Decoding the Copper Worth Chart: A Complete Evaluation

Associated Articles: Decoding the Copper Worth Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Copper Worth Chart: A Complete Evaluation. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Copper Worth Chart: A Complete Evaluation

Copper, typically dubbed "Dr. Copper" for its skill to seemingly predict financial well being, holds a singular place within the commodities market. Its value chart, a fancy tapestry woven from world financial traits, geopolitical occasions, and supply-demand dynamics, provides an enchanting perception into the world’s financial pulse. This text delves deep into the intricacies of the copper value chart, exploring its historic trajectory, key influencing elements, and potential future actions.

A Historic Perspective: From Increase to Bust and Again Once more

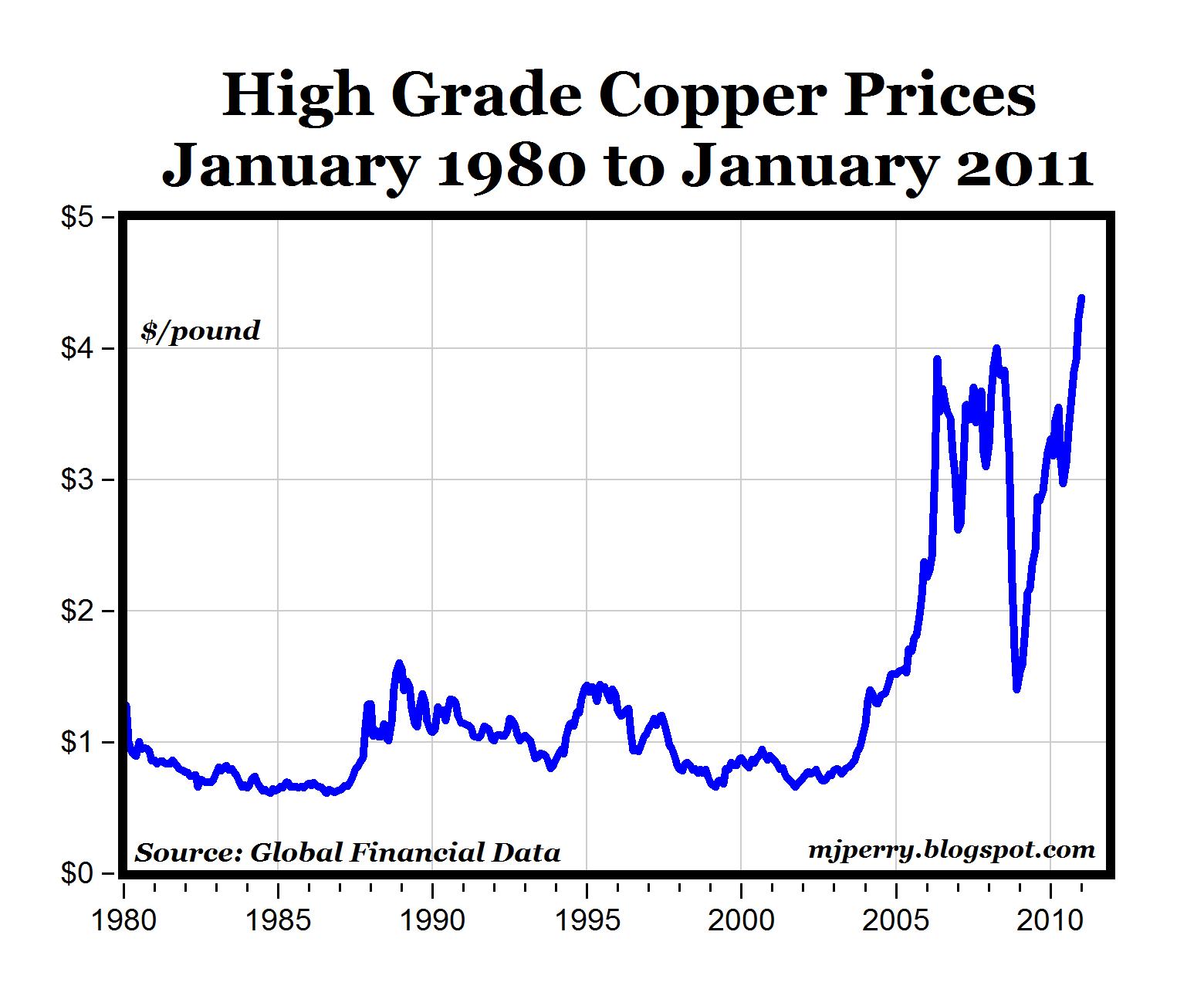

The copper value chart reveals a historical past punctuated by dramatic swings, reflecting the cyclical nature of financial progress and contraction. The early 2000s witnessed a interval of sustained progress, pushed by speedy industrialization in China and rising economies. This surge in demand propelled copper costs to document highs, benefiting producers and traders alike. Nonetheless, the 2008 world monetary disaster introduced a pointy correction, as demand plummeted alongside world financial exercise.

The next restoration was uneven, with costs fluctuating considerably in response to numerous elements, together with:

- International Financial Development: Durations of sturdy world GDP progress sometimes correlate with larger copper costs, as elevated industrial exercise boosts demand. Conversely, financial slowdowns or recessions result in decrease costs.

- Chinese language Financial Exercise: China’s position because the world’s largest copper shopper is paramount. Modifications in its infrastructure spending, manufacturing output, and total financial progress considerably affect copper costs. A slowdown in China’s financial system typically interprets to decrease copper costs, whereas strong progress fuels demand.

- Provide-Aspect Disruptions: Surprising disruptions to copper manufacturing, akin to mine closures as a consequence of labor disputes, environmental considerations, or geopolitical instability, can create value spikes. Equally, logistical bottlenecks affecting transportation and refining may also affect provide and costs.

- Technological Developments: Improvements in varied industries, significantly in renewable power (photo voltaic panels, electrical automobiles) and electronics, can considerably affect copper demand. The transition in direction of a greener financial system is anticipated to drive substantial progress in copper consumption.

- Forex Fluctuations: The US greenback’s power relative to different currencies influences copper costs, as copper is primarily traded in {dollars}. A stronger greenback could make copper costlier for patrons utilizing different currencies, thus decreasing demand and doubtlessly reducing costs.

- Hypothesis and Funding: Monetary markets play a vital position in copper value actions. Speculative buying and selling and funding flows, each lengthy and brief, can amplify value volatility. Trade-traded funds (ETFs) centered on copper additional contribute to this dynamic.

- Stock Ranges: International copper inventories, held by producers, shoppers, and exchanges, act as a buffer in opposition to supply-demand imbalances. Excessive stock ranges can exert downward stress on costs, whereas low inventories can result in value will increase.

Analyzing the Chart: Key Indicators and Patterns

Efficient evaluation of the copper value chart includes understanding varied technical indicators and chart patterns. These instruments assist determine potential traits, help and resistance ranges, and potential turning factors. Some key indicators embrace:

- Shifting Averages: Shifting averages (e.g., 50-day, 200-day) easy out value fluctuations and assist determine the general development. Crossovers between totally different transferring averages can sign potential purchase or promote indicators.

- Relative Energy Index (RSI): RSI measures the momentum of value adjustments and may determine overbought or oversold circumstances, suggesting potential reversals.

- Bollinger Bands: Bollinger Bands measure value volatility and may also help determine potential breakout factors. Costs transferring exterior the bands might point out a robust development.

- Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by. Help ranges signify potential shopping for alternatives, whereas resistance ranges signify potential promoting alternatives.

- Chart Patterns: Numerous chart patterns, akin to head and shoulders, double tops/bottoms, and triangles, can present insights into potential future value actions.

Components Shaping Future Copper Costs:

Predicting future copper costs is inherently difficult, however a number of elements are more likely to play a big position:

- International Financial Outlook: The power of world financial progress, significantly in developed and rising economies, will likely be a key driver of copper demand. A strong world financial system is more likely to help larger copper costs.

- Inexperienced Power Transition: The growing adoption of renewable power applied sciences, electrical automobiles, and energy-efficient infrastructure will considerably increase copper demand. This long-term development is anticipated to be a robust optimistic driver for copper costs.

- Geopolitical Dangers: Geopolitical instability in main copper-producing areas can disrupt provide and result in value volatility. Political dangers, commerce wars, and useful resource nationalism can all affect copper costs.

- Technological Improvements: Advances in copper mining and processing applied sciences can affect manufacturing prices and provide. Equally, improvements in substitute supplies may doubtlessly have an effect on copper demand.

- Inflation and Curiosity Charges: Inflationary pressures and rate of interest hikes by central banks can affect the general funding surroundings and affect commodity costs, together with copper.

Funding Methods and Threat Administration:

Investing in copper includes inherent dangers, given the commodity’s value volatility. Buyers ought to rigorously think about their threat tolerance and funding horizon earlier than making any choices. Diversification is essential to mitigate dangers. Potential funding methods embrace:

- Direct Funding: Investing in bodily copper, although difficult for many particular person traders, provides direct publicity to cost actions.

- Copper ETFs: Trade-traded funds (ETFs) provide a handy option to acquire publicity to copper costs with out immediately proudly owning the bodily commodity.

- Copper Mining Shares: Investing in firms concerned in copper mining gives publicity to each copper costs and the operational efficiency of the mining firms.

- Futures Contracts: Futures contracts enable traders to take a position on future copper costs, however they carry important dangers as a consequence of leverage and value volatility.

Conclusion:

The copper value chart is a dynamic and complicated illustration of world financial forces. Understanding its historic trajectory, key influencing elements, and potential future actions is essential for traders and companies alike. Whereas predicting future costs with certainty is inconceivable, cautious evaluation of the chart, coupled with an understanding of macroeconomic traits and geopolitical dangers, can present priceless insights into potential funding alternatives and dangers. Steady monitoring of the copper market and adapting funding methods primarily based on evolving circumstances is important for navigating this fascinating and risky commodity.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Copper Worth Chart: A Complete Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!