and Sage supply pre-built COA templates and instruments for customizing and sustaining your accounts. These methods automate many points of monetary recording, reporting, and evaluation, liberating up your time to concentrate on strategic enterprise selections.

Sustaining and Updating the Chart of Accounts:

Your COA shouldn’t be a static doc. As your enterprise grows and evolves, you may must replace your COA to mirror adjustments in your operations. This would possibly contain including new accounts, modifying current accounts, or eradicating out of date accounts. Common evaluations are important to make sure your COA stays correct and related.

The Significance of a Nicely-Structured COA:

A well-structured COA provides quite a few advantages:

- Correct Monetary Reporting: Supplies a transparent and correct image of your organization’s monetary well being.

- Improved Resolution-Making: Allows data-driven selections based mostly on dependable monetary data.

- Simplified Tax Compliance: Facilitates correct tax preparation and reduces the danger of errors.

- Enhanced Inside Management: Improves inside management over monetary transactions.

- Streamlined Auditing: Simplifies the audit course of and reduces audit charges.

Conclusion:

The Chart of Accounts is a basic instrument for any US enterprise. Whereas it’d appear to be a technical element, a well-designed and meticulously maintained COA is essential for monetary accuracy, regulatory compliance, and knowledgeable strategic decision-making. By understanding the rules outlined on this article and leveraging accessible accounting software program, companies can construct a strong COA that helps their progress and success. Bear in mind to seek the advice of with a certified accountant or monetary advisor to make sure your COA aligns together with your particular enterprise wants and complies with all relevant rules. Investing effort and time in creating a strong COA is an funding within the long-term well being and success of your enterprise.

/answer/img0004700002.png)

Closure

Thus, we hope this text has offered useful insights into Decoding the Chart of Accounts: A Complete Information for US Companies. We admire your consideration to our article. See you in our subsequent article!