Decoding the Chart of Accounts: The Spine of Monetary Reporting

Associated Articles: Decoding the Chart of Accounts: The Spine of Monetary Reporting

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Chart of Accounts: The Spine of Monetary Reporting. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Chart of Accounts: The Spine of Monetary Reporting

/Financial%20Statements%20Decoding%20the%20Backbone%20of%20Business.webp)

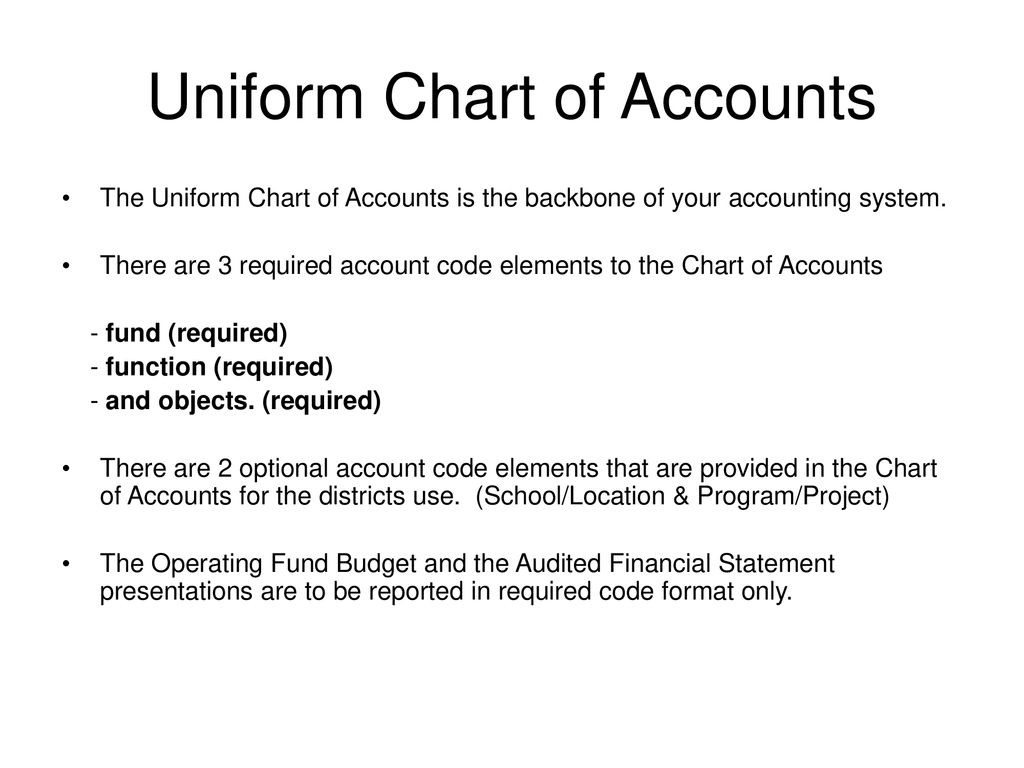

The muse of any strong accounting system rests upon a seemingly easy, but critically essential, doc: the chart of accounts. This seemingly mundane record is, in actuality, a meticulously organized, hierarchical construction that categorizes each monetary transaction inside a enterprise. Understanding its objective, construction, and implications is essential for correct monetary reporting, efficient monetary administration, and profitable enterprise operation. This text will delve into the intricacies of the chart of accounts, exploring its parts, advantages, and greatest practices for implementation and upkeep.

What’s a Chart of Accounts?

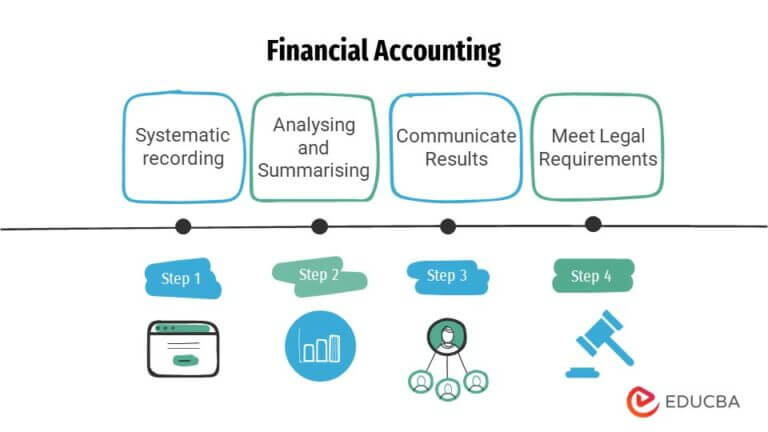

A chart of accounts (COA) is a complete record of all of the accounts utilized by a enterprise to document its monetary transactions. Consider it as an in depth index for a corporation’s monetary life. Every account represents a selected ingredient of the corporate’s monetary exercise, categorized based on its nature. These accounts are organized in a hierarchical construction, usually utilizing a numbering system to make sure consistency and facilitate straightforward retrieval of data. This structured strategy permits for the systematic recording, classification, and summarization of economic knowledge, finally resulting in correct monetary statements.

The accounts inside a COA are usually categorized into broad teams, reflecting the elemental components of the accounting equation: Property = Liabilities + Fairness. Every of those classes is additional subdivided into extra particular accounts, offering a granular view of the corporate’s monetary place.

Key Parts of a Chart of Accounts:

A typical chart of accounts contains accounts from the next classes:

-

Property: These signify what an organization owns. Examples embrace:

- Present Property: Money, Accounts Receivable, Stock, Pay as you go Bills (short-term property anticipated to be transformed into money inside a 12 months).

- Non-Present Property: Property, Plant, and Gear (PP&E), Intangible Property (patents, copyrights), Lengthy-term Investments.

-

Liabilities: These signify what an organization owes to others. Examples embrace:

- Present Liabilities: Accounts Payable, Salaries Payable, Brief-term Loans (obligations due inside a 12 months).

- Non-Present Liabilities: Lengthy-term Loans, Bonds Payable, Deferred Income (obligations due past a 12 months).

-

Fairness: This represents the house owners’ stake within the firm. Examples embrace:

- Contributed Capital: Inventory issued to shareholders.

- Retained Earnings: Gathered income that haven’t been distributed as dividends.

-

Income: This represents the revenue generated from the corporate’s core operations. Examples embrace:

- Gross sales Income, Service Income, Curiosity Income, Rental Income.

-

Bills: These signify the prices incurred in producing income. Examples embrace:

- Price of Items Offered (COGS), Salaries Expense, Hire Expense, Utilities Expense, Advertising Expense.

The Significance of a Effectively-Structured Chart of Accounts:

A well-designed chart of accounts is instrumental in a number of elements of economic administration:

-

Correct Monetary Reporting: A correctly structured COA ensures that each one transactions are recorded within the right accounts, resulting in correct and dependable monetary statements. That is essential for making knowledgeable enterprise choices, attracting buyers, and complying with regulatory necessities.

-

Improved Monetary Evaluation: An in depth COA permits for in-depth monetary evaluation. By analyzing knowledge from particular accounts, companies can establish developments, pinpoint areas for enchancment, and make strategic changes to their operations.

-

Enhanced Inner Management: A well-defined COA contributes to stronger inner controls by offering a framework for monitoring transactions and stopping errors or fraud. Clear account segregation helps in monitoring monetary actions and figuring out potential irregularities.

-

Streamlined Auditing: A well-organized COA simplifies the auditing course of. Auditors can simply hint transactions and confirm the accuracy of economic data, decreasing the effort and time required for audits.

-

Facilitated Budgeting and Forecasting: The COA supplies a framework for budgeting and forecasting. By analyzing previous knowledge from varied accounts, companies can create extra correct budgets and forecasts for the longer term.

-

Higher Choice Making: The detailed monetary data supplied by a well-designed COA allows administration to make knowledgeable choices about pricing, useful resource allocation, and funding methods.

Designing and Implementing a Chart of Accounts:

Creating an efficient COA requires cautious planning and consideration of the precise wants of the enterprise. Listed here are some key issues:

-

Business Requirements: Familiarize your self with industry-specific accounting practices and requirements to make sure compliance.

-

Firm Measurement and Complexity: The complexity of the COA ought to align with the scale and nature of the enterprise. Smaller companies might require a less complicated COA, whereas bigger, extra advanced companies may have a extra detailed construction.

-

Future Development: Design the COA with future development in thoughts. Permit for the addition of recent accounts because the enterprise expands and its operations change into extra various.

-

Account Numbering System: Implement a constant and logical account numbering system to facilitate straightforward identification and retrieval of data. A hierarchical system, utilizing a mix of numbers and letters, is commonly most well-liked.

-

Common Evaluate and Updates: The COA shouldn’t be a static doc. It needs to be commonly reviewed and up to date to mirror modifications within the enterprise’s operations and accounting requirements.

Sustaining the Chart of Accounts:

As soon as carried out, the COA requires ongoing upkeep to make sure its accuracy and relevance. This contains:

-

Common Audits: Periodically assessment the COA to make sure all accounts are nonetheless related and precisely mirror the corporate’s actions.

-

Account Reconciliation: Recurrently reconcile the balances within the COA with supporting documentation to establish and proper any discrepancies.

-

Coaching and Documentation: Present ample coaching to all personnel concerned in utilizing the COA. Keep clear and up-to-date documentation of the COA’s construction and utilization.

-

Software program Integration: Combine the COA with accounting software program to streamline knowledge entry, reporting, and evaluation.

Conclusion:

The chart of accounts is excess of only a record of accounts; it’s the spine of an organization’s monetary reporting system. A well-designed and meticulously maintained COA is essential for correct monetary reporting, efficient monetary administration, and knowledgeable decision-making. By understanding the rules of COA design, implementation, and upkeep, companies can set up a sturdy basis for his or her monetary operations and obtain larger success. Ignoring its significance can result in inaccurate monetary statements, hindering the flexibility to make strategic choices and probably resulting in important monetary issues down the road. Subsequently, investing effort and time in creating and sustaining a complete and correct chart of accounts is a vital funding within the long-term well being and success of any enterprise.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Chart of Accounts: The Spine of Monetary Reporting. We hope you discover this text informative and useful. See you in our subsequent article!