Decoding the Diesel Oil Worth Chart: A Complete Evaluation

Associated Articles: Decoding the Diesel Oil Worth Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Diesel Oil Worth Chart: A Complete Evaluation. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Diesel Oil Worth Chart: A Complete Evaluation

Diesel gasoline, a essential part of world commerce and transportation, reveals a worth volatility that considerably impacts varied sectors, from agriculture and logistics to manufacturing and particular person shoppers. Understanding the components driving diesel worth fluctuations and decoding the related charts is essential for companies and people alike to make knowledgeable selections. This text delves into the intricacies of diesel oil worth charts, analyzing the historic tendencies, influencing components, and future forecasting methodologies.

Historic Traits: A Rollercoaster Trip

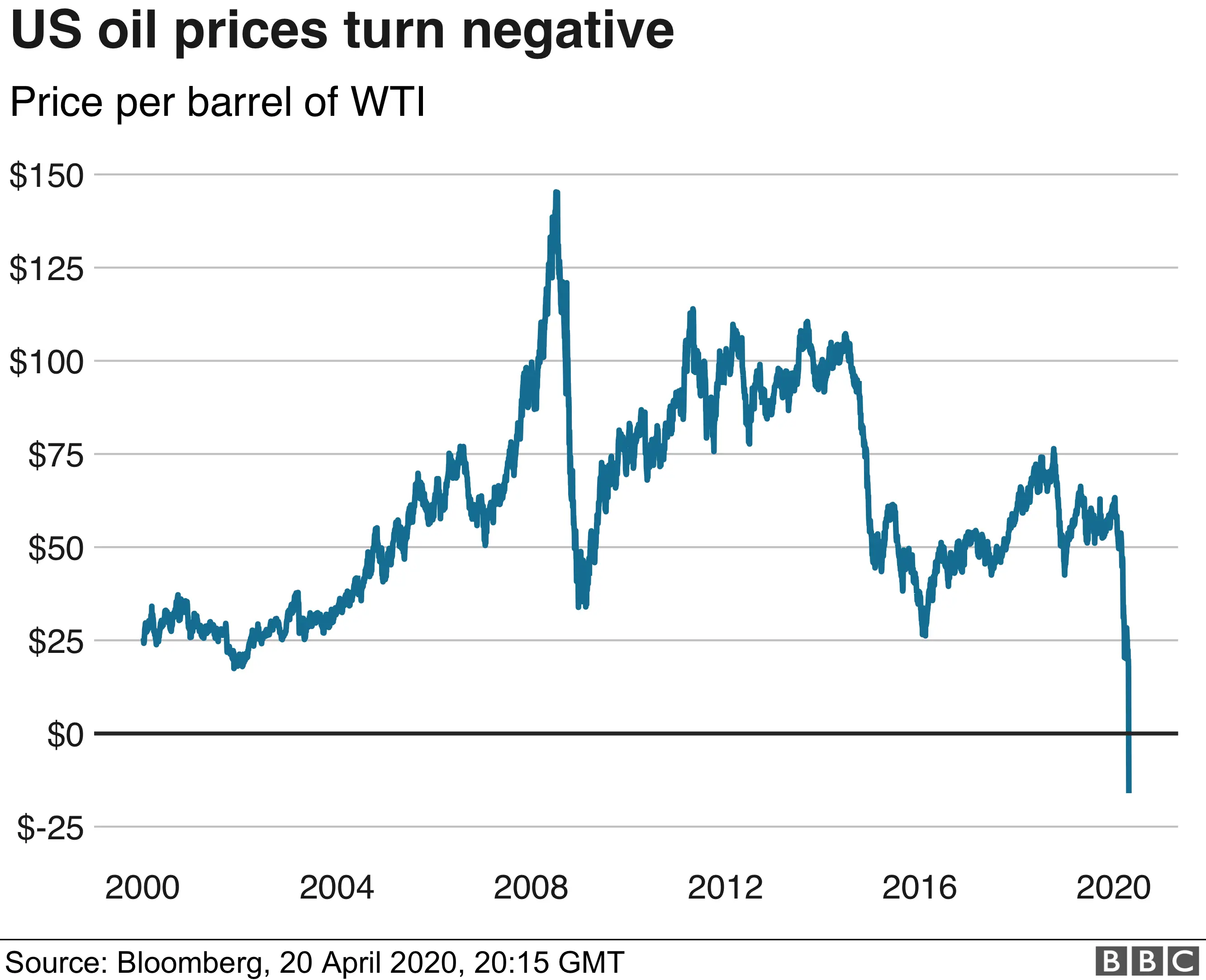

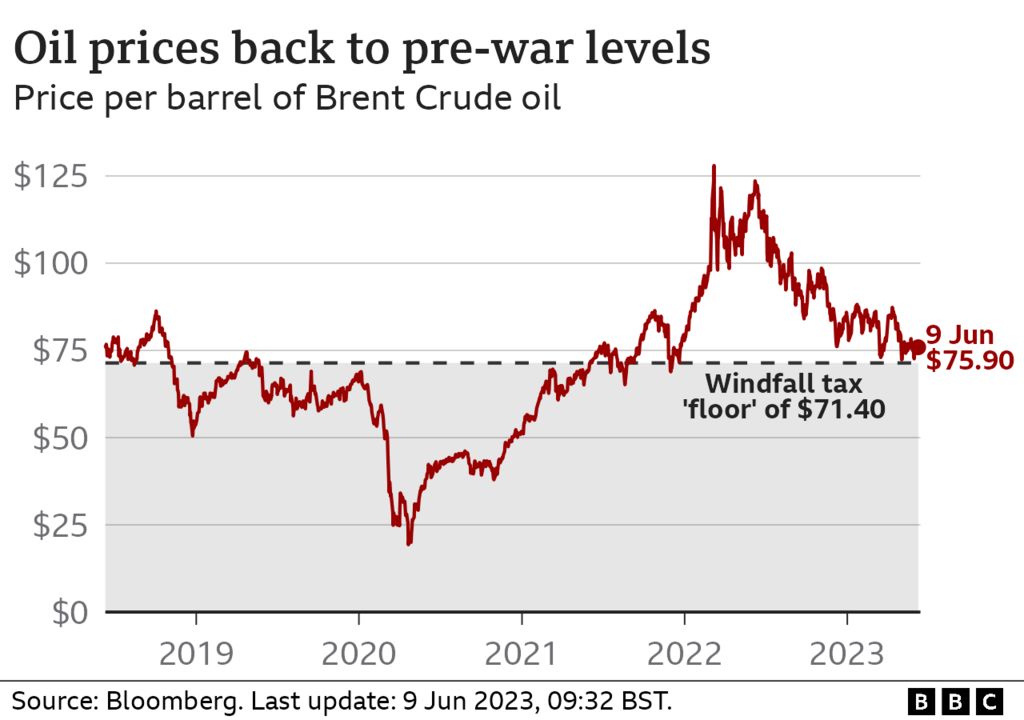

A historic evaluation of diesel oil worth charts reveals a sample of great worth swings, influenced by a fancy interaction of world occasions and market dynamics. The previous twenty years, for instance, have witnessed intervals of relative stability punctuated by dramatic spikes and subsequent declines. The 2008 world monetary disaster, as an example, led to a pointy drop in diesel costs, adopted by a interval of sustained improve pushed by sturdy world financial development and rising demand. Extra not too long ago, geopolitical instability, notably occasions within the Center East and Japanese Europe, has considerably impacted diesel costs, creating intervals of maximum volatility.

Analyzing long-term charts reveals a number of key tendencies:

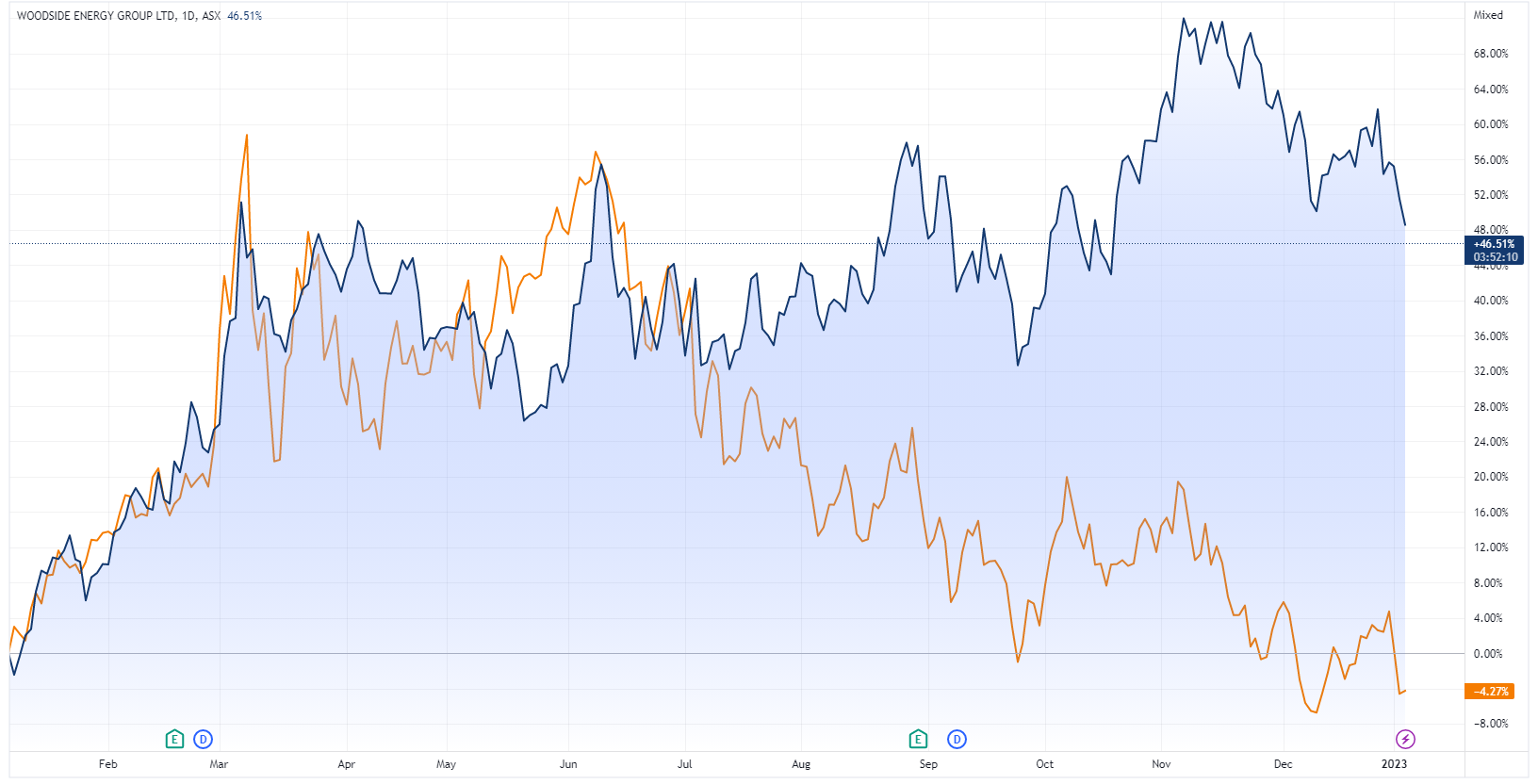

- Correlation with Crude Oil Costs: Diesel costs are strongly correlated with crude oil costs, as diesel is a refined product of crude oil. Will increase in crude oil costs usually translate into increased diesel costs, and vice versa. Nevertheless, the connection is not at all times completely linear; the refining course of, taxes, and distribution prices can affect the worth differential between crude oil and diesel.

- Seasonal Variations: Diesel costs usually exhibit seasonal fluctuations. Demand sometimes will increase throughout peak agricultural seasons and winter months (attributable to heating oil demand in some areas), resulting in increased costs. Conversely, demand tends to melt throughout milder months, leading to decrease costs.

- Financial Development and Demand: World financial development considerably influences diesel demand and, consequently, its worth. Sturdy financial exercise usually results in elevated industrial manufacturing and transportation, boosting diesel consumption and driving costs upward. Recessions, alternatively, usually result in decrease demand and worth declines.

- Geopolitical Components: Geopolitical occasions, reminiscent of wars, sanctions, and political instability in main oil-producing areas, can dramatically influence diesel costs. Provide disruptions attributable to these occasions can result in worth spikes, no matter total world demand.

Deciphering the Chart: Key Indicators and Metrics

Understanding diesel worth charts requires familiarity with a number of key indicators and metrics:

- Worth per Unit: Probably the most primary data displayed on a diesel worth chart is the worth per unit (e.g., per gallon, per liter). The chart sometimes reveals this worth over a particular interval, permitting for the visualization of worth tendencies.

- Transferring Averages: Transferring averages, reminiscent of 50-day or 200-day shifting averages, easy out short-term worth fluctuations and assist establish underlying tendencies. A rising shifting common suggests an upward development, whereas a falling shifting common suggests a downward development.

- Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt via. Help ranges characterize costs under which the worth is unlikely to fall, whereas resistance ranges characterize costs above which the worth is unlikely to rise. Breakouts above resistance or under help can sign vital worth actions.

- Quantity: Buying and selling quantity, usually displayed alongside the worth chart, signifies the quantity of diesel traded throughout a particular interval. Excessive quantity throughout worth actions can affirm the energy of the development.

- Indicators: Technical indicators, reminiscent of Relative Energy Index (RSI) and Transferring Common Convergence Divergence (MACD), can present extra insights into worth momentum and potential development reversals. These indicators are sometimes utilized by merchants to establish potential shopping for or promoting alternatives.

Components Influencing Diesel Oil Costs: A Deeper Dive

Past the historic tendencies and chart interpretation, understanding the underlying components driving diesel costs is important for correct forecasting and knowledgeable decision-making. These components might be broadly categorized as:

- Provide and Demand: The basic precept of provide and demand dictates diesel costs. A lower in provide (attributable to manufacturing cuts, geopolitical instability, or refining capability constraints) or a rise in demand (attributable to financial development or seasonal components) will sometimes result in increased costs.

- Crude Oil Costs: As talked about earlier, crude oil costs are probably the most vital driver of diesel costs. The worth of crude oil is influenced by varied components, together with OPEC manufacturing quotas, world financial development, and geopolitical occasions.

- Refining Capability and Prices: The capability and effectivity of refineries play an important position in figuring out diesel provide. Increased refining prices, attributable to elevated power costs or environmental laws, can even contribute to increased diesel costs.

- Authorities Rules and Taxes: Authorities insurance policies, reminiscent of gasoline taxes, environmental laws, and subsidies, can considerably affect diesel costs. Increased taxes or stricter laws can improve the ultimate worth paid by shoppers.

- Forex Alternate Charges: Fluctuations in foreign money trade charges can influence diesel costs, notably in worldwide markets. A weaker home foreign money could make imported diesel dearer.

- Storage and Transportation Prices: The price of storing and transporting diesel from refineries to distribution factors additionally contributes to the ultimate worth. These prices can differ relying on geographical location and infrastructure.

Forecasting Diesel Oil Costs: Challenges and Methodologies

Predicting future diesel costs is a fancy enterprise, fraught with uncertainties. Whereas historic knowledge and evaluation of the components talked about above can present beneficial insights, precisely forecasting future costs stays difficult as a result of inherent volatility of the market and the unpredictable nature of geopolitical occasions.

A number of methodologies are employed for forecasting diesel costs:

- Elementary Evaluation: This strategy focuses on analyzing the underlying financial and geopolitical components influencing provide and demand. It includes assessing components like world financial development, crude oil manufacturing, refinery capability, and authorities insurance policies.

- Technical Evaluation: This strategy makes use of historic worth knowledge and technical indicators to establish patterns and predict future worth actions. It depends on charting strategies and indicators to establish help and resistance ranges, trendlines, and momentum indicators.

- Econometric Modeling: This refined strategy makes use of statistical fashions to quantify the connection between diesel costs and varied influencing components. These fashions can incorporate historic knowledge and financial indicators to generate worth forecasts.

Conclusion:

The diesel oil worth chart is a dynamic illustration of a fancy market influenced by a mess of interconnected components. Understanding the historic tendencies, decoding chart indicators, and analyzing the underlying drivers of worth fluctuations are essential for navigating this unstable market. Whereas exact forecasting stays difficult, a mix of basic, technical, and econometric approaches can present beneficial insights for companies and people looking for to mitigate threat and make knowledgeable selections within the face of fluctuating diesel costs. Steady monitoring of world occasions, financial indicators, and market sentiment is important for staying forward of the curve on this ever-changing panorama.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Diesel Oil Worth Chart: A Complete Evaluation. We recognize your consideration to our article. See you in our subsequent article!