Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

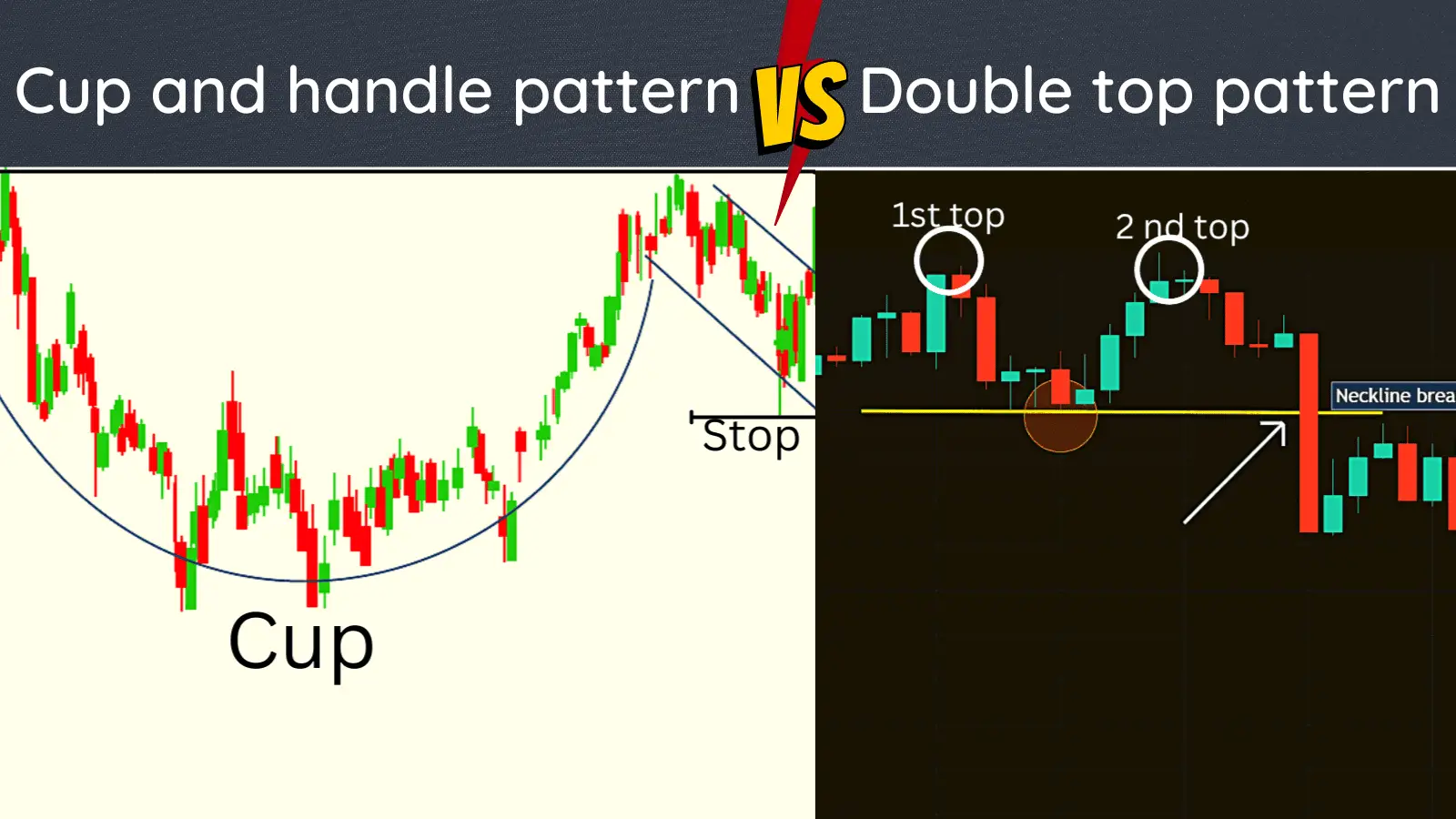

The cup and deal with chart sample is a widely known and revered technical evaluation software utilized by merchants to establish potential bullish breakouts in shares and different belongings. Its distinctive form, resembling a cup with a deal with, indicators a interval of consolidation adopted by a possible surge in value. Whereas not a foolproof predictor, understanding the nuances of this sample can considerably improve your buying and selling technique. This text will delve deep into the cup and deal with sample, exploring its formation, identification standards, variations, limitations, and sensible purposes.

Understanding the Anatomy of the Cup and Deal with

The cup and deal with sample is characterised by two distinct phases: the cup and the deal with.

-

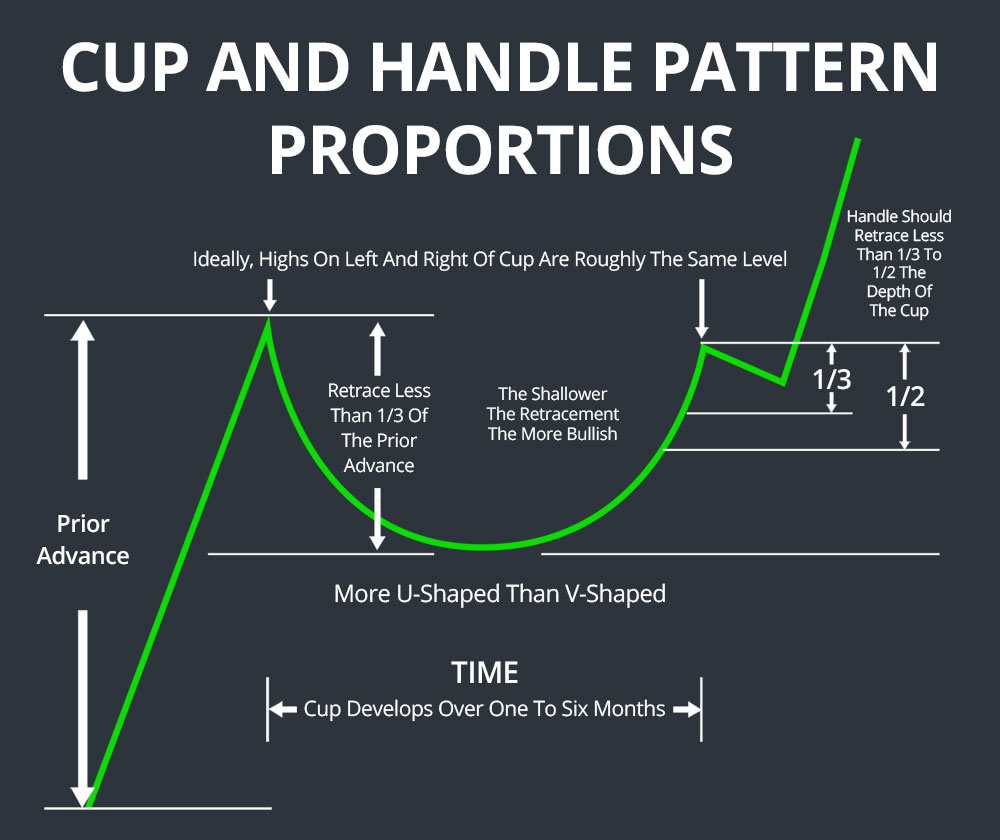

The Cup: This represents a interval of value consolidation, sometimes a U-shaped or rounded backside. The formation is characterised by a gradual decline in value, adopted by a gradual restoration to roughly the identical degree because the preliminary decline’s excessive level. The depth of the cup is essential; a deeper cup usually suggests a extra vital correction and probably a extra highly effective subsequent breakout. Ideally, the cup’s depth needs to be between 15% and 33% of the previous value advance. A shallower cup might point out weaker underlying power.

-

The Deal with: This can be a brief interval of sideways or barely downward value motion, usually representing a quick interval of profit-taking or hesitation earlier than the following upward transfer. The deal with normally slopes downwards, making a barely downward trendline. Its period is mostly shorter than the cup formation, lasting anyplace from 3 to 10 buying and selling days. The deal with’s slope and size are key components in figuring out the potential power and reliability of the breakout. A shorter, much less steep deal with usually suggests a extra imminent and highly effective breakout.

Key Traits of a Legitimate Cup and Deal with Sample:

A number of key traits outline a sound cup and deal with sample, rising the likelihood of a profitable breakout. These embody:

-

U-shaped or Rounded Backside: The cup shouldn’t be V-shaped, as this means a sharper and extra abrupt correction, which is much less indicative of a wholesome consolidation. A rounded backside suggests a extra gradual and managed value adjustment.

-

Symmetrical Cup: Whereas excellent symmetry is uncommon, the cup ought to ideally be comparatively symmetrical, with the left and proper sides mirroring one another by way of slope and period.

-

Properly-defined Deal with: The deal with needs to be clearly outlined, with a discernible downward trendline. The deal with’s size needs to be considerably shorter than the cup’s period.

-

Breakout above the Deal with’s Resistance: The breakout ought to happen above the higher trendline of the deal with, confirming the sample’s validity. This breakout is commonly accompanied by elevated quantity, reinforcing the bullish sign.

-

Quantity Affirmation: Elevated buying and selling quantity through the breakout confirms the power of the transfer and will increase the probability of a sustained value enhance. Decreased quantity through the deal with formation additionally strengthens the sample’s validity.

-

Relative Energy Index (RSI): The RSI indicator can present further affirmation. A studying under 30 through the cup formation and a subsequent rise above 50 through the breakout can strengthen the bullish sign.

-

Transferring Averages: Affirmation from shifting averages, corresponding to a 50-day or 200-day shifting common, may also improve the sample’s reliability. A breakout above a key shifting common strengthens the bullish sign.

Variations of the Cup and Deal with Sample:

Whereas the basic cup and deal with sample adheres to the traits described above, variations exist. These embody:

-

Shallow Cup: A cup with a shallower depth than the perfect 15-33% vary. These usually point out weaker potential breakouts and require extra cautious interpretation.

-

Deep Cup: A cup with a depth exceeding 33% suggests a extra vital correction and probably a stronger breakout, but in addition carries a better threat.

-

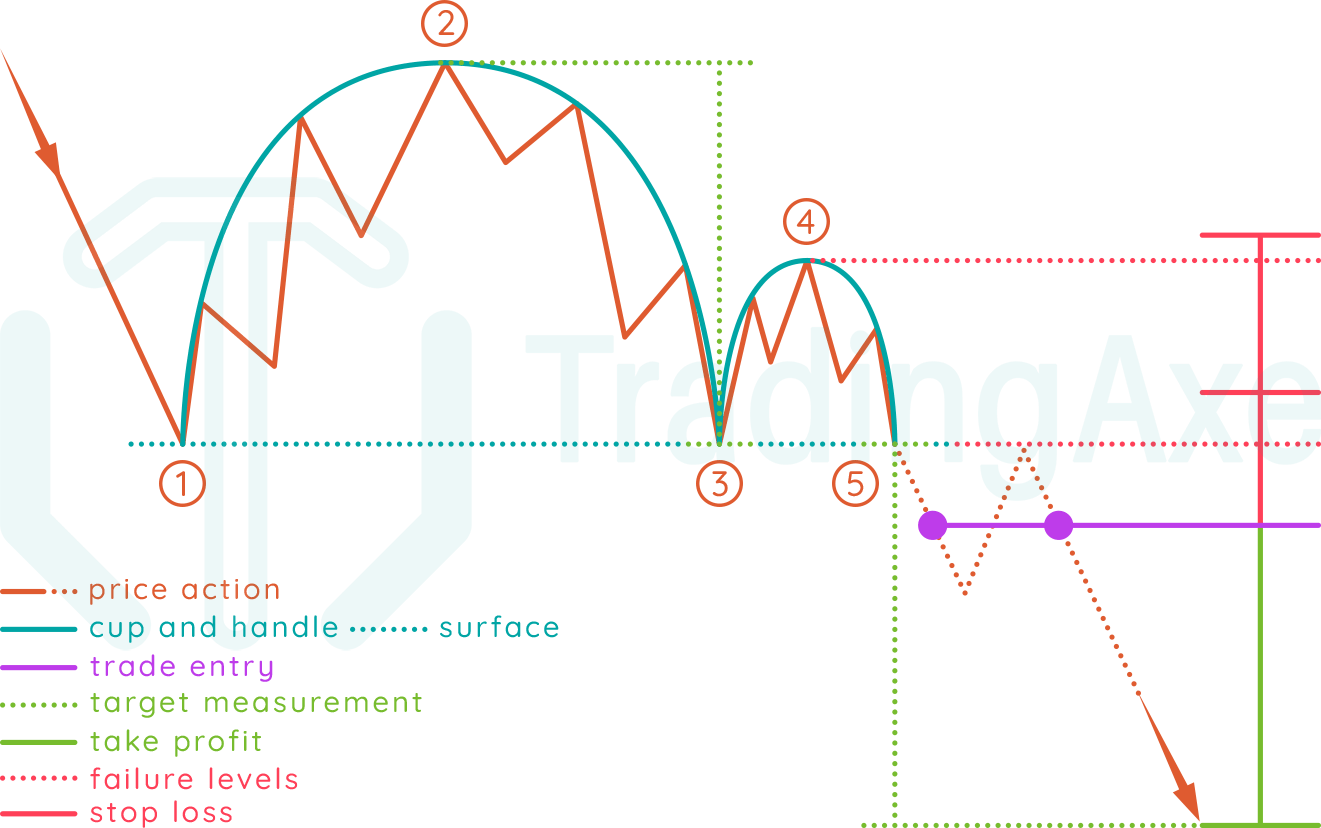

Double Cup and Deal with: Two consecutive cup and deal with patterns can type, offering stronger affirmation of the bullish pattern.

-

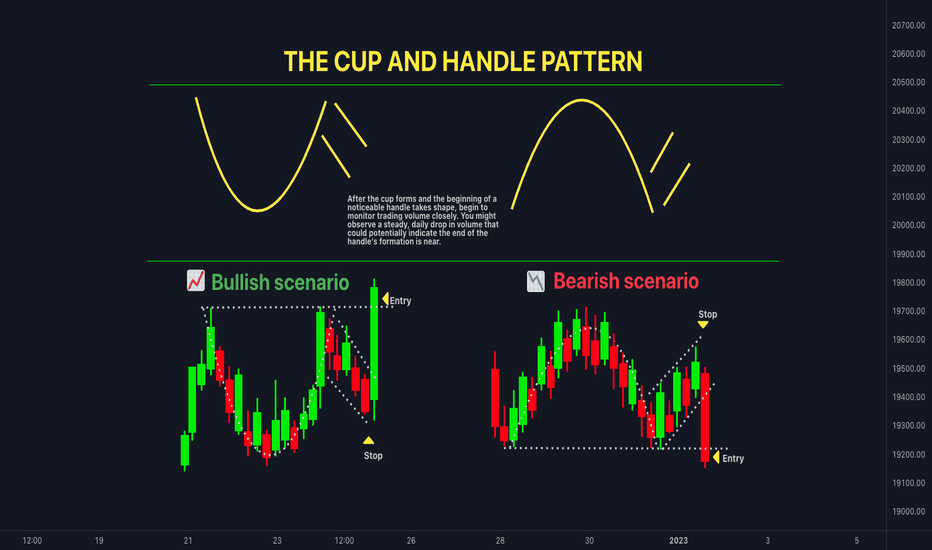

Inverse Cup and Deal with: This can be a bearish sample, representing a possible value decline. It is characterised by an inverted cup form and a deal with sloping upwards.

Limitations and Issues:

Regardless of its effectiveness, the cup and deal with sample shouldn’t be with out its limitations. These embody:

-

Subjectivity: Figuring out the sample will be subjective, as there is no universally agreed-upon definition of the cup’s depth or the deal with’s size.

-

False Breakouts: Breakouts above the deal with’s resistance can generally fail, main to cost reversals. Subsequently, it is essential to make use of stop-loss orders to handle threat.

-

Time Body Dependence: The sample’s effectiveness varies relying on the chosen timeframe (each day, weekly, month-to-month). What constitutes a sound sample on a each day chart will not be legitimate on a weekly chart.

-

Affirmation Required: The cup and deal with sample shouldn’t be utilized in isolation. Affirmation from different technical indicators and elementary evaluation is essential earlier than getting into a commerce.

Sensible Functions and Buying and selling Methods:

The cup and deal with sample can be utilized together with different technical indicators to develop a strong buying and selling technique. Listed here are some sensible purposes:

-

Figuring out potential entry factors: The breakout above the deal with’s resistance is a possible entry level. Merchants usually place purchase orders barely above the resistance line to seize the preliminary value surge.

-

Setting stop-loss orders: Cease-loss orders needs to be positioned under the cup’s low level to restrict potential losses if the breakout fails.

-

Figuring out revenue targets: Revenue targets will be decided utilizing numerous methods, corresponding to measuring the peak of the cup and projecting that peak above the breakout level.

-

Combining with different indicators: Combining the cup and deal with sample with different indicators, corresponding to RSI, MACD, and shifting averages, can enhance buying and selling accuracy and scale back threat.

Conclusion:

The cup and deal with chart sample is a beneficial software for figuring out potential bullish breakouts out there. By understanding its traits, variations, limitations, and sensible purposes, merchants can considerably enhance their decision-making course of. Nonetheless, it is essential to do not forget that no technical sample is foolproof, and affirmation from different indicators and elementary evaluation is important earlier than getting into any commerce. Diligent analysis, threat administration, and a disciplined strategy are key to efficiently using the cup and deal with sample in your buying and selling technique. Bear in mind to all the time apply accountable buying and selling and solely make investments what you may afford to lose. Steady studying and adapting to market circumstances are paramount for long-term success.

![]()

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample. We thanks for taking the time to learn this text. See you in our subsequent article!