Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample

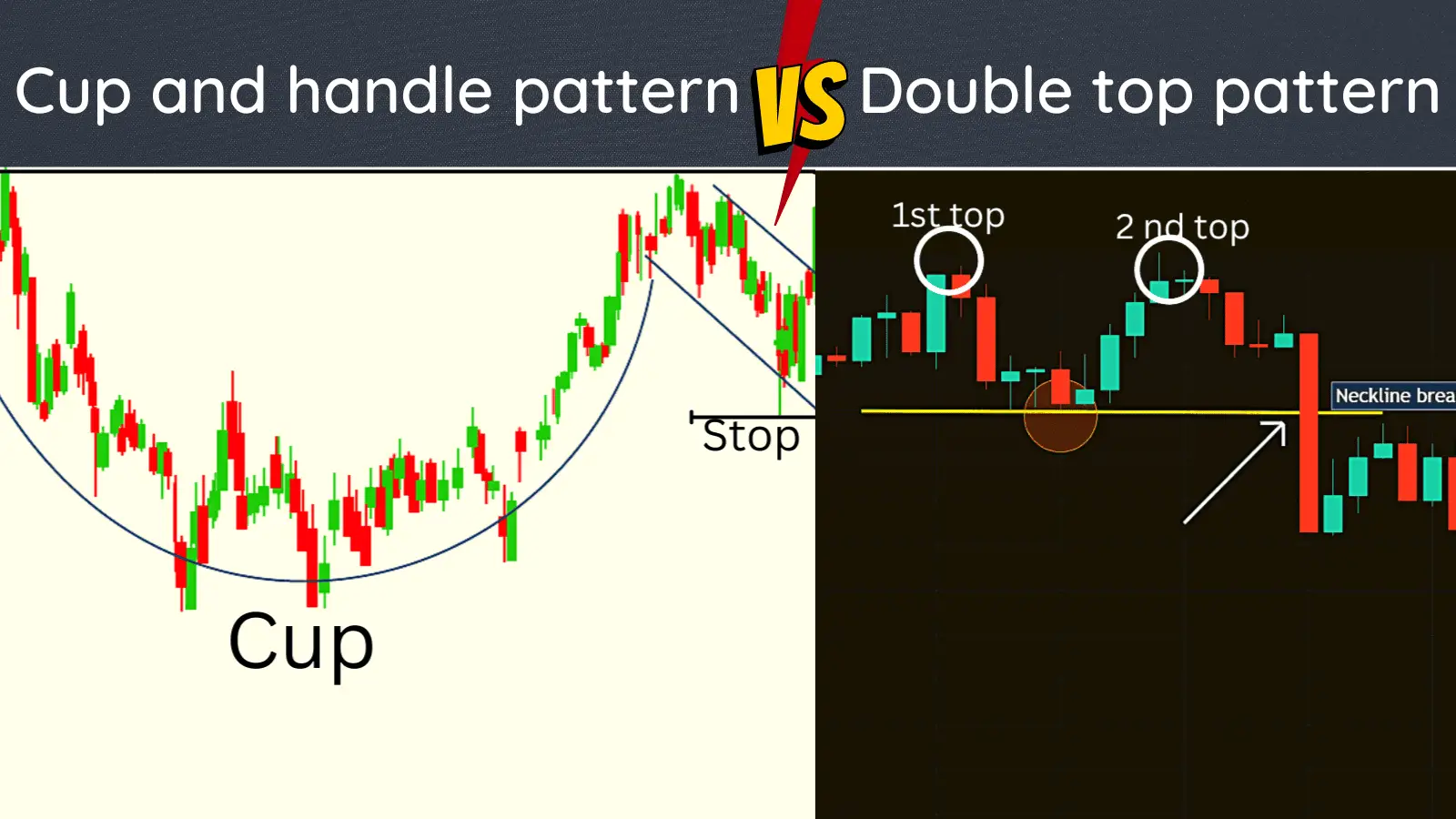

The world of technical evaluation is stuffed with a captivating array of chart patterns, every providing insights into potential value actions. Amongst these, the "cup and deal with" sample stands out as a dependable indicator of bullish continuation, usually signaling important value will increase. Understanding its formation, identification, and interpretation can considerably improve a dealer’s skill to capitalize on market alternatives. This text delves deep into the intricacies of the cup and deal with sample, offering a complete information for each novice and skilled merchants.

Understanding the Anatomy of a Cup and Deal with

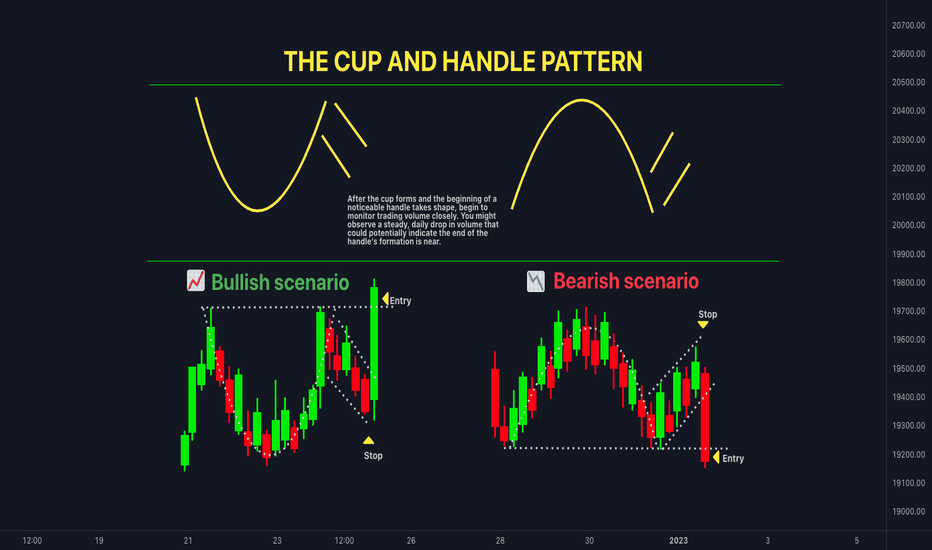

The cup and deal with sample, as its title suggests, resembles a cup with a deal with connected. It is a continuation sample, that means it sometimes seems after a interval of upward momentum, suggesting a short lived pause earlier than a renewed bullish surge. Let’s dissect its key elements:

-

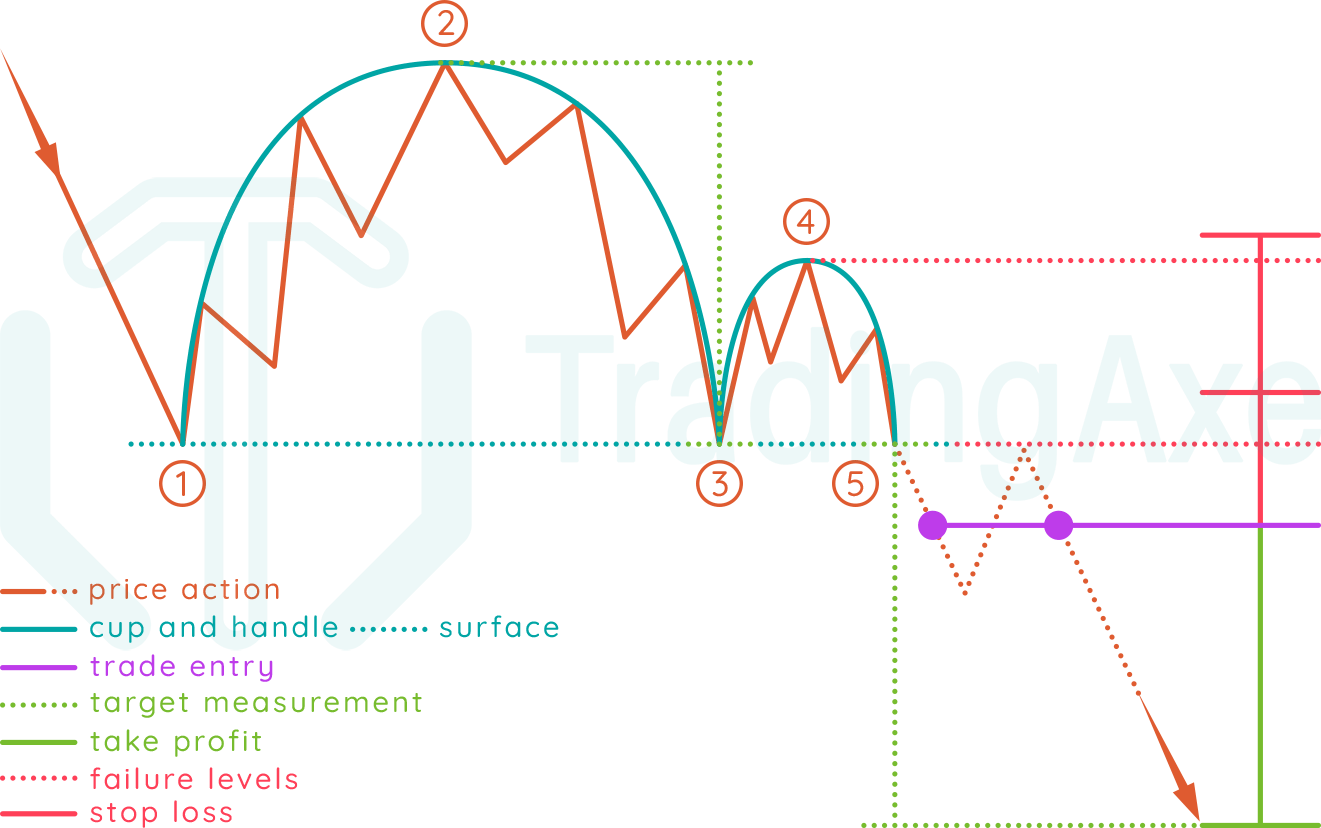

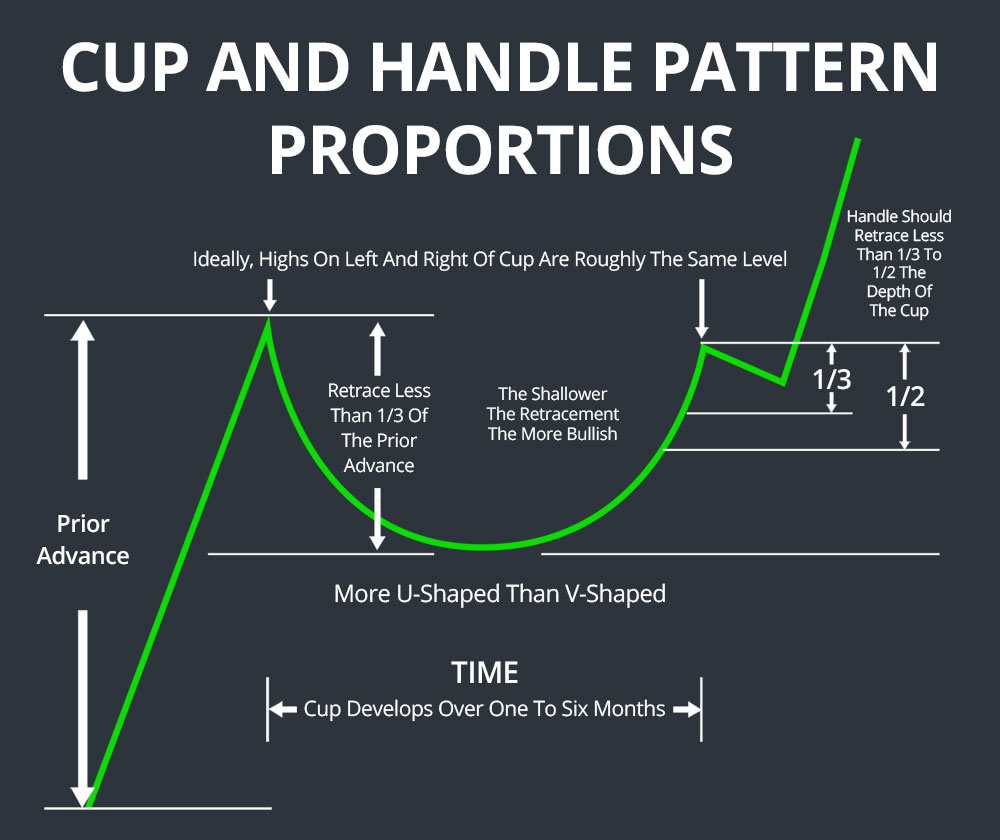

The Cup: That is the U-shaped curve that kinds the principle physique of the sample. It is characterised by a gradual decline adopted by a gradual restoration. The left aspect of the cup represents the preliminary pullback, whereas the appropriate aspect signifies the following restoration. Ideally, the left and proper sides of the cup ought to be comparatively symmetrical, though minor discrepancies are acceptable. The depth of the cup is essential; a deeper cup usually suggests a extra important value correction and a doubtlessly bigger subsequent value enhance. Usually, the depth should not exceed 50% of the previous uptrend.

-

The Deal with: This can be a brief, downward sloping consolidation part that follows the cup. It sometimes lasts for a number of days or even weeks, representing a interval of minor profit-taking or consolidation earlier than the subsequent leg up. The deal with kinds a small, downward sloping trendline, usually resembling a flag or pennant sample. Its size is mostly shorter than the cup’s depth, and its slope ought to be comparatively light. A steep, sharply declining deal with is usually a warning signal, suggesting a possible breakdown reasonably than a continuation.

-

The Breakout: The breakout happens when the worth decisively breaks above the deal with’s resistance line. That is the essential second that indicators the potential for a big value enhance. Affirmation of the breakout is often sought by means of elevated quantity, indicating robust shopping for stress. The value goal for the following transfer is often decided by measuring the depth of the cup and projecting that distance upward from the breakout level. This projection is sometimes called the "value goal" or "goal value."

Figuring out a Legitimate Cup and Deal with Sample

Figuring out a real cup and deal with sample requires cautious remark and an understanding of a number of key traits:

-

Quantity: Quantity performs a big position in confirming the validity of the sample. Greater quantity in the course of the cup’s formation, significantly in the course of the restoration part, signifies robust shopping for curiosity. Conversely, decrease quantity in the course of the deal with suggests a interval of consolidation and diminished buying and selling exercise. A surge in quantity accompanying the breakout additional strengthens the bullish sign.

-

Timeframe: The formation of a cup and deal with sample can differ significantly by way of timeframe. It may possibly seem on each day, weekly, and even month-to-month charts, relying on the asset and the market circumstances. Longer timeframe patterns usually point out extra important value actions.

-

Symmetry: Whereas good symmetry shouldn’t be required, an inexpensive diploma of symmetry between the left and proper sides of the cup is fascinating. This means a balanced interval of correction and restoration.

-

Deal with Size: The deal with ought to be comparatively brief, sometimes lasting for a number of days or even weeks. A protracted deal with can weaken the bullish sign and enhance the chance of a false breakout.

-

Help and Resistance: The underside of the cup usually coincides with a big assist degree, whereas the deal with’s higher trendline acts as resistance. The breakout above this resistance is a key affirmation sign.

Potential Pitfalls and False Breakouts

Whereas the cup and deal with sample is a robust indicator, it is important to pay attention to potential pitfalls and false breakouts. A number of elements can result in inaccurate interpretations:

-

False Breakouts: The value could briefly break above the deal with’s resistance line however fail to maintain the upward momentum. This can be a false breakout, usually leading to a big value decline. To keep away from this, merchants ought to search for affirmation indicators, comparable to elevated quantity and a sustained value motion above the resistance line.

-

Incomplete Patterns: A sample that isn’t absolutely shaped can result in inaccurate predictions. It is essential to attend for the sample to finish earlier than making any buying and selling choices.

-

Market Situations: The effectiveness of the cup and deal with sample will be influenced by broader market circumstances. During times of excessive volatility or important market uncertainty, the sample’s reliability could also be diminished.

-

Subjectivity: Figuring out chart patterns entails a level of subjectivity. Totally different merchants could interpret the identical chart otherwise, resulting in variations in figuring out and deciphering the sample.

Utilizing the Cup and Deal with in Your Buying and selling Technique

The cup and deal with sample could be a helpful software in a complete buying and selling technique. This is learn how to successfully combine it:

-

Affirmation: Do not rely solely on the cup and deal with sample. Verify the breakout with different technical indicators, comparable to transferring averages, RSI, or MACD.

-

Danger Administration: At all times implement correct threat administration strategies, comparable to stop-loss orders, to restrict potential losses. Place a stop-loss order barely under the deal with’s low level to guard towards a possible breakdown.

-

Place Sizing: Decide the suitable place measurement primarily based in your threat tolerance and account stability. Keep away from over-leveraging, as this could amplify losses.

-

Goal Worth: Use the measured transfer approach to estimate the potential value goal. Nevertheless, do not forget that that is simply an estimate, and precise value actions could differ.

-

Endurance: Look forward to the breakout to verify earlier than getting into a protracted place. Keep away from getting into too early, as this could enhance the chance of a false breakout.

Conclusion:

The cup and deal with chart sample is a robust software for figuring out potential bullish continuation strikes. Nevertheless, it is essential to know its nuances, potential pitfalls, and the significance of affirmation indicators. By combining the cup and deal with sample with different technical indicators and sound threat administration practices, merchants can considerably improve their buying and selling methods and capitalize on market alternatives. Keep in mind that technical evaluation is only one piece of the puzzle; elementary evaluation and broader market context also needs to be thought-about earlier than making any buying and selling choices. Constant apply, thorough analysis, and a disciplined strategy are key to mastering the artwork of figuring out and taking advantage of this helpful chart sample. At all times do not forget that previous efficiency shouldn’t be indicative of future outcomes, and buying and selling entails inherent threat.

![]()

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Cup and Deal with: A Complete Information to This Highly effective Chart Sample. We hope you discover this text informative and useful. See you in our subsequent article!